Finding The Right Health Insurance Company

When conducting your research on what coverage you need for your health needs, the insurance company will consider the following factors:

- Your age

- Your Income

- Whether or not you smoke/drink

- Your Geographic location (not all providers are available in every state)

- What is the deductible?

- How much is the co-pay for each doctor visit?

- How much is the co-insurance? (The percentage you have to pay before you reach the out-of-pocket limit)

- Out of Pocket Maximum Per Year

- Maximum per Person / Per Family

- Exclusions (for Preexisting conditions etc)

- Limitations on which Doctors you can use

- Acceptance at local hospitals

- Out of Network Acceptance (if you are traveling)

An excellent way to reduce your health insurance costs is by using a Group Health Insurance Policy. If you can get insurance as one of the Benefits through your place of employment or even by join a group or organization, you may be able to reduce your costs by getting in on a group policy.

Group Health Insurance Policies

How to Find the Right Health Insurance Policy?

Tim McMahon~editor

The Top 5 Health Insurance Companies

According to online sources, there are a total of 25 noted health insurance companies that rank well in the services they provide and the fees they charge. The Top 5 Health Insurance Companies are as follows:

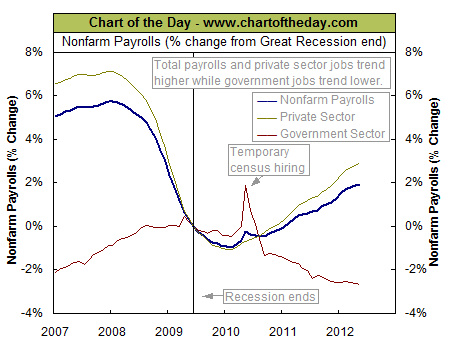

Today’s chart compares the total nonfarm payrolls (blue line) to its two components Private sector job market (gold line) and Government sector job market (red line). But rather than showing total jobs it shows the percentage change in total nonfarm payrolls (blue line) since the declared end of the Great Recession in 2009 (the vertical line). So at that point it is zero. Prior to that point private sector jobs were as high as 7% higher while public sector (government) jobs were 2% lower (i.e. the government increased its

Today’s chart compares the total nonfarm payrolls (blue line) to its two components Private sector job market (gold line) and Government sector job market (red line). But rather than showing total jobs it shows the percentage change in total nonfarm payrolls (blue line) since the declared end of the Great Recession in 2009 (the vertical line). So at that point it is zero. Prior to that point private sector jobs were as high as 7% higher while public sector (government) jobs were 2% lower (i.e. the government increased its

As a result, smart companies are shifting a part of their marketing dollars to social media. Large companies like Proctor & Gamble, Taco Bell, and Pepsi are budgeting huge amounts of money to manage brand perception and promote their products via social media. And in the process, they are creating the demand for thousands of Social Media Managers and Marketing Consultants.

As a result, smart companies are shifting a part of their marketing dollars to social media. Large companies like Proctor & Gamble, Taco Bell, and Pepsi are budgeting huge amounts of money to manage brand perception and promote their products via social media. And in the process, they are creating the demand for thousands of Social Media Managers and Marketing Consultants.