Typically July is one of the worst months for employment second only to January. But this obviously isn’t a typical year.

More than a Half-Million People Return to Work in July as COVID restrictions relax.

The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for July on August 7th.

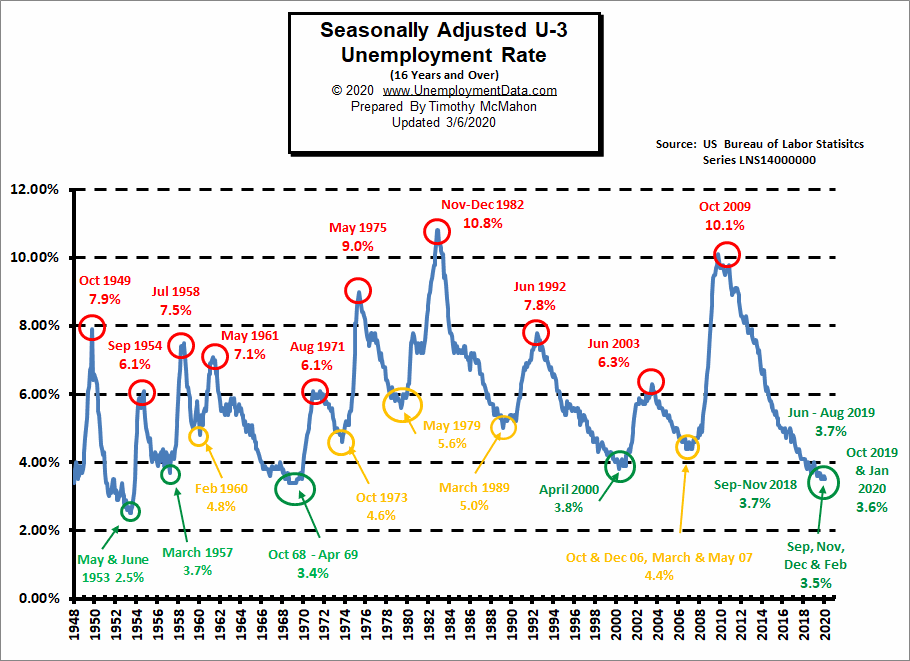

- Unadjusted U-3 was Down from 11.2% to 10.5%!

- Adjusted U-3 was Down from 11.1% to 10.2%!

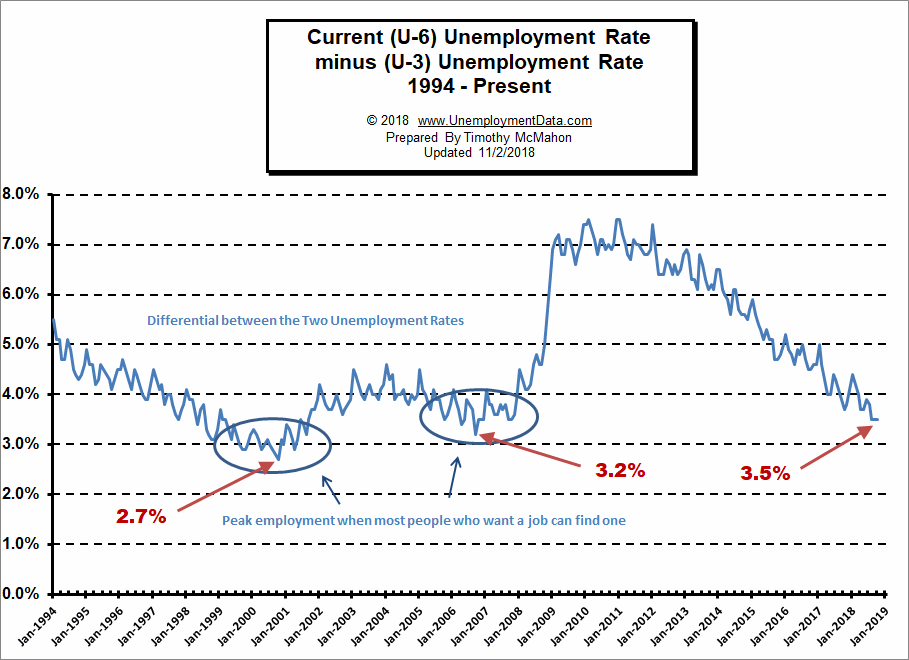

- Unadjusted U-6 was Down from 18.3% to 16.8%!

- Labor Force Participation fell from 61.5% to 61.4%.

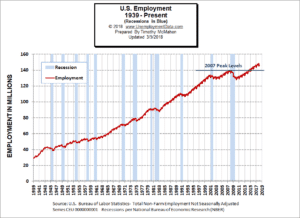

- Unadjusted Employment up from 138.509 to 139.100 million.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

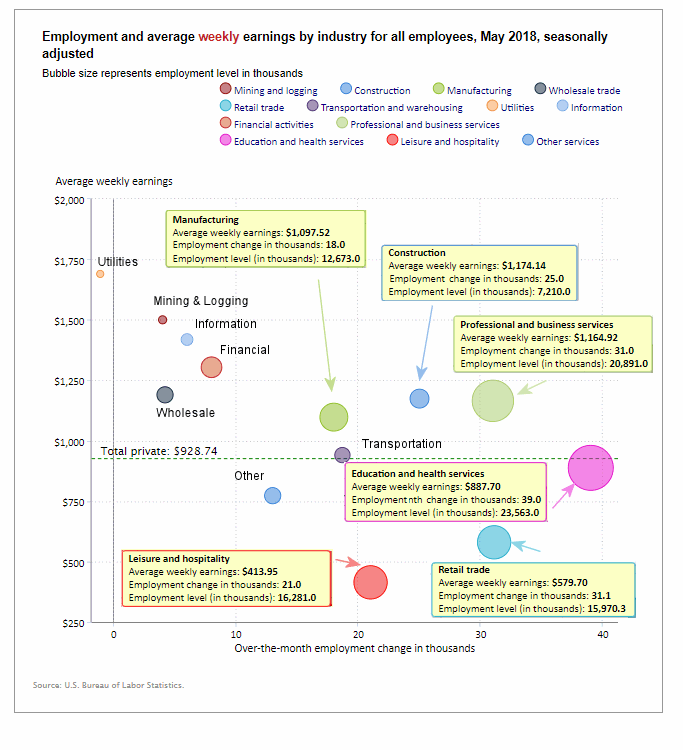

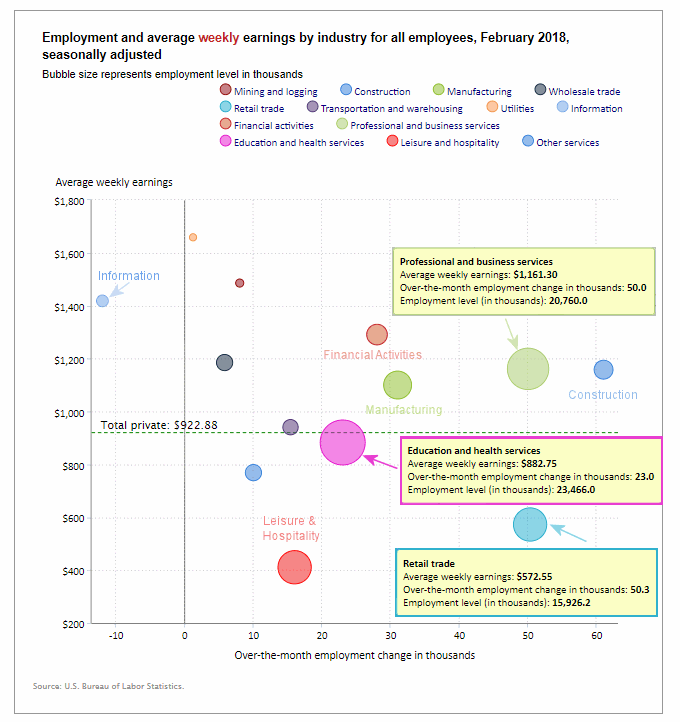

“Non-farm payroll employment increased by 1.8 million in July, and the unemployment rate declined by 0.9 percentage point to 10.2 percent. These improvements reflect the continued resumption of economic activity that had been curtailed due to the Coronavirus (COVID-19) pandemic and efforts to contain it. In July, employment rose in several major industries, with the largest gains in leisure and hospitality, government, retail trade, professional and business services, other services, and health care.”

“The rate of recovery in the labor market slowed in July, as job growth over the month was less than half that for June. As of July, total non-farm employment is 12.9 million, or 8.4 percent, lower than in February, before the pandemic crisis unfolded in many parts of the United States. Similarly, although unemployment continued to fall in July, the unemployment rate and the number of unemployed people are up by 6.7 percentage points and 10.6 million, respectively, since February.”

Of course, he is talking about “Seasonally Adjusted Jobs” from the “Current Population Survey (CPS)” rather than looking at the results reported by actual companies in their “Current Employment Statistics survey (CES)”

Looking at the CES report we see…

Originally the BLS reported 138.513 million jobs for June, they subtracted 4,000 jobs from that estimate.

So currently they are saying 138.509 million jobs for June and 139.100 million jobs for July which is an increase of 591,000 jobs based on their updated estimates.

[Read more…] about Employment Up by a Half-Million in a Typically Bad Month

Over the last month, the actual number of people working (not seasonally adjusted) has increased by

Over the last month, the actual number of people working (not seasonally adjusted) has increased by