Borrowing for College

With stagnant wage levels and increasing costs of living, higher education has become a fact of life for anyone wanting to get ahead. Rising costs of that education are making it harder for parents and students to meet the costs. The past two years, for instance, have seen tuition inflation averaging eight percent, and tuition is virtually guaranteed to increase by three percent every year, if the last two decades are any indication.

Students have some resources available, and a couple of tricks to minimize costs. Private and university scholarships are still a possibility to reduce the costs. The Pell grant can help with undergraduate expenses, but it has not been increased to meet inflation in recent years. Tax credits are a great resource for parents who want to help their children pay for school. Students are increasingly working part-time while attending full-time classes, and they are completing the first two years of core classes at community colleges or on-line.

Even with these options, most students face borrowing to pay for school and living expenses, or putting off their degree programs in favor of full-time employment. How much debt should students feel comfortable with? How much is too much? Are some loans better than others? Finance provider Sallie Mae offers help for those considering student loans.

Remember Why You Borrowed

Students often have difficulty making the transition from high school to college. The latter half of senior year for students planning to attend public universities adds to the confusion with frequent parties and road trips. Student loans can easily become a way of maintaining a particular lifestyle, whether it is eating out regularly, living in classy apartments or buying designer clothes. Every dollar of student loans should be directed to the costs of education. When used to cover housing and food, such as during the more hectic final two years, these costs should be minimized as much as possible.

Make Long-term Goals

A way to help control your use of loans is future orientation. What are your plans after school? Do they include buying a new car or house? Maybe you want to start a family or take a vacation to celebrate? Student loan debt will make all these things more difficult, so minimize the debt. [Read more…] about How Much Should You Borrow to Pay for College?

1. Outsourcing Payroll could help your business save money.

1. Outsourcing Payroll could help your business save money. 2. Education

2. Education Payday loan providers try to make the process as user friendly as possible for anyone who has regular employment. All you need is a bank account and an old pay stub and you can get the money needed on a short-term basis. Just go to the local payday loan office, fill in the paperwork and get the money you need. But once you are on the hook to them your problems just seem to get bigger. Even though the government has mandated maximum interest charges, payday lenders get around this by charging “fees” instead of interest. And the only thing worse than being in debt to a Payday lender is being in debt to a loan shark.

Payday loan providers try to make the process as user friendly as possible for anyone who has regular employment. All you need is a bank account and an old pay stub and you can get the money needed on a short-term basis. Just go to the local payday loan office, fill in the paperwork and get the money you need. But once you are on the hook to them your problems just seem to get bigger. Even though the government has mandated maximum interest charges, payday lenders get around this by charging “fees” instead of interest. And the only thing worse than being in debt to a Payday lender is being in debt to a loan shark.

Building Credit History—natloans (Flickr.com)You have to have credit history in order to buy or lease a car… buy a home…be considered for a loan…

Building Credit History—natloans (Flickr.com)You have to have credit history in order to buy or lease a car… buy a home…be considered for a loan…

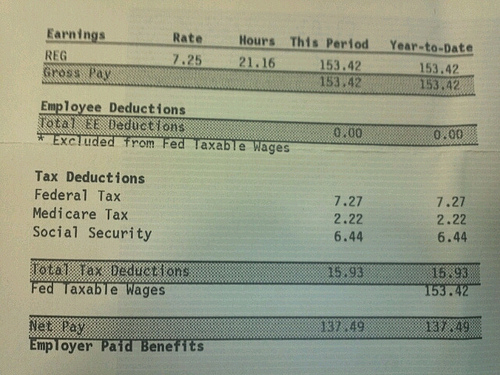

Even contract labor requires certain documentation. If a company pays a contractor more than $600 over the course of the year, a 1099 must be filed. Keeping track of the various tax amounts for various employees as well as which contracted employees earned how much can easily become a full-time job. Small business owners have plenty of other details to manage without adding that to their plates. If only for personnel purposes, an accountant will save time as well as headaches.

Even contract labor requires certain documentation. If a company pays a contractor more than $600 over the course of the year, a 1099 must be filed. Keeping track of the various tax amounts for various employees as well as which contracted employees earned how much can easily become a full-time job. Small business owners have plenty of other details to manage without adding that to their plates. If only for personnel purposes, an accountant will save time as well as headaches.