The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for February on March 10th 2023.

Employment Up and Unemployment Up?

![]()

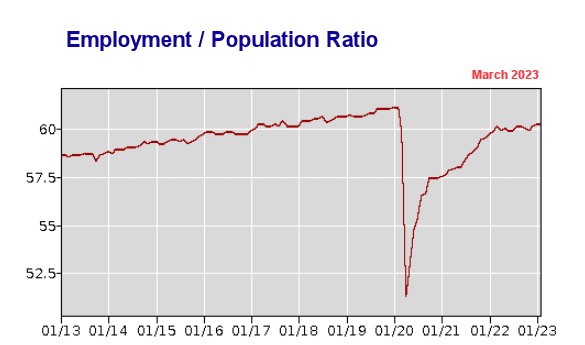

- Unadjusted Employment rose from 152.836 million to 153.955 million

- Labor Force Participation rose from 62.4% to 62.5%

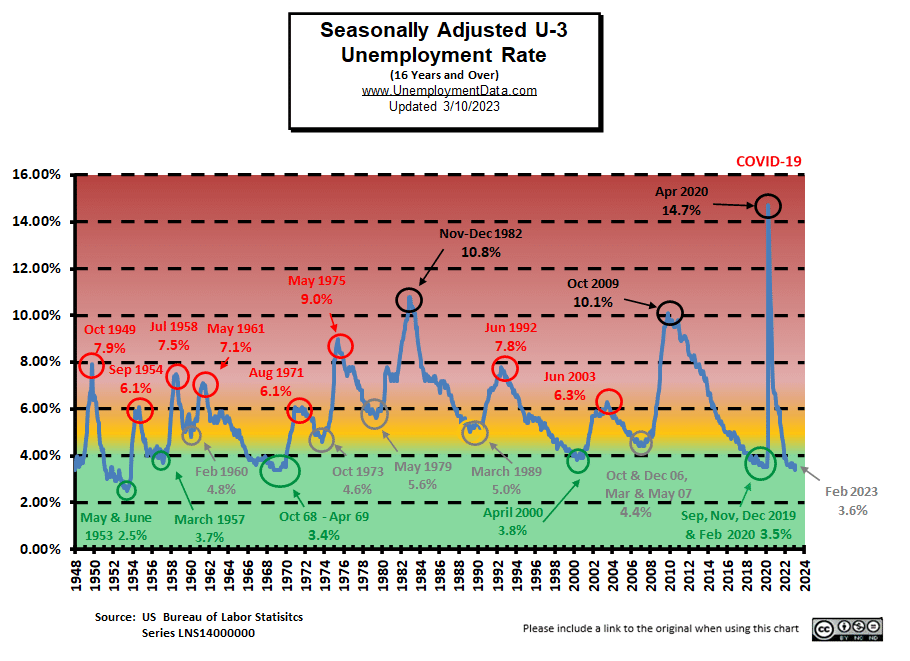

- Adjusted U-3 rose from 3.4% to 3.6%

- Unadjusted U-3 unchanged at 3.9%

- Unadjusted U-6 fell from 7.4% to 7.3%

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Total nonfarm payroll employment rose by 311,000 in February, and the unemployment rate edged up to 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, retail trade, government, and health care. Employment declined in information and in transportation and warehousing.”

You can read the full BLS report here.

As usual, they are talking about “Seasonally Adjusted Jobs”.

Looking at the Unadjusted Establishment Survey report, we see…

Originally the BLS reported employment of 152.844 million for January, which they adjusted down slightly to 152.836 million.

The current estimate for February is 153.955 million which is up 1.11 million from the original number and up 1.12 million from the revised numbers. According to the BLS, this increase didn’t change the unadjusted U-3 number and actually resulted in an increase in unemployment on a seasonally adjusted basis.

ADP® National Employment Report

According to ADP In collaboration with Stanford Digital Economy Lab, private employment was up from January to February by 242,000.

ADP: Private employers added 242,000 jobs in February

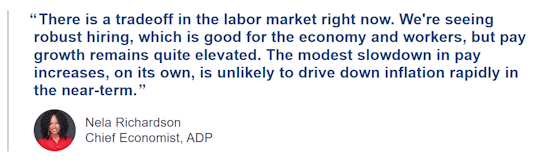

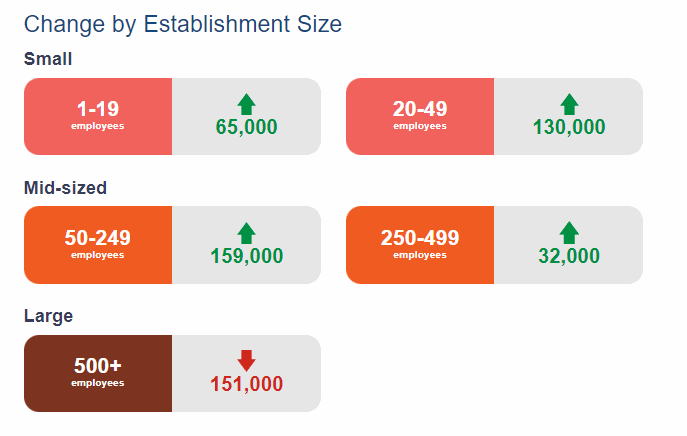

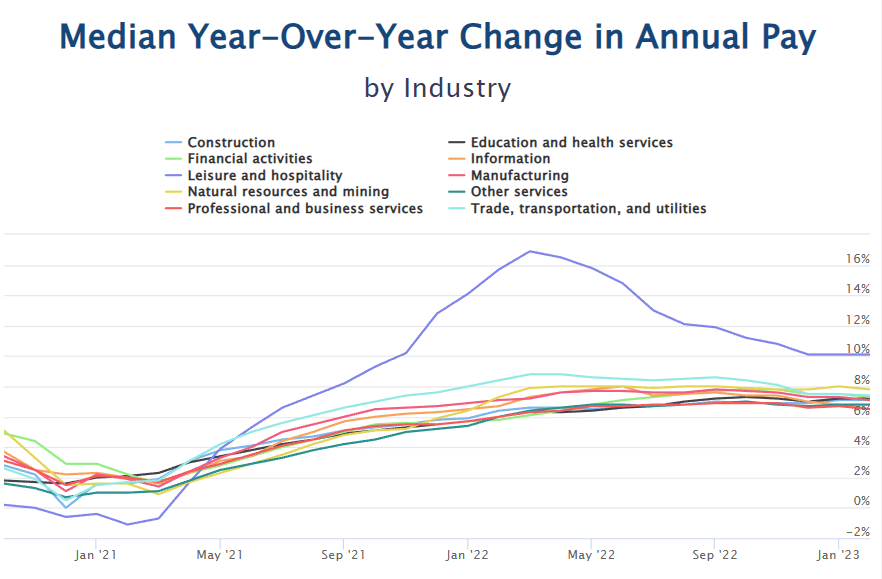

ADP also lists increases by “firm size” and they posted this comment:

- Job gains are solid and wage growth remains elevated. A particular area of weakness is with small establishments, which shed jobs every month since August 2022.

But their December report showed small businesses gaining.

December Changes:

February Changes:

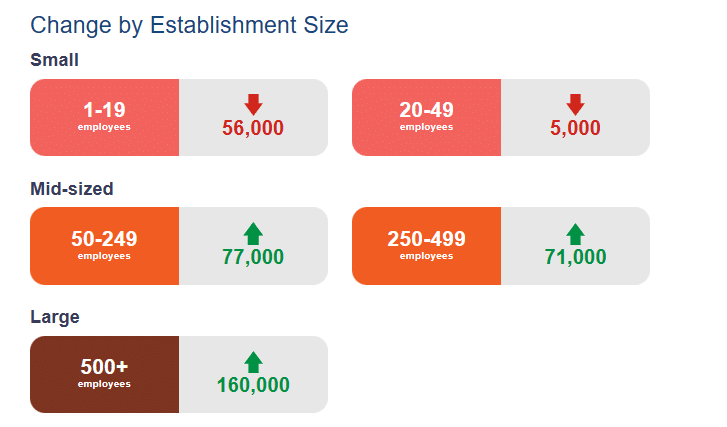

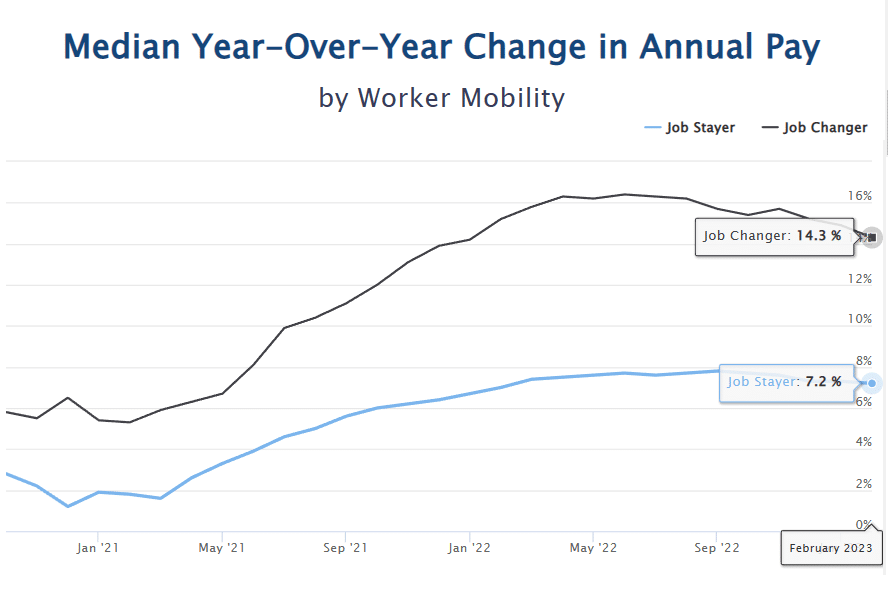

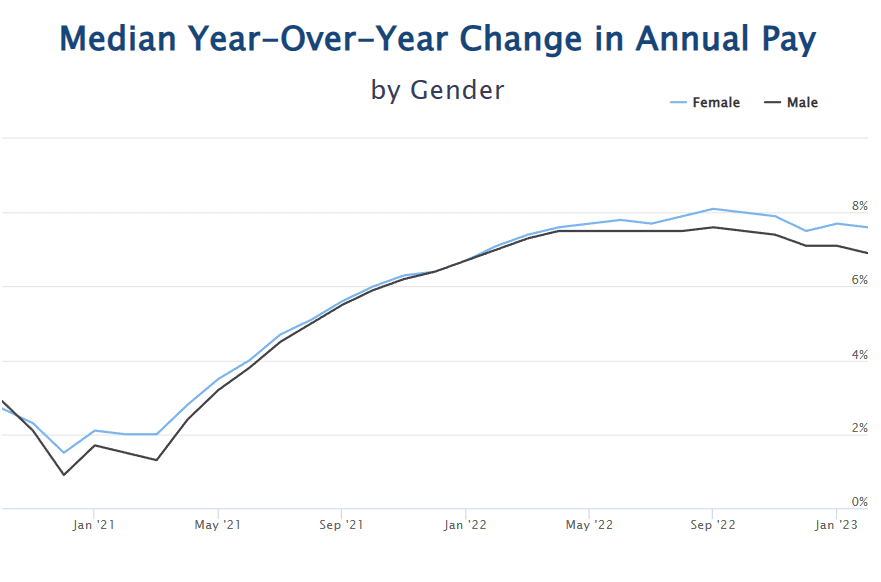

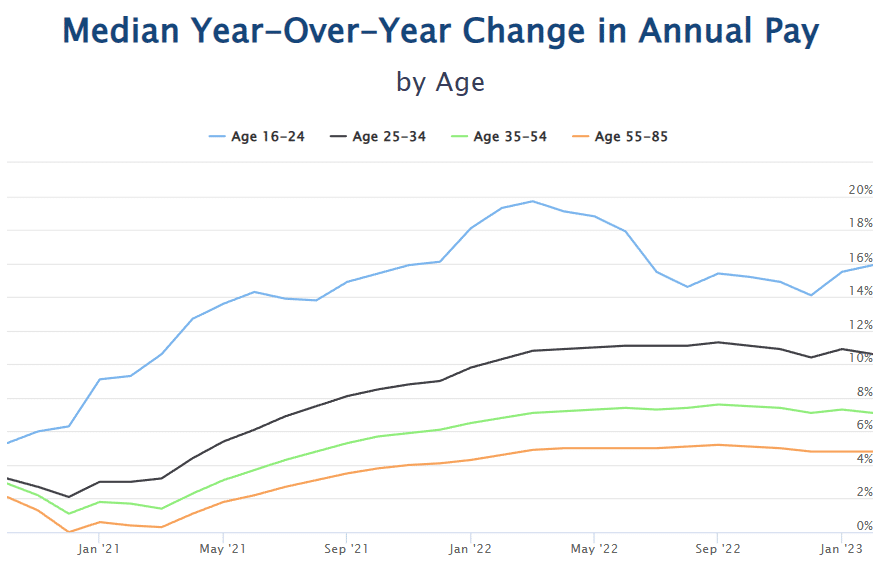

ADP Also Tracks Salary Changes:

As you would expect in a tight labor market, “Job Changers” saw a much greater increase in salary than those who stayed in their job, as companies needed to offer significant increases in order to attract new employees.

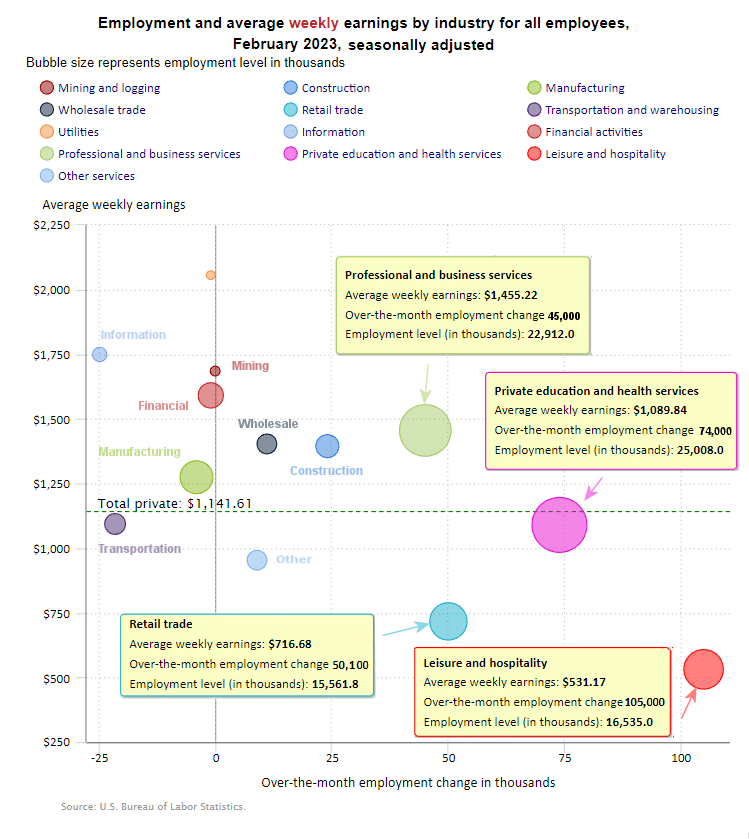

February 2023 Employment by Sector

The employment “bubble chart” is a quick and easy way to see how each sector performs on a seasonally adjusted basis. The Bubble’s Size tells us the total Employment for that industry (i.e., larger bubbles mean more people are employed in that sector).

The bubble’s location on the chart tells us that there has been a change in Employment Levels over the most recent month… A bubble further to the right indicates larger job growth. A bubble’s vertical location on the chart shows the average industry salary.

Average Weekly Wages Fell in February

| Date | Average Weekly Wage |

| February 2023 | $1,141.61 |

| January 2023 | $1,146.14 |

| December 2022 | $1,125.73 |

| November 2022 | $1,129.01 |

| October 2022 | $1,124.01 |

| September 2022 | $1,119.87 |

| August 2022 | $1,116.42 |

| July 2022 | $1,116.54 |

| June 2022 | $1,106.76 |

| May 2022 | $1,105.47 |

| April 2022 | $1,102.01 |

| December 2021 | $1,086.46 |

Remember, these are Seasonally Adjusted Numbers, so they aren’t cumulative!

BLS Employment and Average Weekly Earnings by Industry

February 2023, Seasonally Adjusted Employment

We’ve added another column to the table below that shows the employment levels that the BLS reported the previous month. Note that due to “seasonal adjusting” although they may claim that there was a “monthly increase” (or decrease), there isn’t always a real increase; you can’t just subtract last month’s “employment level” from this month’s level. For instance, Utilities was supposed to have 555,200 employed in January and have a -1,100 “decrease”, but in February, there were only 552,100 employed. That looks like a -3,100 decrease to me. And Information was supposed to have a -25,000 decrease but went from 3,065,000 in January to 3,075,000 in February. Employment for Professional and Business Services supposedly gained 45,000 but the numbers are exactly the same for January and February.

| Industry | February Monthly Increase | Feb. Ave. Weekly Earnings | Employment Level February | Employment Level January |

| Total Private Employment | 265,000 | $1,141.61 | 132,855,000 | 132,684,000 |

| Mining and Logging | 0 | $1,,684.96 | 631,000 | 631,000 |

| Construction | 24,000 | $1,394.64 | 7,918,000 | 7,884,000 |

| Manufacturing | -4,000 | $1,274.29 | 12,983,000 | 12,999,000 |

| Wholesale trade | 11,100 | $1,403.01 | 6,048,800 | 6,041,000 |

| Retail trade | 50,100 | $716.68 | 15,561,800 | 15,482,600 |

| Transportation and Warehousing | -21,500 | $1,093.40 | 6,699,700 | 6,740,500 |

| Utilities | -1,100 | $2,056.16 | 552,100 | 555,200 |

| Information | -25,000 | $1,749.02 | 3,075,000 | 3,065,000 |

| Financial Activities | -1,000 | $1,590.85 | 9,105,000 | 9,114,000 |

| Professional and Business Services | 45,000 | $1,455.22 | 22,912,000 | 22,912,000 |

| Private Education and Health Services | 74,000 | $1,089.84 | 25,008,000 | 24,937,000 |

| Leisure and Hospitality | 105,000 | $531.17 | 16,535,000 | 16,450,000 |

| Other Services | 9,000 | $953.17 | 5,826,000 | 5,819,000 |

Source: BLS

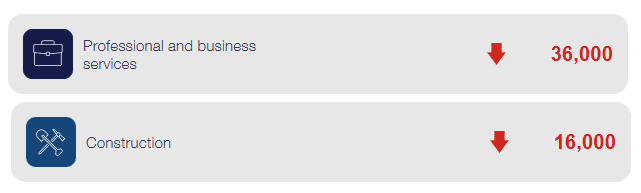

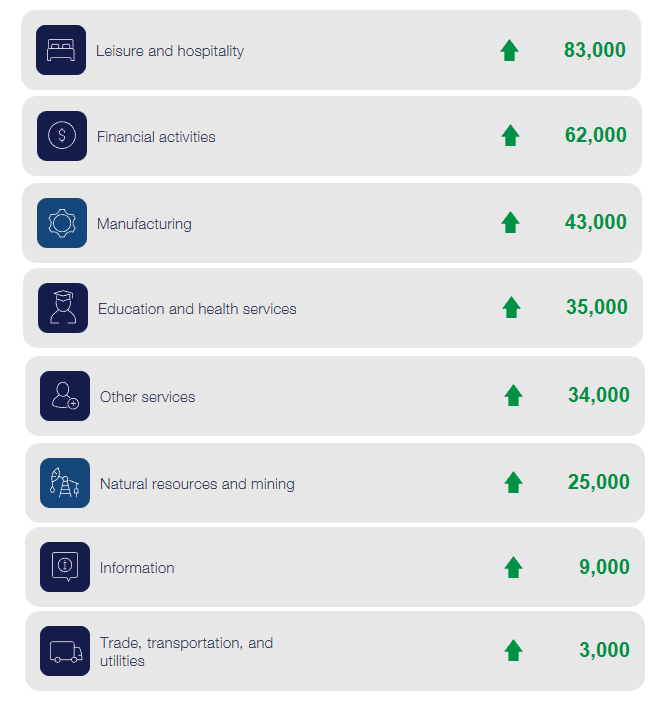

Note: As usual, ADP has an entirely different picture with “Professional and Business Services”, and Construction losing jobs instead of gaining them

ADP Job Losers

ADP Job Gainers

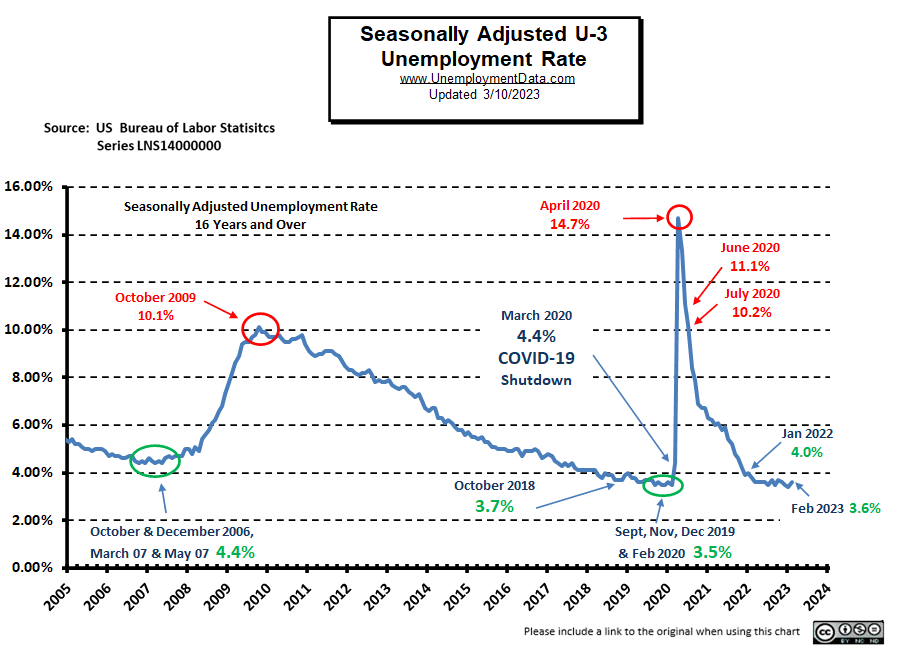

Unemployment

February’s Seasonally Adjusted Unemployment is 3.6%, up from 3.4% in January.

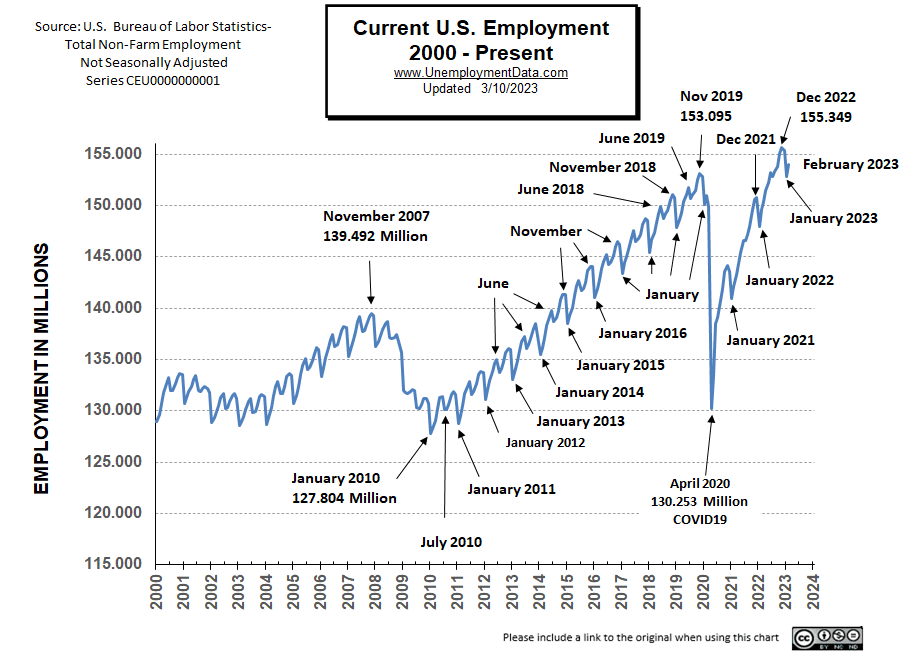

Current Employment Rate Chart

Typically the low point for each year occurs in January. Then employment moves almost straight up to a small peak around June with a slight drop around July, and then the highest peak in employment happens in November with a slight decline in December. In 2021, rather than a decline in December, we saw a slight increase, followed by the typical January decline and a rebound in February through June. Employment peaked at 155.015 million in December, beating the November 2019 peak by roughly 2 million (although the U.S. population has increased by over 4.8 million since then as well).

See Current Employment for more info.

Unemployment Still Historically Low

Unemployment levels are still in the historically low territory. After all, the FED did pump unprecedented TRILLIONS into the economy to get us to this place.

See: FED Actions for more info.

But we can see that Seasonally Adjusted U-3 is definitely in the “Green” territory.

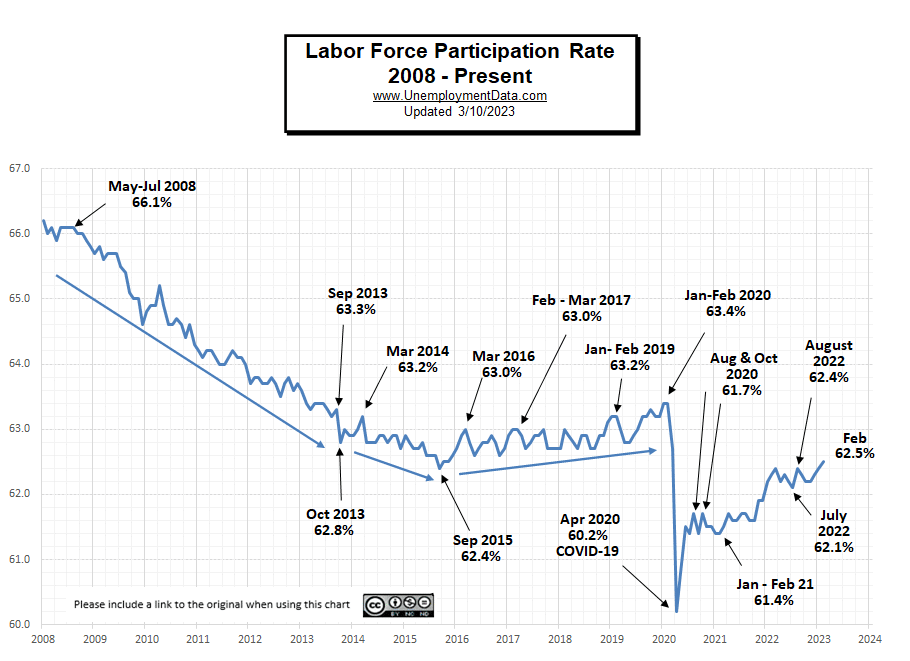

February 2023 Labor Force Participation Rate

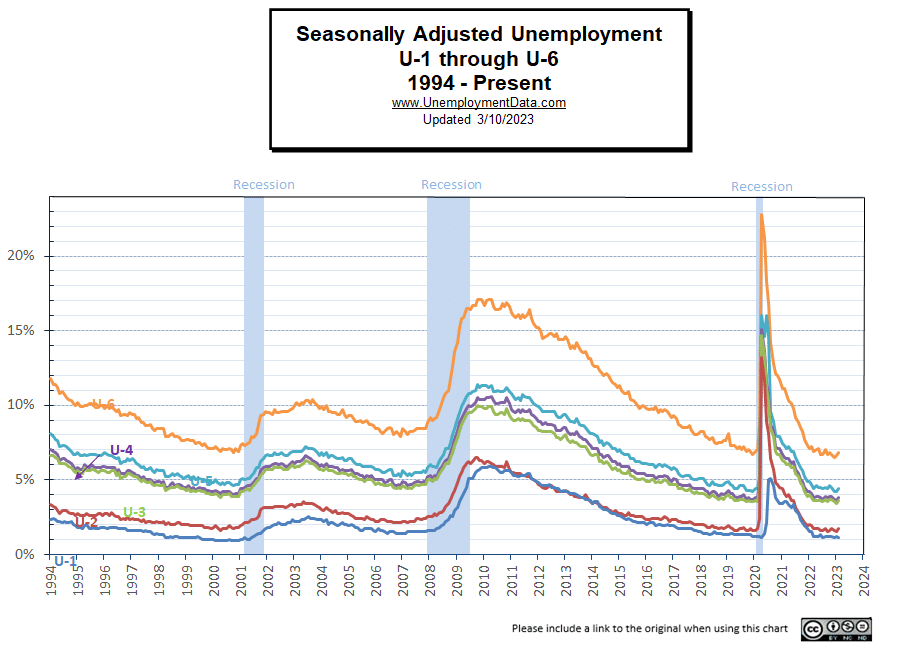

Seasonally Adjusted U1 through U6 Unemployment Rates

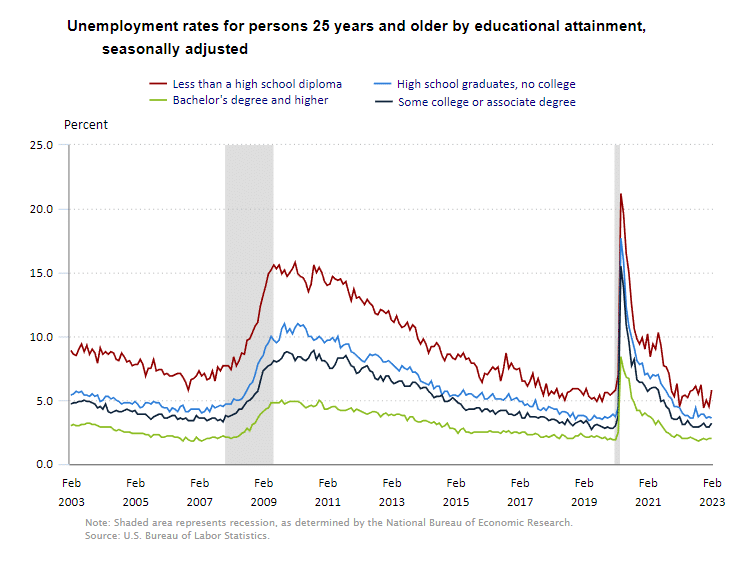

Seasonally Adjusted Unemployment by Education

The primary noteworthy point on this chart is the drastic increase in unemployment by the uneducated, jumping from 4.5% in January to 5.8% in February.

See Employment Population Ratio for more information

Read more on UnemploymentData.com.

- Why Becoming a Flooring Installer is a Stable Career Path

- Strategies for Conquering Job Search Frustration

- December 2022- Employment and Unemployment by State

- 5 Career Opportunities for Disabled Individuals

- 4 Careers that Don’t Require a 4 Year Degree

From InflationData.com

- How Loose Monetary Policies Cause Recessions

- Food and Shelter Prices Keep Climbing as CPI Growth Hits a Three-Month High

- January 2023 Inflation “Disappointing”

- Is The Fed Flashing Signs It’s Done Raising Rates?

- Falling Inflation is Good for Stocks

- Why the Fed Is Bankrupt and Why That Means More Inflation

From Financial Trend Forecaster

- Moore Inflation Predictor

- NYSE ROC

- NASDAQ ROC

- More Cracks in U.S. Dollar Dominance

- Do “Red States” Ride the “Blue State” Gravy Train?

- Has the Stock Market Turned Positive?

- Are Countries Getting Smaller?

- Is the U.S. Dollar Hegemony Ending?

- Latest Recession Alarm

- Housing Is Getting Less Affordable

From Elliott Wave University

- Bull Trap or Market Consolidation?

- 60% stocks, 40% bonds? Ha!

- U.S. Dollar: Has the Mainstream Been Way Too Confident?

- Banks Are Becoming More Cautious About Lending

- Are You Prepared for Widespread Bank Failures?

From OptioMoney.com

- How to Financially Prepare for a Baby

- 6 Ways to Cope with Bad Financial Decisions

- Simple Ways to Save Money When Shopping Online

- How to Start Saving for Your Education

From Your Family Finances