How can College Students become Job-ready?

Are you in your junior or senior year of college? Prepare yourself for the job market now and don’t let the recession bother you. As a college student you might not find too many jobs. But, you can build a strong foundation for a future career.

Here are some tips for college students to lay a foundation while in college.

How can College Students be Successful in the Job Market?

Attitude Goes a Long Way

College students who have the motivation and who can work hard and smart can overcome the “experience” block. One key factor that employers look at is attitude. Often a future employer will choose the candiate with the stronger work ethic over one with more experience or better credentials. Become a hard worker, don’t expect to laze around and get paid for it. Show energy, enthusiasm for the job, a friendly attitude and be willing to learn. You can’t fake this, it must come from within. If you enjoy what you are doing you will have the right attitude. Don’t think of work as a drudgery that you have to do so you will have money to live on weekends. Think of it as an opportunity to do interesting stuff, meet interesting people and learn new things.

Gain Skills and Experience

Make the best use of your junior and senior years to gain [Read more…] about Job Success Tips for College Students

Young Professionals:

Young Professionals:

Building Credit History—natloans (Flickr.com)You have to have credit history in order to buy or lease a car… buy a home…be considered for a loan…

Building Credit History—natloans (Flickr.com)You have to have credit history in order to buy or lease a car… buy a home…be considered for a loan…

Even contract labor requires certain documentation. If a company pays a contractor more than $600 over the course of the year, a 1099 must be filed. Keeping track of the various tax amounts for various employees as well as which contracted employees earned how much can easily become a full-time job. Small business owners have plenty of other details to manage without adding that to their plates. If only for personnel purposes, an accountant will save time as well as headaches.

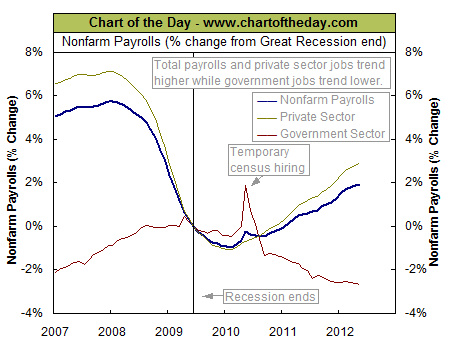

Even contract labor requires certain documentation. If a company pays a contractor more than $600 over the course of the year, a 1099 must be filed. Keeping track of the various tax amounts for various employees as well as which contracted employees earned how much can easily become a full-time job. Small business owners have plenty of other details to manage without adding that to their plates. If only for personnel purposes, an accountant will save time as well as headaches. Today’s chart compares the total nonfarm payrolls (blue line) to its two components Private sector job market (gold line) and Government sector job market (red line). But rather than showing total jobs it shows the percentage change in total nonfarm payrolls (blue line) since the declared end of the Great Recession in 2009 (the vertical line). So at that point it is zero. Prior to that point private sector jobs were as high as 7% higher while public sector (government) jobs were 2% lower (i.e. the government increased its

Today’s chart compares the total nonfarm payrolls (blue line) to its two components Private sector job market (gold line) and Government sector job market (red line). But rather than showing total jobs it shows the percentage change in total nonfarm payrolls (blue line) since the declared end of the Great Recession in 2009 (the vertical line). So at that point it is zero. Prior to that point private sector jobs were as high as 7% higher while public sector (government) jobs were 2% lower (i.e. the government increased its