The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for May on June 7th, 2024.

Employment / Unemployment

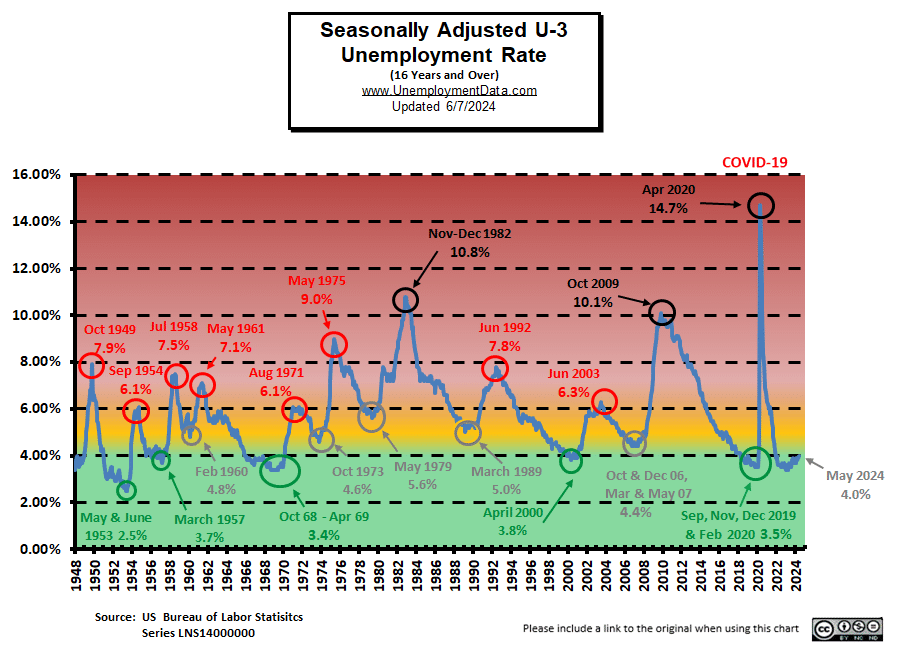

- Seasonally Adjusted U-3 was 4.0% up from 3.9% in April

- Unadjusted U-3 was 3.7% up from 3.5% in April

- Unadjusted U-6 was 7.1% up from 6.9% in April

- Labor Force Participation was 62.5% down from 62.7%

- Unadjusted Employment rose from 158.001 million to 158.918 million

- Next data release July 5th 2024

Summary:

Total Employed increased in May, but Unemployment was also up.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Total nonfarm payroll employment increased by 272,000 in May, and the unemployment rate changed little at 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in several industries, led by health care; government; leisure and hospitality; and professional, scientific, and technical services.

Both the unemployment rate, at 4.0 percent, and the number of unemployed people, at 6.6 million, changed little in May. A year earlier, the jobless rate was 3.7 percent, and the number of unemployed people was 6.1 million.”

You can read the full BLS report here.

As usual, they are talking about “Seasonally Adjusted Jobs”.

Looking at the Unadjusted Establishment Survey report we see…

Originally the BLS reported employment of 158.016 million for April which they adjusted slightly to 158.001 million in May.

They are currently reporting 158.918 million jobs for May which is actually an increase of 902,000 jobs based on their original numbers or 917,000 based on their new numbers for April. The LFPR was down from 62.7% to 62.5%.

The LFPR was down from 62.7% to 62.5%.

Bad News for the Market

In the perverse stock market of these post-pandemic days, the market is looking for an excuse for the FED to cut interest rates so “Bad News is Good News” for the market.

BUT… This month was the opposite of last month, the “experts” were only expecting 190,000 new jobs but the BLS reported 272,000 new jobs. So the market fell on the “good news”. However, had they focused on the Adjusted U3 number itself (like they did last month) which rose from 3.9% to 4.0% the market would have risen. This is the same percentage increase as last month which went from 3.8% in March to 3.9% in April. But last month that increase triggered a buying spree.

And all those extra jobs that the market was worried about? 43,000 of them were new government jobs! Hardly the sign of a booming economy. Mr. Market may have been fooled by the ADP report (which is released 2 days before the BLS report) that showed only 152,000 new jobs based on actual payroll records that ADP processes.

So, the real numbers don’t really matter, as Bob Prechter of Elliottwave International says, all that matters is finding an excuse to do what the market wants to do anyway.

Current Unemployment Rate Chart

Seasonally Adjusted U3 Unemployment remains above the pre-COVID 2019 cyclical lows of 3.5%, as well as above the lows made early in 2023. The unemployment rate is inching back toward the yellow zone.

[Read more…] about May 2024 Employment- Good News is Bad News?