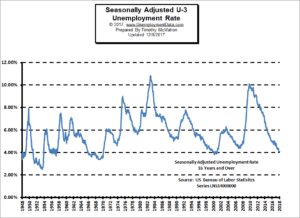

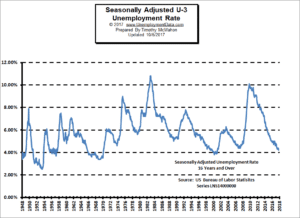

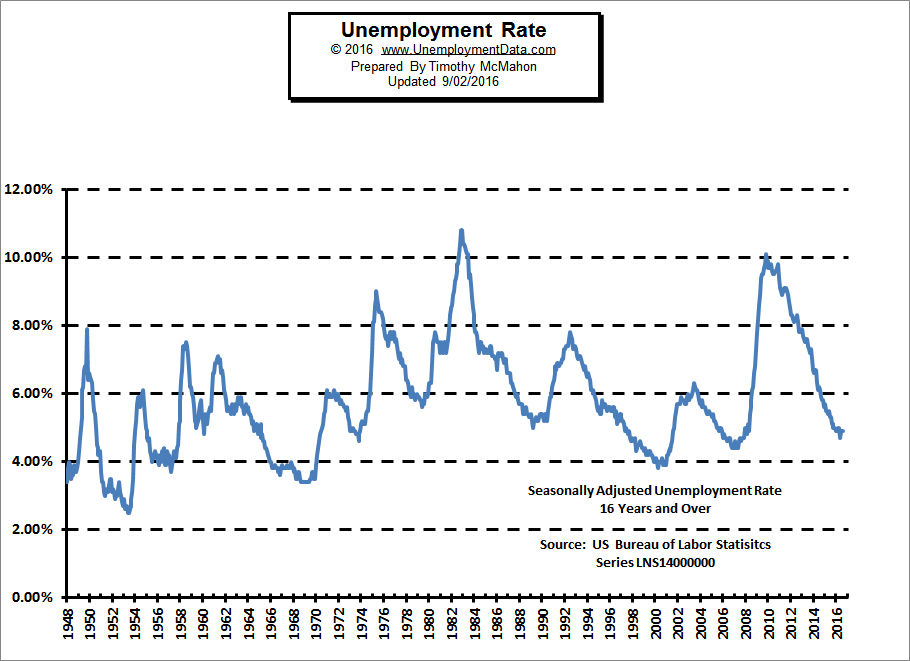

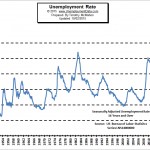

The U.S. Bureau of Labor Statistics (BLS) released their monthly unemployment survey results for October on November 2nd. Unadjusted U-3 and U-6 Unemployment is down again and “Seasonally Adjusted” Unemployment U-3 was 3.7% for the second month in a row. This is the lowest level since December 1969 when it was 3.5%. The lowest level reached in the 1968-1969 timeframe was 3.4% where it hovered from September 1968 through May 1969. The only other time that unemployment was this low since they began tracking unemployment in 1948 was briefly in 1948 and again in 1951-53.

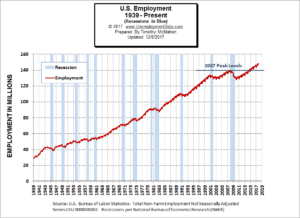

Employment is at an all time record 150.753 million the previous high was set in June 2018. Last month employment was 149.738 million so the actual increase in jobs was over 1 million, although the “Seasonally Adjusted” jobs increase was “only” 250,000. Even that was significantly higher than the projected 208,000.

Previous Record Low Unemployment

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 1965 | 4.9% | 5.1% | 4.7% | 4.8% | 4.6% | 4.6% | 4.4% | 4.4% | 4.3% | 4.2% | 4.1% | 4.0% |

| 1966 | 4.0% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 3.7% | 3.7% | 3.6% | 3.8% |

| 1967 | 3.9% | 3.8% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 4.0% | 3.9% | 3.8% |

| 1968 | 3.7% | 3.8% | 3.7% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.4% | 3.4% | 3.4% | 3.4% |

| 1969 | 3.4% | 3.4% | 3.4% | 3.4% | 3.4% | 3.5% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.5% |

| 1970 | 3.9% | 4.2% | 4.4% | 4.6% | 4.8% | 4.9% | 5.0% | 5.1% | 5.4% | 5.5% | 5.9% | 6.1% |

Key October Employment and Unemployment Numbers

- Adjusted U-3 Unemployment- 3.7% unchanged from September down from 3.9% in August.

- Unadjusted U-3 Unemployment- 3.5% down from 3.6% in September and 3.9% in August and 4.1% in July and 4.2% in June.

- Unadjusted U-6 Unemployment- 7.0% down from 7.1% in September and 7.4% in August and 7.9% in July, 8.1% in June.

- Employment 150.753 million up from 149.741 million in September. (Yes over a Million more jobs!)

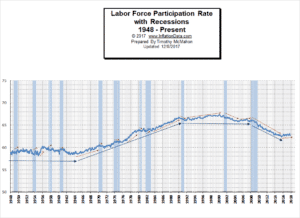

- October Labor Force Participation Rate 62.9% up from 62.7% in September. (Higher is Better)

See Current Unemployment Chart for more info.

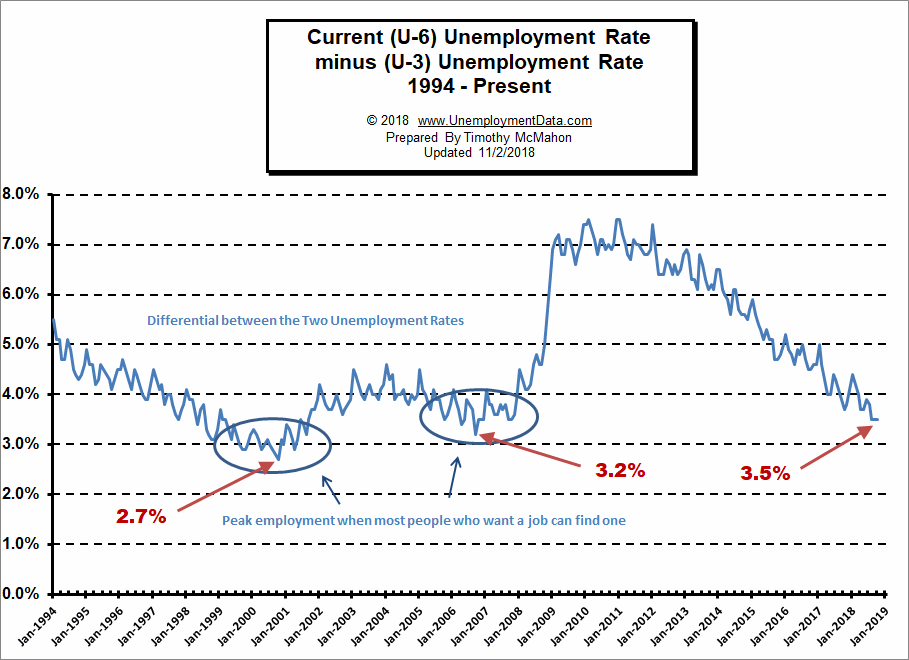

The Differential between U3 and U6 Remains Near September 2006 Lows

Last month the differential between the unadjusted U3 and U6 (reached by subtracting U3 from U6) was at 3.5% and remains there for the 3rd month in a row.

See Current U-6 Unemployment Rate for more info.

Employment by Sector

The employment “bubble chart” gives us a good representation of how each sector of the economy is doing (employment wise). As we can see from the chart below [Read more…] about October Employment Hits New Record High

Typically

Typically

“Nonfarm payroll employment increased by [seasonally adjusted~ editor] 151,000 in August, and the unemployment rate remained at 4.9 percent. Employment continued to trend up in several service-providing industries. Incorporating revisions for June and July, which reduced nonfarm payroll employment by 1,000 on net, monthly job gains have averaged 232,000 over the past 3 months. In the 12 months prior to August, employment growth averaged 204,000 per month. Employment in food services and drinking places continued to trend up in August (+34,000). Over the year, the industry has added 312,000 jobs… Mining employment continued on a

“Nonfarm payroll employment increased by [seasonally adjusted~ editor] 151,000 in August, and the unemployment rate remained at 4.9 percent. Employment continued to trend up in several service-providing industries. Incorporating revisions for June and July, which reduced nonfarm payroll employment by 1,000 on net, monthly job gains have averaged 232,000 over the past 3 months. In the 12 months prior to August, employment growth averaged 204,000 per month. Employment in food services and drinking places continued to trend up in August (+34,000). Over the year, the industry has added 312,000 jobs… Mining employment continued on a

According to the current Bureau of Labor Statistics data, the employment situation for the month of October 2015 was as follows: The number of Unadjusted jobs reported for October 2015 was 143.739 million. That was up from June’s previous peak of 142.836 million.

According to the current Bureau of Labor Statistics data, the employment situation for the month of October 2015 was as follows: The number of Unadjusted jobs reported for October 2015 was 143.739 million. That was up from June’s previous peak of 142.836 million. When looking at employment vs. unemployment you would think that they would simply be the inverse of each other. Flip one over and you have the other. But the U.S. Bureau of Labor Statistics (BLS) actually uses two entirely different surveys to calculate them. So by comparing them we can spot irregularities. See

When looking at employment vs. unemployment you would think that they would simply be the inverse of each other. Flip one over and you have the other. But the U.S. Bureau of Labor Statistics (BLS) actually uses two entirely different surveys to calculate them. So by comparing them we can spot irregularities. See

The misery index combines two factors that can make life difficult for people i.e. unemployment and inflation. High levels of price inflation (rapidly rising prices) will cause households to have difficulty affording the basic necessities while high unemployment will leave a high percentage of households without any income at all.

The misery index combines two factors that can make life difficult for people i.e. unemployment and inflation. High levels of price inflation (rapidly rising prices) will cause households to have difficulty affording the basic necessities while high unemployment will leave a high percentage of households without any income at all.

September Employment Numbers Disappointing

September Employment Numbers Disappointing The U.S. Bureau of Labor Statistics (BLS) also released the newest unemployment data for September 2015 today. According to the BLS, the current “Seasonally Adjusted” Unemployment Rate for September is 5.1% identical to August. The BLS reported the “Unadjusted” Unemployment Rate is 4.9% which is lower than August’s 5.2% . See

The U.S. Bureau of Labor Statistics (BLS) also released the newest unemployment data for September 2015 today. According to the BLS, the current “Seasonally Adjusted” Unemployment Rate for September is 5.1% identical to August. The BLS reported the “Unadjusted” Unemployment Rate is 4.9% which is lower than August’s 5.2% . See  In our chart of employment vs. unemployment we compare them and although you would expect that employment and unemployment are simply the inverse of each other (i.e flip one over and you have the other) actually there are several anomalies in the data. Because the U.S. Bureau of Labor Statistics (BLS) uses two separate surveys to calculate the data it helps us see

In our chart of employment vs. unemployment we compare them and although you would expect that employment and unemployment are simply the inverse of each other (i.e flip one over and you have the other) actually there are several anomalies in the data. Because the U.S. Bureau of Labor Statistics (BLS) uses two separate surveys to calculate the data it helps us see