The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for February on March 6th.

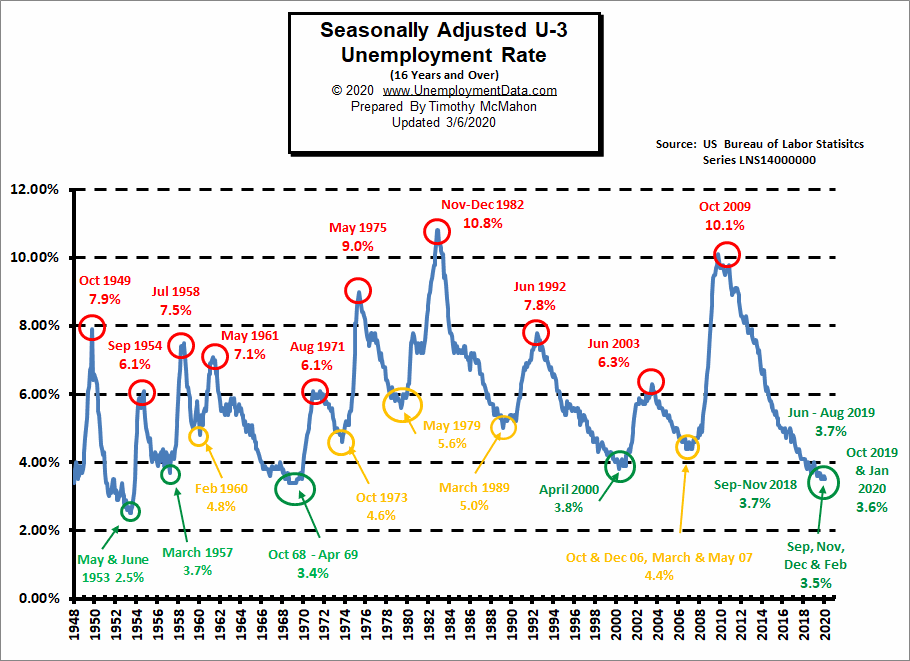

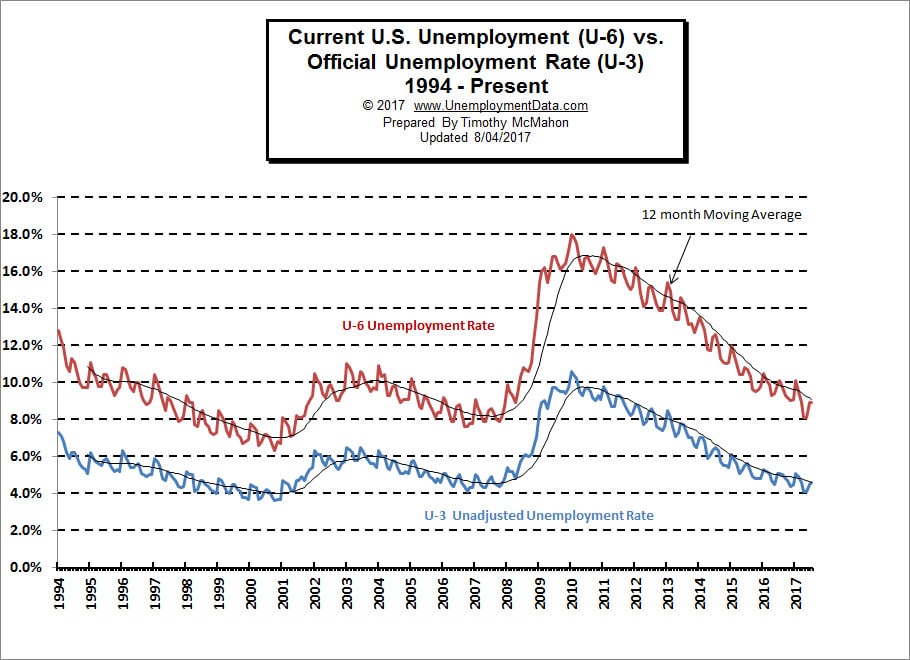

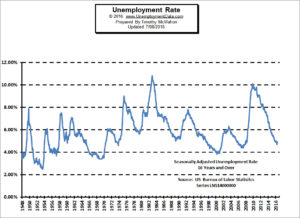

Unemployment returns to 50-year lows. The “Seasonally Adjusted” Unemployment Rate fell from 3.6% in January to 3.5% in February. Thus returning to the previous low levels of September, November, and December after increasing slightly in January.

We are still in record low territory and that won’t change overnight. Seasonally adjusted U-3 Unemployment notched up 1/10th of a percent in January and fell back the same amount in February. The Labor Force Participation Rate (LFPR) remains in territory that it hasn’t seen in years…

This is better than expected results and according to @AP News it shows that “the economy was in strong shape before the coronavirus began to sweep

through the U.S. “

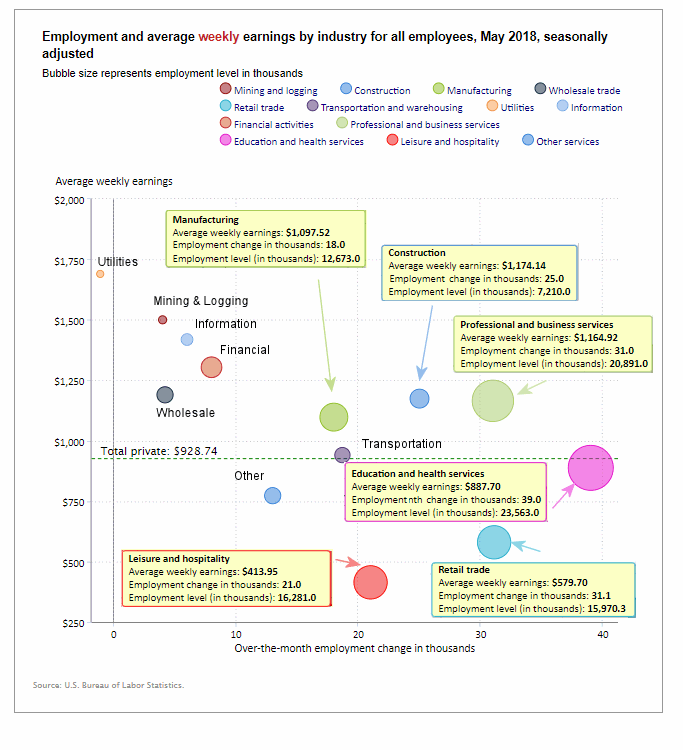

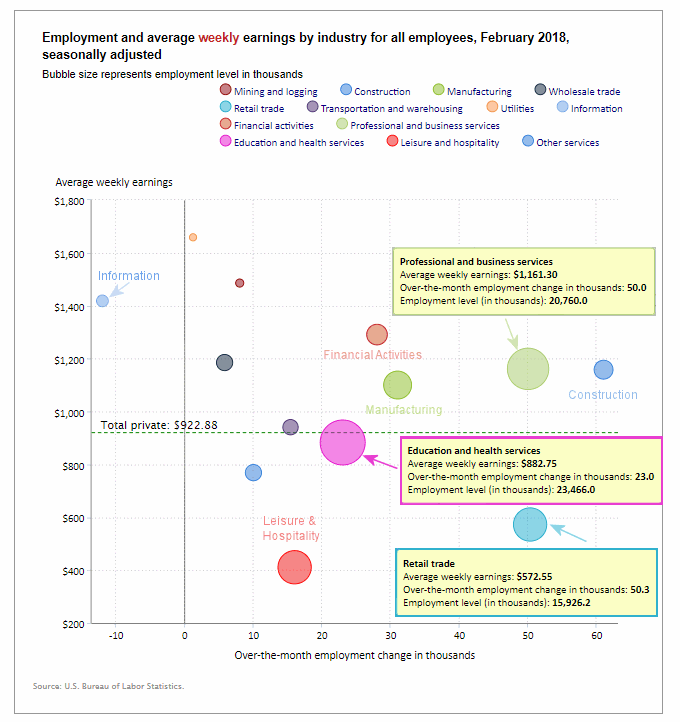

The average monthly wage is up almost $130 over year-ago levels so two-income families are bringing in an average of at least $250 a month more. (See employment by Sector for more info).

This month we will also look at unemployment by Education level, and reasons for unemployment.

February Jobs Report Smashes Expectations

- Unadjusted U-3 was down from 4.0% to 3.8%!

- Adjusted U-3 was down slightly from 3.6% to 3.5%!

- Unadjusted U-6 was down from 7.7% to 7.4%!

- Labor Force Participation remains at the highest level since 2013.

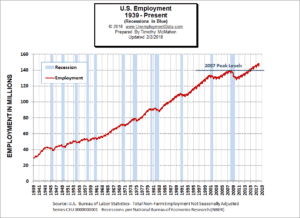

- Unadjusted Employment Up by approx. 880,000 jobs.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Nonfarm payroll employment rose by 273,000 in February, and the unemployment rate was little changed at 3.5 percent.

Notable employment gains occurred in health care and social assistance, food services and drinking places, government, construction, professional and technical services, and financial activities.”But, he is talking about “Seasonally Adjusted Jobs” from the “Current Population Survey (CPS)” rather than looking at the results reported by actual companies in their “Current Employment Statistics survey (CES)”

Looking at the CES report we see…

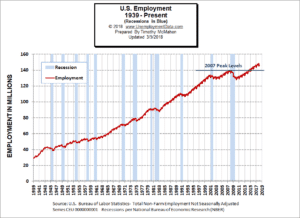

Originally the BLS reported 150.102 million jobs for January and then they added 15,000 jobs to that estimate.

So currently they are saying 150.117 million jobs for January and 150.997 million jobs for February

which is actually an increase of 895,000 jobs over what they originally reported last month and 880,000 more than current estimates for last month.Of course, the Corona Virus scare is affecting the Stock Market as the AP news was quick to point out. So March numbers may be affected by that.

For more info see our Current Unemployment Chart and Current U.S. Employment Chart commentary.

[Read more…] about February Jobs Report Smashes Expectations

Over the last month, the actual number of people working (not seasonally adjusted) has increased by

Over the last month, the actual number of people working (not seasonally adjusted) has increased by  Over the same period, Unadjusted U-6 unemployment which is a broader measure of Unemployment including discouraged workers, climbed steadily.

Over the same period, Unadjusted U-6 unemployment which is a broader measure of Unemployment including discouraged workers, climbed steadily. Over the last month, the actual number of people working (not seasonally adjusted) has decreased by

Over the last month, the actual number of people working (not seasonally adjusted) has decreased by  U-6 Unemployment

U-6 Unemployment

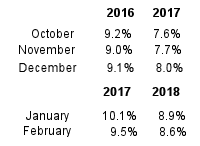

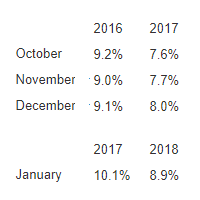

On Friday July 8th, the U.S. Bureau of Labor Statistics (BLS) released their newest unemployment data for June 2016. According to the BLS, the current “Seasonally Adjusted” Unemployment Rate is 4.9% up from 4.7% for May. The current “Unadjusted” rate is 5.1% up from 4.5% in May.

On Friday July 8th, the U.S. Bureau of Labor Statistics (BLS) released their newest unemployment data for June 2016. According to the BLS, the current “Seasonally Adjusted” Unemployment Rate is 4.9% up from 4.7% for May. The current “Unadjusted” rate is 5.1% up from 4.5% in May.