![]() The U.S. Bureau of Labor Statistics (BLS) released their monthly unemployment survey results for November on December 7th. Unadjusted U-3 and “Seasonally Adjusted” Unemployment U-3 were unchanged. Adjusted U-3 was 3.7% for the third month in a row while unadjusted was 3.5% for the second month. This is the lowest level since December 1969 when Adjusted U-3 was 3.5%. The lowest level reached in the 1968-1969 timeframe was 3.4% where it hovered from September 1968 through May 1969. The only other time that unemployment was this low since they began tracking unemployment in 1948 was briefly in 1948 and again in 1951-53.

The U.S. Bureau of Labor Statistics (BLS) released their monthly unemployment survey results for November on December 7th. Unadjusted U-3 and “Seasonally Adjusted” Unemployment U-3 were unchanged. Adjusted U-3 was 3.7% for the third month in a row while unadjusted was 3.5% for the second month. This is the lowest level since December 1969 when Adjusted U-3 was 3.5%. The lowest level reached in the 1968-1969 timeframe was 3.4% where it hovered from September 1968 through May 1969. The only other time that unemployment was this low since they began tracking unemployment in 1948 was briefly in 1948 and again in 1951-53.

Remember that the world population had just been drastically reduced through WWII (ending in 1945) so there were much fewer working age men available. So it is unlikely that we will see unemployment at 1953 levels again.

Key November Employment and Unemployment Numbers

- Adjusted U-3 Unemployment- 3.7% unchanged since September down from 3.9% in August, This is the lowest Seasonally Adjusted Unemployment rate since 1969.

- Unadjusted U-3 Unemployment- 3.5% unchanged from October down from 3.6% in September and 3.9% in August and 4.1% in July and 4.2% in June.

- Unadjusted U-6 Unemployment- 7.2% up from 7.0% in October and 7.1% in September still below the 7.4% in August and 7.9% in July, 8.1% in June.

- Employment 151.232 million up from 150.757 million in October. (475,000 more jobs)

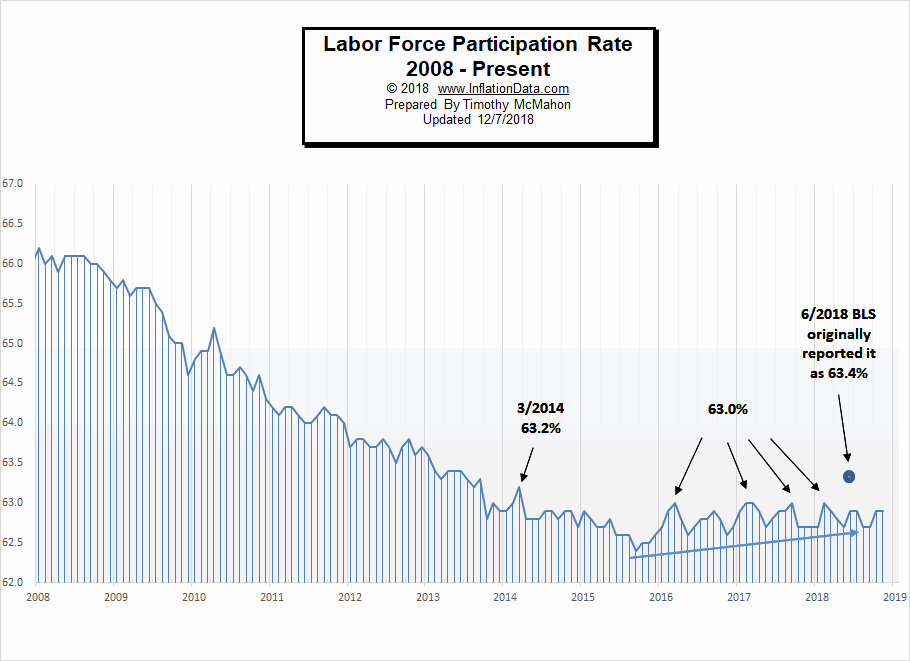

- November Labor Force Participation Rate 62.9% unchanged from October but up from 62.7% in September. (Higher is Better)

See Current Unemployment Chart for more info.

Previous Record Low Unemployment (Seasonally Adjusted U-3)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 1950 | 6.5% | 6.4% | 6.3% | 5.8% | 5.5% | 5.4% | 5.0% | 4.5% | 4.4% | 4.2% | 4.2% | 4.3% |

| 1951 | 3.7% | 3.4% | 3.4% | 3.1% | 3.0% | 3.2% | 3.1% | 3.1% | 3.3% | 3.5% | 3.5% | 3.1% |

| 1952 | 3.2% | 3.1% | 2.9% | 2.9% | 3.0% | 3.0% | 3.2% | 3.4% | 3.1% | 3.0% | 2.8% | 2.7% |

| 1953 | 2.9% | 2.6% | 2.6% | 2.7% | 2.5% | 2.5% | 2.6% | 2.7% | 2.9% | 3.1% | 3.5% | 4.5% |

| 1954 | 4.9% | 5.2% | 5.7% | 5.9% | 5.9% | 5.6% | 5.8% | 6.0% | 6.1% | 5.7% | 5.3% | 5.0% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1965 | 4.9% | 5.1% | 4.7% | 4.8% | 4.6% | 4.6% | 4.4% | 4.4% | 4.3% | 4.2% | 4.1% | 4.0% |

| 1966 | 4.0% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 3.7% | 3.7% | 3.6% | 3.8% |

| 1967 | 3.9% | 3.8% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 4.0% | 3.9% | 3.8% |

| 1968 | 3.7% | 3.8% | 3.7% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.4% | 3.4% | 3.4% | 3.4% |

| 1969 | 3.4% | 3.4% | 3.4% | 3.4% | 3.4% | 3.5% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.5% |

| 1970 | 3.9% | 4.2% | 4.4% | 4.6% | 4.8% | 4.9% | 5.0% | 5.1% | 5.4% | 5.5% | 5.9% | 6.1% |

Employment

According to the Bureau of Labor Statistics Commissioner’s report:

“Total nonfarm payroll employment increased by 155,000 in November, and the unemployment rate remained unchanged at 3.7 percent.

Job gains occurred in health care, in manufacturing, and in transportation and warehousing.”

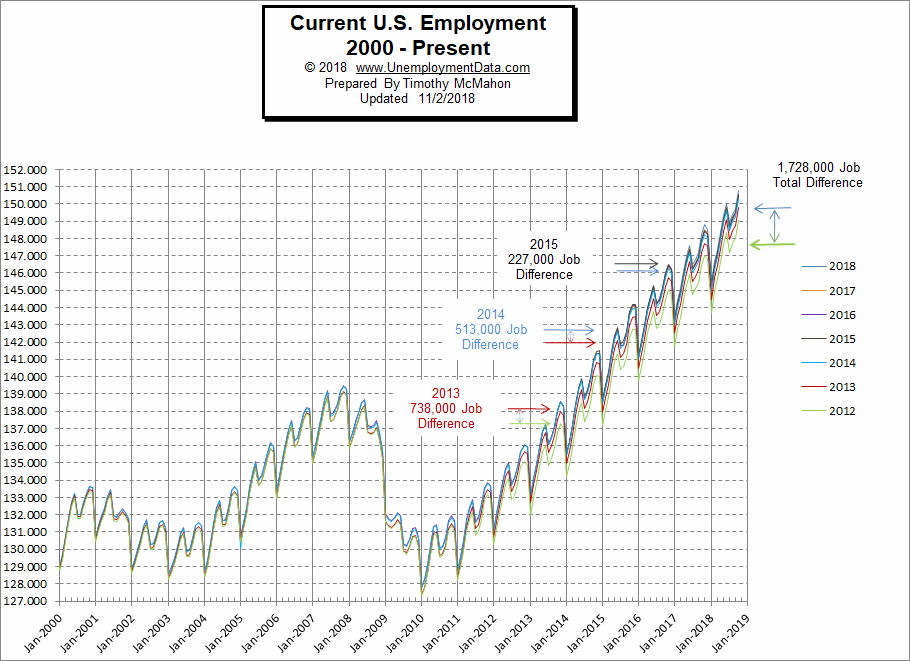

November Employment Gains Less Than Projected But…

The stock market is fretting because projections called for an increase of 195,000 (seasonally adjusted jobs) and we “only” got 155,000 but Employment is at a new all time record 151.232 million up from 150.757 million in October. The previous high was set in June 2018 at 150.040 million. So, although the “Seasonally Adjusted” jobs increase was “only” 155,000 there were 475,000 more actual jobs.

Incidentally, last month adjusted jobs exceeded projections by almost exactly the same amount as they fell short this month. So one could argue that the two month increase is exactly on projection.

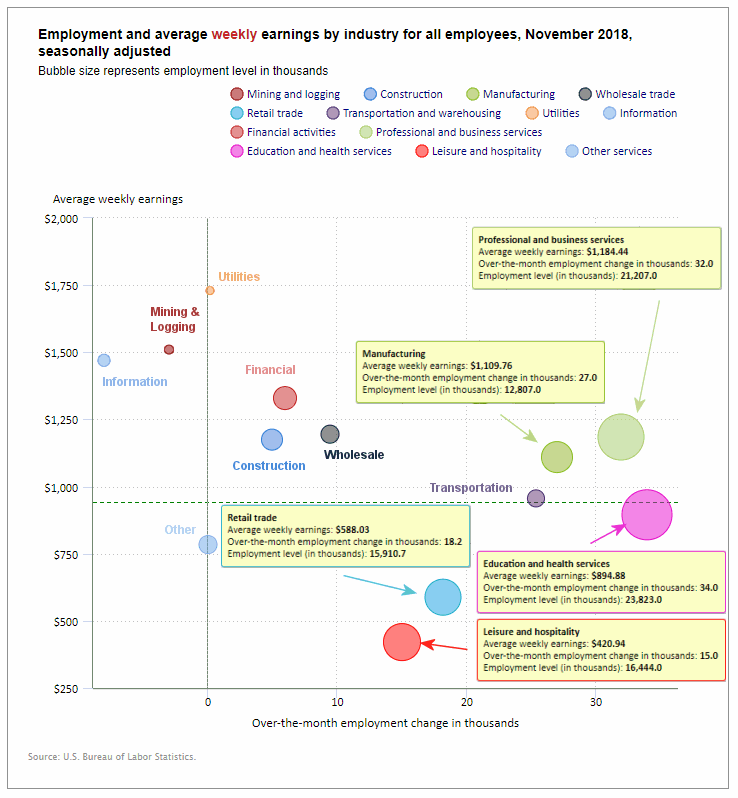

Employment by Sector

The employment “bubble chart” gives us a good representation of how each sector of the economy is doing (employment wise). As we can see from the chart below there are two single sector that are to the left of the zero line this month (i.e. mining & Logging, and Information) losing -3000 and -8000 employees respectively. Other Services and Utilities were virtually unchanged. Every other sector gained employees. The further further to the right on the chart the more employees they gained.

The biggest gainer was Education and Health adding 34,000 jobs (on top of the 44,000 they gained last month). Professional and Business Services (+32,000) was not far behind (adding 35,000 jobs last month). Other big gainers were and Manufacturing (+27,000), Transportation & Warehousing (+25,400) and Retail (+18,200).

Average weekly wages fell from $941.85 in October to $940.84 in November but were still above September’s $939.78.

(See the table below for average weekly earnings and other details.)

How to read this chart:

Bubbles location on the chart tell us two things:

- Change in Employment Levels over the most recent month.

- Average Weekly earnings.

- The further to the right the bubble the larger the increase in the number of jobs.

- The higher up on the chart the larger the average salary.

Bubble Size tells us:

- Total Employment for the sector.

- Larger bubbles mean more people are employed in that sector.

Employment and Average Weekly Earnings by Industry for All Employees

November 2018, Seasonally Adjusted

| Industry | Monthly Increase | Average Weekly Earnings | Employment Level |

| Total Private Employment | 161,000 | $940.84 | 127,515,000 |

| Mining and Logging | -3,000 | $1,510.03 | 750,000 |

| Construction | 5,000 | $1,174.86 | 7,312,000 |

| Manufacturing | 27,000 | $1,109.76 | 12,807,000 |

| Wholesale trade | 9,500 | $1,195.01 | 6,026,300 |

| Retail trade | 18,200 | $588.03 | 15,910,700 |

| Transportation and Warehousing | 25,400 | $956.00 | 5,419,300 |

| Utilities | 200 | $1,729.65 | 552,800 |

| Information | -8,000 | $1,469.99 | 2,759,000 |

| Financial Activities | 6,000 | $1,329.43 | 8,622,000 |

| Professional and Business Services | 32,000 | $1,184.44 | 21,207,000 |

| Education and Health Services | 34,000 | $894.88 | 23,823,000 |

| Leisure and Hospitality | 15,000 | $420.94 | 16,444,000 |

| Other Services | 0 | $784.10 | 5,882,000 |

Note: Even though the BLS commissioner’s report says seasonally adjusted employment increased 155,000 in this table they say it increased 161,000. And if you subtract the employment level they published last month 127,353,000 from the employment level this month 127,515,000 you get an increase of 162,000.

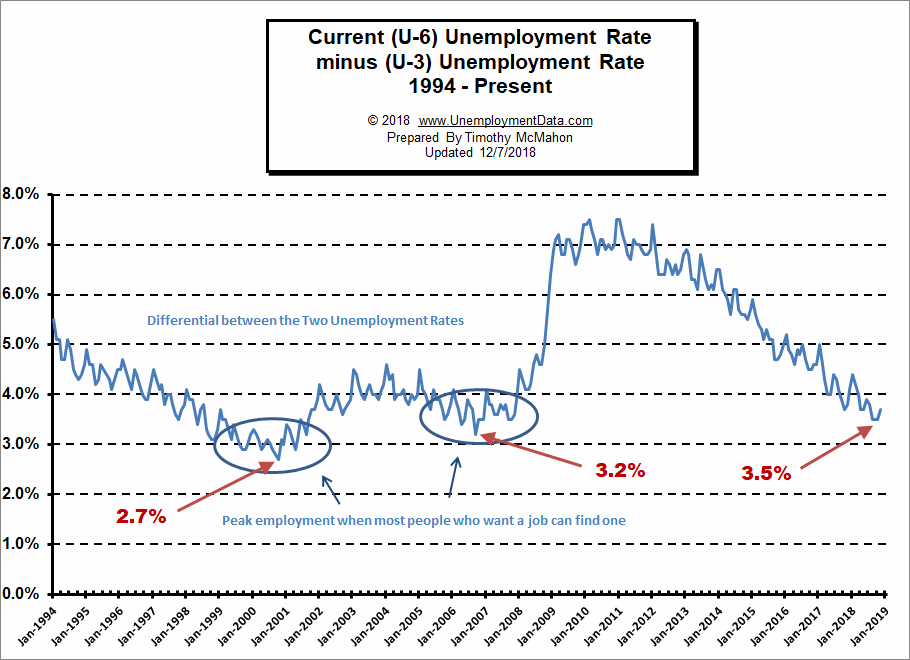

The Differential between U3 and U6

For the last several months the differential between the unadjusted U3 and U6 (reached by subtracting U3 from U6) was at 3.5% but this month it jumped up a bit to 3.7% due to an increase in the U6 from 7.0% to 7.2%.

See Current U-6 Unemployment Rate for more info.

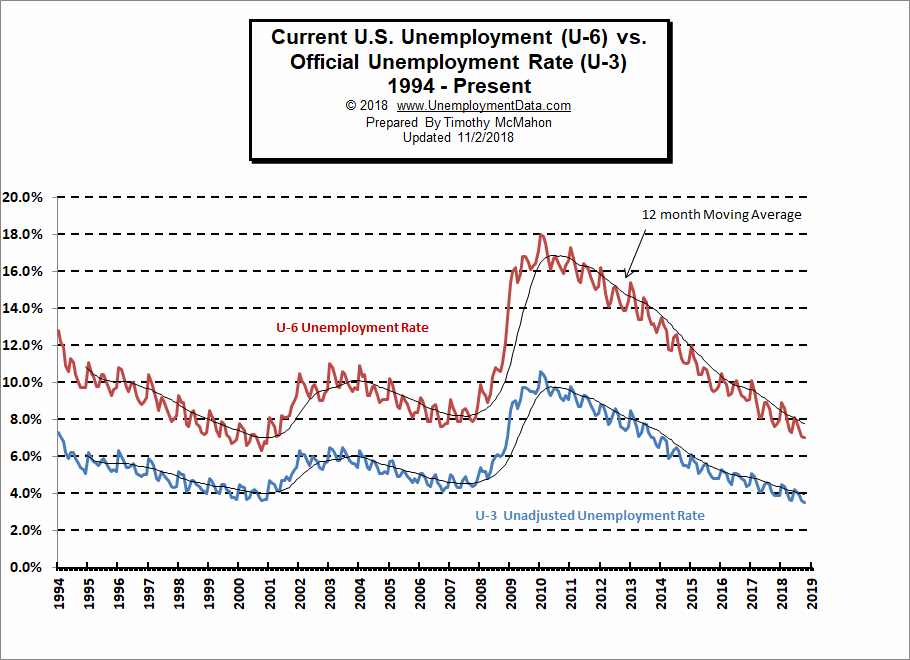

U-6 Unemployment

Current U-6 Unadjusted Unemployment Rate for November 2018 is:

Current U-6 Unadjusted Unemployment Rate for November 2018 is:

7.2% up from 7.0% in October and 7.1% in September, below 7.4% in August, 7.9% in July and 8.1% in June.

See Unadjusted U-6 unemployment for more info.

Employment

According to the BLS Commissioner’s report for this month:

“Total nonfarm payroll employment increased by 155,000 in November, and the unemployment rate remained unchanged at 3.7 percent.

Job gains occurred in health care, in manufacturing, and in transportation and warehousing.”

Note: These are Seasonally adjusted numbers. Actual employment increase for November was 475,000. Final employment numbers for October were 150.757 million. This month’s preliminary employment numbers are 151.232 million for an actual increase of 475,000. But the Commissioner is saying that it rose 155,000 more than average for the month of November.

Labor Force Participation Rate

The Labor Force Participation Rate (LFPR) for November was 62.9% unchanged from October but up from 62.7% in September. The LFPR for August and May was also 62.7%, and in April it was 62.8%, March was 62.9%, February was 63.0%. (Higher is better). But basically the LFPR for 2018 bounced around in a range from 62.7% to 63.0% with the BLS mistakenly reporting 63.4% in June but then changing it in July.

See Labor Force Participation Rate for more information.

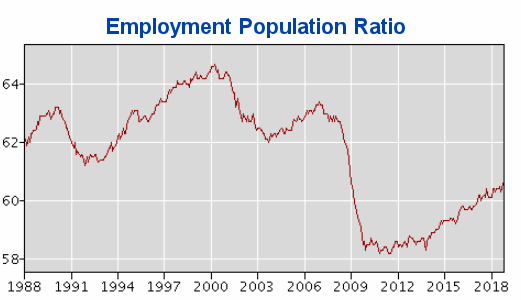

Employment Population Ratio

The index many people think of when they hear the term Labor Force Participation Rate might be better described by the Employment Population Ratio. This index shows the percentage of the entire population that is working. In many ways it is a better index than the LFPR or the Unemployment rate.

Here are some articles you might enjoy in case you missed them:

Read more on UnemploymentData.com.

- Valuable Career Benefits of Studying Abroad

- Getting Your Dream Job: Nailing the Interview

- How to Impress Your Interviewer After the Interview

- Arkansas, California, Idaho, South Carolina, Texas and Washington Set New Unemployment Lows in September

- Here’s Why “Strong Jobs” Don’t Mean “Higher Stocks”

- Unemployment Reaches Lowest Point Since 1969

- 5 Types of Jobs That Are Perfect for When You Can’t Decide Which Degree to Pursue

From InflationData.com

- October Inflation Up Slightly

- Did the Democrats Really Vote Against the Social Security Cost of Living Increase?

- September Annual Inflation Down to 2.28%

- Can Crypto Solve Venezuela’s Hyperinflation Problem?

- Cost of Living: LA and New York vs. The World

- What Impact (if any) Does Disruption have on Inflation?

- Debt and Inflationary Pressures: A Lesson in Economic Interactivity

- Inflation Risk

From Financial Trend Forecaster

- Move Aside Lithium – Vanadium Is The New Super-Metal/li>

- U.S. Shale Has A Glaring Problem

- How Free is Your State?

- Oil Price Rally Boosts Electric Car Sales

- $100 Oil Is A Distinct Possibility

- Do the FED’s Interest Rates Affect the Stock Market?/li>

- Technological Solution to 100 Year Old Oil Problem

From Elliott Wave University

- Have Smartphone Sales Peaked?

- Are Falling Oil Prices Really Good for the Stock Market?

- 1987 vs. 2018

- Bitcoin Breakdown May Push Prices Below $5000

- The Psychology of Volatility

- What is the Up/Down Volume Saying About the Current Market?

- This Doesn’t Happen in Bear Markets

From OptioMoney.com

- Big Family Getting Expensive? 4 Ways to Stay in the Green

- Getting a Motorcycle? Things to Cover Before Hitting the Road

- Finding the Right Material for Your Roof

- Undercut Utilities: How to Save on the Essentials

- Risk and Reward: Why You Should Be Investing Now

From Your Family Finances

Current U-6 Unadjusted Unemployment Rate for November 2018 is:

Current U-6 Unadjusted Unemployment Rate for November 2018 is: