November 2021 Unemployment report from the Bureau of Labor Statistics (BLS)

- Unadjusted U-3 was Down from 4.3% to 3.9%

- Adjusted U-3 was Down from 4.6% to 4.2%

- Unadjusted U-6 was Down from 7.7% to 7.4%

- Labor Force Participation Up 61.6% to 61.8%

- Unadjusted employment rose from 149.226 million to 150.004 million

Although November’s job numbers are generally an improvement over October, Bloomberg called them”weird” and “the smallest jobs gain this year”. This jobs report is so weird because retail employment is DOWN by -20,400 in a month, known for increased retail employment. Market commentators are also blaming the Jobs report for Friday’s market drop.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

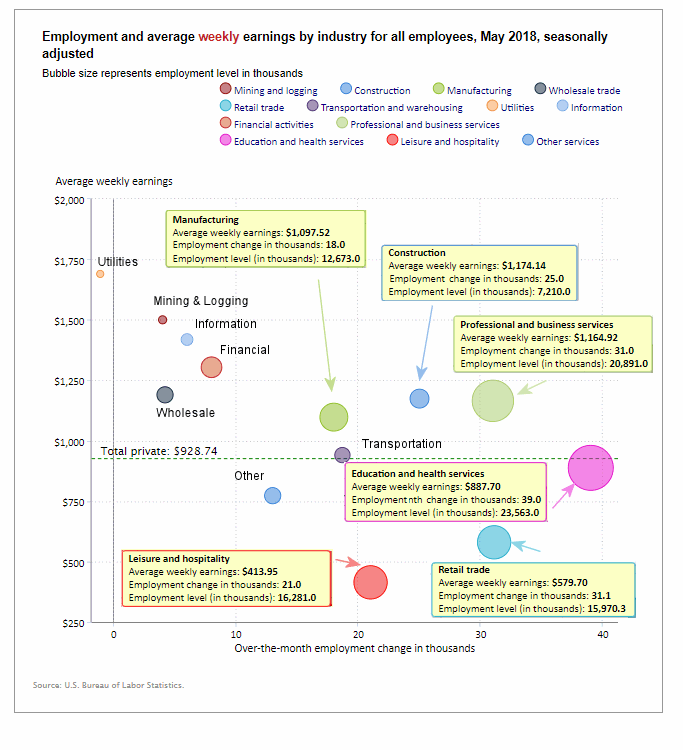

“Nonfarm payroll employment rose by 210,000 in November, and the unemployment rate fell by 0.4 percentage point to 4.2 percent. Notable job gains occurred in professional and business services, transportation and warehousing, construction, and manufacturing. Employment in retail trade declined over the month.”

As usual, they are talking about “Seasonally Adjusted Jobs” from the “Current Population Survey (CPS)” rather than looking at the results reported by actual companies in their “Current Employment Statistics survey (CES).”

But looking at the CES report, we see…

Initially, the BLS reported 149.217 million for October, which they adjusted to 149.226 million. For November, they are reporting 150.004 million,

which is an increase of 787,000 jobs based on their original estimates or an increase of 778,000 based on their updated numbers.