The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for October on November 1st.

Unemployment is still near record lows. Although the “Seasonally Adjusted” Unemployment Rate for October ticked up from 3.5% in September to 3.6%. However, the unadjusted U-3 Unemployment rate was unchanged at 3.3%. This Jobs report was unexpectedly good despite counting 30,000 “unemployed” strikers at auto manufacturers.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Nonfarm payroll employment increased by 128,000 in October, and the unemployment rate was little changed at 3.6 percent. Notable employment gains occurred in food services and drinking places, social assistance, and financial activities. Within manufacturing, employment declined in motor vehicles and parts due to strike activity. Federal government employment was down, reflecting a drop in the number of temporary jobs for the 2020 Census.”

Experts had been predicting that the economy would add no more than 75,000 jobs. In fact, MarketWatch on Thursday told readers that

the report would be “a big dud” due to the impact of the General Motors strike on the overall numbers.

If it hadn’t been for the strike the October numbers would have been even better.

Of course, the Commissioner is talking about “Seasonally Adjusted Jobs” from the “Current Population Survey (CPS)”

rather than looking at the results reported by actual companies in the BLS’ “Current Employment Statistics survey (CES)”

in reality, the BLS has done a lot of “Adjusting” over the last few months.

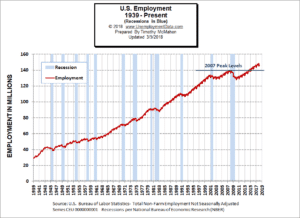

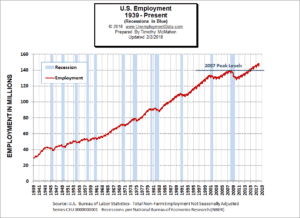

The original CES numbers the BLS reported for August was 151.517 million people employed in August

then later they adjusted it up to 151.607 million. And for September they originally reported there were 151.949 million employed

and currently they are reporting 152.962 million employed so that is an actual increase of 1.013 million NOT and adjusted increase of 128,000!

But in addition to “Seasonal Adjustment”, they adjusted September’s number up to 152.015 million

so the difference between September and October appears to be less than it actually was.

For more info see our Current Unemployment Chart and Current U.S. Employment Chart commentary:

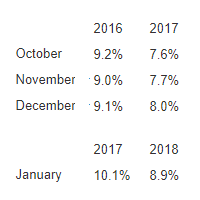

October Jobs Report Smashes Expectations

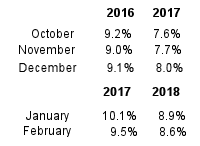

- Unadjusted U-3 was Unchanged at 3.3%!

- Adjusted U-3 was up slightly from 3.5% to 3.6%!

- Unadjusted U-6 was Unchanged at 6.5%!

- Labor Force Participation hits levels not seen since 2013 at recent peak levels of 63.3%.

- Unadjusted Employment Up

- The unemployment rate for black Americans nudged lower to 5.4 percent, setting a new record,

Key factors in the BLS report were:

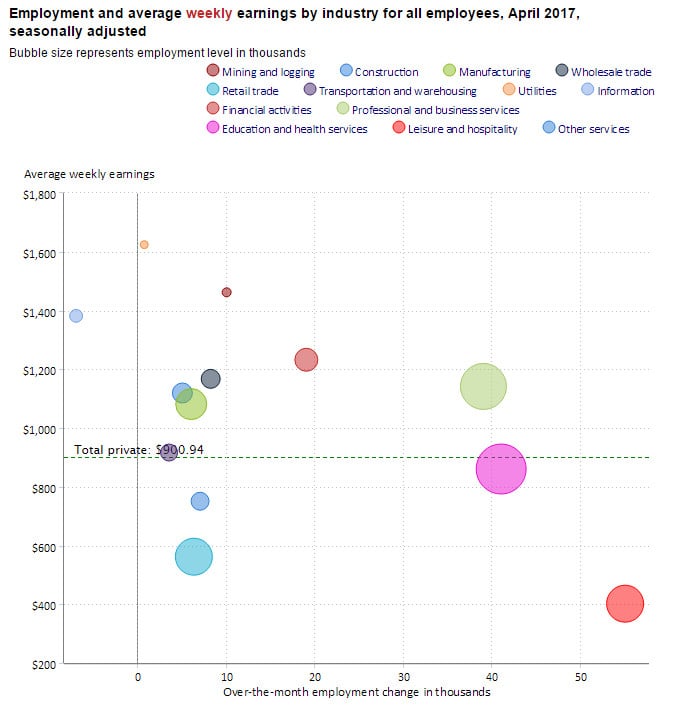

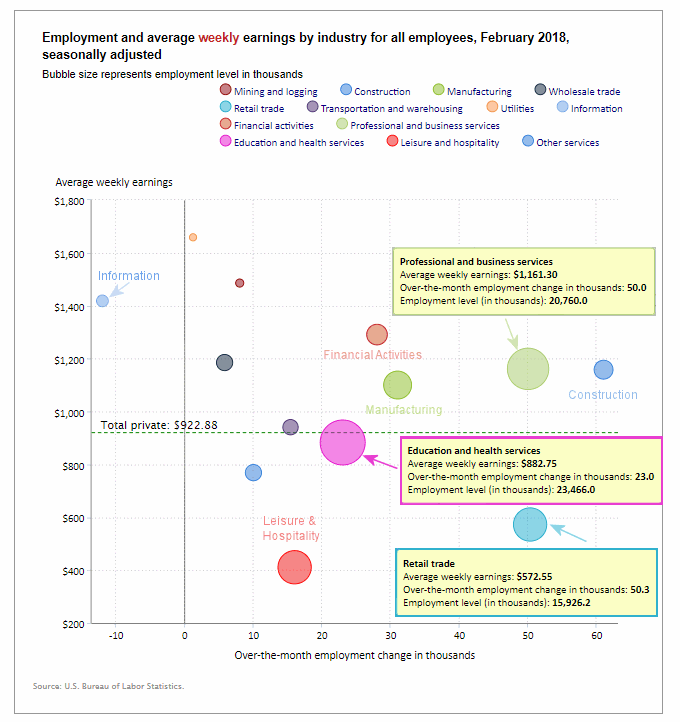

Employment in food services and drinking places rose by 48,000 over the month.

Financial activities employment rose by 15,000, with nearly half of the gain occurring in insurance carriers and related activities (+7,000).

Social assistance added 20,000 jobs in October, with most of the gain occurring in individual and family services.

Financial activities added 16,000 jobs.

Professional and business services added 22,000 jobs.

Health care added 15,000 jobs.

Manufacturing employment declined by 36,000 in October.

Employment in motor vehicles and parts manufacturing decreased

by 42,000, reflecting strike activity.

[Read more…] about October Unemployment- Jobs Much Better Than Expected

Over the last month, the actual number of people working (not seasonally adjusted) has increased by

Over the last month, the actual number of people working (not seasonally adjusted) has increased by  Over the same period, Unadjusted U-6 unemployment which is a broader measure of Unemployment including discouraged workers, climbed steadily.

Over the same period, Unadjusted U-6 unemployment which is a broader measure of Unemployment including discouraged workers, climbed steadily. Over the last month, the actual number of people working (not seasonally adjusted) has decreased by

Over the last month, the actual number of people working (not seasonally adjusted) has decreased by