The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for April on May 3rd, 2024.

Employment / Unemployment

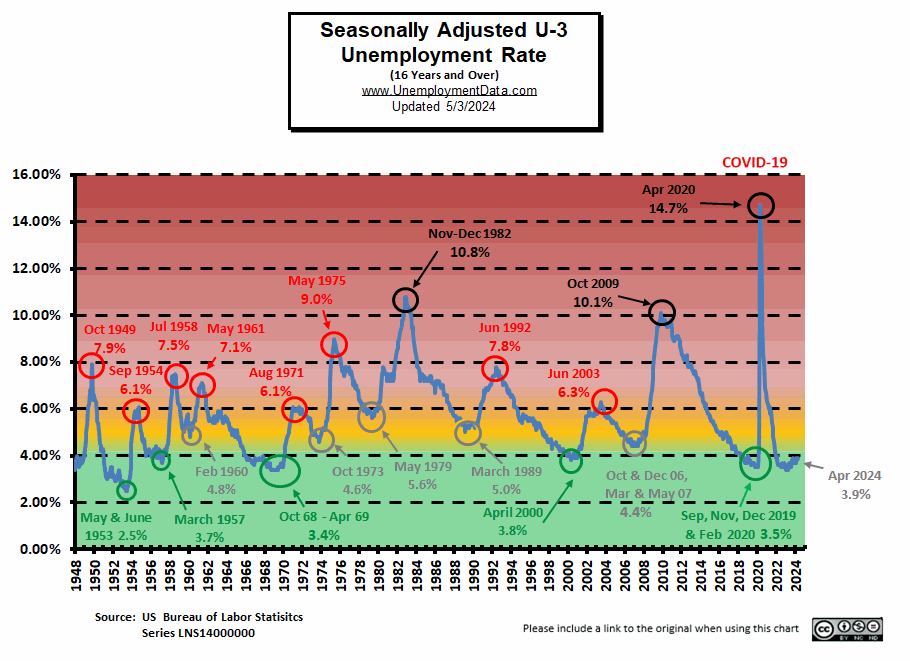

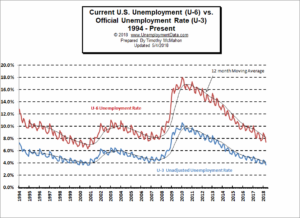

- Seasonally Adjusted U3: 3.9% up from 3.8% in March

- Unadjusted U3: 3.5% down from 3.9% in March

- Unadjusted U6: 6.9% down from 7.4% in March

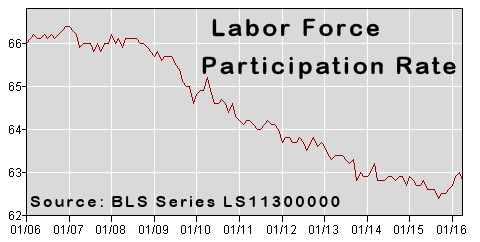

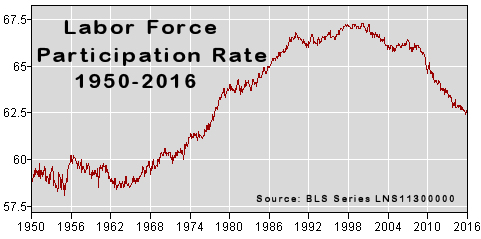

- Labor Force Participation was 62.7% unchanged

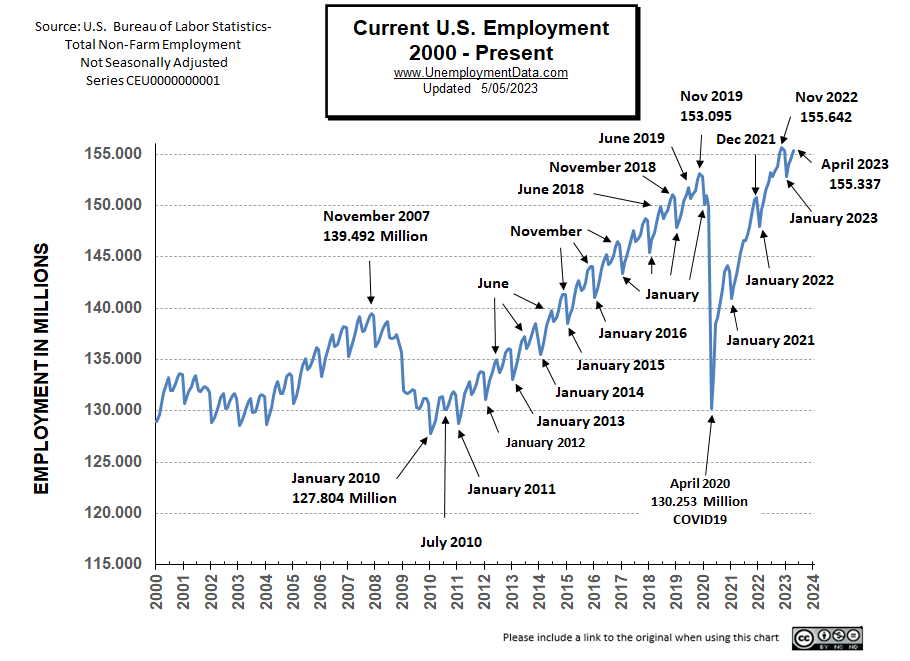

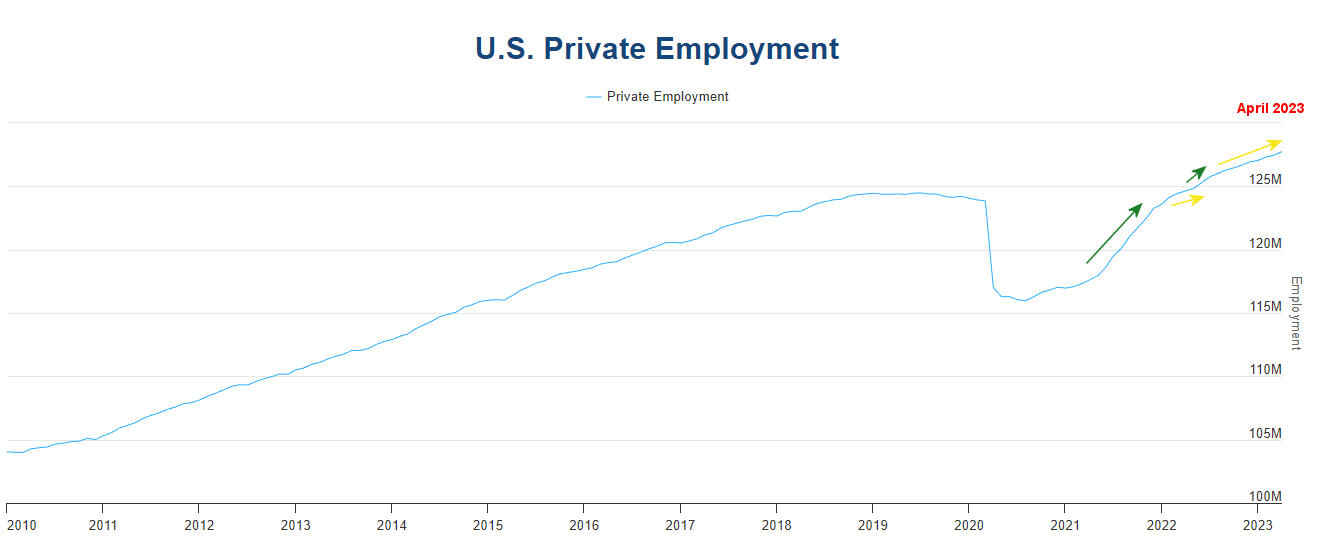

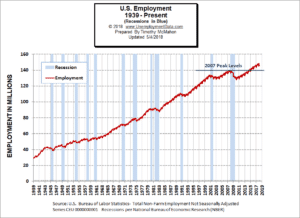

- Unadjusted Employment rose from 157.213 million to 158.016 million

- Next data release June 7th 2024

Summary:

Total Employed increased in April, Unadjusted Unemployment was down, but Seasonally adjusted Unemployment increased.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

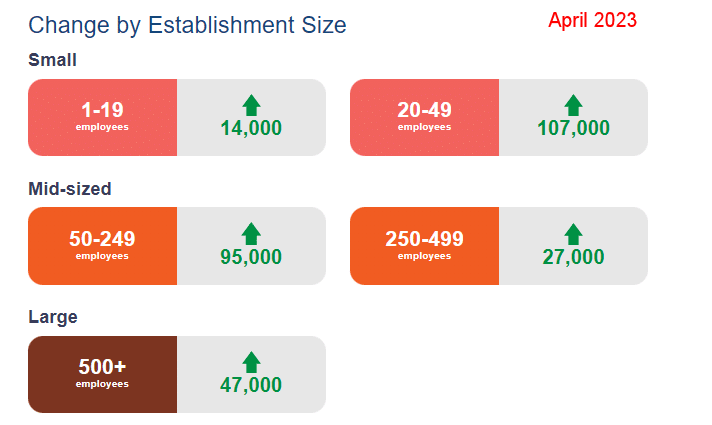

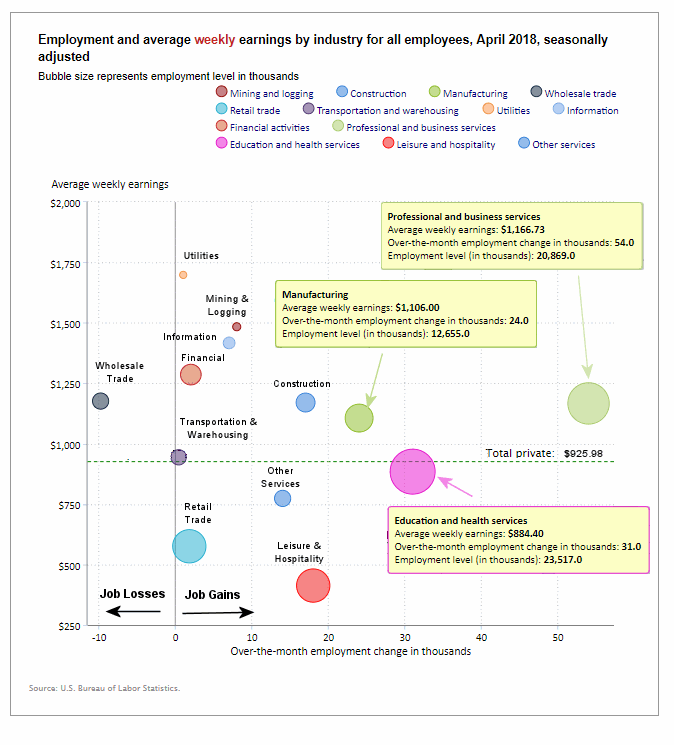

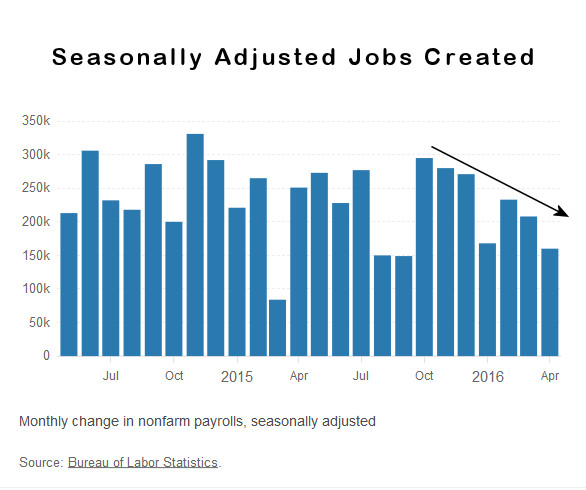

“Total nonfarm payroll employment increased by 175,000 in April, and the unemployment rate changed little at 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains

occurred in health care, in social assistance, and in transportation and warehousing.

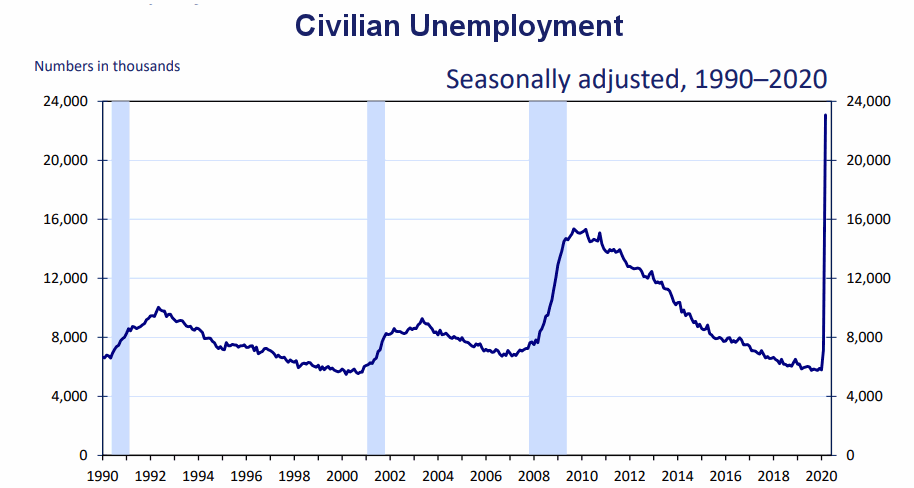

Both the unemployment rate, at 3.9 percent, and the number of unemployed people, at 6.5 million changed little in April. The unemployment rate has remained in a narrow range of 3.7 percent to 3.9 percent since August 2023.”

You can read the full BLS report here.

As usual, they are talking about “Seasonally Adjusted Jobs”.

Looking at the Unadjusted Establishment Survey report we see…

Originally the BLS reported employment of 157.218 million for March which they adjusted slightly to 157.213 million.

They are currently reporting 158.016 million jobs for April which is actually an increase of 798,000 jobs compared to the original numbers or 803,000 based on their new numbers.

The LFPR was unchanged at 62.7%.

Bad News is Good News for the Market

In the perverse stock market of these post-pandemic days, the market is looking for an excuse for the FED to cut interest rates so “Bad News is Good News” for the market. So, with the Adjusted U3 rising, Mr. Market took that as “Bad News” and rallied.

BUT… was it really even bad news? Or was it Fake News?

First of all, it was only the “Adjusted” U3 that increased, the Unadjusted U3 was down from 3.9% to 3.5% and the Unadjusted U6 was down from 7.4% to 6.9%. So, unadjusted unemployment was good news, making it bad news for the market?

Typically we can think of the adjusted rate as a comparison to the average. So let’s look at what has happened in the UNADJUSTED U3 over the last few years.

Unadjusted U3

| Date | March | April | Change |

| 2024 | 3.9% | 3.5% | -0.4% |

| 2023 | 3.6% | 3.1% | -0.5% |

| 2022 | 3.8% | 3.3% | -0.5% |

| 2021 | 6.2% | 5.7% | -0.5% |

So, what do we see? Over the last few years, the unadjusted U-3 declined -0.5% from March to April so that is the “normal” behavior for March – April. But this year, it only declined -0.4%. So, in perverse Government logic, it increased by +0.1%. Thus, Adjusted U-3 went from 3.8% last month to 3.9% this month. But actual unemployment fell from 3.9% to 3.5% this is a decrease not an increase (just not quite as big a decrease as usual). But Mr. Market was looking for an excuse to rally, so any excuse will do.

As I’ve said many times, January unemployment is the worst and it gets progressively better until summer when all the kids get out of school and the workforce swells making it look like more people are unemployed.

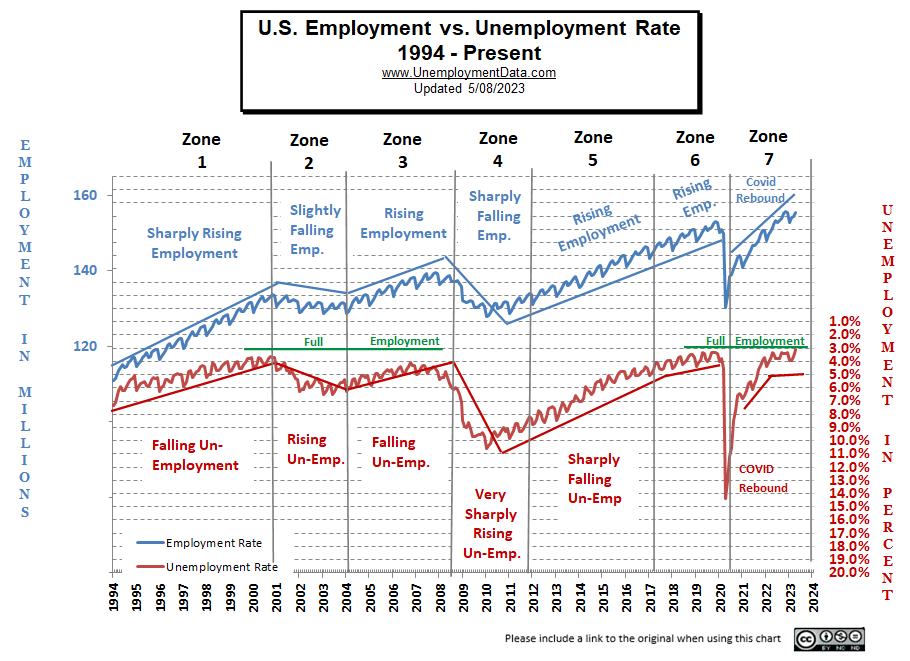

Actually, there are some good reasons for the Seasonal adjustments see Adj vs Unadj. But in this case, looking at the Adjusted numbers compared to last month isn’t going to give you the picture the market was looking for. Looking at the chart below we can see that even at 3.9% unemployment is still in the green, so there is nothing there to convince the FED to start easing.

Current Unemployment Rate Chart

Seasonally Adjusted U3 Unemployment remains above the pre-COVID 2019 cyclical lows of 3.5%, as well as above the lows made early in 2023. But have retreated away from the “yellow zone.”

[Read more…] about April Unemployment- Bad News is Good News?

Looking at the broader measure of

Looking at the broader measure of

On a seasonally adjusted basis employment has fallen while on a non-adjusted basis the actual number of non-farm employed has increased from 142.887 Million to 143.944 million for a net increase of 1,057,000 jobs but since April traditionally sees a large increase in seasonal workers the seasonally adjusted number says that we were only 160,000 jobs better than what we would expect if there were zero jobs growth.

On a seasonally adjusted basis employment has fallen while on a non-adjusted basis the actual number of non-farm employed has increased from 142.887 Million to 143.944 million for a net increase of 1,057,000 jobs but since April traditionally sees a large increase in seasonal workers the seasonally adjusted number says that we were only 160,000 jobs better than what we would expect if there were zero jobs growth.