Highlights from the Bureau of Labor Statistics (BLS) employment / unemployment report for April released on May 7th.

![]()

- Unadjusted U-3 was Down from 6.2% to 5.7%

- Adjusted U-3 was Up from 6.0% to 6.1%

- Unadjusted U-6 was Down from 10.9% to 9.9%

- Labor Force Participation rose from 61.5% to 61.7%

- Unadjusted Employment rose from 143.309 million to 144.398

MSN classified this unemployment report as “disappointing” and the “greatest test yet of President Biden’s strategy to revive the pandemic economic recovery“.

There has been speculation that expanded unemployment benefits are making people reluctant to renter the labor market since generous unemployment benefits are more than they earn at minimum wage jobs. To counteract this, states like Montana are canceling Federal COVID unemployment benefits in an effort to encourage people to go back to work.

According to CNBC: “Montana opts to end $300 unemployment boost. Other states may, too.”

- Montana Gov. Greg Gianforte, a Republican, is ending participation in federal programs that expanded and raised unemployment benefits on June 27.

- The American Rescue Plan, a $1.9 trillion Covid relief bill President Joe Biden signed in March, offered them through Labor Day.

- Gianforte is instead offering a $1,200 return-to-work bonus to address a labor shortage. Some experts question the move.

Buried in the middle of the article is this quote:

“Montana is turning down expanded federal benefits to address a “severe workforce shortage,” Gianforte said. The state’s labor force is 10,000 workers smaller than before the pandemic and its 3.8% unemployment rate is near pre-Covid lows.

So despite the fact that “Some ‘experts’ question the move” unemployment levels are not “disappointing” in Montana at least, in fact, quite the opposite… they are having trouble finding workers.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Total nonfarm payroll employment rose by 266,000 in April, and the unemployment rate was little changed at 6.1 percent.

Notable job gains in leisure and hospitality, other services, and local government education were partially offset by losses in temporary help services and in couriers and messengers.”

As usual, they are talking about “Seasonally Adjusted Jobs” from the “Current Population Survey (CPS)” rather than looking at the results reported by actual companies in their “Current Employment Statistics survey (CES)”

But looking at the CES report we see…

Originally the BLS reported 143.400 million jobs for March, this month they adjusted that down to 143.309 million.

And currently, they are saying 144.398 for April.

which is an increase of 998,000 jobs based on their original estimates.

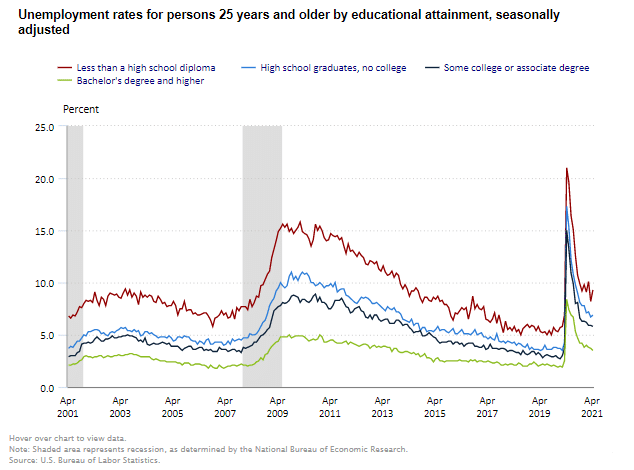

Unemployment by Education

We can see an interesting phenomenon in this month’s chart unemployment among those with less than a High School education spiked up sharply, unemployment among those with no college spiked up slightly and the other classes were flat or fell. Why? Perhaps the Governor of Montana is right and “incentives matter” with unemployment benefits higher than the minimum wage why should the uneducated return to a minimum wage job?

Although other metrics fell, unemployment among the less educated rose from 8.2% in March to 9.3% in April. This is still down from the peak of 21.2% in April 2020, after bottoming at 4.8% in September 2019.

Typically those with a Bachelor’s degree are relatively immune to unemployment. Although during the 2008 recession college grads’ unemployment rose to slightly above 4%. However, in April 2020 the unemployment rate among the highly educated spiked to 8.4%.

Source: Bureau of Labor Statistics

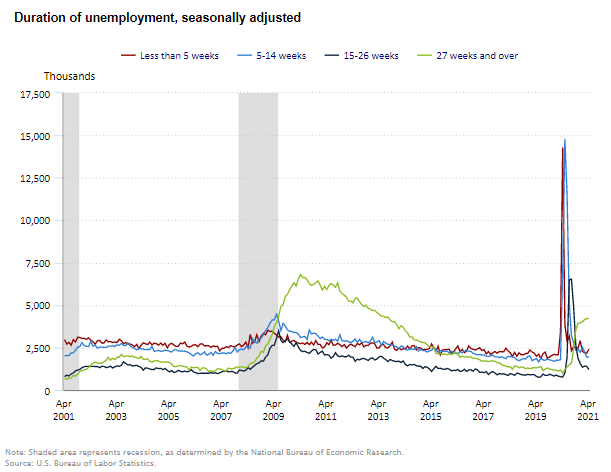

Duration of Unemployment

In the above chart, we can see that prior to COVID long-term unemployment (green line) had fallen to very low levels indicating that we were near “full employment” then short-term unemployment (red line) spiked as everyone was laid off simultaneously. As the shutdown dragged on long-term unemployment rose and short-term fell. But in April we saw something interesting happening, long-term unemployment continued upward and short-term unemployment turned upward as well. So either people were getting laid off again or they were deciding that they’d rather be unemployed.

Source: Bureau of Labor Statistics

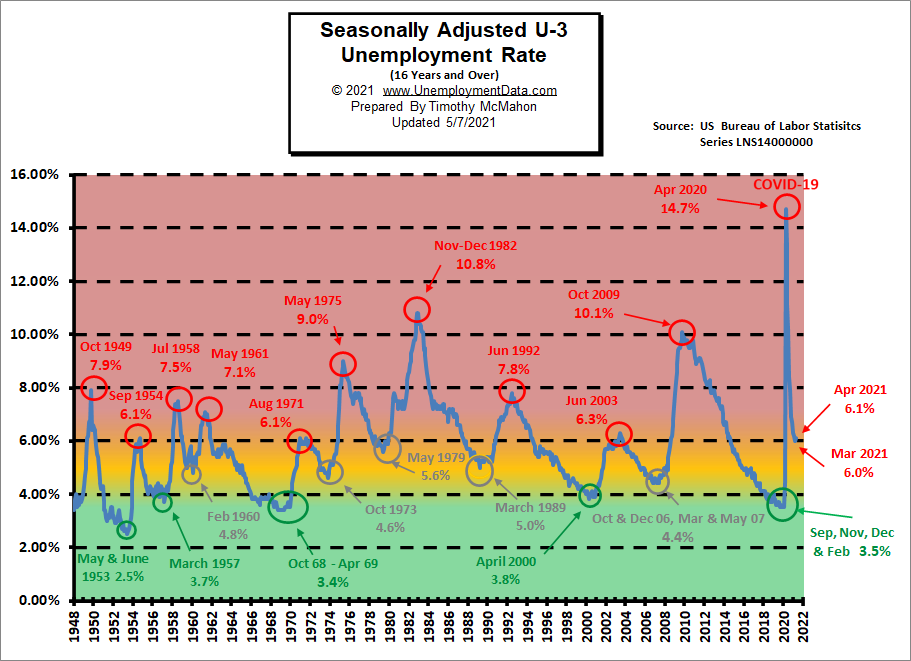

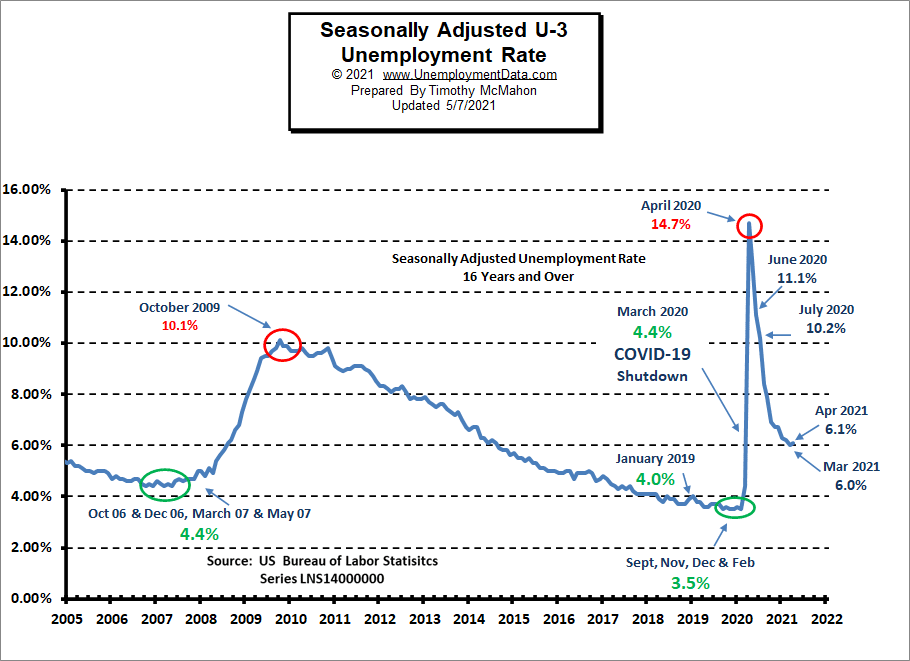

Unemployment Retreats from “Yellow Zone” back toward “Red zone”

As we can see from the chart below when unemployment gets into the “red zone” things are really bad. But historically “Bad” for the U-3 usually starts at around 7% and stops at around 10% with only two previous occasions getting into the 10% range. But this time, due to COVID shutdowns, the U.S. economy went from really good (green zone) to really bad virtually overnight. The yellow zone is the normal operating range and it runs from about 4% to 6% and when unemployment stays in this range the economy is generally doing OK. Below 4% and the economy is doing great and above 7% and the economy is in for trouble. Previously, the U-3 unemployment rate fell from the horrendous 14.7% of April down to the normally bad 6.0%. In April it moved up to 6.1% in a month that typically moves in the other direction.

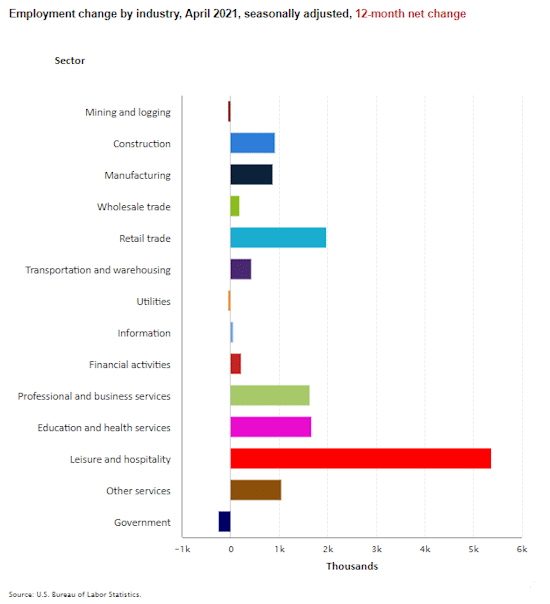

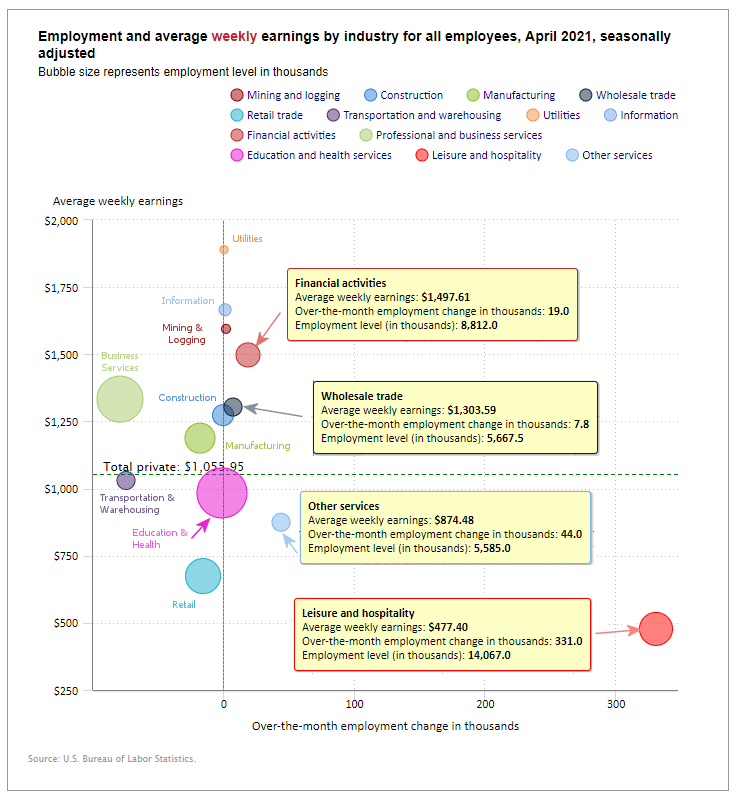

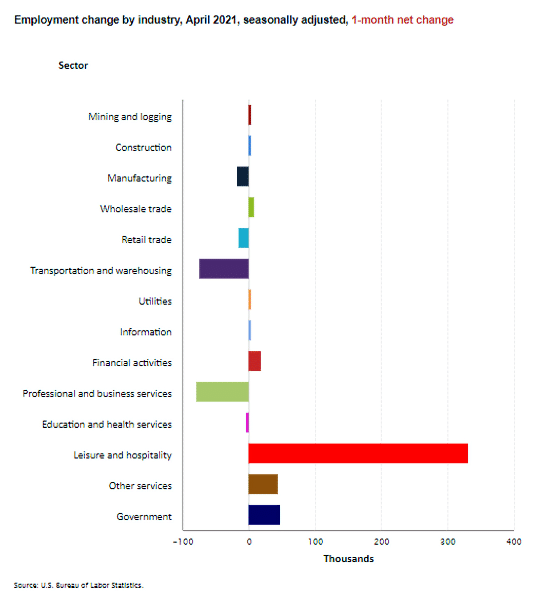

Employment by Sector

The employment “bubble chart” shows how each sector of the economy is doing (employment-wise on a seasonally adjusted basis). Here we can see where the “disappointment” lies. The majority of the sectors are sitting on or very close to the zero line with only Leisure and Hospitality doing really well and Professional and Business Services doing very poorly. Even Retail and Construction are below par.

Average weekly wages rose from $1,045.60 in March to $1,055.95 in April

(See the table below for details.)

How to read this chart:

The bubbles location on the chart tell us two things:

- Change in Employment Levels over the most recent month.

- Average Weekly earnings.

- The further to the right the bubble the larger the increase in the number of jobs.

- The higher up on the chart the larger the average salary.

Bubble Size tells us:

- Total Employment for the sector.

- Larger bubbles mean more people are employed in that sector.

Employment and Average Weekly Earnings by Industry

April 2021, Seasonally Adjusted

| Industry | Monthly Increase | Average Weekly Earnings | Employment Level |

| Total Private Employment | 218,000 | $1,055.95 | 122,507,000 |

| Mining and Logging | 2,000 | $1,594.66 | 615,000 |

| Construction | 0 | $1,273.49 | 7,452,000 |

| Manufacturing | -18,000 | $1,187.87 | 12,284,000 |

| Wholesale trade | 7,800 | $1,303.59 | 5,667,500 |

| Retail trade | -15,300 | $674.25 | 15,210,200 |

| Transportation and Warehousing | -74,100 | $1030.16 | 5,681,000 |

| Utilities | 400 | $1,889.55 | 540,400 |

| Information | 1,000 | $1,665.80 | 2,687,000 |

| Financial Activities | 19,000 | $1,497.64 | 8,812,000 |

| Professional and Business Services | -79,000 | $1,333.11 | 20,721,000 |

| Education and Health Services | -1,000 | $983.68 | 23,395,000 |

| Leisure and Hospitality | 331,000 | $477.40 | 14,067,000 |

| Other Services | 44,000 | $874.48 | 5,585,000 |

Another way to look at these monthly numbers. This one includes government jobs and shows the magnitude of the gain in Leisure and Hospitality jobs compared to the losses in Transportation & Warehousing, and Professional & Business Services.

Source: BLS

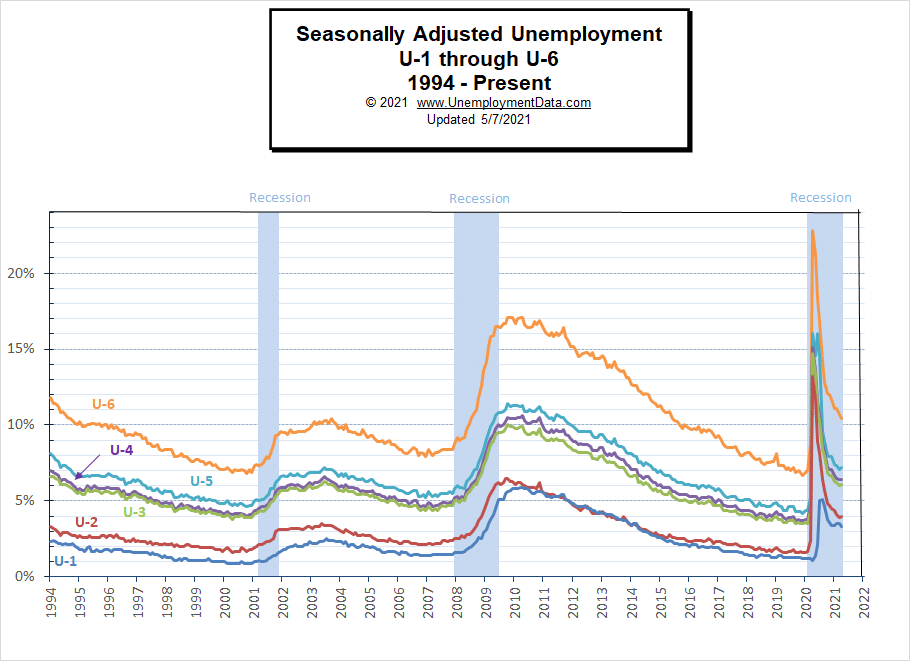

U1 through U6 Unemployment Rates

Due to COVID, all the various measurements of Seasonally Adjusted Unemployment from U-1 through U-6 spiked up sharply beginning in April. In July, they began falling rapidly. In November they only fell slightly due to renewed restrictions by several states. And in December they were basically flat. Beginning in January most of the measurements have begun to level off.

For more information about the various measurements of unemployment see What Is U-6 Unemployment?

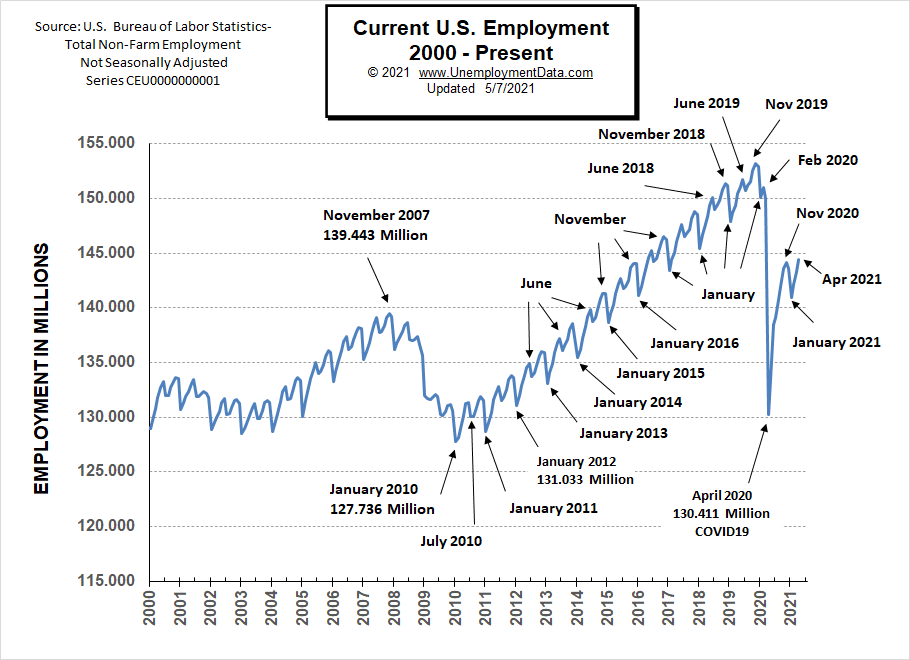

Current Employment

Typically the low point for each year occurs in January and then it moves almost straight up to a small peak around June with a slight drop around July and then the highest peak in employment happens in November with a slight decline in December. As expected January employment dropped sharply (perhaps a bit more sharply than typical). April 2021 employment has exceeded November 2020 but is still roughly -8.8 million below the peak in November 2019 and -6.6 million below February 2020.

Last year the COVID virus shortcircuited the normal trend with a drop that began in March and by April it had wiped out all the employment gains since July 2010. June 2020 saw employment rebound to approximately the January 2015 level. Fortunately, July did not follow the traditional falling pattern but instead rose (although only slightly). August’s employment rose to roughly the January 2016 level. September employment rose roughly triple the rate at which it rose in 2019. October’s employment rose to slightly above the January 2017 level. In December we got the traditional slight decline. And January got the expected sharp drop.

In November and December employment was still just over 9 million below year-ago levels and the civilian population has increased by more than a million people.

See Current Employment for more info.

Previous Record Low Unemployment (Seasonally Adjusted U-3)

If we consider anything 4% or below as “low” we have had a few “low” stretches as we can see in the table below.

(4% or below in Green)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 1950 | 6.5% | 6.4% | 6.3% | 5.8% | 5.5% | 5.4% | 5.0% | 4.5% | 4.4% | 4.2% | 4.2% | 4.3% |

| 1951 | 3.7% | 3.4% | 3.4% | 3.1% | 3.0% | 3.2% | 3.1% | 3.1% | 3.3% | 3.5% | 3.5% | 3.1% |

| 1952 | 3.2% | 3.1% | 2.9% | 2.9% | 3.0% | 3.0% | 3.2% | 3.4% | 3.1% | 3.0% | 2.8% | 2.7% |

| 1953 | 2.9% | 2.6% | 2.6% | 2.7% | 2.5% | 2.5% | 2.6% | 2.7% | 2.9% | 3.1% | 3.5% | 4.5% |

| 1954 | 4.9% | 5.2% | 5.7% | 5.9% | 5.9% | 5.6% | 5.8% | 6.0% | 6.1% | 5.7% | 5.3% | 5.0% |

| 1955 | 4.9% | 4.7% | 4.6% | 4.7% | 4.3% | 4.2% | 4.0% | 4.2% | 4.1% | 4.3% | 4.2% | 4.2% |

| 1956 | 4.0% | 3.9% | 4.2% | 4.0% | 4.3% | 4.3% | 4.4% | 4.1% | 3.9% | 3.9% | 4.3% | 4.2% |

| 1957 | 4.2% | 3.9% | 3.7% | 3.9% | 4.1% | 4.3% | 4.2% | 4.1% | 4.4% | 4.5% | 5.1% | 5.2% |

| 1958 | 5.8% | 6.4% | 6.7% | 7.4% | 7.4% | 7.3% | 7.5% | 7.4% | 7.1% | 6.7% | 6.2% | 6.2% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1965 | 4.9% | 5.1% | 4.7% | 4.8% | 4.6% | 4.6% | 4.4% | 4.4% | 4.3% | 4.2% | 4.1% | 4.0% |

| 1966 | 4.0% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 3.7% | 3.7% | 3.6% | 3.8% |

| 1967 | 3.9% | 3.8% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 4.0% | 3.9% | 3.8% |

| 1968 | 3.7% | 3.8% | 3.7% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.4% | 3.4% | 3.4% | 3.4% |

| 1969 | 3.4% | 3.4% | 3.4% | 3.4% | 3.4% | 3.5% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.5% |

| 1970 | 3.9% | 4.2% | 4.4% | 4.6% | 4.8% | 4.9% | 5.0% | 5.1% | 5.4% | 5.5% | 5.9% | 6.1% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1999 | 4.3% | 4.4% | 4.2% | 4.3% | 4.2% | 4.3% | 4.3% | 4.2% | 4.2% | 4.1% | 4.1% | 4.0% |

| 2000 | 4.0% | 4.1% | 4.0% | 3.8% | 4.0% | 4.0% | 4.0% | 4.1% | 3.9% | 3.9% | 3.9% | 3.9% |

| 2001 | 4.2% | 4.2% | 4.3% | 4.4% | 4.3% | 4.5% | 4.6% | 4.9% | 5.0% | 5.3% | 5.5% | 5.7% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 2018 | 4.1% | 4.1% | 4.1% | 3.9% | 3.8% | 4.0% | 3.9% | 3.9% | 3.7% | 3.7% | 3.7% | 3.9% |

| 2019 | 4.0% | 3.8% | 3.8% | 3.6% | 3.6% | 3.7% | 3.7% | 3.7% | 3.5% | 3.6% | 3.5% | 3.5% |

| 2020 | 3.6% | 3.5% | 4.4% | 14.7% | 13.3% | 11.1% | 10.2% | 8.4% | 7.9% | 6.9% | 6.7% | 6.7% |

| 2021 | 6.3% | 6.2% | 6.0% | 6.1% |

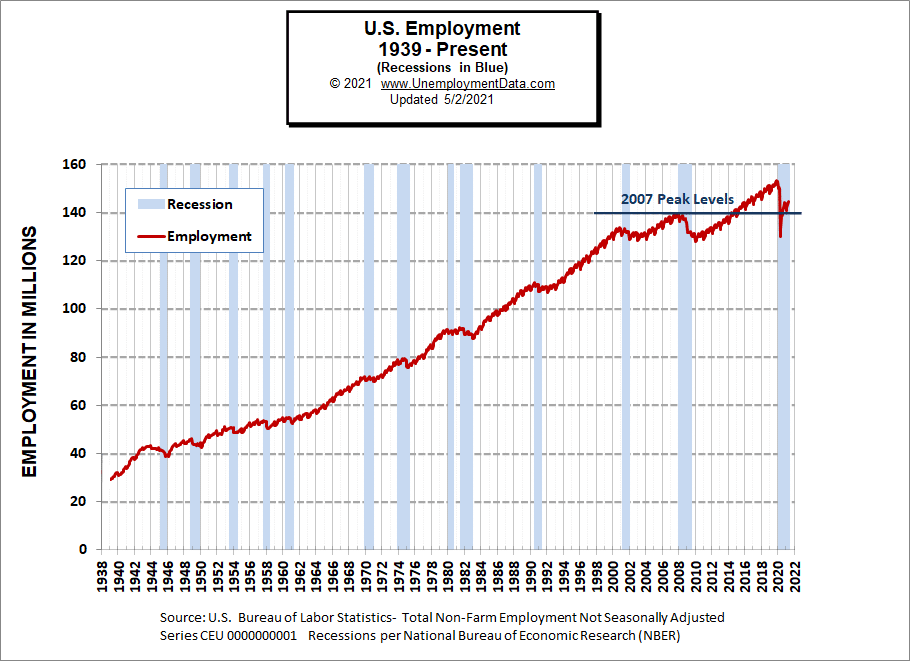

Historical Employment

Historically employment is closely tied to recessions because one of the primary determining factors of whether the economy is officially in a recession is an increase in the unemployment rate. The chart below provides the Historical Employment Data overlaid on blue bars showing periods of official recessions. In April, the number of people employed fell below the 2007 peak, near the lows of the 2008-2010 crash. In August it rebounded back above the 2007 peak level. According to the National Bureau of Economic Research (NBER) we have officially been in a recession since February 2020. Since they measure a recession beginning from the peak, that just means the economy was no longer growing, which is pretty obvious due to the virus.

See Historical Employment Data for more info.

Current Seasonally Adjusted Unemployment

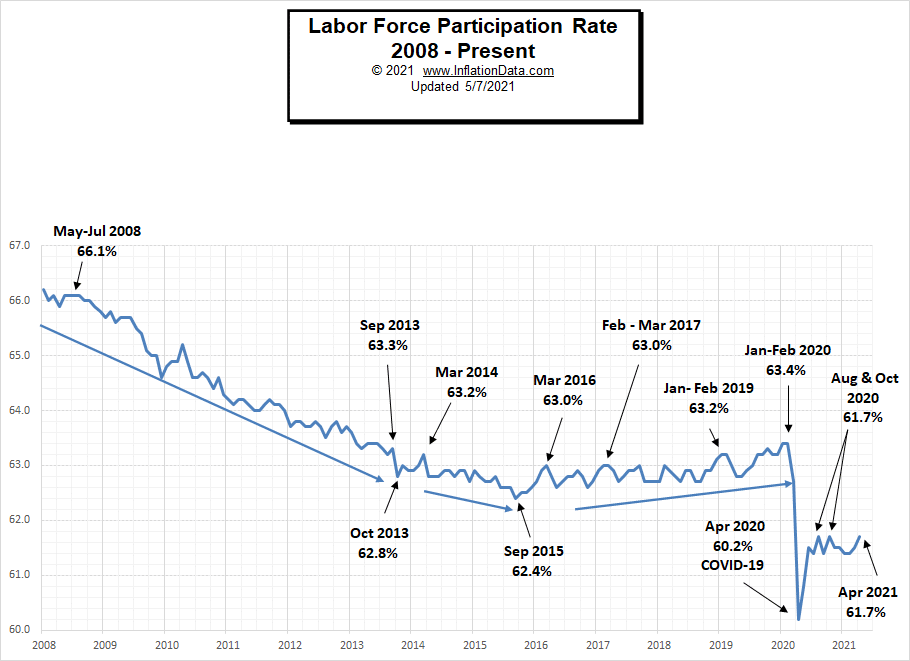

Labor Force Participation Rate

The Labor Force Participation Rate (LFPR) was 66.2% in January 2008, from there it fell fairly steadily (higher is better). Reaching 62.8% by October 2013, by March 2014 it had rallied a bit back to 63.2% but then it continued to fall. It bottomed at 62.4% in September 2015. From there, it made several attempts to rally above 63% but failed every time until January 2019 when it once again attained the 63.2% level and remained there in February. Unfortunately, the Coronavirus shutdown knocked it back all the way to 60.2% in April 2020. Since then it has rebounded as far as 61.7% in October 2020 and just reached that level again in April 2021.

See Labor Force Participation Rate for more information.

If you would like to receive this monthly report and other article updates click here … you can unsubscribe at any time.

Here are some articles you might enjoy in case you missed them:

Read more on UnemploymentData.com.

- Signs You Need to Upgrade Your Business Equipment

- Fleet Management 101: What Does It Take to Do It Well?

- 6 Tips to Help You in a Successful Job Interview

- Start a Career in Financial Risk Management

- Things to Consider When Opening Your Restaurant

From InflationData.com

- March Inflation Skyrockets

- Inflation Adjusted Crude Oil Prices (updated)

- Managing Business During Periods of Inflation

- A Stock Pickers Guide To Thinking About Inflation

- How Inflation Can Effect Rising Prices

From Financial Trend Forecaster

- Common Mistakes When Trading Penny Stocks

- Cisco Systems Stock is on the Move in April

- Why These Stock Market Indicators Should Grab Your Full Attention

- Ripple the Cryptocurrency of Banks

From Elliott Wave University

- Rise of the “Know Nothings”

- Are Investors “Courting Doom”?

- Too Many Bulls?

- You’re invited: Spot the Next BIG Move in Oil, Gas, Energy ETFs (April 7-14)

- Should Stock Markets Fear Inflation or Deflation?

From OptioMoney.com

- 4 Things to Know Before Buying Car Insurance

- Tips in Buying a Home for Retirement

- Best Real Estate Investments for First-Timers

- Downsizing to Pay Off a Mortgage – Is it a Good Idea?

- Teach Your Kids to Budget Money Effectively

From Your Family Finances