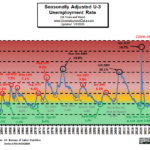

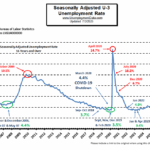

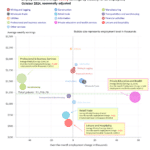

- Seasonally Adjusted U-3 was 4.4% up from 4.3%

- Unadjusted U-3 was 4.7%

- Unadjusted U-6 was 8.3%

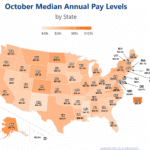

- Labor Force Participation was 62.0%

- Unadjusted Employment rose from 156.723 million to 157.286 million

- Next Update: April 3rd, 2026

Summary:

The BLS adjusted many of its numbers this month. According to the BLS “January 2026 estimates were revised to incorporate updated population controls.” January’s UnAdjusted U-6 was increased from 8.7% to 8.8%, UnAdjusted U3 was increased from 4.6% to 4.7%, but the Seasonally Adjusted U3 remained the same at 4.3%. The changes were based on the adjustment of the Civilian population from 274.982 million to 274.676 million.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

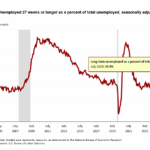

“Total nonfarm payroll employment edged down by 92,000 in February, and the unemployment rate changed little at 4.4 percent, the U.S. Bureau of Labor Statistics reported today. Employment in health care decreased, reflecting strike activity. Employment in information and federal government continued to trend down… Both the unemployment rate, at 4.4 percent, and the number of unemployed people, at 7.6 million, changed little in February.”

You can read the full BLS report here.

As usual, they are talking about “Seasonally Adjusted Jobs”.

Looking at the Unadjusted Establishment Survey report we see…

Originally, the BLS reported employment of 156.714 million for January, which they adjusted slightly to 156.723 million this month.

They are currently reporting 157.286 million jobs for February which is actually an increase of 572,000 jobs based on their original numbers. The LFPR was originally 62.5% in January, but January’s numbers were adjusted down to 62.1% this month. February is said to be 62.0%.