Nurse

We often think of the primary characteristic of a nurse to be compassion but although it may not be obvious at first glance, it is highly beneficial for nurses to also be good leaders, have strong personalities and excellent organizational skills. They often have to keep track of many patients and pay close attention to detail. They have to be effective communicators with patients, their families, doctors, and other supporting staff. And on occasion they need to be forceful in order to ensure the best care for their patients.

Teacher

Teachers are charged with [Read more…] about Six Careers for Natural Leaders

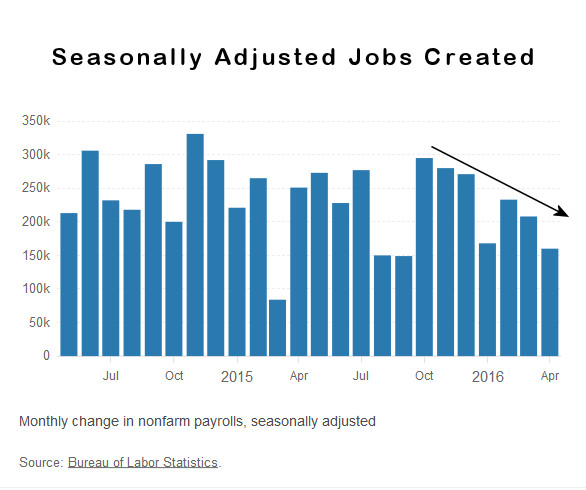

On a seasonally adjusted basis employment has fallen while on a non-adjusted basis the actual number of non-farm employed has increased from 142.887 Million to 143.944 million for a net increase of 1,057,000 jobs but since April traditionally sees a large increase in seasonal workers the seasonally adjusted number says that we were only 160,000 jobs better than what we would expect if there were zero jobs growth.

On a seasonally adjusted basis employment has fallen while on a non-adjusted basis the actual number of non-farm employed has increased from 142.887 Million to 143.944 million for a net increase of 1,057,000 jobs but since April traditionally sees a large increase in seasonal workers the seasonally adjusted number says that we were only 160,000 jobs better than what we would expect if there were zero jobs growth.

According to the current Bureau of Labor Statistics data, the employment situation for the month of October 2015 was as follows: The number of Unadjusted jobs reported for October 2015 was 143.739 million. That was up from June’s previous peak of 142.836 million.

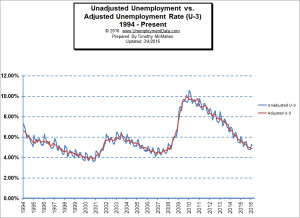

According to the current Bureau of Labor Statistics data, the employment situation for the month of October 2015 was as follows: The number of Unadjusted jobs reported for October 2015 was 143.739 million. That was up from June’s previous peak of 142.836 million. When looking at employment vs. unemployment you would think that they would simply be the inverse of each other. Flip one over and you have the other. But the U.S. Bureau of Labor Statistics (BLS) actually uses two entirely different surveys to calculate them. So by comparing them we can spot irregularities. See

When looking at employment vs. unemployment you would think that they would simply be the inverse of each other. Flip one over and you have the other. But the U.S. Bureau of Labor Statistics (BLS) actually uses two entirely different surveys to calculate them. So by comparing them we can spot irregularities. See

The misery index combines two factors that can make life difficult for people i.e. unemployment and inflation. High levels of price inflation (rapidly rising prices) will cause households to have difficulty affording the basic necessities while high unemployment will leave a high percentage of households without any income at all.

The misery index combines two factors that can make life difficult for people i.e. unemployment and inflation. High levels of price inflation (rapidly rising prices) will cause households to have difficulty affording the basic necessities while high unemployment will leave a high percentage of households without any income at all.

September Employment Numbers Disappointing

September Employment Numbers Disappointing The U.S. Bureau of Labor Statistics (BLS) also released the newest unemployment data for September 2015 today. According to the BLS, the current “Seasonally Adjusted” Unemployment Rate for September is 5.1% identical to August. The BLS reported the “Unadjusted” Unemployment Rate is 4.9% which is lower than August’s 5.2% . See

The U.S. Bureau of Labor Statistics (BLS) also released the newest unemployment data for September 2015 today. According to the BLS, the current “Seasonally Adjusted” Unemployment Rate for September is 5.1% identical to August. The BLS reported the “Unadjusted” Unemployment Rate is 4.9% which is lower than August’s 5.2% . See  In our chart of employment vs. unemployment we compare them and although you would expect that employment and unemployment are simply the inverse of each other (i.e flip one over and you have the other) actually there are several anomalies in the data. Because the U.S. Bureau of Labor Statistics (BLS) uses two separate surveys to calculate the data it helps us see

In our chart of employment vs. unemployment we compare them and although you would expect that employment and unemployment are simply the inverse of each other (i.e flip one over and you have the other) actually there are several anomalies in the data. Because the U.S. Bureau of Labor Statistics (BLS) uses two separate surveys to calculate the data it helps us see  In an age where companies must use a wide range of different marketing tactics to compete, the salesman has somewhat of a bad reputation. While many salespeople are helpful professionals, many people think of the aggressive telemarketer or the high-pressure car salesman when they picture what it looks like to work in sales. In actuality, sales jobs can be extremely lucrative and the experience attained can offer professionals an extreme advantage in the job market. Here are six payoffs you might not expect to have when you start a career in sales.

In an age where companies must use a wide range of different marketing tactics to compete, the salesman has somewhat of a bad reputation. While many salespeople are helpful professionals, many people think of the aggressive telemarketer or the high-pressure car salesman when they picture what it looks like to work in sales. In actuality, sales jobs can be extremely lucrative and the experience attained can offer professionals an extreme advantage in the job market. Here are six payoffs you might not expect to have when you start a career in sales.