Highlights from the Bureau of Labor Statistics (BLS) employment / unemployment report for May released on June 4th.

![]()

- Unadjusted U-3 was Down from 5.7% to 5.5%

- Adjusted U-3 was Down from 6.1% to 5.8%

- Unadjusted U-6 was Down from 9.9% to 9.7%

- Labor Force Participation fell from 61.7% to 61.6%

- Unadjusted Employment rose from 144.412 million to 145.385 million

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Total nonfarm payroll employment rose by 559,000 in May, and the unemployment rate declined by 0.3 percentage point to 5.8 percent. Notable job gains occurred in leisure and hospitality, in public and private education, and in health care and social assistance…

Employment in leisure and hospitality rose by 292,000 in May, as pandemic-related restrictions continued to ease in some parts of the country. The industry has added 1.3 million jobs since January. Employment rose in food services and drinking places (+186,000); amusements, gambling, and recreation (+58,000); and accommodation (+35,000). Employment in leisure and hospitality is down by 2.5 million, or 15.0 percent, since February 2020.”

As usual, they are talking about “Seasonally Adjusted Jobs” from the “Current Population Survey (CPS)” rather than looking at the results reported by actual companies in their “Current Employment Statistics survey (CES)”

But looking at the CES report we see…

Originally the BLS reported 144.398 for April which they adjusted to 144.412 million. For May they are currently saying employment is 145.385 million.

which is actually an increase of 987,000 unadjusted jobs based on their original estimates.

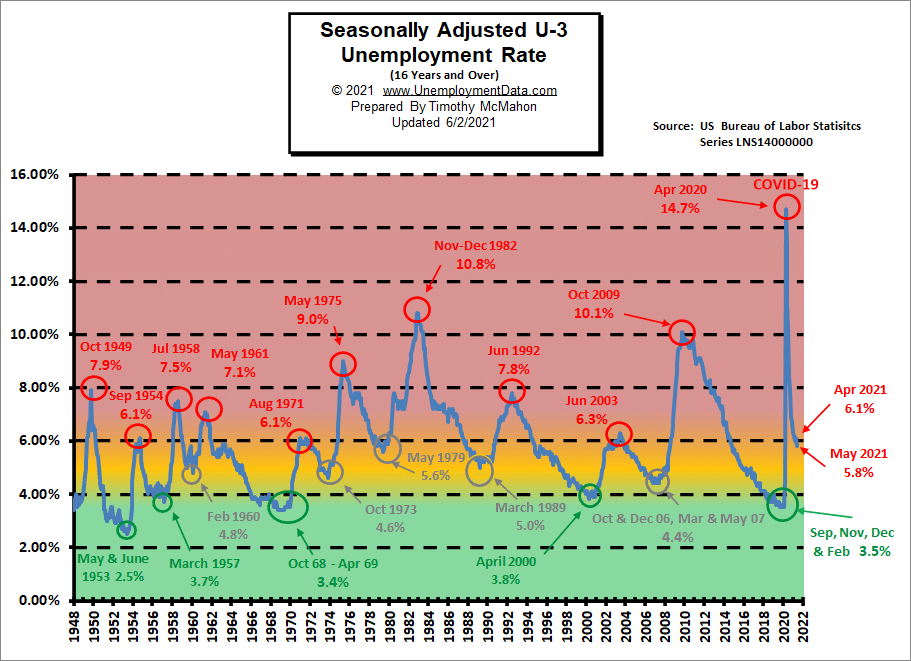

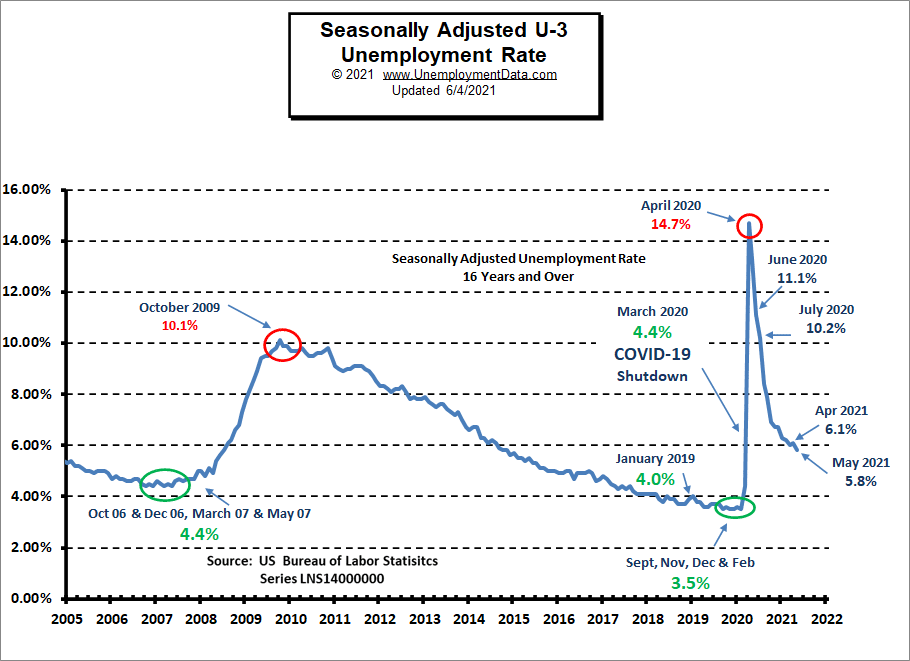

Unemployment Re-enters “Yellow Zone”

As we can see from the chart below when unemployment gets into the “red zone” things are really bad. But historically “Bad” for the U-3 usually starts at around 7% and stops at around 10% with only two previous occasions getting into the 10% range. But this time, due to COVID shutdowns, the U.S. economy went from really good (green zone) to really bad virtually overnight. The yellow zone is the normal operating range and it runs from about 4% to 6% and when unemployment stays in this range the economy is generally doing OK. Below 4% and the economy is doing great and above 7% and the economy is in for trouble. Currently, the U-3 unemployment rate has fallen from the horrendous 14.7% of April down to the normally bad 6.0%. We have to remember that the PEAKS in 1954, 1971, and 2003 were at 6.3% and that was the worst it got. The September 1954 and August 1971 peaks were at 6.1% so although current levels are slightly better than that, they were they still aren’t good.

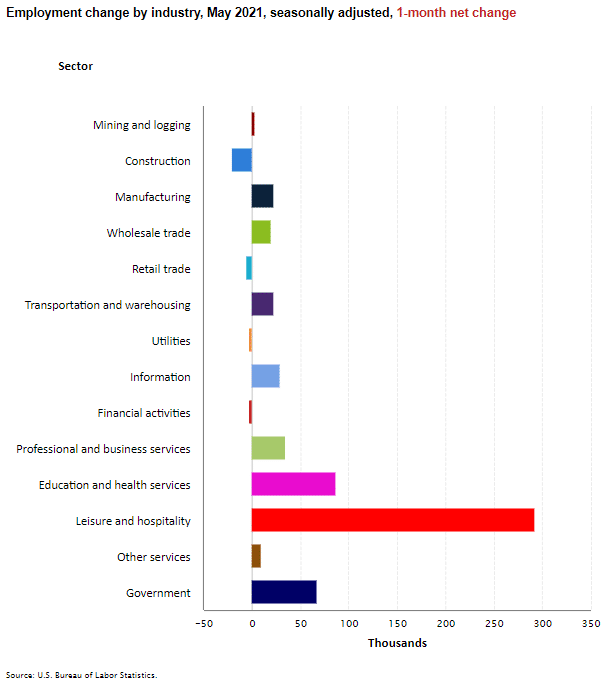

Employment by Sector

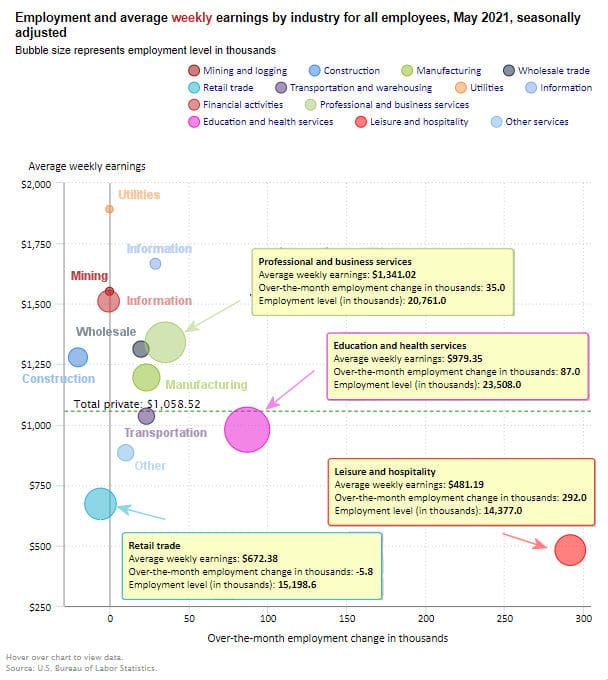

The employment “bubble chart” shows how each sector of the economy is doing (employment-wise on a seasonally adjusted basis).

Typically January is the worst month with retailers and hospitality reducing seasonal staff. In January Leisure and Hospitality lost -61,000 jobs. As things begin to reopen, February- April saw Leisure and Hospitality GAIN a massive number of jobs. In May it gained another 292,000 jobs on a seasonally adjusted basis. Other big gainers for May were Education and Health gaining 87,000 jobs, Professional and Business Services gaining 35,000 jobs, and Manufacturing which gained 23,000 jobs. Big losers were Construction -20,000 jobs, and Retail which lost -5,800.

(See the table below for details.)

How to read this chart:

The bubbles location on the chart tell us two things:

- Change in Employment Levels over the most recent month.

- Average Weekly earnings.

- The further to the right the bubble the larger the increase in the number of jobs.

- The higher up on the chart the larger the average salary.

Bubble Size tells us:

- Total Employment for the sector.

- Larger bubbles mean more people are employed in that sector.

Employment and Average Weekly Earnings by Industry

May 2021, Seasonally Adjusted

| Industry | Monthly Increase | Average Weekly Earnings | Employment Level |

| Total Private Employment | 492,000 | $1,058.52 | 123,226,000 |

| Mining and Logging | 0 | $1,551.87 | 614,000 |

| Construction | -20,000 | $1,278.81 | 7,423,000 |

| Manufacturing | 23,000 | $1,195.56 | 12,290,000 |

| Wholesale trade | 19,900 | $1,312.81 | 5,684,100 |

| Retail trade | -5,800 | $672.38 | 15,198,600 |

| Transportation and Warehousing | 22,900 | $1035.43 | 5,723,300 |

| Utilities | -200 | $1,891.87 | 540,200 |

| Information | 29,000 | $1,666.13 | 2,721,000 |

| Financial Activities | -1,000 | $1,511.14 | 8,802,000 |

| Professional and Business Services | 35,000 | $1,341.02 | 20,761,000 |

| Education and Health Services | 87,000 | $979.35 | 23,508,000 |

| Leisure and Hospitality | 292,000 | $481.19 | 14,377,000 |

| Other Services | 10,000 | $883.87 | 5,584,000 |

Another way to look at these monthly numbers. This one includes a decrease in government jobs and shows the magnitude of the gain in Leisure and Hospitality jobs.

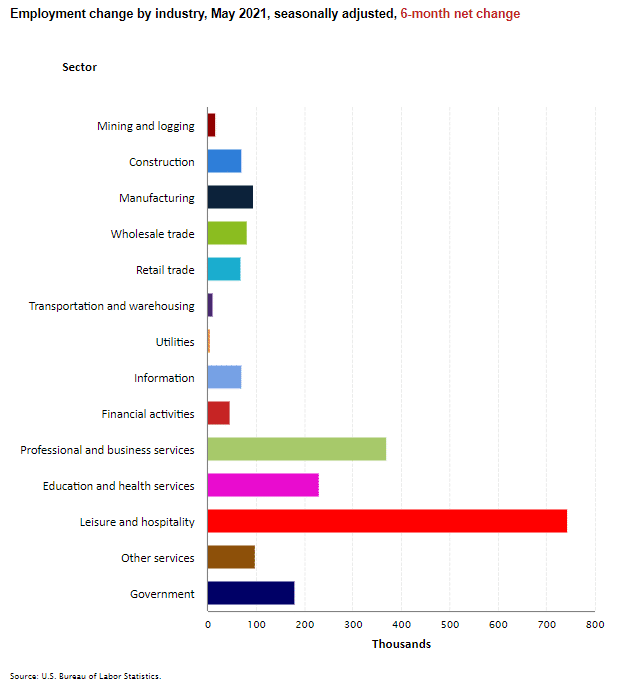

Looking at it over 6 months we can see an improvement in all sectors.

Source: BLS

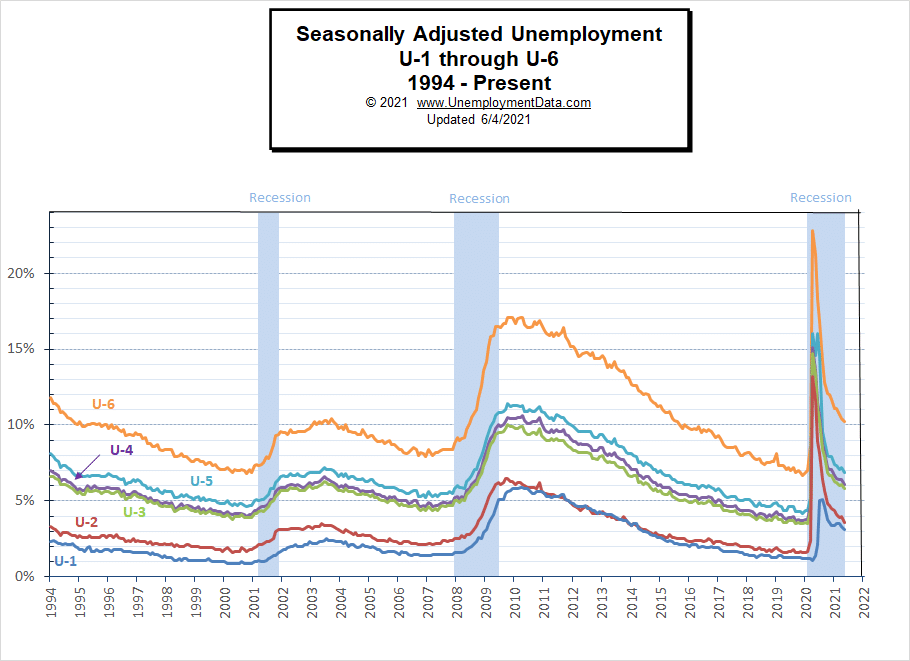

U1 through U6 Unemployment Rates

Due to COVID, all the various measurements of Seasonally Adjusted Unemployment from U-1 through U-6 spiked up sharply beginning in April 2020 except U1 which measures unemployment longer than 15 weeks. In July, they began falling rapidly. In November they only fell slightly due to renewed restrictions by several states. And in December they were basically flat. In January most of the measurements fell slightly on a seasonally adjusted basis even though they rose on a nominal basis. Since then all measures have continued to fall.

For more information about the various measurements of unemployment see What Is U-6 Unemployment?

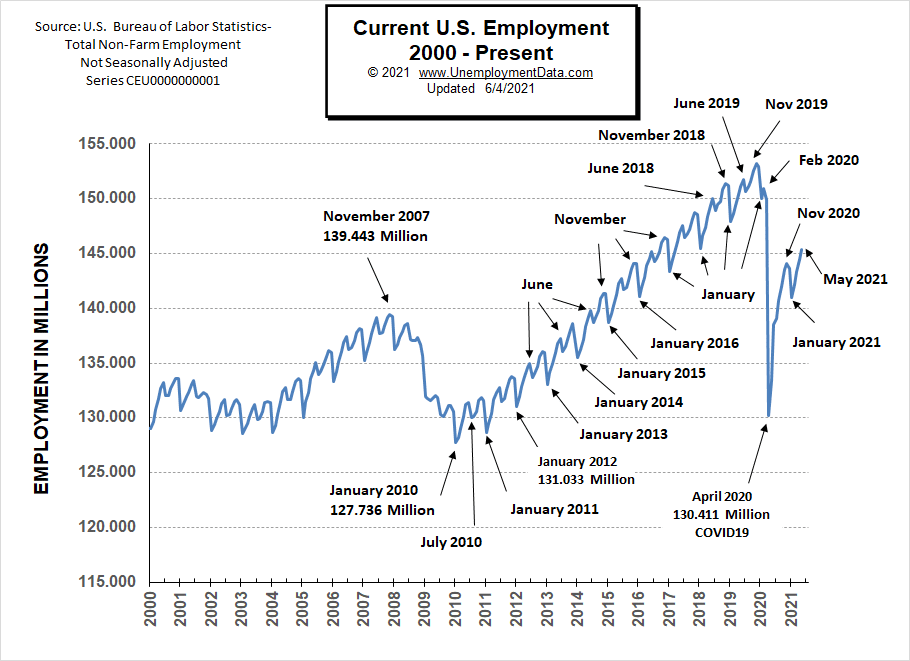

Current Employment

Typically the low point for each year occurs in January and then it moves almost straight up to a small peak around June with a slight drop around July and then the highest peak in employment happens in November with a slight decline in December. As expected January employment dropped sharply (perhaps a bit more sharply than typical). But as expected February through May saw the typical rebound.

Note: In 2020, the COVID virus shortcircuited the normal trend with a drop that began in March, and by April it had wiped out all the employment gains since July 2010. June 2020 saw employment rebound to approximately the January 2015 level. Fortunately, July did not follow the traditional falling pattern but instead rose (although only slightly). August’s employment rose to roughly the January 2016 level. September employment rose roughly triple the rate at which it rose in 2019. October’s employment rose to slightly above the January 2017 level. In December we got the traditional slight decline. And in May we have returned to the June 2016 level for employment but the Civilian Noninstitutional Population has increased by 7.8 million since then.

See Current Employment for more info.

Previous Record Low Unemployment (Seasonally Adjusted U-3)

If we consider anything 4% or below as “low” we have had a few “low” stretches as we can see in the table below.

(4% or below in Green)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 1950 | 6.5% | 6.4% | 6.3% | 5.8% | 5.5% | 5.4% | 5.0% | 4.5% | 4.4% | 4.2% | 4.2% | 4.3% |

| 1951 | 3.7% | 3.4% | 3.4% | 3.1% | 3.0% | 3.2% | 3.1% | 3.1% | 3.3% | 3.5% | 3.5% | 3.1% |

| 1952 | 3.2% | 3.1% | 2.9% | 2.9% | 3.0% | 3.0% | 3.2% | 3.4% | 3.1% | 3.0% | 2.8% | 2.7% |

| 1953 | 2.9% | 2.6% | 2.6% | 2.7% | 2.5% | 2.5% | 2.6% | 2.7% | 2.9% | 3.1% | 3.5% | 4.5% |

| 1954 | 4.9% | 5.2% | 5.7% | 5.9% | 5.9% | 5.6% | 5.8% | 6.0% | 6.1% | 5.7% | 5.3% | 5.0% |

| 1955 | 4.9% | 4.7% | 4.6% | 4.7% | 4.3% | 4.2% | 4.0% | 4.2% | 4.1% | 4.3% | 4.2% | 4.2% |

| 1956 | 4.0% | 3.9% | 4.2% | 4.0% | 4.3% | 4.3% | 4.4% | 4.1% | 3.9% | 3.9% | 4.3% | 4.2% |

| 1957 | 4.2% | 3.9% | 3.7% | 3.9% | 4.1% | 4.3% | 4.2% | 4.1% | 4.4% | 4.5% | 5.1% | 5.2% |

| 1958 | 5.8% | 6.4% | 6.7% | 7.4% | 7.4% | 7.3% | 7.5% | 7.4% | 7.1% | 6.7% | 6.2% | 6.2% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1965 | 4.9% | 5.1% | 4.7% | 4.8% | 4.6% | 4.6% | 4.4% | 4.4% | 4.3% | 4.2% | 4.1% | 4.0% |

| 1966 | 4.0% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 3.7% | 3.7% | 3.6% | 3.8% |

| 1967 | 3.9% | 3.8% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 4.0% | 3.9% | 3.8% |

| 1968 | 3.7% | 3.8% | 3.7% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.4% | 3.4% | 3.4% | 3.4% |

| 1969 | 3.4% | 3.4% | 3.4% | 3.4% | 3.4% | 3.5% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.5% |

| 1970 | 3.9% | 4.2% | 4.4% | 4.6% | 4.8% | 4.9% | 5.0% | 5.1% | 5.4% | 5.5% | 5.9% | 6.1% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1999 | 4.3% | 4.4% | 4.2% | 4.3% | 4.2% | 4.3% | 4.3% | 4.2% | 4.2% | 4.1% | 4.1% | 4.0% |

| 2000 | 4.0% | 4.1% | 4.0% | 3.8% | 4.0% | 4.0% | 4.0% | 4.1% | 3.9% | 3.9% | 3.9% | 3.9% |

| 2001 | 4.2% | 4.2% | 4.3% | 4.4% | 4.3% | 4.5% | 4.6% | 4.9% | 5.0% | 5.3% | 5.5% | 5.7% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 2018 | 4.1% | 4.1% | 4.1% | 3.9% | 3.8% | 4.0% | 3.9% | 3.9% | 3.7% | 3.7% | 3.7% | 3.9% |

| 2019 | 4.0% | 3.8% | 3.8% | 3.6% | 3.6% | 3.7% | 3.7% | 3.7% | 3.5% | 3.6% | 3.5% | 3.5% |

| 2020 | 3.6% | 3.5% | 4.4% | 14.7% | 13.3% | 11.1% | 10.2% | 8.4% | 7.9% | 6.9% | 6.7% | 6.7% |

| 2021 | 6.3% | 6.2% | 6.0% | 5.8% |

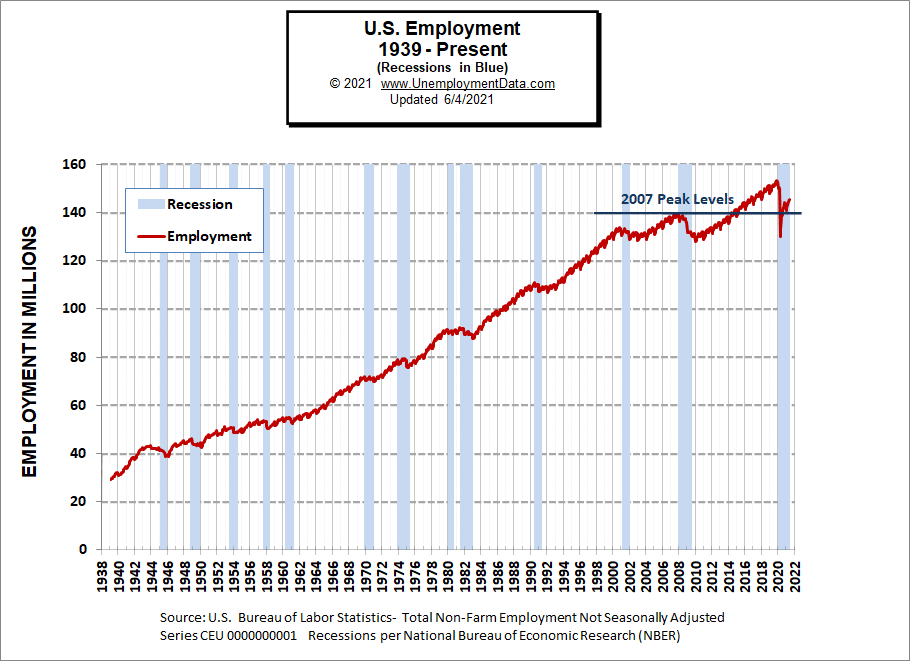

Historical Employment

Historically employment is closely tied to recessions because one of the primary determining factors of whether the economy is officially in a recession is an increase in the unemployment rate. The chart below provides the Historical Employment Data overlaid on blue bars showing periods of official recessions. In April, the number of people employed fell below the 2007 peak, near the lows of the 2008-2010 crash. In August it rebounded back above the 2007 peak level. According to the National Bureau of Economic Research (NBER) we have officially been in a recession since February. Since they measure a recession beginning from the peak, that just means the economy was no longer growing, which is pretty obvious due to the virus.

See Historical Employment Data for more info.

Current Seasonally Adjusted Unemployment

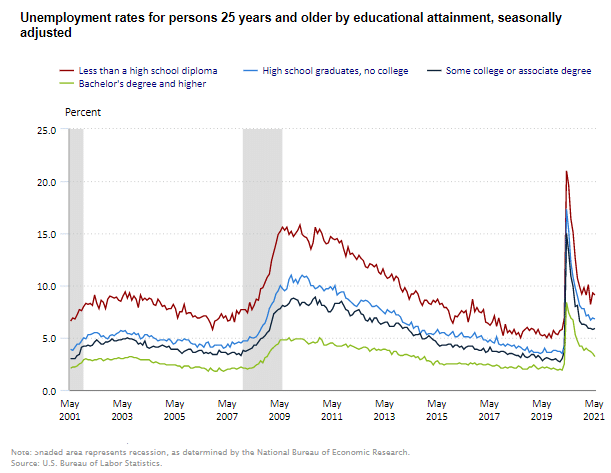

Unemployment by Education

Although other metrics fell, unemployment among the less educated rose in April but in May it fell slightly to 9.1%. Although in March it was actually lower at 8.2%. This is still down from the peak of 21.2% in April 2020, after bottoming at 4.8% in September 2019.

Typically those with a Bachelor’s degree are relatively immune to unemployment. Although during the 2008 recession college grads’ unemployment rose to slightly above 4%.

Those with a Bachelor’s degree or higher had a low of 1.9% unemployment in February 2019 and rose to 8.4% in April 2020. Unemployment fell to 3.8% in December but rose back to 4% in January and returned to 3.2% in May.

Note: For some unknown reason, the BLS has not added a shaded region for the current recession which began in February 2020 according to NBER.

Source: Bureau of Labor Statistics

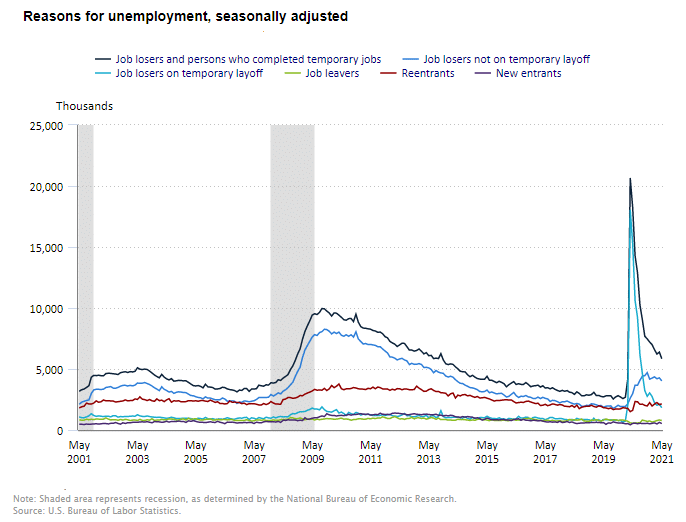

Reasons for Unemployment – Layoff Status

Note: As in the previous chart, the BLS has not added a shaded region for the current recession which began in February 2020 according to NBER.

Source: BLS

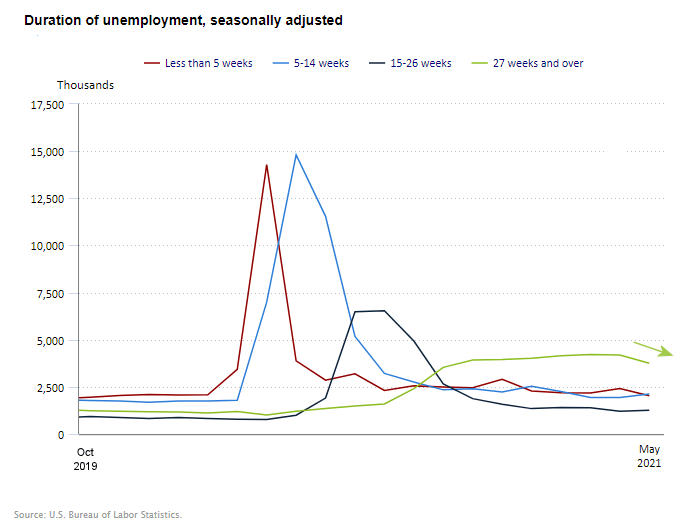

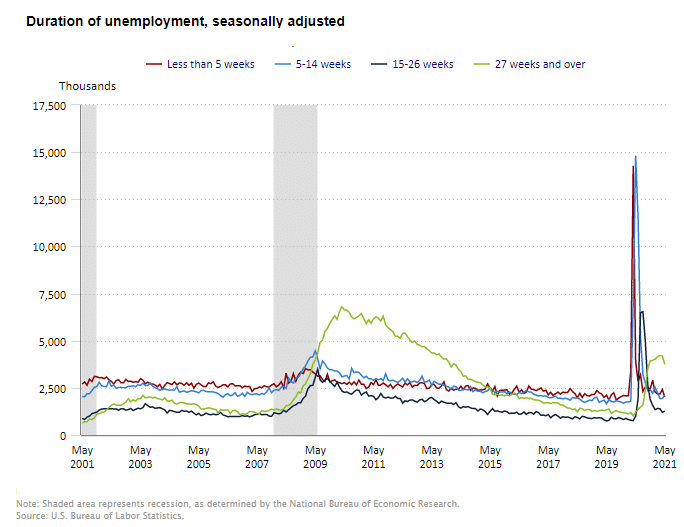

Duration of Unemployment

The bright spot on this chart is the dropoff of the tail of the light green long-term unemployment line. Meaning that those that were unemployed long-term are now returning to work.

Taking a closer look at the chart just since October 2019 we see long-term unemployment has just started falling.

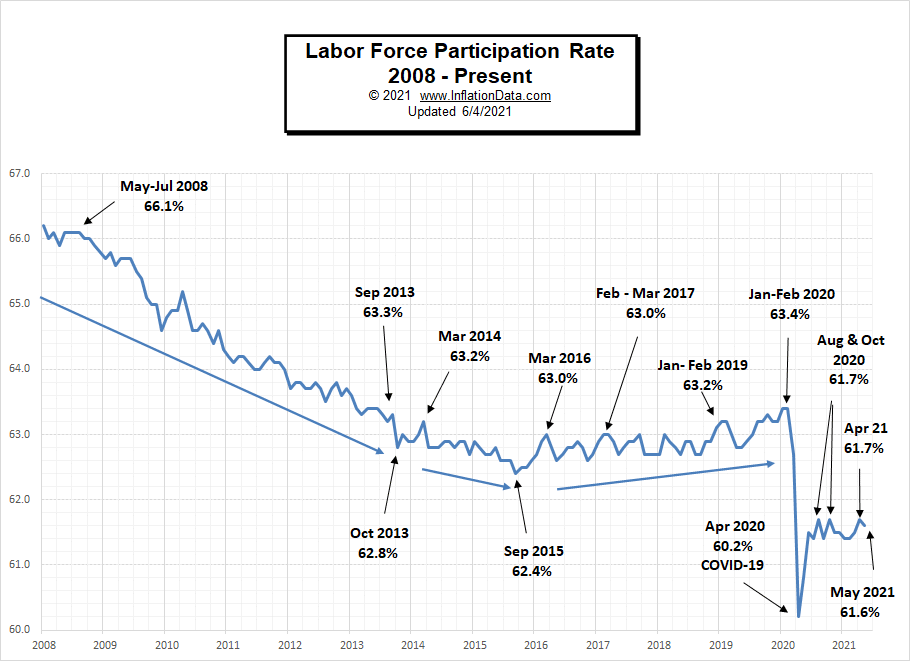

Labor Force Participation Rate

Even though Unemployment was in record low territory for quite some time, it wasn’t until January and February 2020, that the LFPR was finally able to claw its way back to 63.4%, its highest level since 2013.

Then COVID decimated all those gains dropping the LFPR down to 60.2% in April. In May 2020, it began to rebound and in June the LFPR was able to bounce back a little more to 61.5%, it fell slightly in July but this was probably due to people returning to the labor force rather than other factors. Over the last few months, the LFPR has bounced around between 61.4% and 61.7%. In May it fell again to 61.6% from 61.7% in April.

See Labor Force Participation Rate for more information.

If you would like to receive this monthly report and other article updates click here you can unsubscribe at any time.

Here are some articles you might enjoy in case you missed them:

Read more on UnemploymentData.com.

- What Qualities Do You Need for a Career in Political Marketing?

- Breathing Easier: How to Increase Safety in a Building With Asbestos

- Considering Starting a Salon Business?

- April Unemployment Report “Disappointing”

- Signs You Need to Upgrade Your Business Equipment

From InflationData.com

- The 3 Stages of Inflation

- April Inflation More than Double FED Target

- Managing Business During Periods of Inflation

- March Inflation Skyrockets

- A Stock Pickers Guide To Thinking About Inflation

- How Inflation Can Effect Rising Prices

- Inflation-Adjusted Crude Oil Prices (updated)

From Financial Trend Forecaster

- Moore Inflation Predictor

- NYSE ROC

- NASDAQ ROC

- Online Stockbrokers Going Public

- Aspiring Investors: Getting Started in the Stock Market

- Common Mistakes When Trading Penny Stocks

- Cisco Systems Stock is on the Move in April

- Why These Stock Market Indicators Should Grab Your Full Attention

- Ripple the Cryptocurrency of Banks

- Elliott Wave Analysis Can Help You See Countertrends. Pattern in Focus: the Zigzag.

- Capital Gains Tax Hike News: Was It REALLY to Blame for Sell-off?

- Rise of the “Know Nothings”

- Are Investors “Courting Doom”?

- Too Many Bulls?

From OptioMoney.com

- Downsizing Mistakes People Make in Retirement

- The Complete Guide to Selling Rental Property

- 4 Things to Know Before Buying Car Insurance

- Tips in Buying a Home for Retirement

- Best Real Estate Investments for First-Timers

- Downsizing to Pay Off a Mortgage – Is it a Good Idea?

- Teach Your Kids to Budget Money Effectively

From Your Family Finances

- Keeping Remodeling Costs Down

- Home Repair Costs: How Homeowners Keep Their Pocketbook Balanced

- When Should You Replace Your Furnace?

- Home Renovations Before Selling

- Ways to Diversify Your Family’s Investments

- How To Negotiate When Buying a Home

- Growing Family: How to Set up Your Finances for a New Home

- Avoid These Investing Mistakes