Highlights from the Bureau of Labor Statistics (BLS) employment / unemployment report for February released on March 5th.

![]()

- Unadjusted U-3 was Down from 6.8% to 6.6%

- Adjusted U-3 was Down from 6.3% to 6.2%

- Unadjusted U-6 was Down from 12.0% to 11.6%

- Labor Force Participation held steady at 61.4%

- Unadjusted Employment rose from 140.948 million to 141.926 million

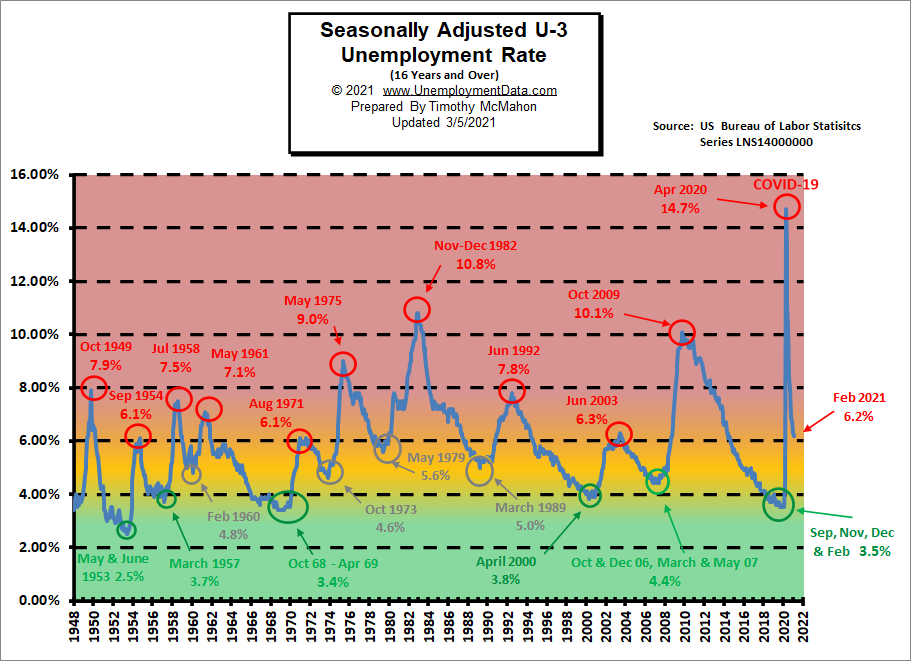

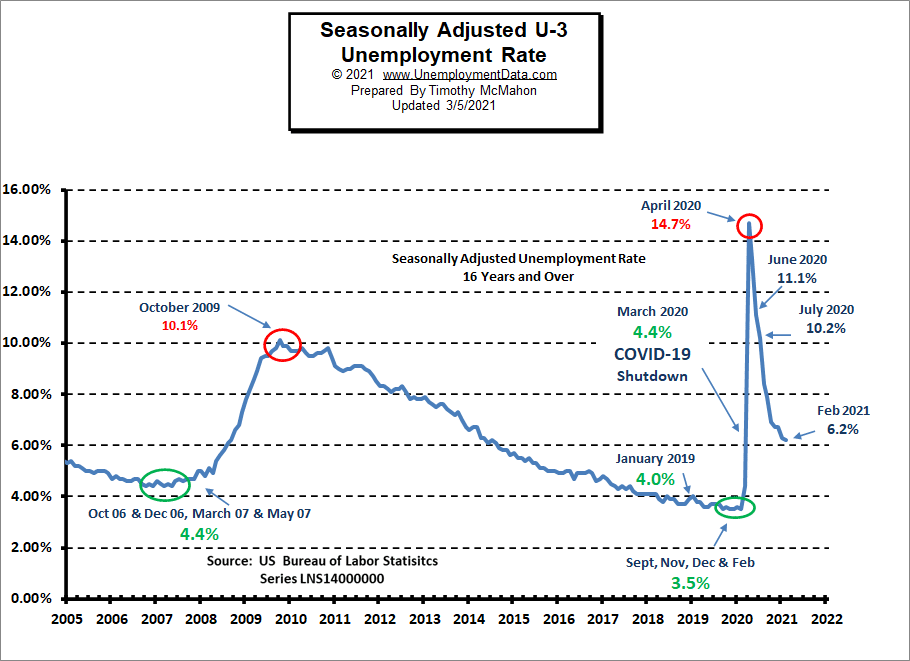

Unemployment Nears “Yellow Zone”

As we can see from the chart below when unemployment gets into the “red zone” things are really bad. But historically “Bad” for the U-3 usually starts at around 7% and stops at around 10% with only two previous occasions getting into the 10% range. But this time, due to COVID shutdowns, the U.S. economy went from really good (green zone) to really bad virtually overnight. The yellow zone is the normal operating range and it runs from about 4% to 6% and when unemployment stays in this range the economy is generally doing OK. Below 4% and the economy is doing great above 7% and the economy is in for trouble. Currently, the U-3 unemployment rate has fallen from the horrendous 14.7% of April down to the normally bad 6.2%. We have to remember that the PEAKS in 1954, 1971, and 2003 were at 6.3% and that was the worst it got. So although current levels are better than they were they still aren’t good.

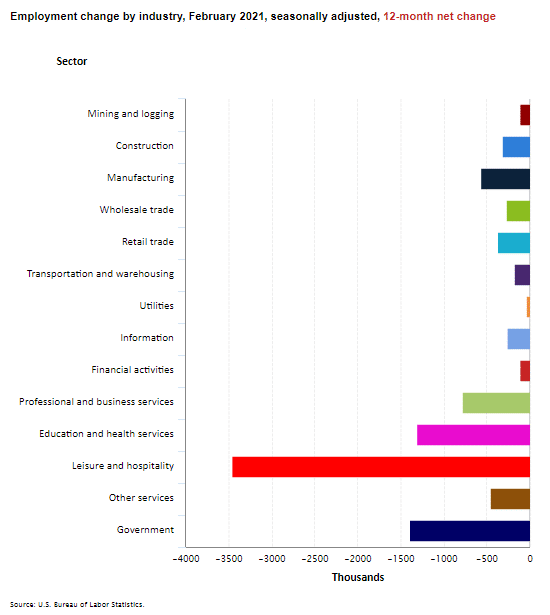

Employment by Sector

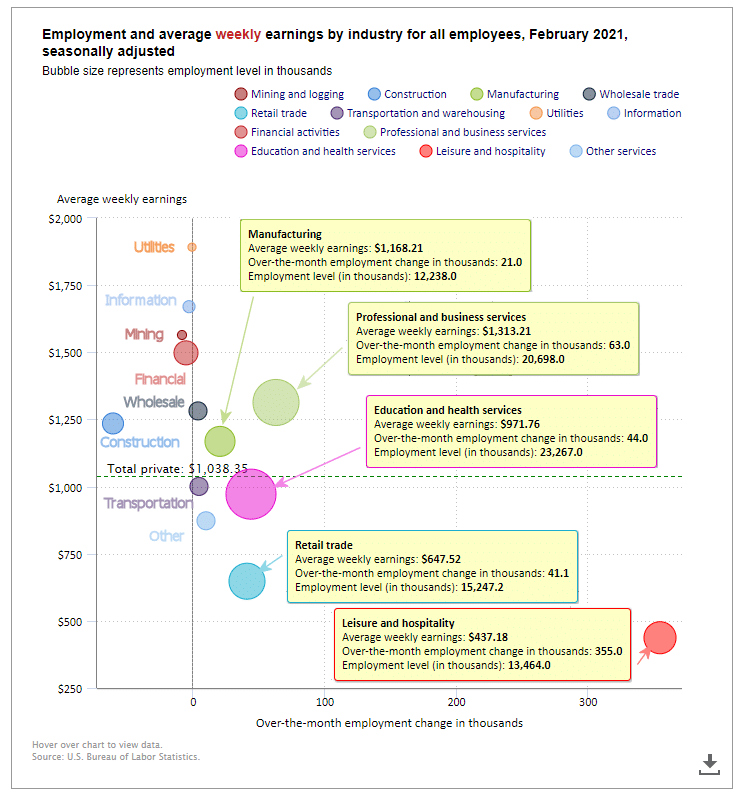

The employment “bubble chart” shows how each sector of the economy is doing (employment-wise on a seasonally adjusted basis).

Typically January is the worst month with retailers and hospitality reducing seasonal staff. In January Leisure and Hospitality lost -61,000 jobs. As things begin to reopen, February saw Leisure and Hospitality GAIN a massive 355,000 jobs. Retail gained 41,100 jobs, Education and Health gained 44,000 jobs and Professional and Business Services gained 63,000 jobs. Construction was the biggest loser losing as many jobs as Leisure did last month.

Average weekly wages fell from $1,048.60 in January to $1,038.35 in February but was still above the $1034.41 in December and November’s $1029.38.

(See the table below for details.)

How to read this chart:

The bubbles location on the chart tell us two things:

- Change in Employment Levels over the most recent month.

- Average Weekly earnings.

- The further to the right the bubble the larger the increase in the number of jobs.

- The higher up on the chart the larger the average salary.

Bubble Size tells us:

- Total Employment for the sector.

- Larger bubbles mean more people are employed in that sector.

Employment and Average Weekly Earnings by Industry

February 2021, Seasonally Adjusted

| Industry | Monthly Increase | Average Weekly Earnings | Employment Level |

| Total Private Employment | 465,000 | $1,038.35 | 121,602,000 |

| Mining and Logging | -8,000 | $1,564.32 | 589,000 |

| Construction | -61,000 | $1,235.01 | 7,340,000 |

| Manufacturing | 21,000 | $1,168.21 | 12,238,000 |

| Wholesale trade | 3,600 | $1,281.74 | 5,634,700 |

| Retail trade | 41,100 | $647.52 | 15,247,200 |

| Transportation and Warehousing | 4,400 | $1000.51 | 5,658,400 |

| Utilities | -400 | $1,891.46 | 538,800 |

| Information | -300 | $1,669.92 | 2,666,000 |

| Financial Activities | -500 | $1,497.82 | 8,770,000 |

| Professional and Business Services | 63,000 | $1,313.21 | 20,698,000 |

| Education and Health Services | 44,000 | $971.76 | 23,267,000 |

| Leisure and Hospitality | 355,000 | $437.18 | 13,464,000 |

| Other Services | 10,000 | $872.62 | 5,491,000 |

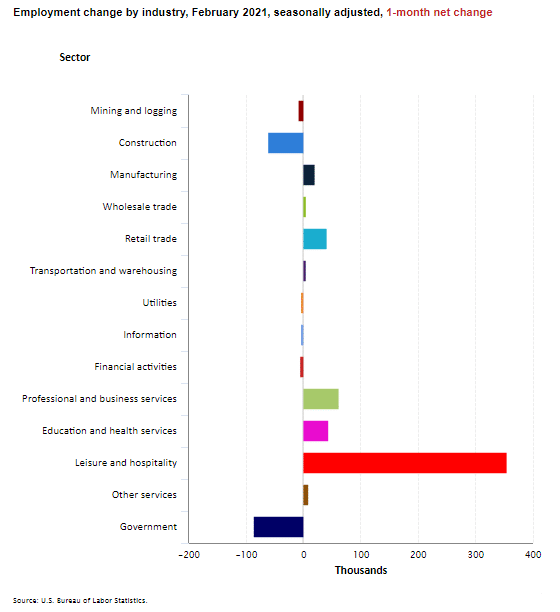

Another way to look at these monthly numbers. This one includes a decrease in government jobs and shows the magnitude of the gain in Leisure and Hospitality jobs.

Source: BLS

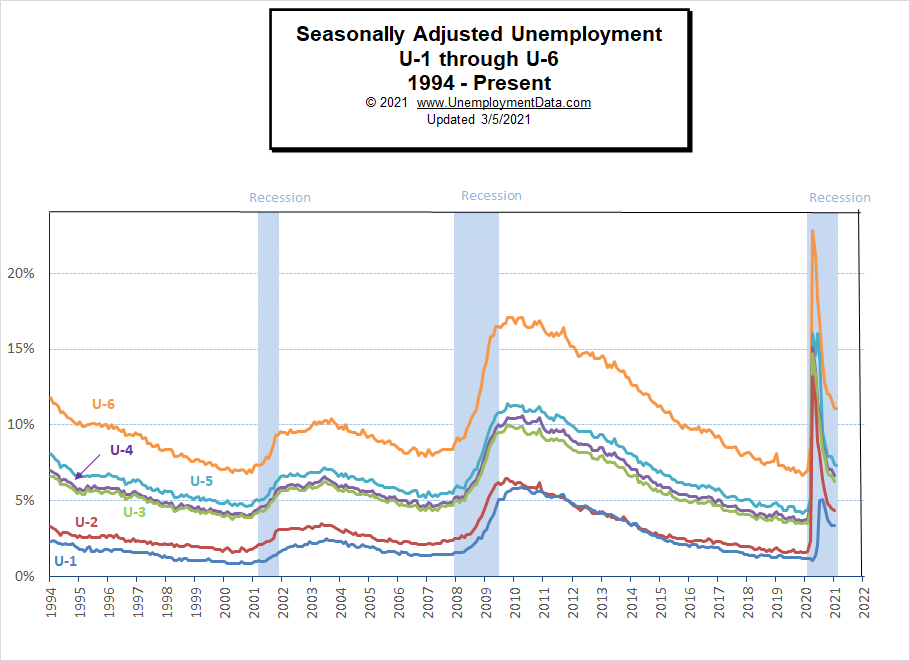

U1 through U6 Unemployment Rates

Due to COVID, all the various measurements of Seasonally Adjusted Unemployment from U-1 through U-6 spiked up sharply beginning in April except U1 which measures unemployment longer than 15 weeks. In July, they began falling rapidly. In November they only fell slightly due to renewed restrictions by several states. And in December they were basically flat. In January most of the measurements fell slightly on a seasonally adjusted basis even though they rose on a nominal basis. February fell slightly

For more information about the various measurements of unemployment see What Is U-6 Unemployment?

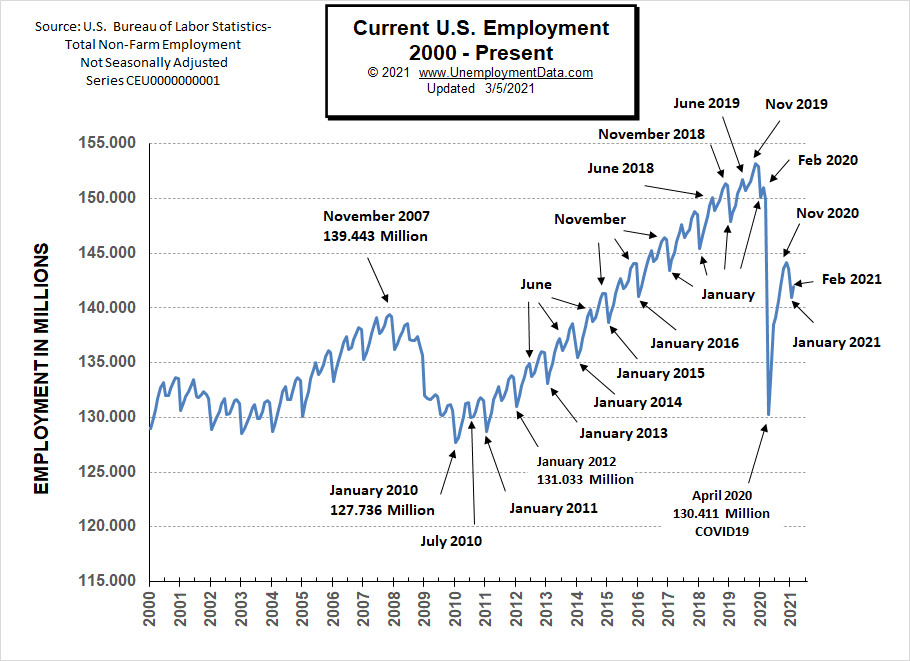

Current Employment

Typically the low point for each year occurs in January and then it moves almost straight up to a small peak around June with a slight drop around July and then the highest peak in employment happens in November with a slight decline in December. As expected January employment dropped sharply (perhaps a bit more sharply than typical). But as expected February saw the typical rebound.

Last year the COVID virus shortcircuited the normal trend with a drop that began in March and by April it had wiped out all the employment gains since July 2010. June 2020 saw employment rebound to approximately the January 2015 level. Fortunately, July did not follow the traditional falling pattern but instead rose (although only slightly). August’s employment rose to roughly the January 2016 level. September employment rose roughly triple the rate at which it rose in 2019. October’s employment rose to slightly above the January 2017 level. In December we got the traditional slight decline. And January got the expected sharp drop, while February saw a slight increase.

Since November employment has remained just over 9 million below year-ago levels and the civilian population has increased by more than a million people.

See Current Employment for more info.

Previous Record Low Unemployment (Seasonally Adjusted U-3)

If we consider anything 4% or below as “low” we have had a few “low” stretches as we can see in the table below.

(4% or below in Green)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 1950 | 6.5% | 6.4% | 6.3% | 5.8% | 5.5% | 5.4% | 5.0% | 4.5% | 4.4% | 4.2% | 4.2% | 4.3% |

| 1951 | 3.7% | 3.4% | 3.4% | 3.1% | 3.0% | 3.2% | 3.1% | 3.1% | 3.3% | 3.5% | 3.5% | 3.1% |

| 1952 | 3.2% | 3.1% | 2.9% | 2.9% | 3.0% | 3.0% | 3.2% | 3.4% | 3.1% | 3.0% | 2.8% | 2.7% |

| 1953 | 2.9% | 2.6% | 2.6% | 2.7% | 2.5% | 2.5% | 2.6% | 2.7% | 2.9% | 3.1% | 3.5% | 4.5% |

| 1954 | 4.9% | 5.2% | 5.7% | 5.9% | 5.9% | 5.6% | 5.8% | 6.0% | 6.1% | 5.7% | 5.3% | 5.0% |

| 1955 | 4.9% | 4.7% | 4.6% | 4.7% | 4.3% | 4.2% | 4.0% | 4.2% | 4.1% | 4.3% | 4.2% | 4.2% |

| 1956 | 4.0% | 3.9% | 4.2% | 4.0% | 4.3% | 4.3% | 4.4% | 4.1% | 3.9% | 3.9% | 4.3% | 4.2% |

| 1957 | 4.2% | 3.9% | 3.7% | 3.9% | 4.1% | 4.3% | 4.2% | 4.1% | 4.4% | 4.5% | 5.1% | 5.2% |

| 1958 | 5.8% | 6.4% | 6.7% | 7.4% | 7.4% | 7.3% | 7.5% | 7.4% | 7.1% | 6.7% | 6.2% | 6.2% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1965 | 4.9% | 5.1% | 4.7% | 4.8% | 4.6% | 4.6% | 4.4% | 4.4% | 4.3% | 4.2% | 4.1% | 4.0% |

| 1966 | 4.0% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 3.7% | 3.7% | 3.6% | 3.8% |

| 1967 | 3.9% | 3.8% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 4.0% | 3.9% | 3.8% |

| 1968 | 3.7% | 3.8% | 3.7% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.4% | 3.4% | 3.4% | 3.4% |

| 1969 | 3.4% | 3.4% | 3.4% | 3.4% | 3.4% | 3.5% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.5% |

| 1970 | 3.9% | 4.2% | 4.4% | 4.6% | 4.8% | 4.9% | 5.0% | 5.1% | 5.4% | 5.5% | 5.9% | 6.1% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1999 | 4.3% | 4.4% | 4.2% | 4.3% | 4.2% | 4.3% | 4.3% | 4.2% | 4.2% | 4.1% | 4.1% | 4.0% |

| 2000 | 4.0% | 4.1% | 4.0% | 3.8% | 4.0% | 4.0% | 4.0% | 4.1% | 3.9% | 3.9% | 3.9% | 3.9% |

| 2001 | 4.2% | 4.2% | 4.3% | 4.4% | 4.3% | 4.5% | 4.6% | 4.9% | 5.0% | 5.3% | 5.5% | 5.7% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 2018 | 4.1% | 4.1% | 4.1% | 3.9% | 3.8% | 4.0% | 3.9% | 3.9% | 3.7% | 3.7% | 3.7% | 3.9% |

| 2019 | 4.0% | 3.8% | 3.8% | 3.6% | 3.6% | 3.7% | 3.7% | 3.7% | 3.5% | 3.6% | 3.5% | 3.5% |

| 2020 | 3.6% | 3.5% | 4.4% | 14.7% | 13.3% | 11.1% | 10.2% | 8.4% | 7.9% | 6.9% | 6.7% | 6.7% |

| 2021 | 6.3% | 6.2% |

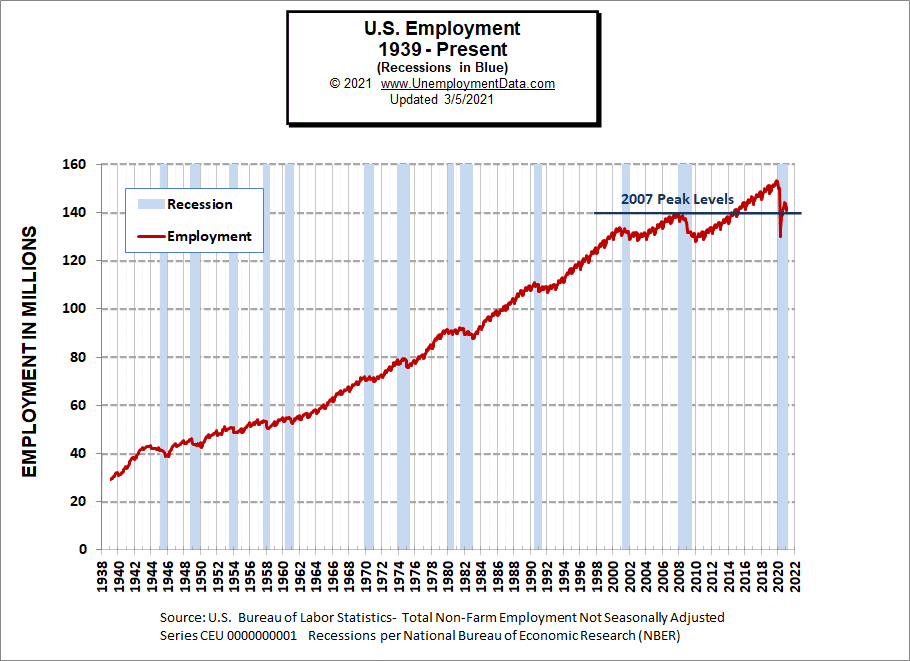

Historical Employment

Historically employment is closely tied to recessions because one of the primary determining factors of whether the economy is officially in a recession is an increase in the unemployment rate. The chart below provides the Historical Employment Data overlaid on blue bars showing periods of official recessions. In April, the number of people employed fell below the 2007 peak, near the lows of the 2008-2010 crash. In August it rebounded back above the 2007 peak level. According to the National Bureau of Economic Research (NBER) we have officially been in a recession since February. Since they measure a recession beginning from the peak, that just means the economy was no longer growing, which is pretty obvious due to the virus.

See Historical Employment Data for more info.

Current Seasonally Adjusted Unemployment

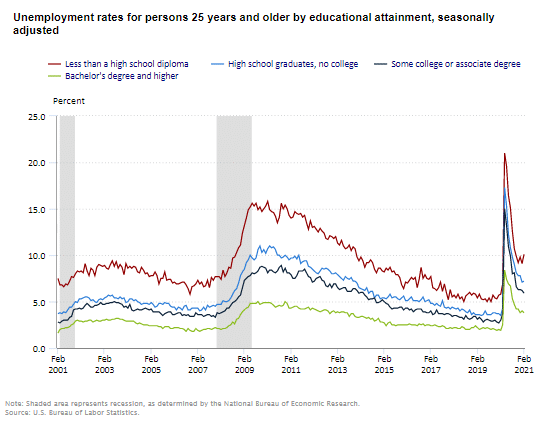

Unemployment by Education

Although other metrics fell, unemployment among the less educated rose in February to 10.1% from 9.1% in January. This is still down from the peak of 21.2% in April 2020, after bottoming at 4.8% in September 2019.

Typically those with a Bachelor’s degree are relatively immune to unemployment. Although during the 2008 recession college grads’ unemployment rose to slightly above 4%.

Those with a Bachelor’s degree or higher had a low of 1.9% unemployment in February 2019 and rose to 8.4% in April 2020. Unemployment fell to 3.8% in December but rose back to 4% in January and returned to 3.8% in February.

Source: Bureau of Labor Statistics

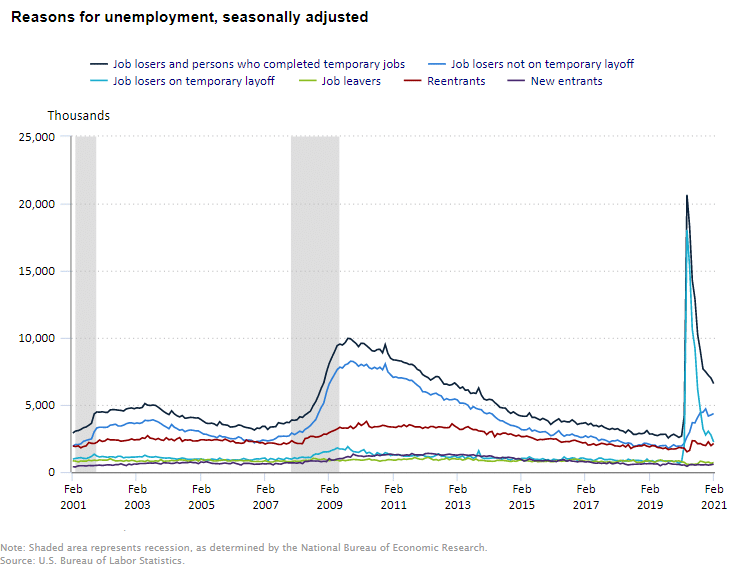

Reasons for Unemployment – Layoff Status

Source: BLS

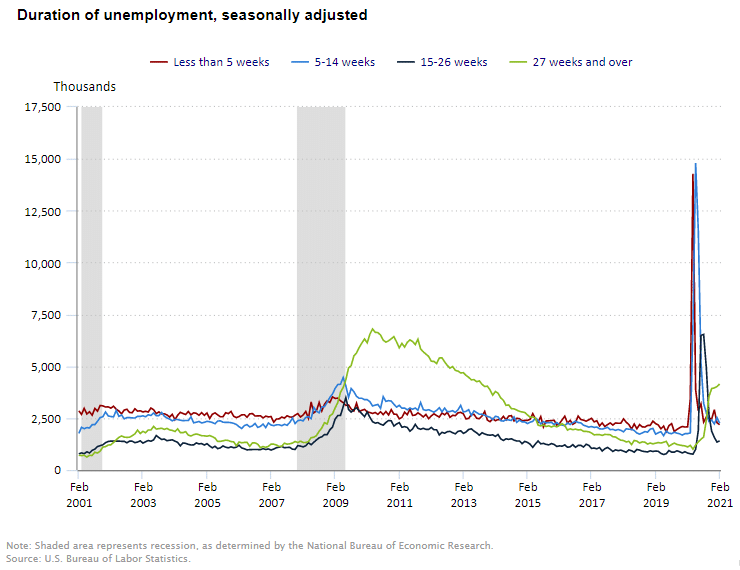

Duration of Unemployment

The troubling feature of this chart is the extension of the light green long-term unemployment line.

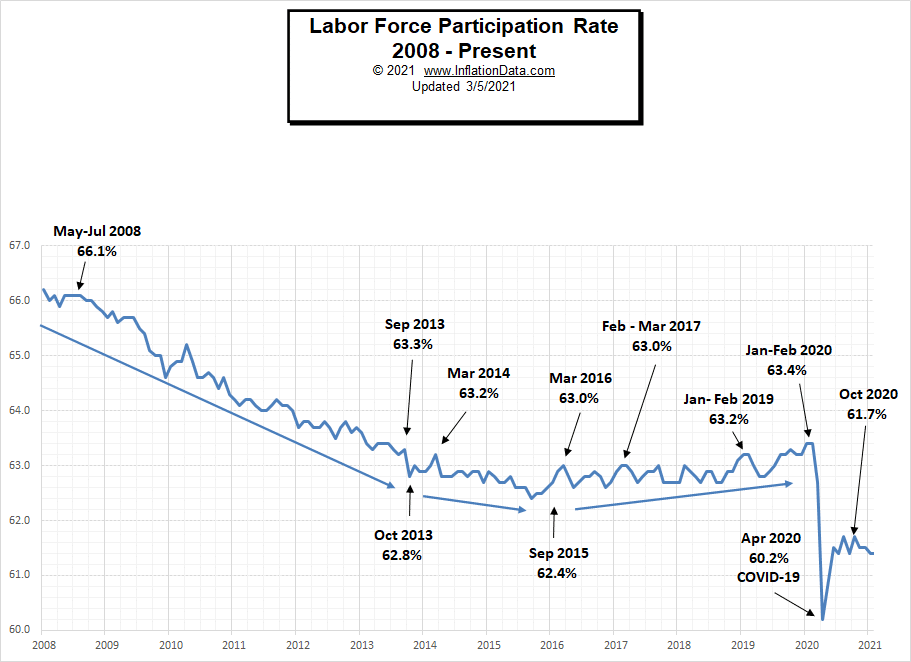

Labor Force Participation Rate

Even though Unemployment was in record low territory for quite some time, it wasn’t until January and February 2020, that the LFPR was finally able to claw its way back to 63.4%, its highest level since 2013.

Then COVID decimated all those gains dropping the LFPR down to 60.2% in April. In May it began to rebound and in June the LFPR was able to bounce back a little more to 61.5%, it fell slightly in July but this was probably due to people returning to the labor force rather than other factors. Over the last few months, the LFPR has bounced around between 61.4% and 61.7%. In January it fell again to 61.4% where it remained for February.

See Labor Force Participation Rate for more information.

If you would like to receive this monthly report and other article updates click here you can unsubscribe at any time.

Here are some articles you might enjoy in case you missed them:

Read more on UnemploymentData.com.

- How to Go Back to School as an Adult: The Steps Explained

- Create a Professional Resume

- How to Get a Job with No Experience

- Turning Unemployment to Success

From InflationData.com

- Price and Wage Changes since 2000

- Why Hasn’t the U.S. Dollar Experienced Hyperinflation?

- Using Risk to Combat Inflation

- The Price of Oil Denominated in Bitcoin

- How has Venezuela’s Bitcoin experiment Fared?

From Financial Trend Forecaster

- Top Financial Trends Shaping Banking

- The Death Of U.S. Shale Has Been Greatly Exaggerated

- China Ramps Up U.S. Crude Oil Imports

- Speed and Affordability: Cost of Internet Access Over Time

- New Technologies in the Oil and Gas Industry

- Spotting the Slide in Silver

- Market Participants are Extremely Bullish

- Why Most Investors Miss Major Stock Market Turns

- This High-Confident Trade Set-up Makes for Highly-Confident Traders

- Bond Market: “When Investors Should Worry”

From OptioMoney.com

- Smart Finance Moves: Questions to Ask Yourself Before You Buy a New Car

- Wealth Transfer: Estate Planning

- 5 Things to Consider When Managing Money in a Relationship

- Should You Buy a Second Home?

- Learning to Trade from Video Tutorials

From Your Family Finances