Due to the government shutdown the Bureau of Labor Statistics is not publishing the regular Unemployment statistics.

The Federal Reserve Bank of Atlanta President, Dennis Lockhart, says that it is fortunate that the FED chose not to begin “tapering” the money stimulus under the circumstances. “We avoided a potentially very awkward situation of reducing stimulus just on the eve of what now has developed” he said.

Speaking of accuracy, according to [Read more…] about Government Shutdown Delays Unemployment Data

This is excellent news for employers as it means that businesses across the UK are expanding and growing at a healthy rate. As well as this, Companies House reports that there are still over 3,000,000 businesses in the UK and only 2,486 were liquidated in July. So, if you’re just starting your business the outlook appears broadly positive- although there’s still a lot of hard work to do!

This is excellent news for employers as it means that businesses across the UK are expanding and growing at a healthy rate. As well as this, Companies House reports that there are still over 3,000,000 businesses in the UK and only 2,486 were liquidated in July. So, if you’re just starting your business the outlook appears broadly positive- although there’s still a lot of hard work to do!

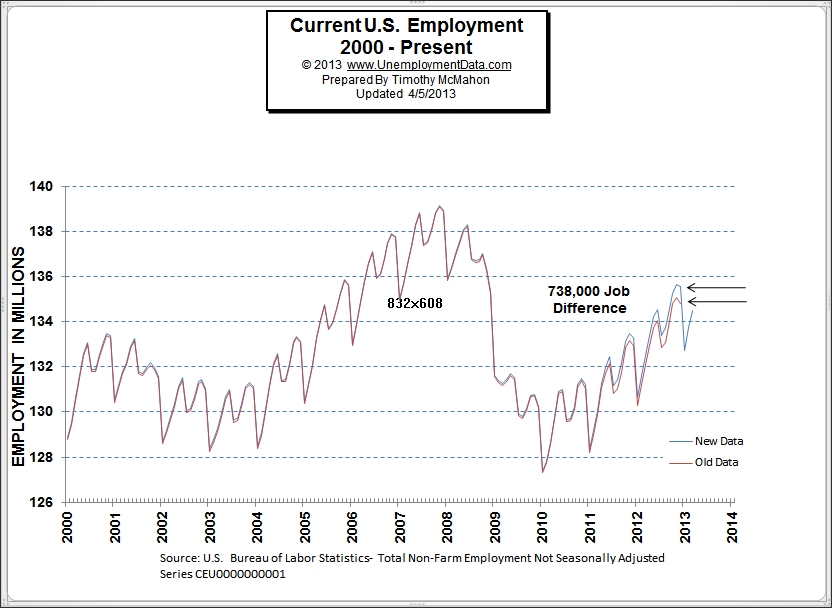

In February, I got an answer, not directly mind you, but when I looked at the January Employment numbers they have magically changed all the way back to July of 1991. Yes, “unadjusted” employment numbers have been adjusted, changed, fudged, manipulated whatever you want to call it.

In February, I got an answer, not directly mind you, but when I looked at the January Employment numbers they have magically changed all the way back to July of 1991. Yes, “unadjusted” employment numbers have been adjusted, changed, fudged, manipulated whatever you want to call it.

“Let’s declare that in the wealthiest nation on Earth, no one who works full time should have to live in

“Let’s declare that in the wealthiest nation on Earth, no one who works full time should have to live in

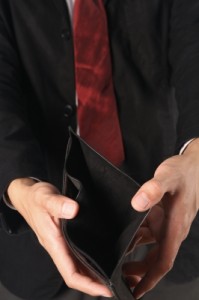

If you find yourself suddenly unemployed, one of the first things you need to do is find ways to cut your expenses. There are some things that may be set in stone, such as your rent, but there are many other things that are negotiable. Start by making a list of your bills. Flag things that can be reduced–electric, water, gas, telephone, internet. Get your entire family in on the plan so that you can brainstorm money-saving ideas and put cost-cutting measures into action right away. Finally, reduce your other bills. Contact various insurance companies for better rates. Call your credit card companies to ask for a reduction in interest or payments. Refinance your loans (if you can do so cheaply) to get a lower rate and a lower monthly payment; If you can’t refinance, request an extension.

If you find yourself suddenly unemployed, one of the first things you need to do is find ways to cut your expenses. There are some things that may be set in stone, such as your rent, but there are many other things that are negotiable. Start by making a list of your bills. Flag things that can be reduced–electric, water, gas, telephone, internet. Get your entire family in on the plan so that you can brainstorm money-saving ideas and put cost-cutting measures into action right away. Finally, reduce your other bills. Contact various insurance companies for better rates. Call your credit card companies to ask for a reduction in interest or payments. Refinance your loans (if you can do so cheaply) to get a lower rate and a lower monthly payment; If you can’t refinance, request an extension. The media has depicted a crisis in the American manufacturing industry. Though the manufacturing industry has significantly shrunk in the U.S., no one can deny that the manufacturing business is still very strong. Manufacturing generates over 1.5 trillion dollars (more than 10 percent of the GDP) to the U.S. economy every year, and it employs over 17 million citizens. According to the United Nations Statistic Division, the U.S. produces more manufactured products than any other country in the world. The U.S. makes more than 20 percent of global manufactured products, compared to China’s 15 percent (second place) and Japan’s 12 percent (third place).

The media has depicted a crisis in the American manufacturing industry. Though the manufacturing industry has significantly shrunk in the U.S., no one can deny that the manufacturing business is still very strong. Manufacturing generates over 1.5 trillion dollars (more than 10 percent of the GDP) to the U.S. economy every year, and it employs over 17 million citizens. According to the United Nations Statistic Division, the U.S. produces more manufactured products than any other country in the world. The U.S. makes more than 20 percent of global manufactured products, compared to China’s 15 percent (second place) and Japan’s 12 percent (third place). Purchasing a home has long been a big financial undertaking. For many, the thought of a looming home loan becoming more and more swollen with interest over the next 20-30 years isn’t exactly the most alluring aspect of having your own hearth to decorate each holiday. In short, it’s a decision you can drag your feet to make; combine that with the fact that the market is currently tipped in favor of buyers who have more time and reduced pressure to find a quality, affordable home without fear of their options disappearing. In this buyer’s market, families looking for a new home know they have the luxury of more and better options when it comes to financing and overall home prices and they’re taking their time. According to CNN Money, home prices are down on a national average of 34% (although

Purchasing a home has long been a big financial undertaking. For many, the thought of a looming home loan becoming more and more swollen with interest over the next 20-30 years isn’t exactly the most alluring aspect of having your own hearth to decorate each holiday. In short, it’s a decision you can drag your feet to make; combine that with the fact that the market is currently tipped in favor of buyers who have more time and reduced pressure to find a quality, affordable home without fear of their options disappearing. In this buyer’s market, families looking for a new home know they have the luxury of more and better options when it comes to financing and overall home prices and they’re taking their time. According to CNN Money, home prices are down on a national average of 34% (although