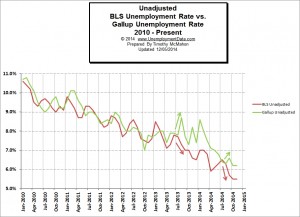

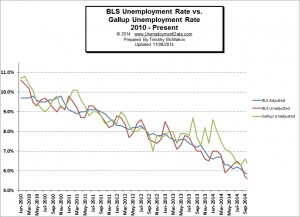

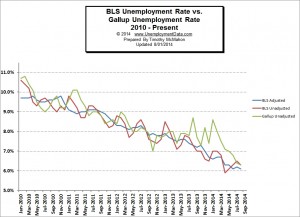

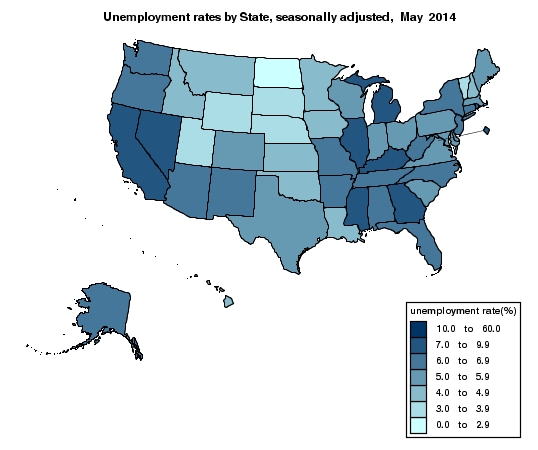

The U.S. Bureau of Labor Statistics (BLS) released the November Unemployment figures on December 5th. The Seasonally Adjusted Unemployment Rate was 5.8% the same as the October. The Unadjusted Unemployment rate was also flat at 5.5% for November.

According to surveys by [Read more…] about November Unemployment Rate Flat

Employers are not interested in every skill you can bring to the table. Specific, marketable, skills are often preferred to task-based talents. In addition, most employers will not be interested in long, comprehensive lists. Instead, employers will search for skills they think will enhance a potential employee’s ability to successfully do their job.

Employers are not interested in every skill you can bring to the table. Specific, marketable, skills are often preferred to task-based talents. In addition, most employers will not be interested in long, comprehensive lists. Instead, employers will search for skills they think will enhance a potential employee’s ability to successfully do their job. One Page

One Page

Source

Source