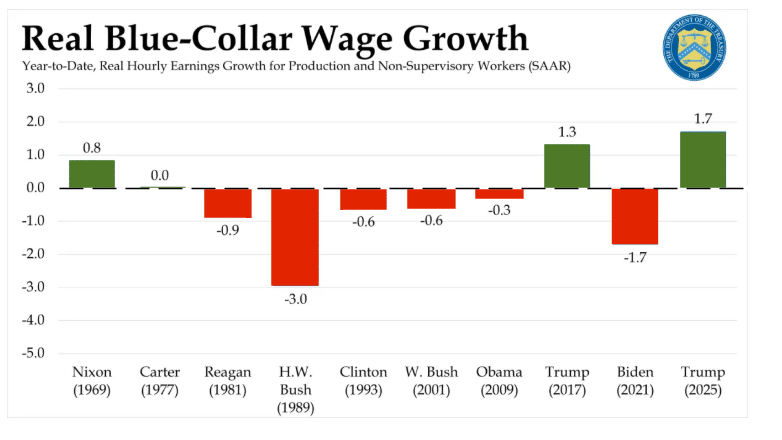

According to recent data from the U.S. Department of the Treasury, in the first five months of President Donald Trump’s second term, blue-collar workers have experienced the strongest early-term wage gains for working-class Americans under any U.S. president in nearly 60 years. The 1.7% real (i.e., inflation-adjusted) wage increase sharply contrasts with negative growth under most Presidents.

Since President Richard Nixon took office in 1969, no other president has matched this level of early-term wage growth for non-supervisory and production workers. Nixon’s comparable figure stood at just 0.8% during his initial months in office. Trump’s latest achievement builds upon his previous track record; in his first term, blue-collar wages grew by 1.3% in the same period, already a strong showing, but now surpassed. [Read more…] about Blue-Collar Wages Surge in 2025