The following article by Valerie Rhea originally appeared on Quora. Valerie is a thirty-something PhD economist, former military pilot, with a law degree.

Would More Jobs Help Social Security?

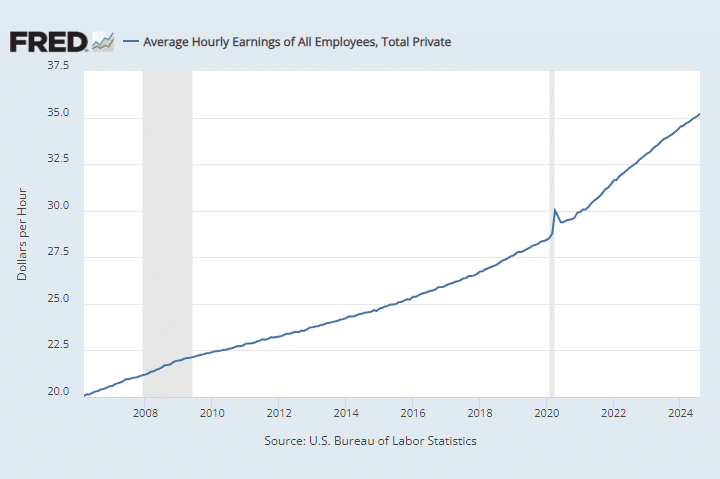

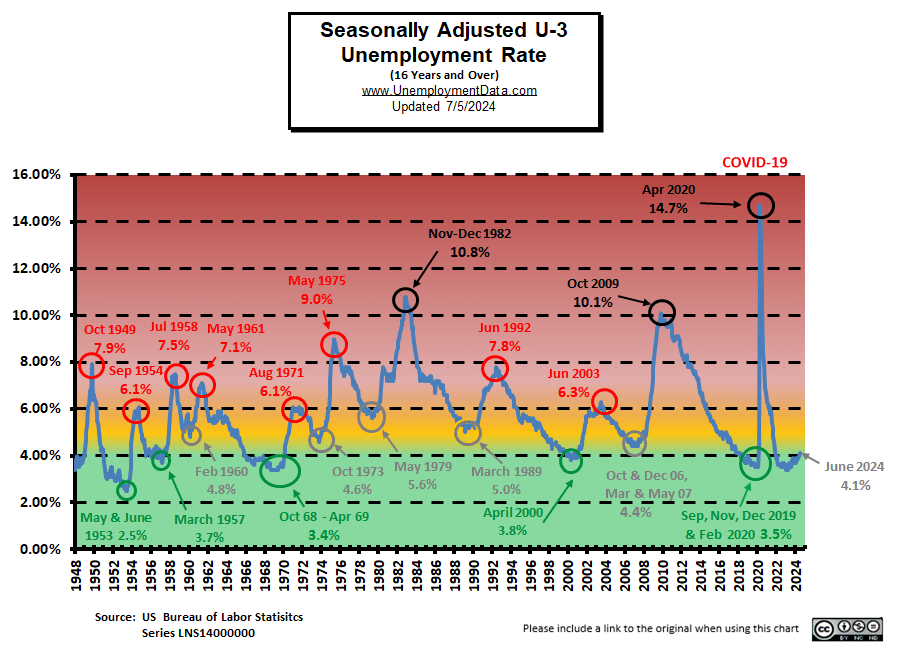

Yes, higher employment (and higher wages, by the way) results in more inflows to the Social Security system. In 2024, the SSA spent about $60 billion more than it took in via payroll taxes. If US payrolls increased by about $500 billion – that’s about 1.75% of GDP – then instead of operating at a deficit, Social Security would have approximately broken even.

To realize $500 billion in increased payrolls, roughly 6 million average-paying jobs would need to be added. If we forget about population growth for a moment, that means expanding the US workforce participation rate by about 4% would do the trick. That would take us to a workforce participation rate of about 66%—levels last seen during the Bush administration.

Unfortunately, keeping Social Security solvent becomes increasingly difficult to keep up with because of the country’s demographics. Right now, an estimated 2.4 workers pay into Social Security for every person receiving benefits, down from about five workers per beneficiary in 1960. By 2050, the ratio is expected to fall below two workers per beneficiary. Further, during any period of inflation, COLA adjustments and so on force the cost of benefits to grow rapidly. Although every little bit helps, America just isn’t likely to grow our workforce fast enough to keep up with longer lifespans.

Deciding to obtain a Commercial Driver’s License (CDL) can unlock a variety of career paths in the transportation industry. From long-haul trucking to local delivery, each role offers its own unique set of opportunities and demands. Whether driving across the country or staying within city limits, CDL holders can find fulfilling jobs that suit different lifestyles and preferences. Understanding the different opportunities available with a CDL can help you make an informed decision about which path might be right for you.

Deciding to obtain a Commercial Driver’s License (CDL) can unlock a variety of career paths in the transportation industry. From long-haul trucking to local delivery, each role offers its own unique set of opportunities and demands. Whether driving across the country or staying within city limits, CDL holders can find fulfilling jobs that suit different lifestyles and preferences. Understanding the different opportunities available with a CDL can help you make an informed decision about which path might be right for you.

The University of Michigan Consumer Sentiment Survey plummeted to its lowest level in seven months. The index reading for June came in at 65.6, down from 69.1 in May and under the consensus expectation of 72. In the current conditions and expectations categories, the survey fell below economists’ expectations.

The University of Michigan Consumer Sentiment Survey plummeted to its lowest level in seven months. The index reading for June came in at 65.6, down from 69.1 in May and under the consensus expectation of 72. In the current conditions and expectations categories, the survey fell below economists’ expectations. The demand for skilled electric vehicle technicians is surging, with the automotive industry rapidly transitioning towards electric vehicles (EVs). Today we explore the essential skills required to excel in this field and the training options available to aspiring EV technicians. By understanding the necessary competencies and choosing the right training path, you can set yourself up for a promising career in EV maintenance and repair.

The demand for skilled electric vehicle technicians is surging, with the automotive industry rapidly transitioning towards electric vehicles (EVs). Today we explore the essential skills required to excel in this field and the training options available to aspiring EV technicians. By understanding the necessary competencies and choosing the right training path, you can set yourself up for a promising career in EV maintenance and repair.

Unlike any other healthcare environment, working in an

Unlike any other healthcare environment, working in an  Are you looking for a career that offers stability, flexibility, and the opportunity for growth? If so, a career in truck driving may be the perfect fit for you. In this blog post, we will explore the many benefits of pursuing a career in truck driving and why it may be the right choice for you.

Are you looking for a career that offers stability, flexibility, and the opportunity for growth? If so, a career in truck driving may be the perfect fit for you. In this blog post, we will explore the many benefits of pursuing a career in truck driving and why it may be the right choice for you.