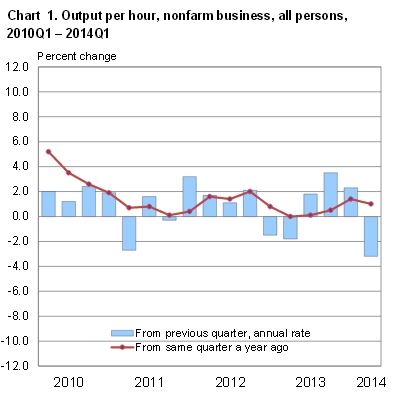

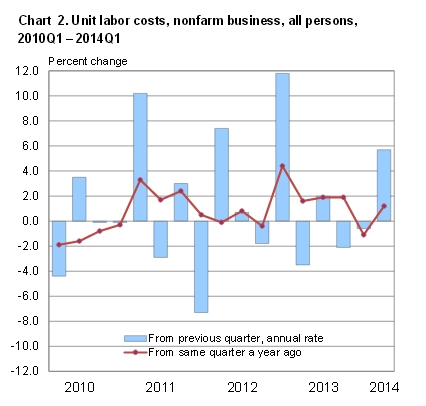

The U.S. Bureau of Labor Statistics (BLS) released its revised estimate of productivity and costs for the first quarter of 2014. According to this report productivity in the “Non-farm” sector fell drastically. “The decrease in productivity was the largest since the first quarter of 2008 (-3.9 percent).”

Productivity is a measure of how much stuff is produced per hour of labor (not including farming). It is “annualized” based on “seasonally adjusted” numbers.

Due in part to the drastic drop in productivity, businesses suffered a massive increase in labor costs as they increased 5.7% on an annual basis.

Manufacturing Productivity Up

Even though Non-farm productivity was down drastically (-3.5%) the decrease was limited to the “Business” sector with “manufacturing” productivity actually up 3.8% and it’s subset durable manufacturing up 4.1%. Durable goods are things that do not wear out quickly such as household appliances, cars, consumer electronics, furniture, sports equipment, firearms, and toys.

Business sector output does not include government, non-profit institutions or private households but even so it makes up 76% of the entire Gross Domestic Product (GDP).

So although business productivity was down manufacturing productivity was actually up.

Before you panic, you need to take a step back and come up with a game plan. How much money is in the bank? Do you have enough money to pay your mortgage and other bills for the next few months? Did you receive a severance package? Are you eligible for unemployment compensation? Either way you need to cut your expenses to the bone. Evaluate ongoing subscriptions, stop eating out, going to movies, etc.

Before you panic, you need to take a step back and come up with a game plan. How much money is in the bank? Do you have enough money to pay your mortgage and other bills for the next few months? Did you receive a severance package? Are you eligible for unemployment compensation? Either way you need to cut your expenses to the bone. Evaluate ongoing subscriptions, stop eating out, going to movies, etc. As many people discover the advantages of taking classes online, more top-tier universities, such as Harvard, Yale and MIT are providing “MOOC’s” or massive open online courses . These online lectures are often available free of charge. Stanford has the most popular free course: Introduction to “AI” with 160,000 students from 190 countries.

As many people discover the advantages of taking classes online, more top-tier universities, such as Harvard, Yale and MIT are providing “MOOC’s” or massive open online courses . These online lectures are often available free of charge. Stanford has the most popular free course: Introduction to “AI” with 160,000 students from 190 countries.

As a general rule, payments that are made under an employment contract are taxable. This obviously includes salary, commission, bonuses, and holiday pay. Meanwhile, payments that are made by way of compensation are tax-free (up to £30,000). For example, damages for unfair dismissal or discrimination would come within this category. And so an important question is whether the PILON is contractual or not. Does your employment contract contain a clause that allows your employer to make a PILON? If it does, then the PILON should be taxed. Since it is being made in accordance with the employment contract.

As a general rule, payments that are made under an employment contract are taxable. This obviously includes salary, commission, bonuses, and holiday pay. Meanwhile, payments that are made by way of compensation are tax-free (up to £30,000). For example, damages for unfair dismissal or discrimination would come within this category. And so an important question is whether the PILON is contractual or not. Does your employment contract contain a clause that allows your employer to make a PILON? If it does, then the PILON should be taxed. Since it is being made in accordance with the employment contract.