Early Indicators of possible recession appeared in the June jobs report, but you have to look closely to find them in reports by the mainstream media.

- Adjusted U-3 was Unchanged at 3.6%

- Unadjusted U-3 was Up from 3.4% to 3.8%

- Unadjusted U-6 was Up from 6.7% to 7.0%

- Unadjusted Employment rose from 150.964 to 151.773 million

- Average Weekly Wages Still Rising

Early Warning Negative Indicators

Early Indicators of a possible recession

- Labor Force Participation Down from 62.3% to 62.2%

- Upturn in Uneducated Unemployment

- Rising Unemployment among the newly unemployed

- Average Weekly Hours among manufacturing workers falling

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Total nonfarm payroll employment rose by 372,000 in June, and the unemployment rate remained at 3.6 percent, the U.S. Bureau of Labor Statistics reported today.

Notable job gains occurred in professional and business services, leisure and hospitality, and health care.

The unemployment rate was 3.6 percent for the fourth month in a row, and the number of unemployed persons was essentially unchanged at 5.9 million in June. These measures are little different from their values in February 2020 (3.5 percent and 5.7 million, respectively), prior to the coronavirus (COVID19) pandemic.”

You can read the full BLS report here.

As usual, they are talking about “Seasonally Adjusted Jobs” from the “Household Survey” rather than looking at the results reported by actual companies in the BLS “Establishment Survey.”

But looking at the Establishment Survey report, we see…

Initially, the BLS reported employment of 151.773 million for May, which they adjusted to 151.748 million. So 25,000 jobs disappeared in May. They are reporting 152.692 million jobs for June, which is an increase of 919,000 based on their original estimates or an increase of 944,000 based on their updated numbers.

The latest Job Openings and Labor Turnover Survey, released on Wednesday, showed there were 11.3 million job openings in May, or 1.9 positions for every job seeker, and historically low levels of layoffs… But, the BLS reported that initial jobless claims for the week ending July 2 totaled 235,000, an increase of 4,000 from the prior week’s reading and the highest level since mid-January… New job cuts data released Thursday by Challenger, Gray & Christmas revealed that US employers announced 32,517 layoffs in June, a 58.8% increase from the same month last year, and the highest monthly total since February 2021.

According to the Washington Post:

The strong job growth keeps pressure on the Fed to continue raising interest rates when it meets later this month. After years of keeping interest rates at or near zero, the central bank has so far hiked rates three times this year, by a total of 1.5 percentage points, in the hope of slowing the economy just enough to curb inflation, which is at 40-year highs, without pushing it into a deep recession.

Recession Ahead?

The Federal Reserve Bank of Atlanta estimated that the economy shrank by 1.2 percent in the second quarter, which would put the U.S. in a recession by one common definition i.e. two consecutive quarters of economic contraction. But the National Bureau of Economic Research, the nonprofit organization that is the official arbiter of recessions, also includes unemployment in their calculations, so according to their definition, there is no recession yet.

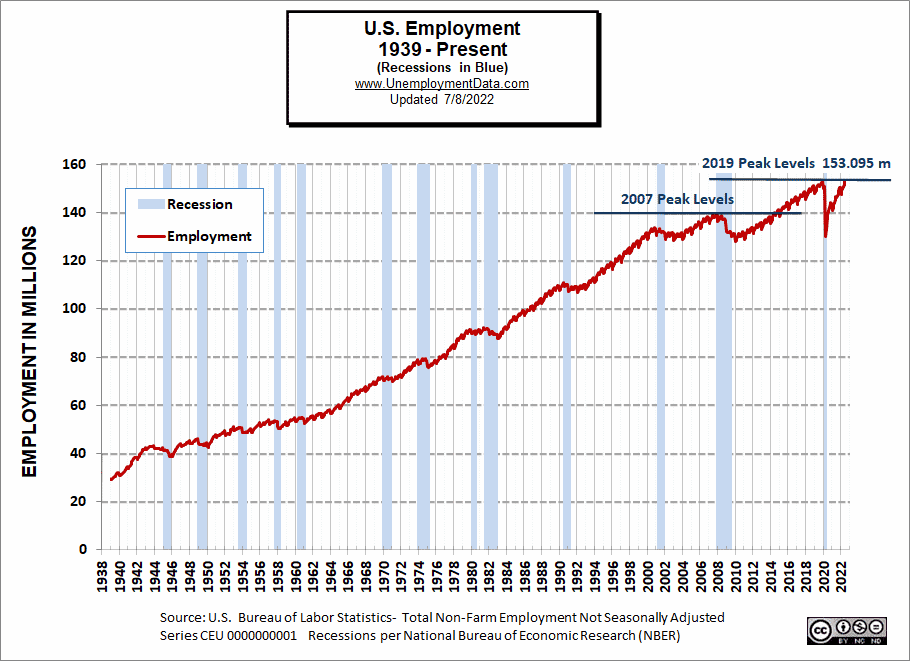

Employment is almost back to 2019 peak levels (although the civilian population is about 4 million higher now).

[Read more…] about June 2022 BLS Jobs Report- Recession Indicators?