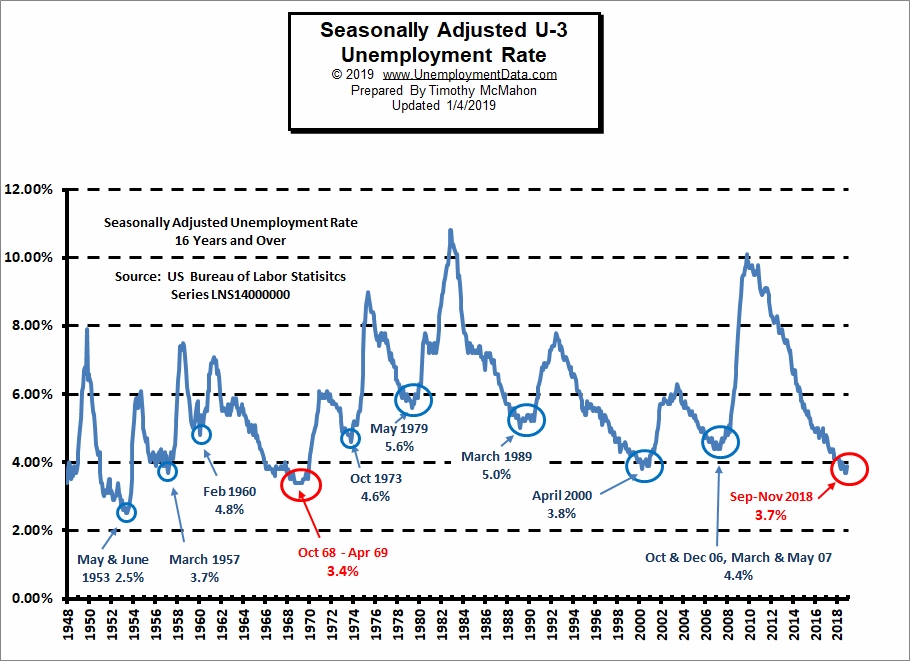

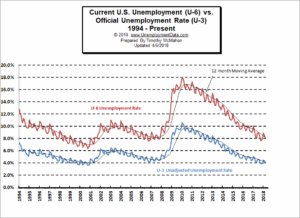

The U.S. Bureau of Labor Statistics (BLS) released their monthly unemployment survey results for January on February 1st. “Seasonally Adjusted” Unemployment U-3 is 4.0% up from 3.9% in December. Unadjusted U-3 was 4.4% up from 3.7% in December and 3.5% in November.

Looking back, Seasonally Adjusted U-3 started 2017 at 4.8% then it bounced around between 4.3% and 4.4% from April through October 2017, then it stayed at 4.1% from October 2017 through March 2018. It bounced between 3.8% and 4.0% from April through August 2018 before falling to 3.7% in September – November. So unemployment is currently at the same level as it was from April through August 2018.

Key January Employment and Unemployment Numbers

- Adjusted U-3 Unemployment- 4.0% up from 3.9% in December and 3.7% in November.

- Unadjusted U-3 Unemployment- 4.4% up from 3.7% in December and 3.5% in November.

- Unadjusted U-6 Unemployment- 8.8% up from 7.5% in December and 7.2% in November.

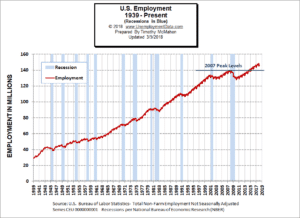

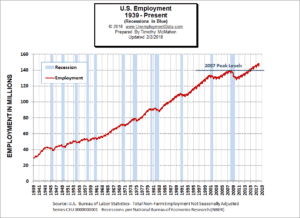

- Unadjusted Employment- 148.201 million down from 151.190 million in December and 151.244 million in November.

- January Labor Force Participation Rate- 63.2% up from 63.1% in December and LFPR 62.9%.

- 100th straight gain in Seasonally Adjusted Employment

As I have been saying for a while [Read more…] about January Employment the Good and Bad

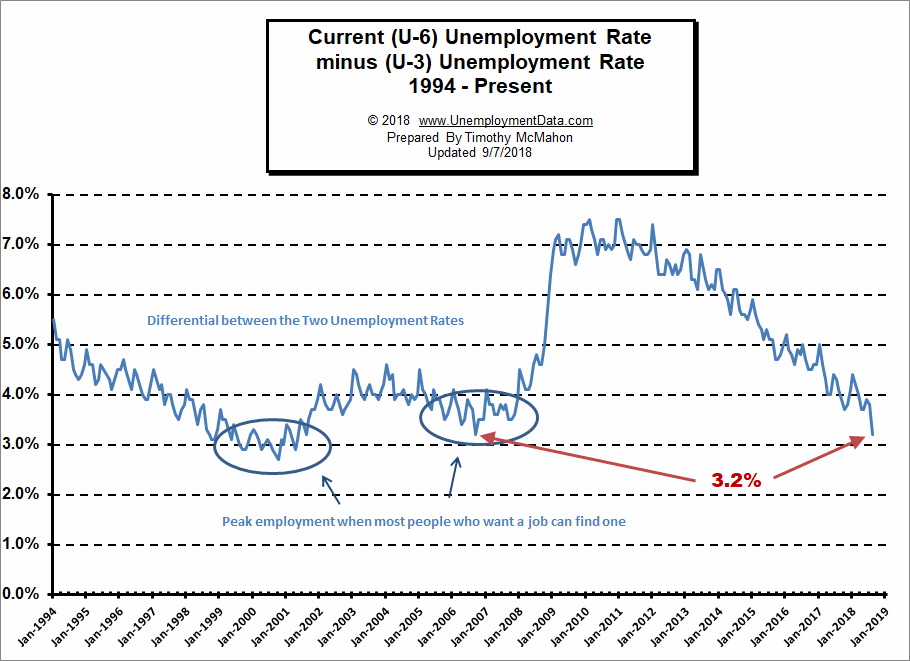

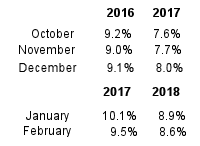

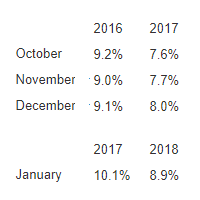

Looking at the broader measure of Unemployment which includes discouraged workers, we see that the U-6 unemployment rate fell from 8.9% in

Looking at the broader measure of Unemployment which includes discouraged workers, we see that the U-6 unemployment rate fell from 8.9% in

Over the same period, Unadjusted U-6 unemployment which is a broader measure of Unemployment including discouraged workers, climbed steadily.

Over the same period, Unadjusted U-6 unemployment which is a broader measure of Unemployment including discouraged workers, climbed steadily. Over the last month, the actual number of people working (not seasonally adjusted) has decreased by

Over the last month, the actual number of people working (not seasonally adjusted) has decreased by