![]() The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for November on December 6th.

The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for November on December 6th.

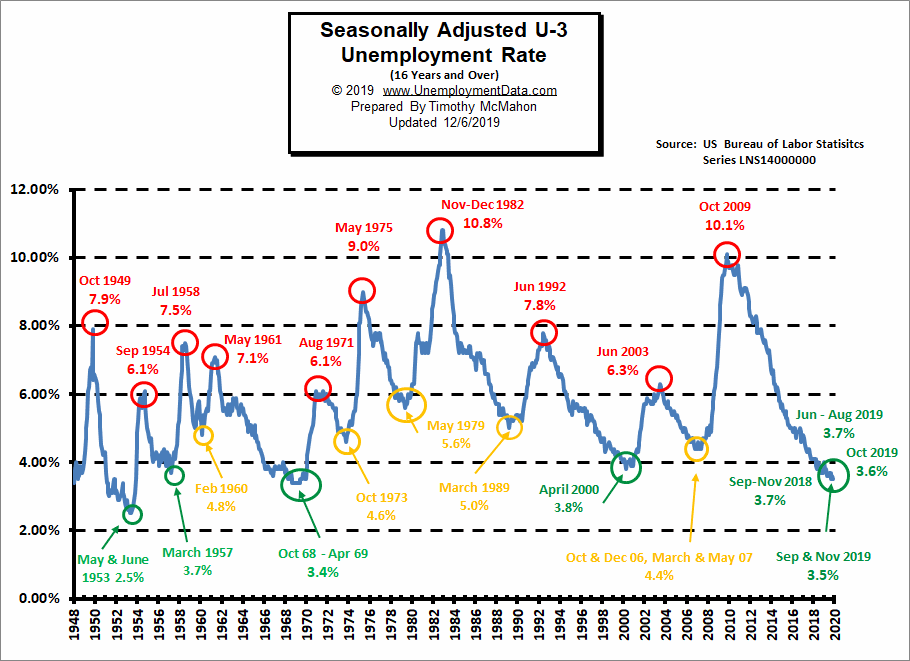

Unemployment returns to 50-year lows. The “Seasonally Adjusted” Unemployment Rate for November fell from 3.6% in October to 3.5% despite the media’s narrative that many employers are either delaying hiring until a breakthrough in the U.S.-China trade war is reached.

November Jobs Report Smashes Expectations Again

- Unadjusted U-3 was Unchanged at 3.3%!

- Adjusted U-3 was down slightly from 3.6% to 3.5%!

- Unadjusted U-6 was Unchanged at 6.5%!

- Labor Force Participation retreated slightly from 63.3% to 63.2%.

- Unadjusted Employment Up by approx. 660,000 jobs.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Nonfarm payroll employment rose by 266,000 in November, and the unemployment rate, at 3.5 percent, was little changed. Notable job gains occurred in health care and in professional and technical services. Manufacturing employment increased as workers in motor vehicles and parts returned from a strike. Employment in health care increased by 45,000… Employment rose by 31,000 in professional and technical services… Employment in leisure and hospitality +45,000… Employment in transportation and warehousing +16,000… Employment in financial activities +13,000…

Of course, he is talking about “Seasonally Adjusted Jobs” from the “Current Population Survey (CPS)”

rather than looking at the results reported by actual companies in their “Current Employment Statistics survey (CES)”

Originally the BLS reported 152,962 million jobs for October and they added 40,000 jobs to that estimate. Currently they are estimating 153.624 million jobs for November which is an increase of 662,000 jobs over what they originally reported last month. So what he is actually saying is that there were 266,000 more jobs created in November than is normal for this time of year!Returning striking General Motors autoworkers added about 30,000 jobs in November, a one-time bounce-back that followed a 30,000 decline in October, when the GM strikers weren’t counted as employed. But even without that 30,000 Manufacturing still added 24,000 additional jobs!

Just days ago, the media and Moody’s Chief Economist Mark Zandi were trying to paint a grim picture for the economy. Zandi told CNBC there was trouble brewing in the jobs market “Manufacturers, commodity producers and retailers are shedding jobs. Job openings are declining, and if job growth slows any further unemployment will increase.”

Instead of a Decrease in jobs we got a massive INCREASE. And the futures market spiked upward on the good news.

For more info see our Current Unemployment Chart and Current U.S. Employment Chart commentary.

See Current Unemployment Chart for more info.

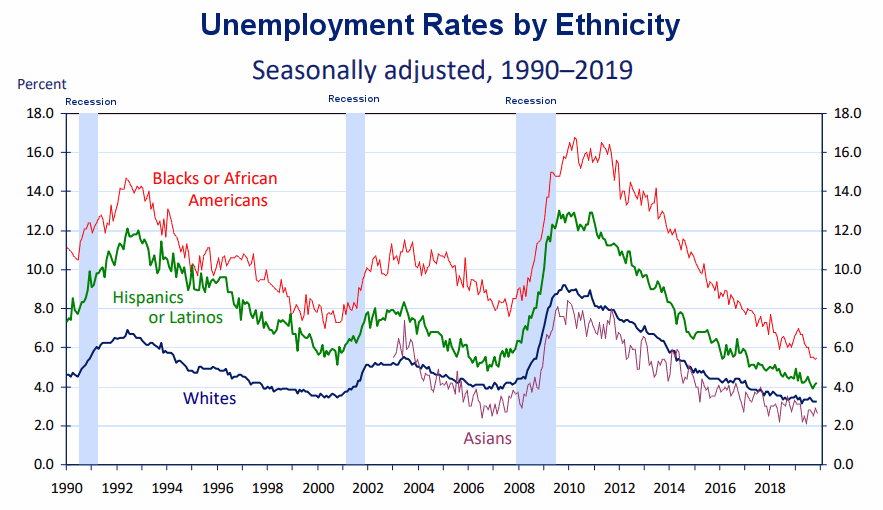

November Unemployment by Ethnicity

The unemployment rate among Blacks ticked down again in November. However, Hispanic unemployment ticked up slightly but is still well below 2001 and 2007 lows at just above 4%.

Source: Bureau of Labor Statistics Charts

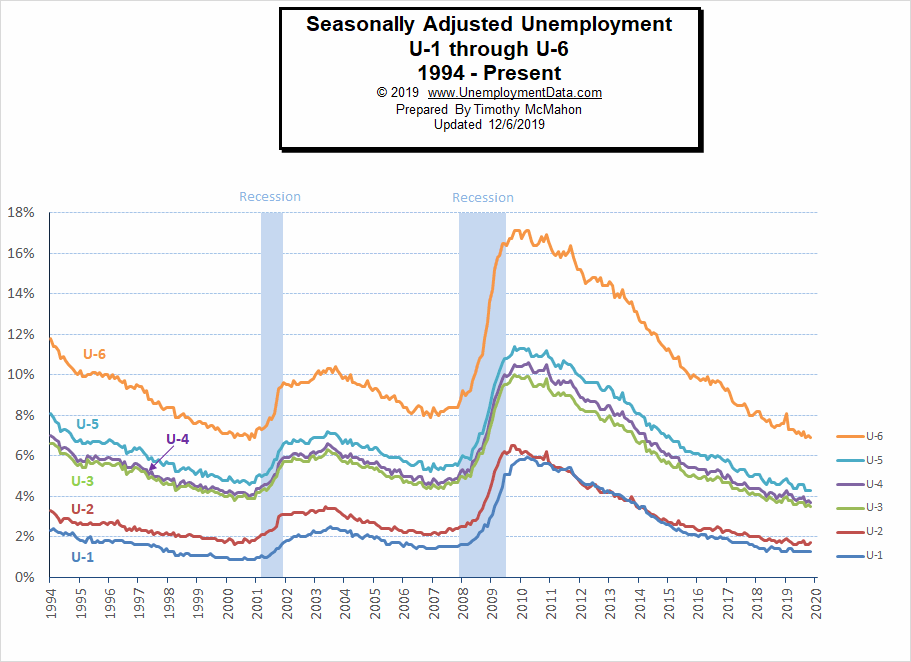

U1 through U6 Unemployment Rates

As we can see from the above chart all the various measurements of Unemployment from U-1 through U-6 are near or below record lows. For more information about the various measurements of unemployment see What Is U-6 Unemployment?

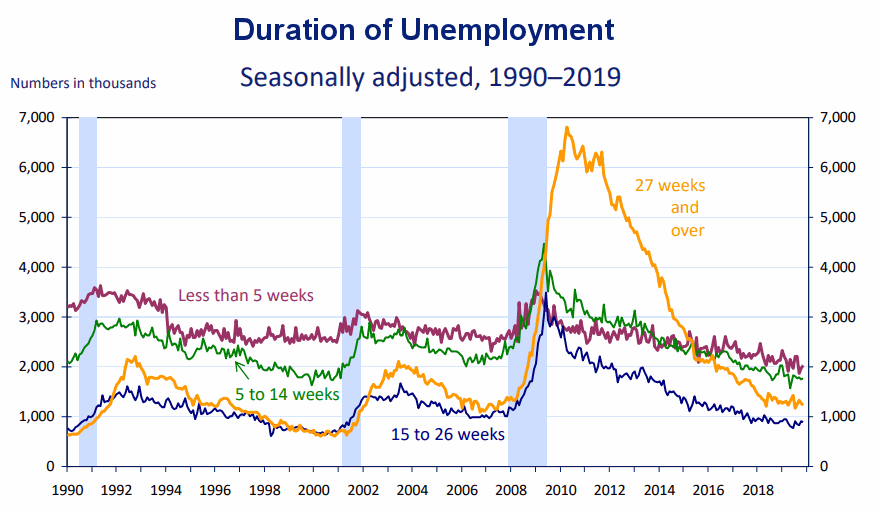

Duration of Unemployment

Obviously, the worse the economy is, the longer it takes for the average person to find a job. But not everyone can find a job in 5 weeks or less no matter how good the economy is. Generally, those are the people who already have a job when they leave their old job. But the falling number of people taking over 27 weeks to find a new job is a good indicator of a healthy economy.

In this chart, we can see that the “long term unemployed” have fallen drastically since the last recession. We can also see that most people are now unemployed less than 5 weeks (i.e. the red line is above all the other lines), so a healthy rotation is occurring as people move to better jobs opening up lower-paid jobs for new employees. .

Source: Bureau of Labor Statistics Charts (Blue bars represent recessions)

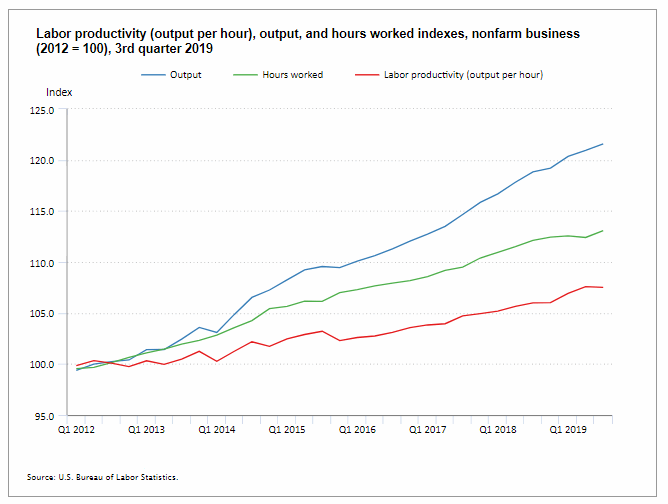

Labor Productivity

Labor productivity has increased by about 21% in the last 7 years. This is partially due to an increase in the number of hours worked but also due to an increase in output per hour. However, in early 2019 we saw an obvious flattening of hours worked but output continued upward. But then we saw an increase in hours worked and a flattening in Labor Productivity (output per hour). It is quite possible that this is related to hiring new employees who need to become acclimated to their new positions. But Output continues to climb so that is a good thing.

Data Source: BLS Labor Productivity

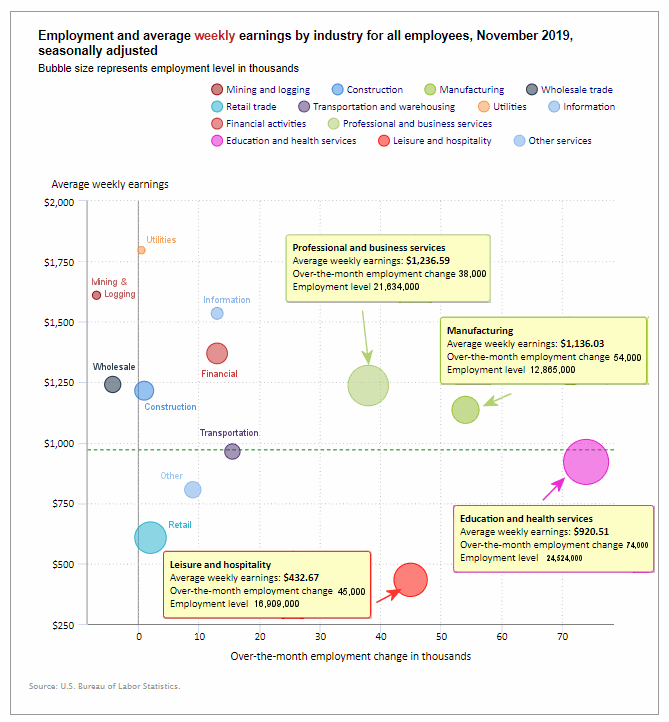

Employment by Sector

The employment “bubble chart” gives us a good representation of how each sector of the economy is doing (employment wise). As we can see from the chart below, the biggest gainer (furthest to the right on the chart) was Education and Health Services adding a whopping 74,000 jobs. Manufacturing added 39,000 after losing -30,000 jobs due to a strike last month, Professional and Business Services added 38,000 jobs, Financial Services added 13,000 jobs, and Leisure and Hospitality added 45,000 jobs. Utilities gained 500 jobs after losing -1,400 jobs last month.

There are two sectors to the left of the vertical zero line this month, meaning that they lost employees. Mining and Logging lost -7,000 seasonally adjusted jobs. and Wholesale lost -4,300 jobs.

Average weekly wages rose. It was $973.18 in November up from $969.39 in October and $959.76 in June.

(See the table below for details.)

How to read this chart:

Bubbles location on the chart tell us two things:

- Change in Employment Levels over the most recent month.

- Average Weekly earnings.

- The further to the right the bubble the larger the increase in the number of jobs.

- The higher up on the chart the larger the average salary.

Bubble Size tells us:

- Total Employment for the sector.

- Larger bubbles mean more people are employed in that sector.

Employment and Average Weekly Earnings by Industry

November 2019, Seasonally Adjusted

| Industry | Monthly Increase | Average Weekly Earnings | Employment Level |

| Total Private Employment | 254,000 | $973.18 | 129,608,000 |

| Mining and Logging | -7,000 | $1,610.07 | 743,000 |

| Construction | 1,000 | $1,215.23 | 7,530,000 |

| Manufacturing | 54,000 | $1,136.03 | 12,865,000 |

| Wholesale trade | -4,300 | $1,240.98 | 5,952,400 |

| Retail trade | 2,000 | $607.26 | 15,795,500 |

| Transportation and Warehousing | 15,500 | $963.46 | 5,585,400 |

| Utilities | 500 | $1,796.74 | 550,500 |

| Information | 13,000 | $1,535.13 | 2,835,000 |

| Financial Activities | 13,000 | $1,369.49 | 8,730,000 |

| Professional and Business Services | 38,000 | $1,236.59 | 21,634,000 |

| Education and Health Services | 74,000 | $920.51 | 24,524,000 |

| Leisure and Hospitality | 45,000 | $432.67 | 16,909,000 |

| Other Services | 9,000 | $805.48 | 5,954,000 |

Previous Record Low Unemployment (Seasonally Adjusted U-3)

If we consider anything 4% or below as “low” we have had a few “low” stretches as we can see in the table below.

(4% or below in Green)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 1950 | 6.5% | 6.4% | 6.3% | 5.8% | 5.5% | 5.4% | 5.0% | 4.5% | 4.4% | 4.2% | 4.2% | 4.3% |

| 1951 | 3.7% | 3.4% | 3.4% | 3.1% | 3.0% | 3.2% | 3.1% | 3.1% | 3.3% | 3.5% | 3.5% | 3.1% |

| 1952 | 3.2% | 3.1% | 2.9% | 2.9% | 3.0% | 3.0% | 3.2% | 3.4% | 3.1% | 3.0% | 2.8% | 2.7% |

| 1953 | 2.9% | 2.6% | 2.6% | 2.7% | 2.5% | 2.5% | 2.6% | 2.7% | 2.9% | 3.1% | 3.5% | 4.5% |

| 1954 | 4.9% | 5.2% | 5.7% | 5.9% | 5.9% | 5.6% | 5.8% | 6.0% | 6.1% | 5.7% | 5.3% | 5.0% |

| 1955 | 4.9% | 4.7% | 4.6% | 4.7% | 4.3% | 4.2% | 4.0% | 4.2% | 4.1% | 4.3% | 4.2% | 4.2% |

| 1956 | 4.0% | 3.9% | 4.2% | 4.0% | 4.3% | 4.3% | 4.4% | 4.1% | 3.9% | 3.9% | 4.3% | 4.2% |

| 1957 | 4.2% | 3.9% | 3.7% | 3.9% | 4.1% | 4.3% | 4.2% | 4.1% | 4.4% | 4.5% | 5.1% | 5.2% |

| 1958 | 5.8% | 6.4% | 6.7% | 7.4% | 7.4% | 7.3% | 7.5% | 7.4% | 7.1% | 6.7% | 6.2% | 6.2% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1965 | 4.9% | 5.1% | 4.7% | 4.8% | 4.6% | 4.6% | 4.4% | 4.4% | 4.3% | 4.2% | 4.1% | 4.0% |

| 1966 | 4.0% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 3.7% | 3.7% | 3.6% | 3.8% |

| 1967 | 3.9% | 3.8% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 4.0% | 3.9% | 3.8% |

| 1968 | 3.7% | 3.8% | 3.7% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.4% | 3.4% | 3.4% | 3.4% |

| 1969 | 3.4% | 3.4% | 3.4% | 3.4% | 3.4% | 3.5% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.5% |

| 1970 | 3.9% | 4.2% | 4.4% | 4.6% | 4.8% | 4.9% | 5.0% | 5.1% | 5.4% | 5.5% | 5.9% | 6.1% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1999 | 4.3% | 4.4% | 4.2% | 4.3% | 4.2% | 4.3% | 4.3% | 4.2% | 4.2% | 4.1% | 4.1% | 4.0% |

| 2000 | 4.0% | 4.1% | 4.0% | 3.8% | 4.0% | 4.0% | 4.0% | 4.1% | 3.9% | 3.9% | 3.9% | 3.9% |

| 2001 | 4.2% | 4.2% | 4.3% | 4.4% | 4.3% | 4.5% | 4.6% | 4.9% | 5.0% | 5.3% | 5.5% | 5.7% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 2018 | 4.1% | 4.1% | 4.1% | 3.9% | 3.8% | 4.0% | 3.9% | 3.9% | 3.7% | 3.7% | 3.7% | 3.9% |

| 2019 | 4.0% | 3.8% | 3.8% | 3.6% | 3.6% | 3.7% | 3.7% | 3.7% | 3.5% | 3.6% | 3.5% |

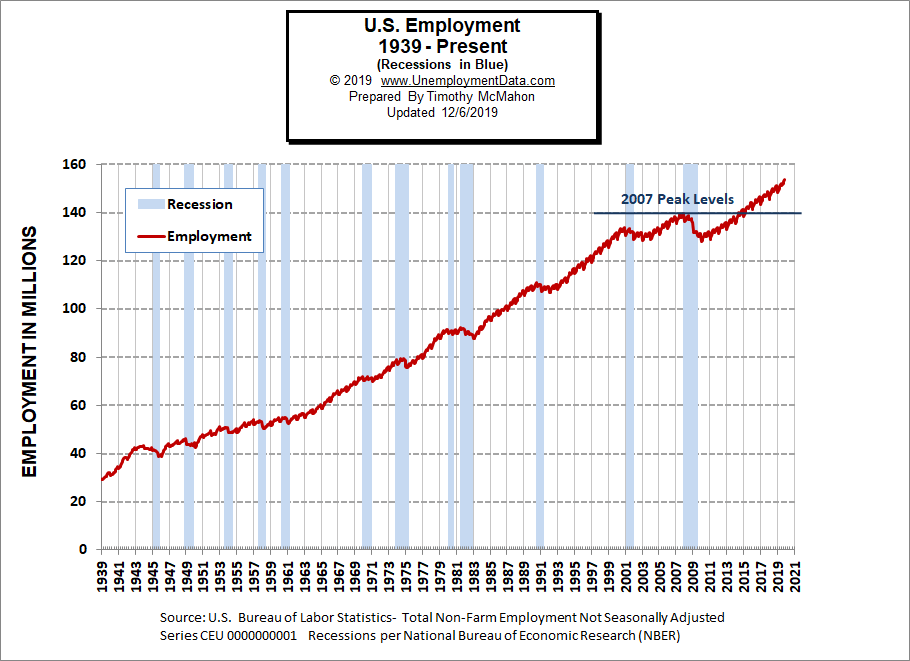

Employment

Historically employment is closely tied to recessions and that is no accident. One of the primary factors in calculating whether the economy is officially in a recession is an increase in the unemployment rate. The chart below provides the Historical Employment Data overlaid on blue bars showing periods of official recessions.

In November employment rose to 153.624 million. Last month the BLS said employment was 152.962 million. This month they “adjusted” October’s numbers up by 40,000 giving us a NOT seasonally adjusted increase of 662,000.

As we can see from the table below from November 2007 to January 2008 there were over 3 million jobs lost but that actually wasn’t all that surprising. Typically January suffers from a reduction in Seasonal workers. Even good years like 2005-2006 saw a reduction of 3 million workers and January 2008 employment levels were still above January 2007 levels. But by January 2009, year-over-year losses exceeded 4 million. By 2010 the economy had lost another 4.2 million. 2011 showed almost a million jobs improvement but the economy was still on shaky ground. It wasn’t until January 2014 that the economy reached January 2007 levels and January 2015 exceeded January 2008 levels.

| Date | Employment in Millions |

| January 2007 | 135.335 |

| November 2007 (Peak) | 139.510 |

| January 2008 | 136.268 |

| January 2009 | 132.042 |

| January 2010 | 127.820 |

| January 2011 | 128.778 |

| January 2012 | 131.113 |

| January 2013 | 133.081 |

| January 2014 | 135.488 |

| January 2015 | 138.511 |

| January 2016 | 141.088 |

| January 2017 | 143.393 |

| January 2018 | 145.428 |

| January 2019 | 148.295 |

| February 2019 | 149.148 |

| March 2019 | 149.864 |

| April 2019 | 150.938 |

| May 2019 | 151.610 |

| June 2019 | 152.243 |

| July 2019 | 151.169 |

| August 2019 | 151.607 |

| September 2019 | 152.016 |

| October 2019 | 153.002 |

| November 2019 | 153.624 |

Employment Numbers are “Preliminary” for two months before the BLS considers them finalized due to late coming data.

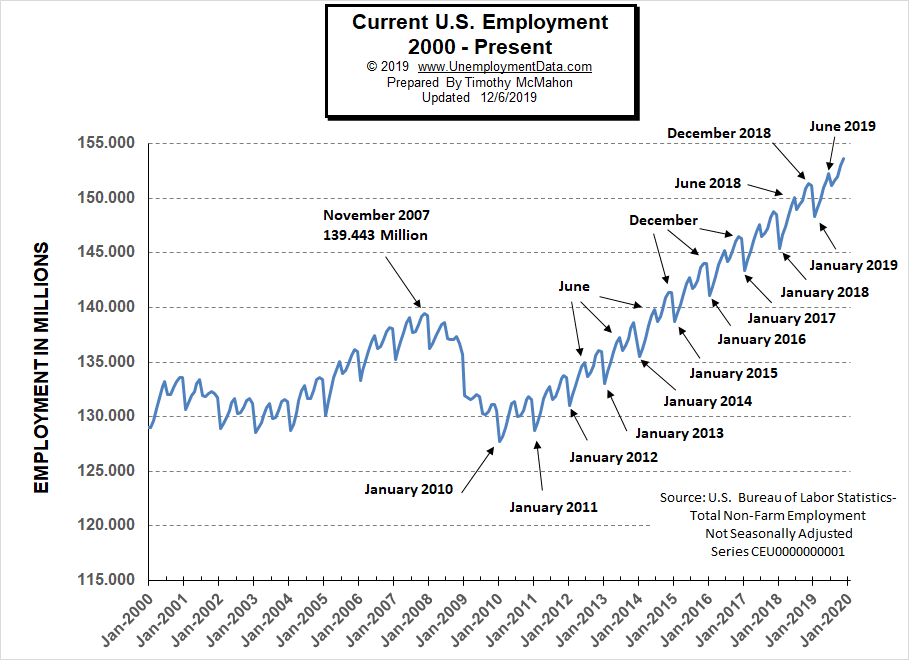

Current Employment

From the above current employment chart, we can see that the low point for each year occurs in January and then a small peak occurs around June with a slight drop around July and then the highest peak in employment happens in November/December.

See Historical Employment and Current Employment for more info.

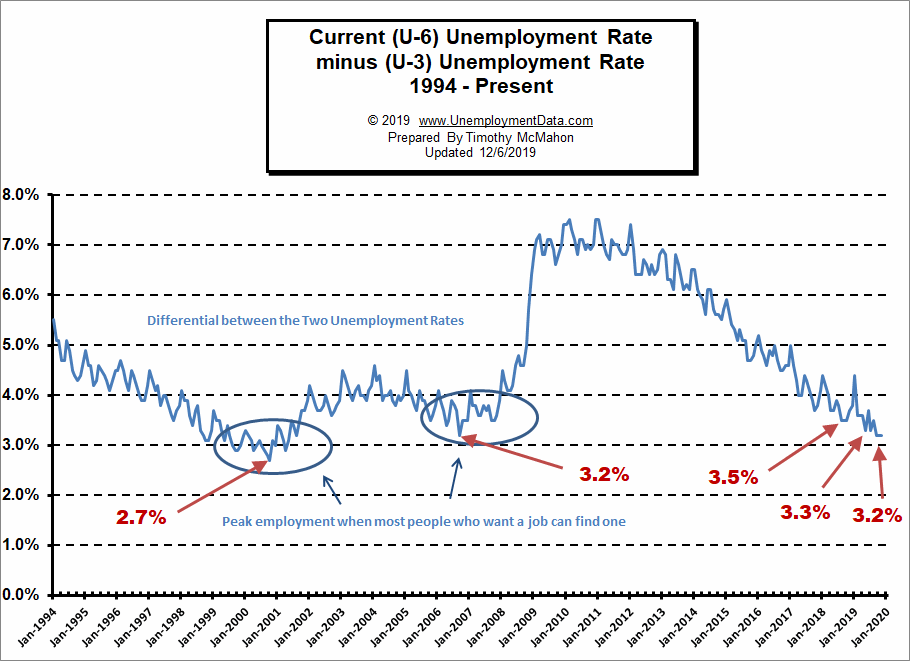

The Differential between U3 and U6

The previous lows on this chart are at 2.7% in October 2000 and 3.2% in September 2006. In August, September, and October of 2018, the differential between unadjusted U-3 and unadjusted U-6 dropped to 3.5% indicating that we were getting closer to “full employment” but then in December, the U-6 ticked up to 7.5% from 7.2% a month earlier and the differential ticked back up to 3.8%.

Typically the differential peaks in January and this year was no exception. In January 2019 U-6 shot up to 8.8% and U-3 was 4.4% for a differential of 4.4%. In February the differential fell back to 3.6%. From there we saw it fall to 3.3% in May rise in June and then fall back to 3.3% in July and then rose again in August. It has been flat at 3.2% for the last couple of months.

See Current U-6 Unemployment Rate for more info.

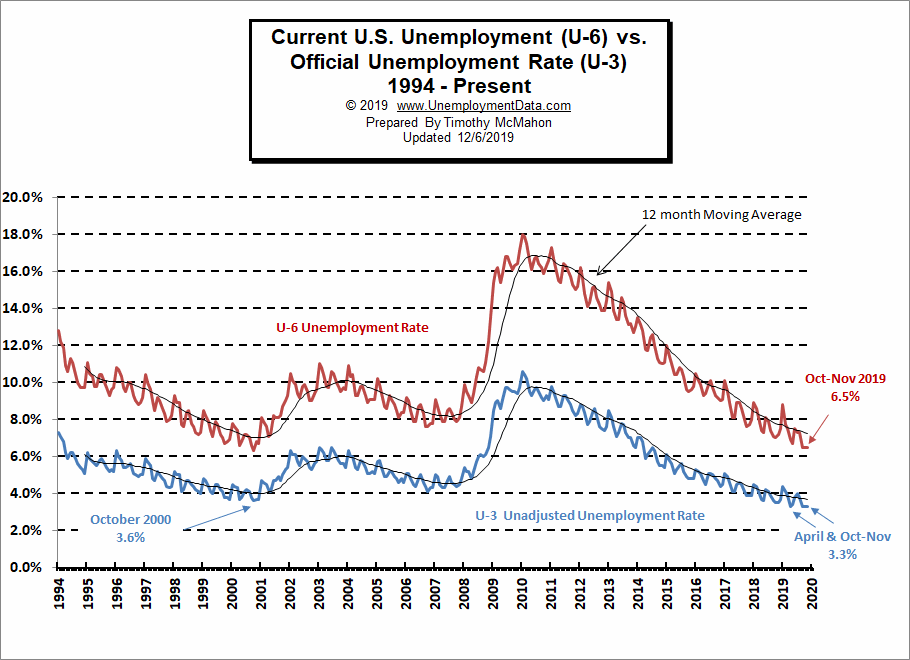

U-6 Unemployment

Current U-6 Unemployment Rate for November is 6.5% Unchanged since September, August 2019 is 7.3%, it was 7.3% in July, 7.5% in June, 6.7% in May, and 8.8% in January.

See Unadjusted U-6 unemployment for more info.

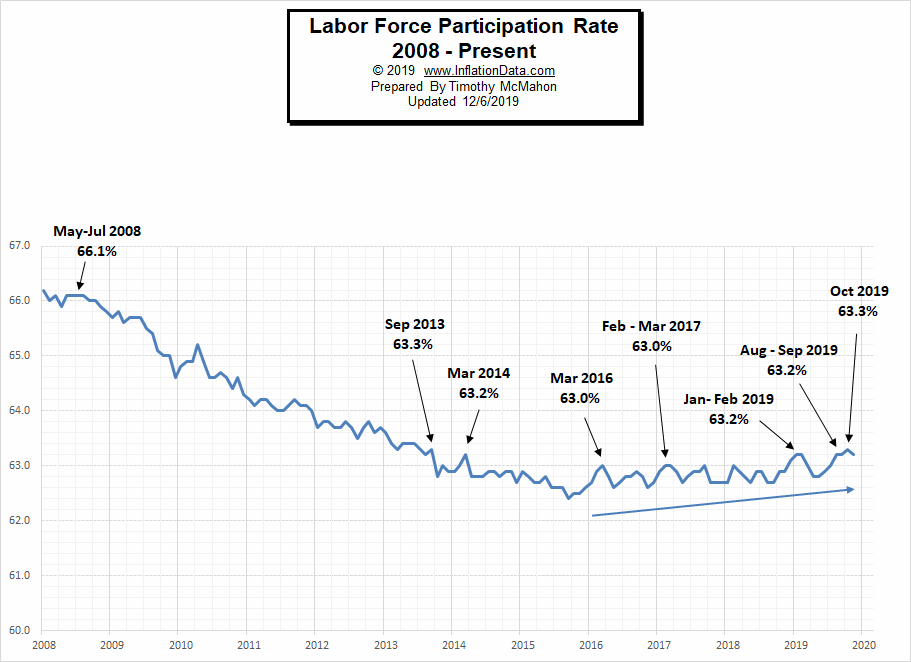

Labor Force Participation Rate

The Current Labor Force Participation Rate for November 2019 is down slightly from 63.3% to 63.2%

See Labor Force Participation Rate for more information.

If you would like to receive this monthly report and other article updates click here unsubscribe at any time.

Here are some articles you might enjoy in case you missed them:

Read more on UnemploymentData.com.

- Tips For Making Yourself More Employable

- Things to Consider Before Starting Your Own Business

- How Businesses Can Support the Career Goals of their Veteran Employees

- Tips for Finding a Job after Serving Jail Time

- Industries Begging for Applicants

From InflationData.com

- October Inflation has Slight Increase

- Modern Monetary Theory

- Investing to Fight Inflation

- Cumulative Inflation By Category 1996-2016

- If Everything Big is Increasing in Cost at Some Rate Faster than Inflation Why Hasn’t Inflation Risen to Match?

From Financial Trend Forecaster

- Gold is Still King of the Investing Market

- The Markets in Perspective: What Goes up Must Come down?

- Is Bill Gates Right On Energy Investing?

- The Oil Crisis Saudi Arabia Can’t Solve

- 5 Ways Automation Has Changed the Financial World

- Asteroid Mining: Science Fiction or Science?

- The Beginning of a Long-Term “Secular” Bull Market?

- What Does this Rare & Rapid Drop in Manufacturing Mean?

- Bullish Signal Has Only Happened 10 Times in the Last 94 Years.

- Spotting a 178-Year-Old Firm’s Collapse… 2 Years in Advance

- Trade, Impeachment, and the Conviction of Buyers and Sellers

From OptioMoney.com

- Have Minimal Car Insurance? What to Do in Case of an Accident

- How to Choose a Residential Roofing Contractor

- Avoid a Money Pit: 4 Vital Inspection Items before Buying an Older Home

- 3 Benefits of Finding a Reliable Family Lawyer

- 4 Hidden Car Costs

From Your Family Finances