The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for August on September 5th, 2025.

Employment / Unemployment

- Seasonally Adjusted U3- 4.3% Up from 4.2%

- Unadjusted U3- 4.5% Down from 4.6% in July

- Unadjusted U6- 8.2% Down from 8.3% in July

- Labor Force Participation Rate- 62.3% Up from 62.2%

- Employment- 159.410 million Up from 159.210 million

- Next data release October 3, 2025

Summary:

Total Employed increased in August, Unadjusted Unemployment was down, but Seasonally adjusted Unemployment increased.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Total nonfarm payroll employment changed little in August (+22,000) and has shown little change since April, the U.S. Bureau of Labor Statistics (BLS) reported today. The unemployment rate, at 4.3 percent, also changed little in August. A job gain in health care was partially offset by losses in federal government and in mining, quarrying, and oil and gas extraction…

Federal government employment continued to decline in August (-15,000) and is down by 97,000 since reaching a peak in January. (Employees on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey.)”

As usual, they are talking about “Seasonally Adjusted Jobs”.

Looking at the Unadjusted Establishment Survey report, we see…

Originally, the BLS reported employment of 159.227 million jobs for July,

which they adjusted slightly to 159.210 million in September.

They are currently reporting 159.410 million jobs for August, which is an increase of 200,000 jobs based on their new numbers or 183,000 based on their original numbers. The LFPR increased from 62.2% to 62.3%.

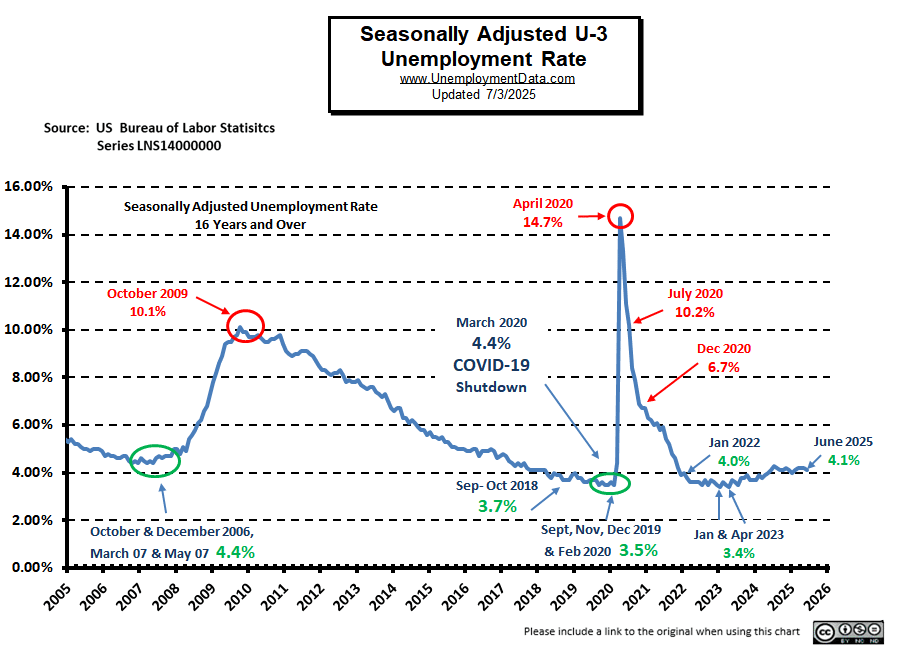

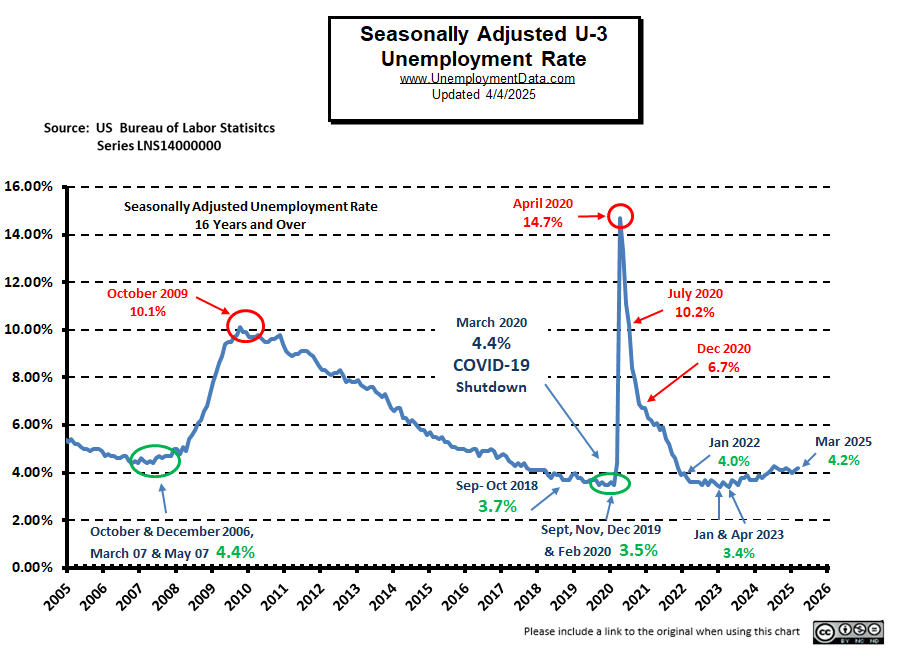

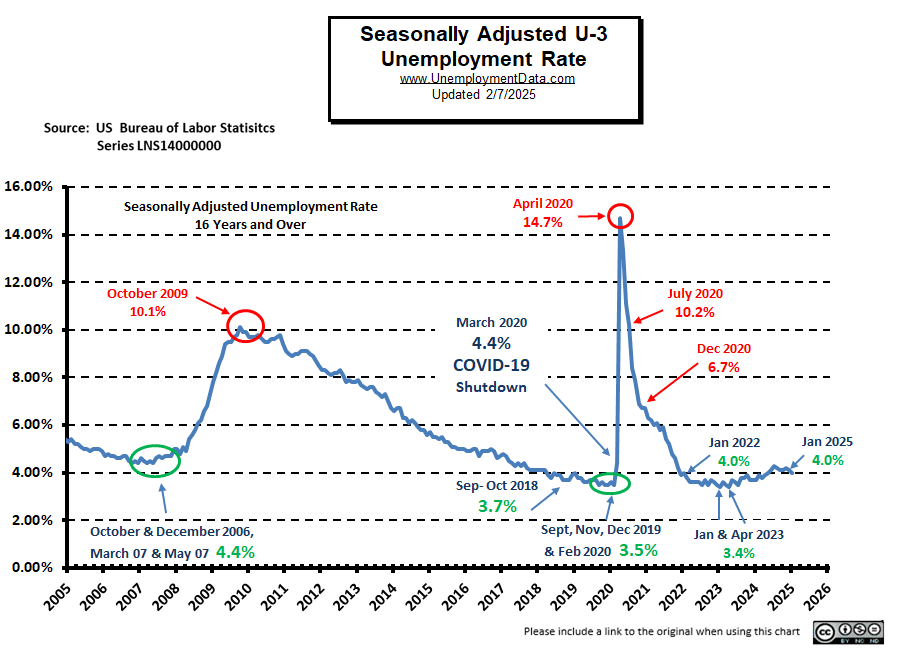

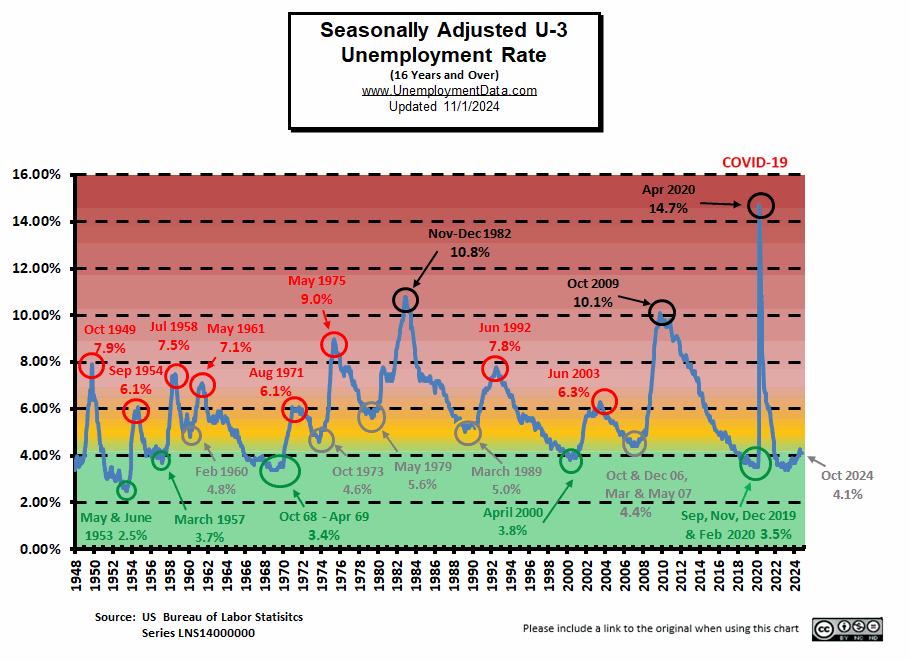

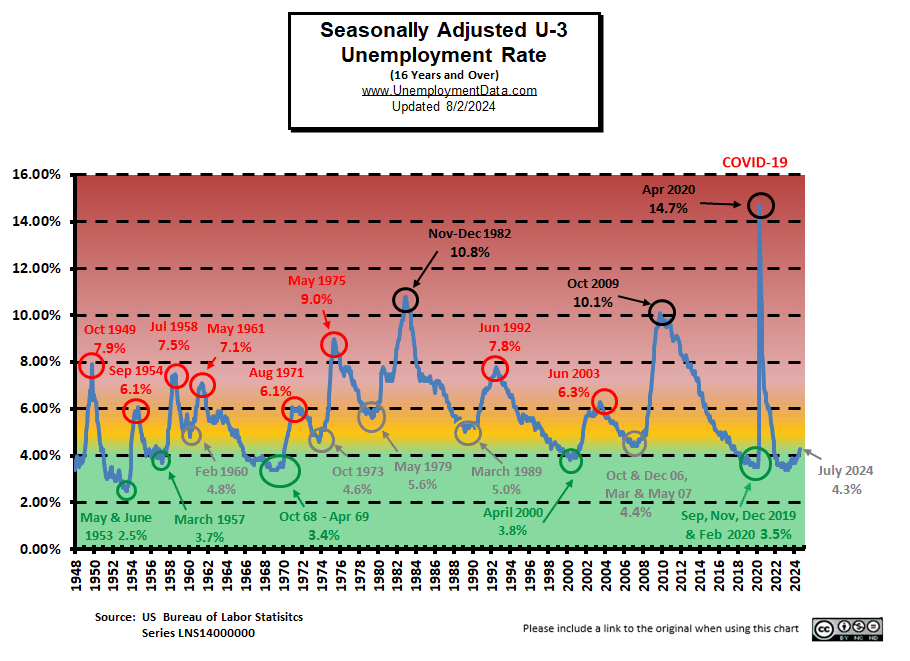

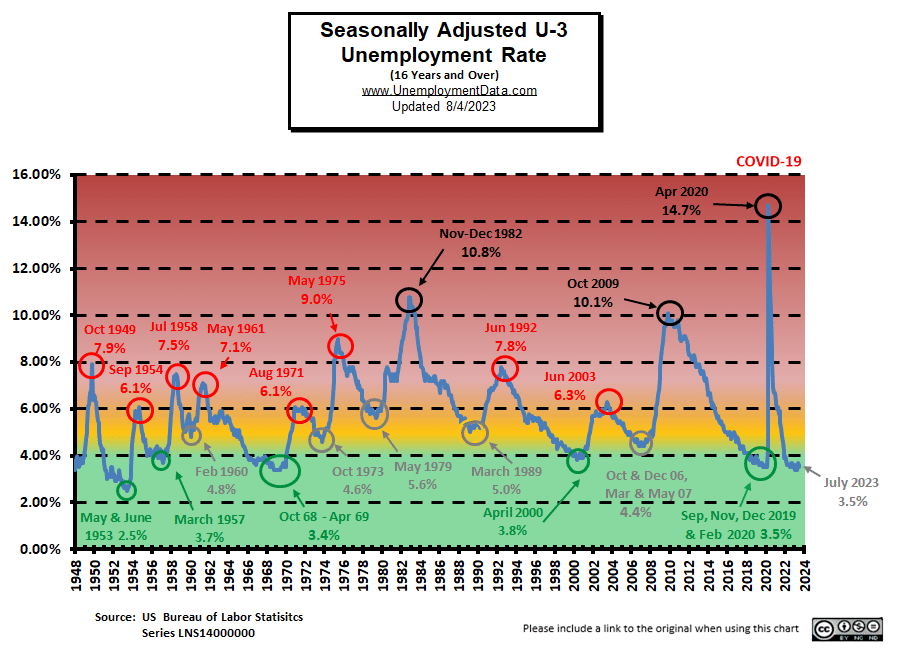

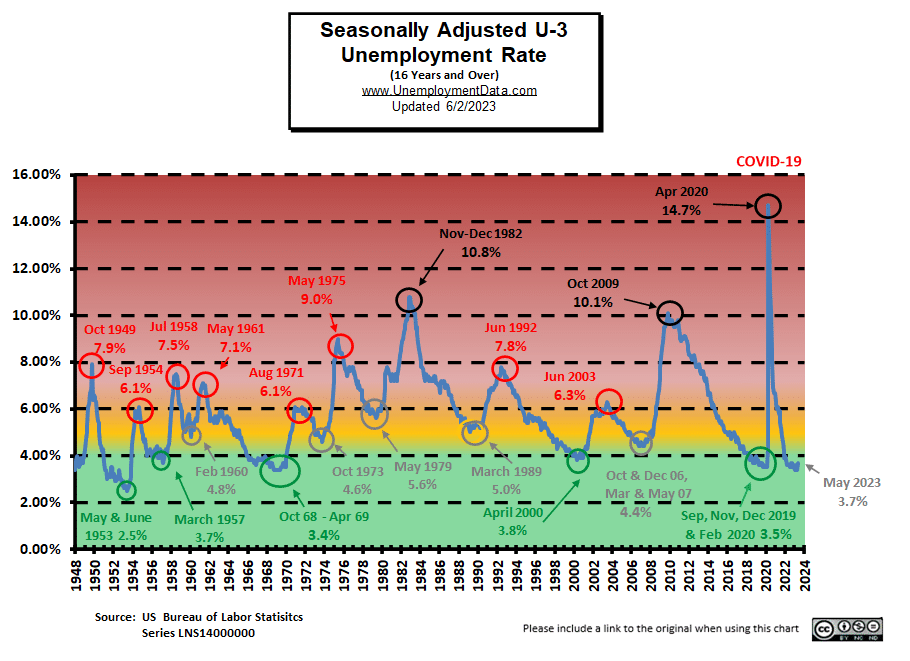

Current Unemployment Rate Chart

Seasonally Adjusted Unemployment is up from 4.2% to 4.3%. As we can see, unemployment is 0.9% above the January and April lows of 2023 but relatively unchanged over the last year.