The U.S. Bureau of Labor Statistics (BLS) released their monthly unemployment survey results for June on July 5th. Unemployment is still near record lows but it has ticked up a bit.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

” Nonfarm payroll employment increased by 224,000 in June, and the unemployment rate was little changed at 3.7 percent.

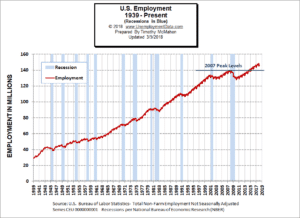

Over the month, notable job gains occurred in professional and business services, in health care, and in transportation and warehousing.”Of course the Commissioner is talking about “Seasonally Adjusted Jobs” in reality there were 152.307 million people employed in June up from 151.600 million employed in May so the actual increase was 707,000 new jobs in June. There were only 148.295 million employed in January so there are over 4 million more people employed in June than in January!

Key factors in the report were:

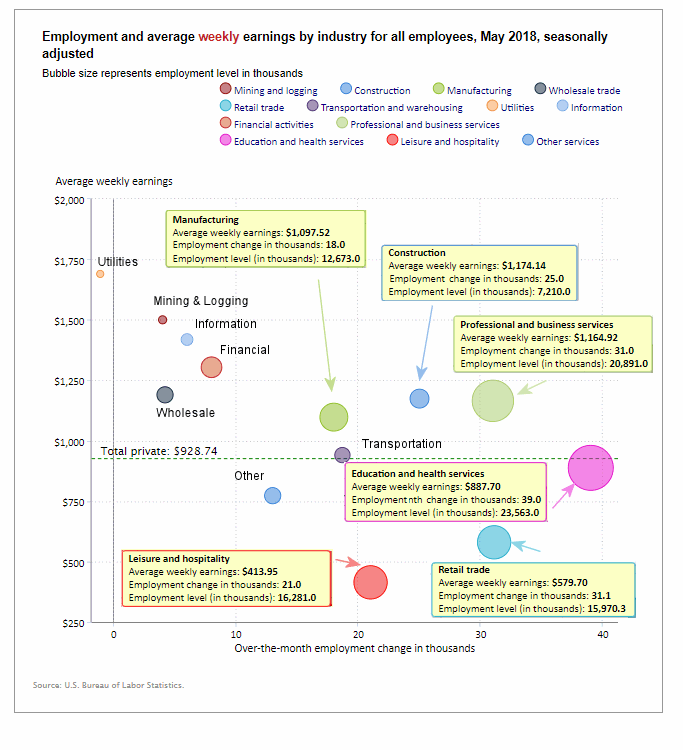

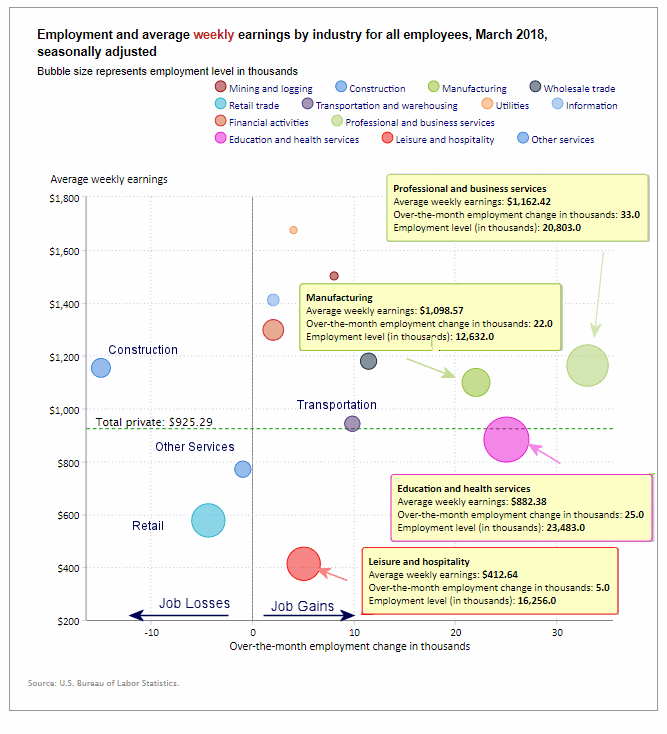

Employment in Professional and Business Services increased by 51,000…

Health care employment increased by 35,000 in June…

Employment in transportation and warehousing increased by 24,000

Construction employment rose by 21,000…

For more info see our Current Unemployment Chart and Current U.S. Employment Chart commentary:

Key June Employment and Unemployment Numbers

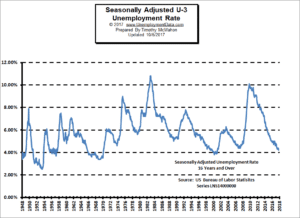

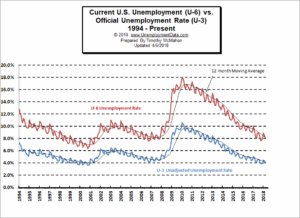

- Adjusted U-3 Unemployment- 3.7% Up from 3.6% in May

- Unadjusted U-3 Unemployment- 3.8% Up from 3.4% in May but still below 4.1% in February, and 4.4% in January.

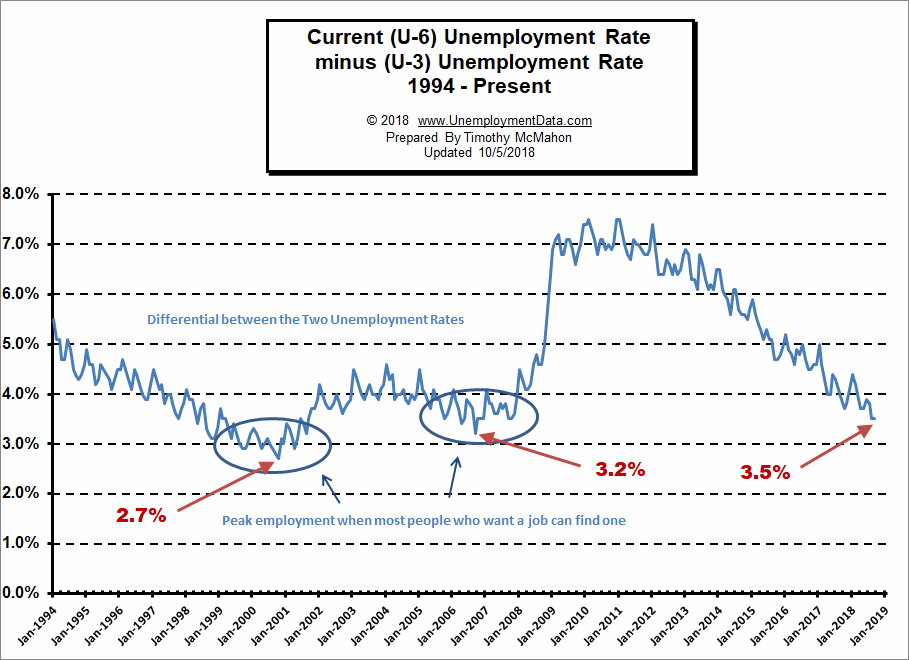

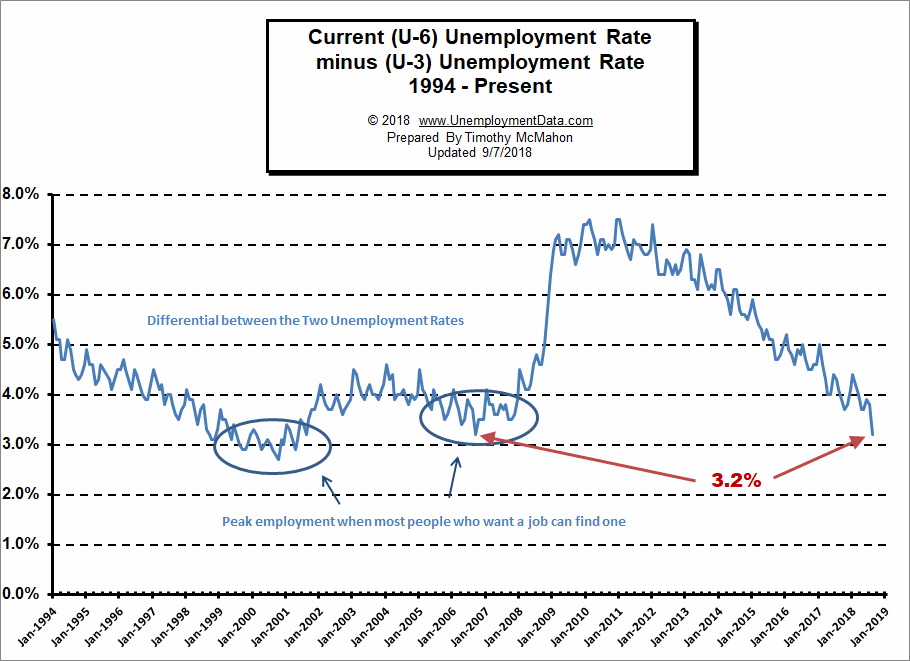

- Unadjusted U-6 Unemployment- 7.5% Up from 6.7% in May. It was 7.5% in March, 7.7% in February and 8.8% in January.

- Unadjusted Employment (Establishment Survey)- 152.307 million up from 151.600 Million in May and 148.295 million in January.

- Labor Force Participation Rate- 62.9% up from 62.8% in April and May down from 63.0% in March and from the peak of 63.2% in February.

Current Seasonally Adjusted U-3 levels are still below the 3.8% lows of 2000. Prior to that we have to go all the way back to 1969 to see better unemployment levels than we have currently. If we break below 3.4% we have to go all the way back to 1953 to find lower levels and remember that was during the boom that followed WWII with a massive loss of the workforce due to the war so we probably won’t see levels that low again.

Looking at the broader measure of Unemployment which includes discouraged workers, we see that the U-6 unemployment rate fell from 8.9% in

Looking at the broader measure of Unemployment which includes discouraged workers, we see that the U-6 unemployment rate fell from 8.9% in