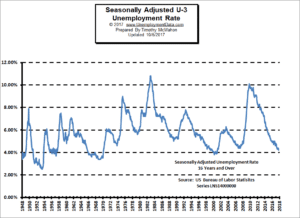

Highlights from the August 6th Bureau of Labor Statistics (BLS) employment / unemployment report for July.

- Unadjusted U-3 was Down from 6.1% to 5.7%

- Adjusted U-3 was Down from 5.9% to 5.4%

- Unadjusted U-6 was Down from 10.1% to 9.6%

- Labor Force Participation UP from 61.6% to 61.7%

- Unadjusted Employment fell from 146.603 million to 146.470 million