The U.S. Bureau of Labor Statistics (BLS) released its delayed employment / unemployment report for November

on December 16th, 2025.

Employment / Unemployment

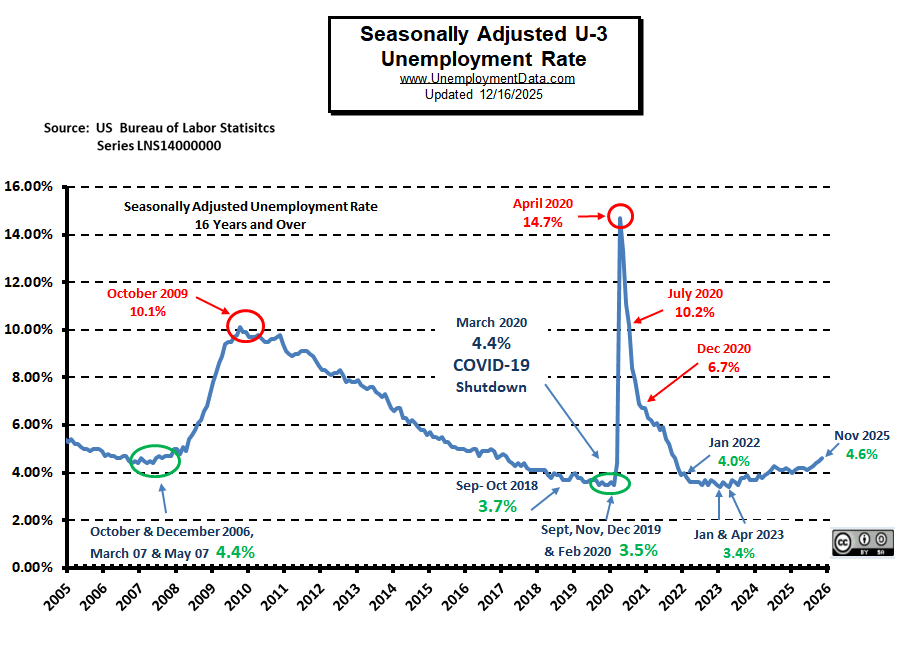

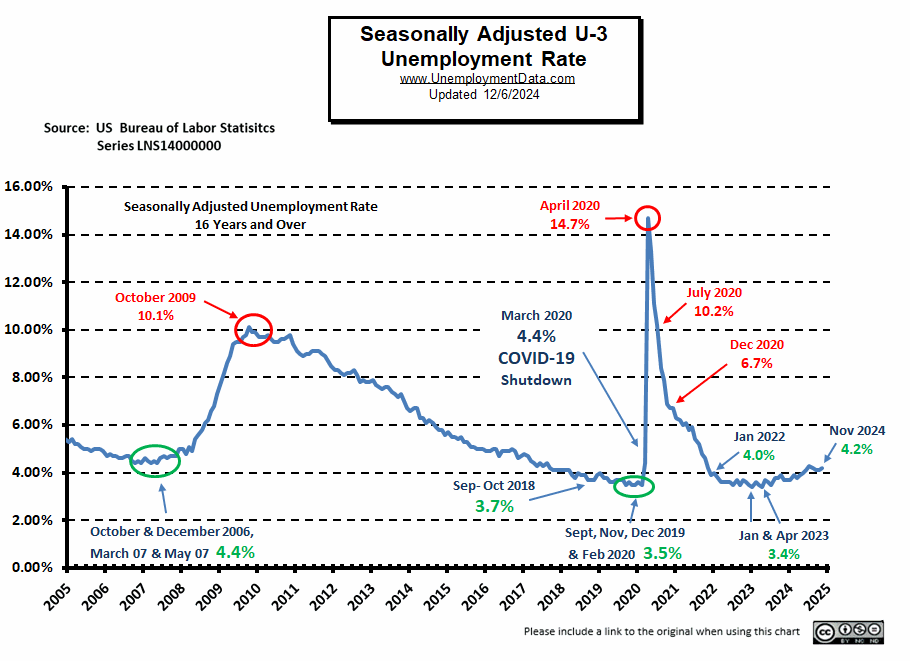

- Seasonally Adjusted U3- 4.6% Up from 4.4% in September

- Unadjusted U3- 4.3% unchanged from September

- Unadjusted U6- 8.4% Up from 7.7% in September

- Labor Force Participation Rate- 62.5% Up from 62.4%

- Employment- 160.411 million in October

- Employment- 160.652 million in November

- Next data release- January 9, 2026

- October Unemployment Data not available due to gov’t shutdown

Summary:

Although unemployment information for October is not available Employmentdata was still collected. Total Employed increased in both October and November. Unadjusted Unemployment was 4.3% in both September and November, but Seasonally adjusted Unemployment increased in November.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

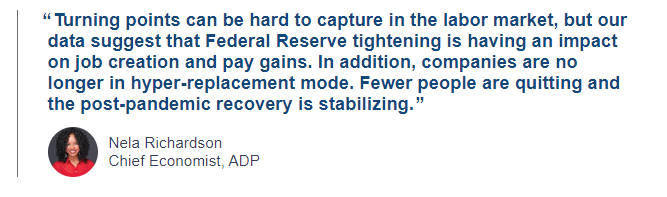

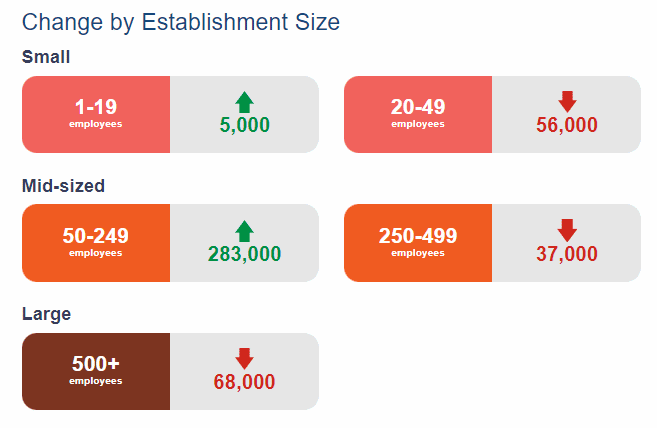

“Total nonfarm payroll employment changed little in November (+64,000) and has shown little net change since April, the U.S. Bureau of Labor Statistics reported today. In November, the unemployment rate, at 4.6 percent, was little changed from September. Employment rose in health care and construction in November, while the federal government continued to lose jobs…

Federal government employment continued to decrease in November (-6,000). This follows a sharp decline of 162,000 in October, as some federal employees who accepted a deferred resignation offer came off federal payrolls. Federal government employment is down by 271,000 since reaching a peak in January. (Federal employees on furlough during the government shutdown were counted as employed in the establishment survey because they received pay, even if later than usual, for the pay period that included the 12th of the month. Employees on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey.)”

You can read the full BLS report here.

As usual, they are talking about “Seasonally Adjusted Jobs”.

Looking at the Unadjusted Establishment Survey report, we see…

Originally, the BLS reported employment of 159.732 million for September.

They are currently reporting 160.411 million jobs for October and 160.652 million for November, which is actually an increase of 241,000 jobs from October to November. The LFPR was up from 62.4% in September to 62.5% in November.

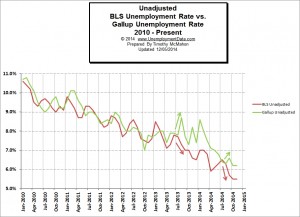

Current Unemployment Rate Chart

As we can see, unemployment is above pre-COVID lows of 2019 and the January and April lows of 2023.

Once again the BLS numbers are quite a bit different than the independently generated Gallup numbers. This is no surprise, based on the long-term comparison between the BLS numbers and the Gallup numbers the BLS numbers consistently present a rosier picture than the Gallup numbers do.

Once again the BLS numbers are quite a bit different than the independently generated Gallup numbers. This is no surprise, based on the long-term comparison between the BLS numbers and the Gallup numbers the BLS numbers consistently present a rosier picture than the Gallup numbers do.