Employment Increased by 1.5 Million in August

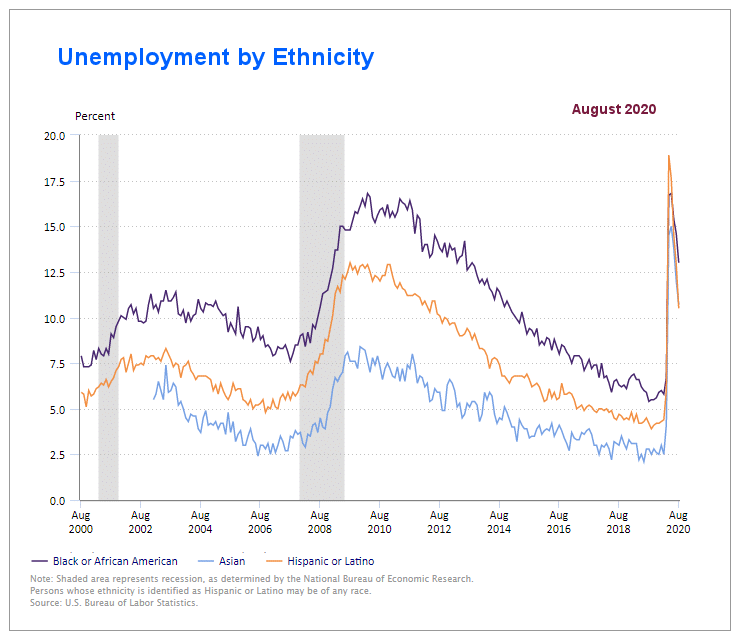

Latino unemployment is lower than Asian unemployment for the first time since the BLS began tracking Asian unemployment separately.

The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for August on September 4th.

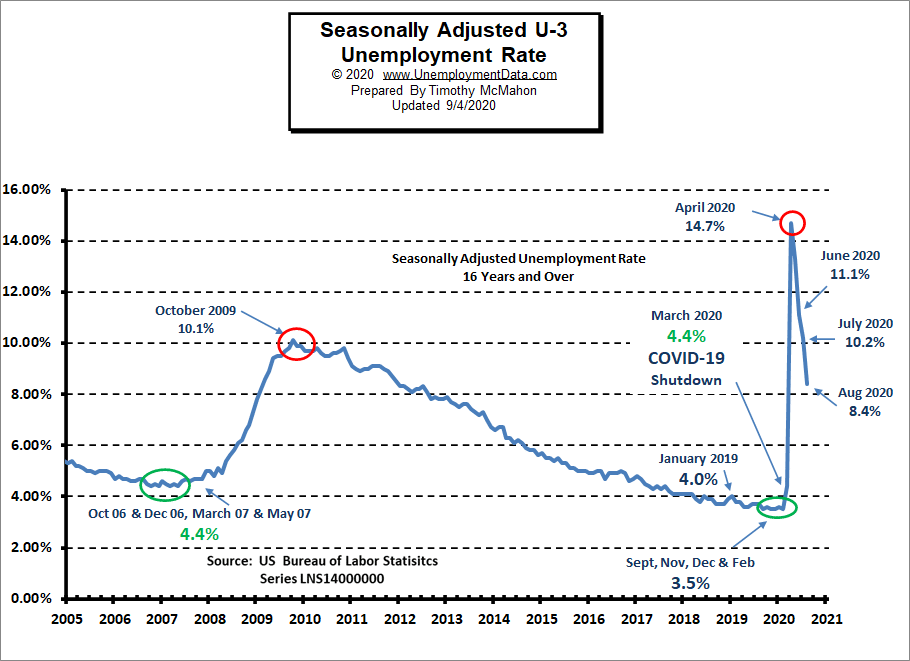

- Unadjusted U-3 was Down from 10.5% to 8.5%!

- Adjusted U-3 was Down from 10.2% to 8.4%!

- Unadjusted U-6 was Down from 16.8% to 14.3%!

- Labor Force Participation rose from 61.4% to 61.7%.

- Unadjusted Employment up from 139.063 to 140.598 million.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Nonfarm payroll employment increased by 1.4 million in August, and the unemployment rate declined by 1.8 percentage points to 8.4 percent. These improvements reflect the continued resumption of economic activity that had been curtailed due to the coronavirus (COVID-19) pandemic and efforts to contain it.

In August, employment rose in several major industry sectors. A gain in government largely reflected the hiring of temporary workers for the 2020 Census. Notable job gains also occurred in retail trade, in professional and business services, in leisure and hospitality, and in education and health services.”

Of course, he is talking about “Seasonally Adjusted Jobs” from the “Current Population Survey (CPS)” rather than looking at the results reported by actual companies in their “Current Employment Statistics survey (CES)”

Looking at the CES report we see…

Originally the BLS reported 139.100 million jobs for July, they subtracted 37,000 jobs from that estimate.

So currently they are saying 139.063 million jobs for July and 140.598 million jobs for August which is an increase of 1,535,000 jobs based on their updated estimates.

Unemployment by Ethnicity

Source: BLS

Current Seasonally Adjusted Unemployment

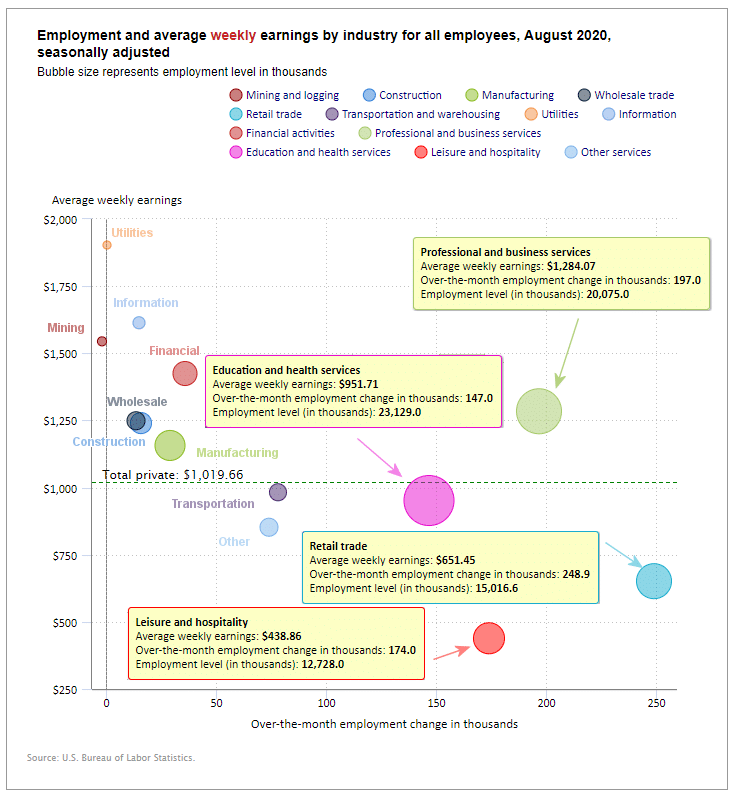

Employment by Sector

The employment “bubble chart” gives us a good representation of how each sector of the economy is doing (employment wise on a seasonally adjusted basis).

The four best performing sectors in August were Retail which gained 248,900 jobs, Professional and Business Services with a gain of 197,000 jobs, Education and Health which gained 147,000 jobs, and Leisure & Hospitality which gained 174,000 jobs.

At the other end of the spectrum, Mining & Logging lost -2,000 jobs (on top of last month’s -7,000 jobs) and Utilities only gained 600 jobs.

Average weekly wages rose slightly in August to $1,019.66 from July’s $1,013.96.

(See the table below for details.)

How to read this chart:

The bubbles location on the chart tell us two things:

- Change in Employment Levels over the most recent month.

- Average Weekly earnings.

- The further to the right the bubble the larger the increase in the number of jobs.

- The higher up on the chart the larger the average salary.

Bubble Size tells us:

- Total Employment for the sector.

- Larger bubbles mean more people are employed in that sector.

Employment and Average Weekly Earnings by Industry

August 2020, Seasonally Adjusted

| Industry | Monthly Increase | Average Weekly Earnings | Employment Level |

| Total Private Employment | 1,027,000 | $1,019.66 | 119,000,000 |

| Mining and Logging | -2,000 | $1,544.40 | 617,000 |

| Construction | 16,000 | $1,240.13 | 7,214,000 |

| Manufacturing | 29,000 | $1,156.80 | 12,132,000 |

| Wholesale trade | 13,500 | $1,248.77 | 5,606,200 |

| Retail trade | 248,900 | $651.45 | 15,016,600 |

| Transportation and Warehousing | 78,100 | $982.52 | 5,297,400 |

| Utilities | 600 | $1,903.04 | 539,000 |

| Information | 15,000 | $1,613.69 | 2,582,000 |

| Financial Activities | 36,000 | $1,424.63 | 8,654,000 |

| Professional and Business Services | 197,000 | $1,284.07 | 20,075,000 |

| Education and Health Services | 147,000 | $951.71 | 23,129,000 |

| Leisure and Hospitality | 174,000 | $438.86 | 12,728,000 |

| Other Services | 74,000 | $852.33 | 5,410,000 |

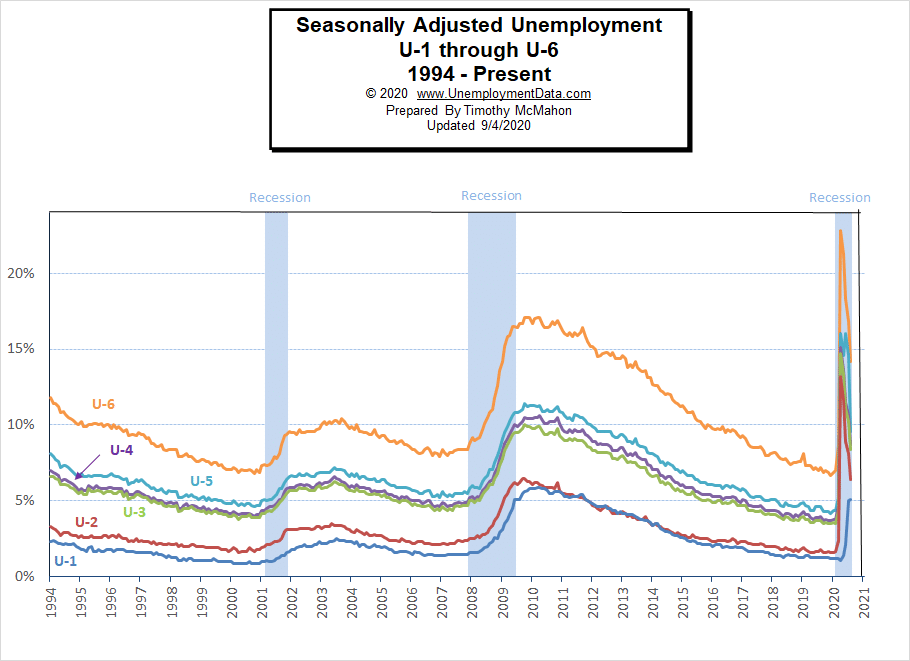

U1 through U6 Unemployment Rates

In April all the various measurements of Seasonally Adjusted Unemployment from U-1 through U-6 spiked up sharply except U1 which measures unemployment longer than 15 weeks. In August as in July, they all fell except U1 indicating that unemployment for some people has now lasted more than 15 weeks.

For more information about the various measurements of unemployment see What Is U-6 Unemployment?

Previous Record Low Unemployment (Seasonally Adjusted U-3)

If we consider anything 4% or below as “low” we have had a few “low” stretches as we can see in the table below.

(4% or below in Green)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 1950 | 6.5% | 6.4% | 6.3% | 5.8% | 5.5% | 5.4% | 5.0% | 4.5% | 4.4% | 4.2% | 4.2% | 4.3% |

| 1951 | 3.7% | 3.4% | 3.4% | 3.1% | 3.0% | 3.2% | 3.1% | 3.1% | 3.3% | 3.5% | 3.5% | 3.1% |

| 1952 | 3.2% | 3.1% | 2.9% | 2.9% | 3.0% | 3.0% | 3.2% | 3.4% | 3.1% | 3.0% | 2.8% | 2.7% |

| 1953 | 2.9% | 2.6% | 2.6% | 2.7% | 2.5% | 2.5% | 2.6% | 2.7% | 2.9% | 3.1% | 3.5% | 4.5% |

| 1954 | 4.9% | 5.2% | 5.7% | 5.9% | 5.9% | 5.6% | 5.8% | 6.0% | 6.1% | 5.7% | 5.3% | 5.0% |

| 1955 | 4.9% | 4.7% | 4.6% | 4.7% | 4.3% | 4.2% | 4.0% | 4.2% | 4.1% | 4.3% | 4.2% | 4.2% |

| 1956 | 4.0% | 3.9% | 4.2% | 4.0% | 4.3% | 4.3% | 4.4% | 4.1% | 3.9% | 3.9% | 4.3% | 4.2% |

| 1957 | 4.2% | 3.9% | 3.7% | 3.9% | 4.1% | 4.3% | 4.2% | 4.1% | 4.4% | 4.5% | 5.1% | 5.2% |

| 1958 | 5.8% | 6.4% | 6.7% | 7.4% | 7.4% | 7.3% | 7.5% | 7.4% | 7.1% | 6.7% | 6.2% | 6.2% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1965 | 4.9% | 5.1% | 4.7% | 4.8% | 4.6% | 4.6% | 4.4% | 4.4% | 4.3% | 4.2% | 4.1% | 4.0% |

| 1966 | 4.0% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 3.7% | 3.7% | 3.6% | 3.8% |

| 1967 | 3.9% | 3.8% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 4.0% | 3.9% | 3.8% |

| 1968 | 3.7% | 3.8% | 3.7% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.4% | 3.4% | 3.4% | 3.4% |

| 1969 | 3.4% | 3.4% | 3.4% | 3.4% | 3.4% | 3.5% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.5% |

| 1970 | 3.9% | 4.2% | 4.4% | 4.6% | 4.8% | 4.9% | 5.0% | 5.1% | 5.4% | 5.5% | 5.9% | 6.1% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1999 | 4.3% | 4.4% | 4.2% | 4.3% | 4.2% | 4.3% | 4.3% | 4.2% | 4.2% | 4.1% | 4.1% | 4.0% |

| 2000 | 4.0% | 4.1% | 4.0% | 3.8% | 4.0% | 4.0% | 4.0% | 4.1% | 3.9% | 3.9% | 3.9% | 3.9% |

| 2001 | 4.2% | 4.2% | 4.3% | 4.4% | 4.3% | 4.5% | 4.6% | 4.9% | 5.0% | 5.3% | 5.5% | 5.7% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 2018 | 4.1% | 4.1% | 4.1% | 3.9% | 3.8% | 4.0% | 3.9% | 3.9% | 3.7% | 3.7% | 3.7% | 3.9% |

| 2019 | 4.0% | 3.8% | 3.8% | 3.6% | 3.6% | 3.7% | 3.7% | 3.7% | 3.5% | 3.6% | 3.5% | 3.5% |

| 2020 | 3.6% | 3.5% | 4.4% | 14.7% | 13.3% | 11.1% | 10.2% | 8.4% |

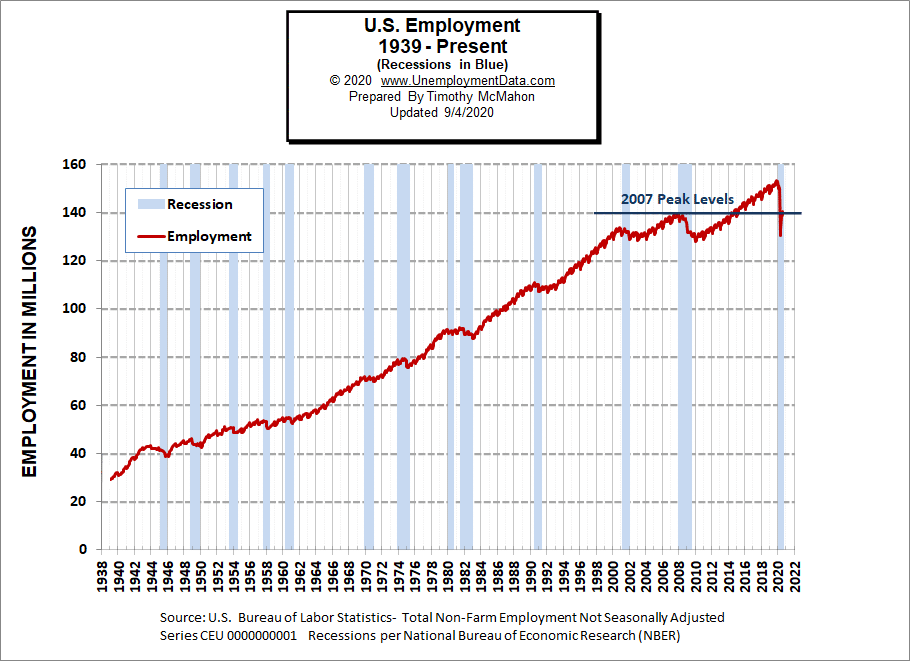

Employment

Historically employment is closely tied to recessions and that is no accident. One of the primary factors in calculating whether the economy is officially in a recession is an increase in the unemployment rate. The chart below provides the Historical Employment Data overlaid on blue bars showing periods of official recessions. In April, the number of people employed fell below the 2007 peak, near the lows of the 2008-2010 crash. In August it rebounded back above the 2007 peak level. According to the National Bureau of Economic Research (NBER) we have officially been in a recession since February. Since they measure a recession beginning from the peak, that just means the economy is no longer growing, which is pretty obvious due to the virus.

See Historical Employment Data for more info.

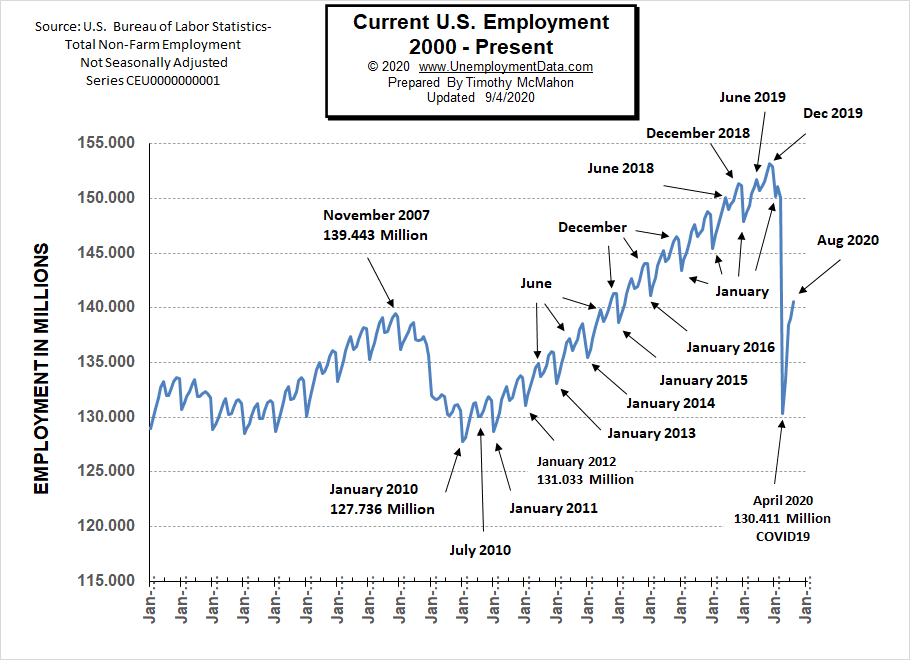

Current Employment

Typically the low point for each year occurs in January and then it moves almost straight up to a small peak around June with a slight drop around July and then the highest peak in employment happens in November/December.

But the COVID virus has shortcircuited the normal trend and we saw a drop which began in March and by April it took employment back down to approximately the level of July 2010. June saw employment rebound to approximately the January 2015 level. Fortunately, July did not follow the traditional pattern but instead rose (although only slightly) rather than falling. August’s employment rose to roughly the January 2016 level.

See Current Employment for more info.

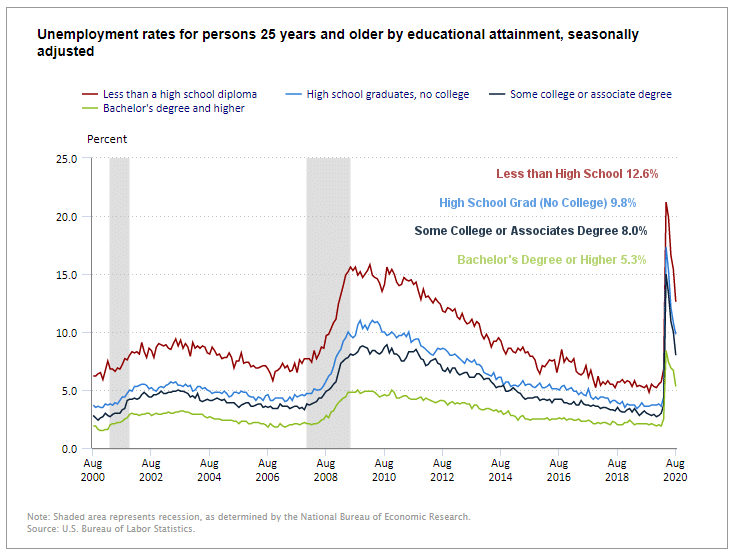

Unemployment by Education

Typically those with a Bachelor’s degree are relatively immune to unemployment. Although during the 2008 recession college grads unemployment rose to slightly above 4%.

Source: Bureau of Labor Statistics

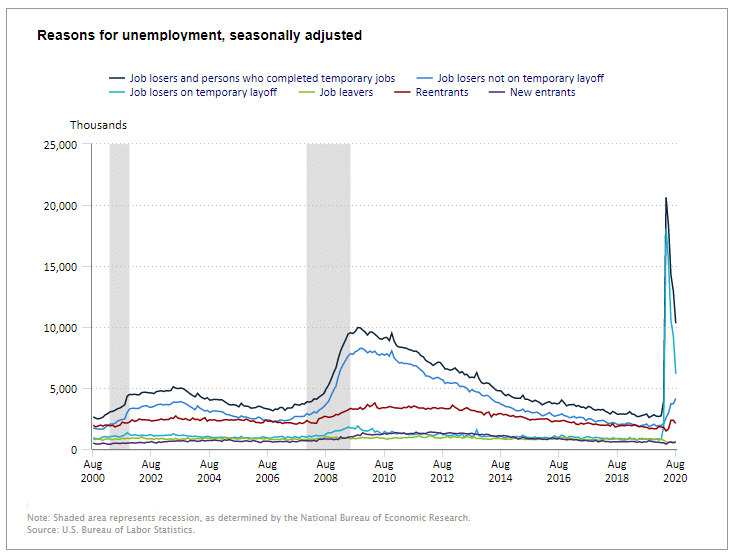

Layoff Status

Job losers who completed temporary jobs continued to fall as did those on temporary layoff (i.e. people who were laid off due to the virus are returning to work) but the troubling number on this chart is the job losers NOT on temporary layoff this number is increasing meaning that the number of jobs that are going away permanently is increasing.

Source: BLS

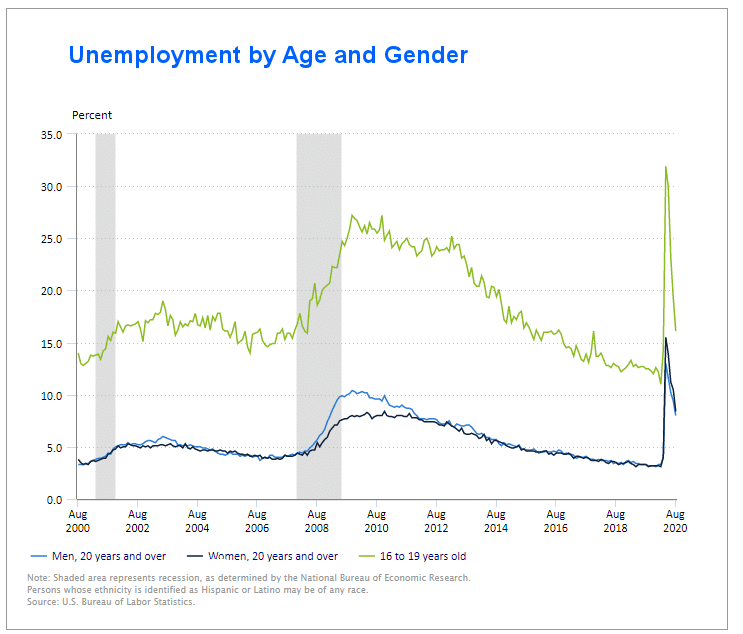

Unemployment by Age and Gender

Teenage Unemployment spiked to 31.9% in April and fell to 19.3% by July and 16.1% in August. Adult woman unemployment fell from 15.5% in April to 10.5% in July and 8.4% in August, and unemployment among adult men was 13.0% in April and 9.4% in July and 8.0% in August. It is interesting to note unemployment among men and women generally tracks very closely but back in 2009 unemployment among men spiked much higher than among women while in 2020 women’s unemployment spiked higher.

Source: BLS Civilian Unemployment Rate

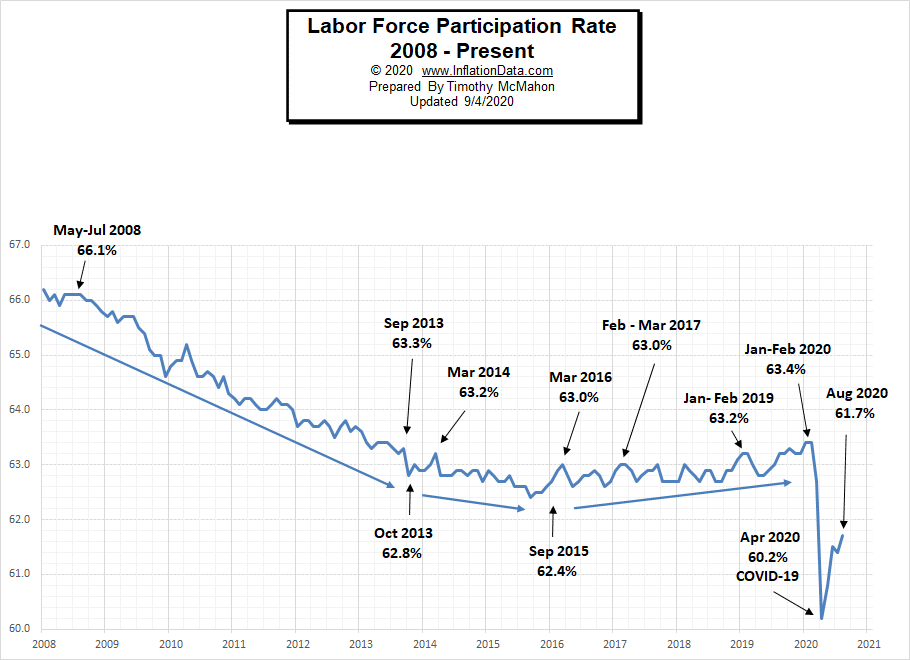

Labor Force Participation Rate

Even though Unemployment was in record low territory for quite some time, it wasn’t until January and February 2020, that the LFPR was finally able to claw its way back to 63.4%, its highest level since 2013.

Then COVID decimated all those gains dropping the LFPR down to 60.2% in April. In May it began to rebound and in June the LFPR was able to bounce back a little more to 61.5%, it fell slightly in July but this was probably due to people returning to the labor force rather than other factors. In August the LFPR rose to 61.7%.

See Labor Force Participation Rate for more information.

If you would like to receive this monthly report and other article updates click here you can unsubscribe at any time.

Here are some articles you might enjoy in case you missed them:

Read more on UnemploymentData.com.

- 7 Steps to Finding a Career Without a College Degree

- 4 Ways a Criminal Record Can Affect Your Employment

- Hopeful Entrepreneur: Starting Your Own Business With Limited Funds

- Medical Office Administration Career

From InflationData.com

- Gold vs. Dollar vs. BitCoin Revisited

- July’s Annual Inflation 0.99%

- 3 Factors Causing the Current Gold Rally

- Inflation Quintuples… Still Below 1%

- Is the FED Tightening or Is Hyperinflation on the Horizon?

From Financial Trend Forecaster

- Oil Demand Impacts Foreign Exchange Rates

- 2020 Pandemic Bankruptcy Statistics

- Saudi Arabia Eyes Total Dominance In Oil And Gas

- 4 Investments Making Waves in the Technology Sector

- Mutual Funds

From Elliott Wave University

- Gold: See What This Fibonacci Ratio Says About the Trend

- Forecasting Markets by Looking at Chart Patterns

- Seeking Certainty in Uncertain Times?

- Emerging Markets and Epidemics

- Deflationary Psychology Versus the Fed: Here’s the Likely Winner

- Crude Oil’s 2020 Crash: See What Helped (Some) Traders Pivot Just in Time

From OptioMoney.com

- Should You Buy a Second Home?

- Learning to Trade from Video Tutorials

- Five Business Tips to Help Your Company Thrive

From Your Family Finances