Employment Increased by 1.6 Million in October

The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for October on November 6th.

- Unadjusted U-3 was Down from 7.7% to 6.6%.

- Adjusted U-3 was Down from 7.9% to 6.9%.

- Unadjusted U-6 was Down from 12.4% to 11.6%.

- Labor Force Participation rose from 61.4% to 61.7%.

- Unadjusted Employment up from 141.854 million to 143.459 million.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Total nonfarm payroll employment rose by 638,000 in October, and the unemployment rate declined to 6.9 percent, the U.S. Bureau of Labor Statistics reported today. These improvements in the labor market reflect the continued resumption of economic activity that had been curtailed due to the coronavirus (COVID-19) pandemic and efforts to contain it. In October, notable job gains occurred in leisure and hospitality, professional and business services, retail trade, and construction. Employment in government declined.”

Of course, they are talking about “Seasonally Adjusted Jobs” from the “Current Population Survey (CPS)” rather than looking at the results reported by actual companies in their “Current Employment Statistics survey (CES)”

But looking at the CES report we see…

Originally the BLS reported 141.855 million jobs for September, this month they only adjusted that slightly.

So currently they are saying 141.854 million jobs for September and 143.459 million for October.

which is actually an increase of 1,604,000 jobs based on their original estimates.

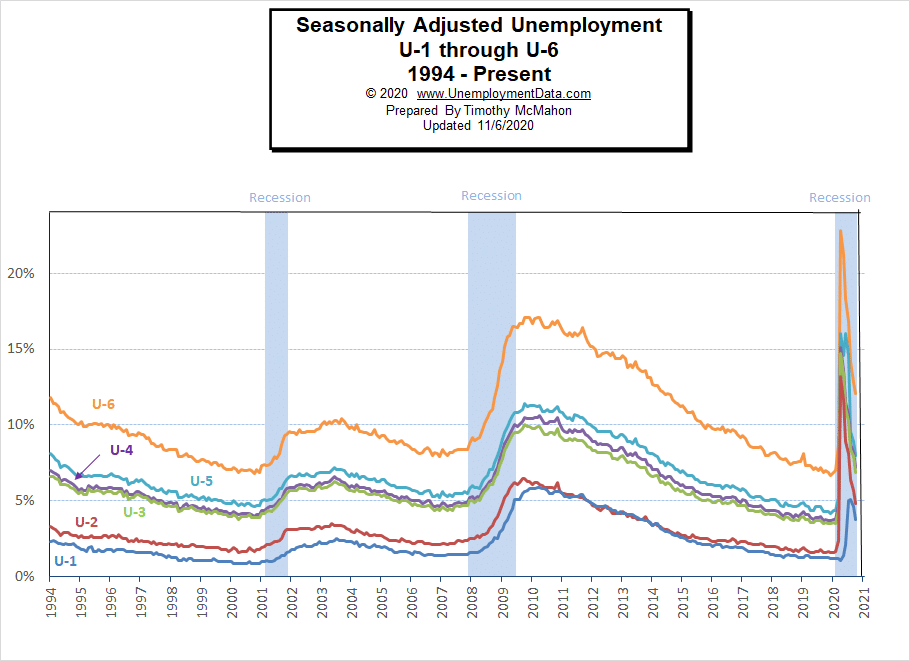

U1 through U6 Unemployment Rates

Due to COVID, all the various measurements of Seasonally Adjusted Unemployment from U-1 through U-6 spiked up sharply beginning in April except U1 which measures unemployment longer than 15 weeks. Beginning in July, they began falling.

For more information about the various measurements of unemployment see What Is U-6 Unemployment?

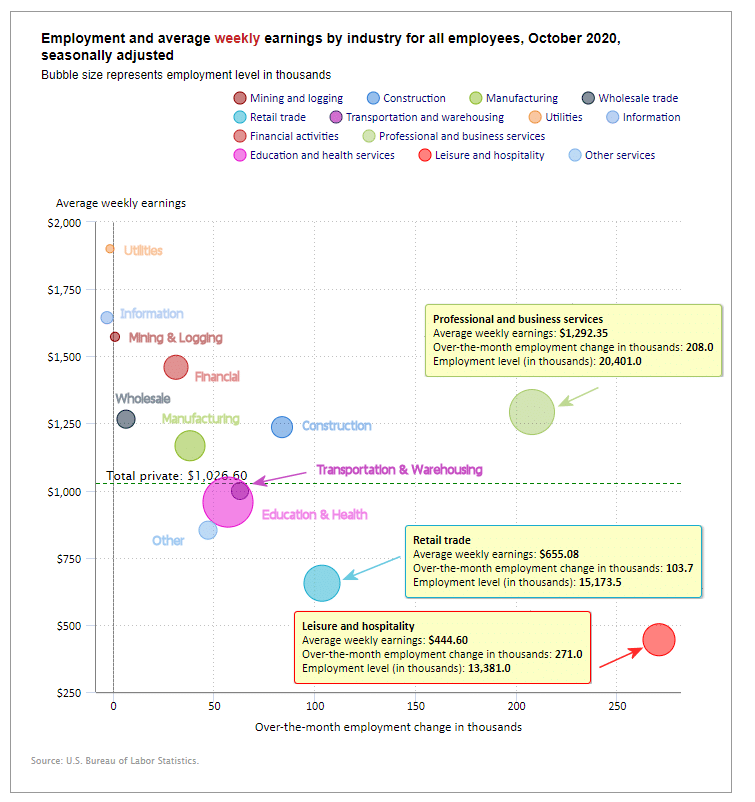

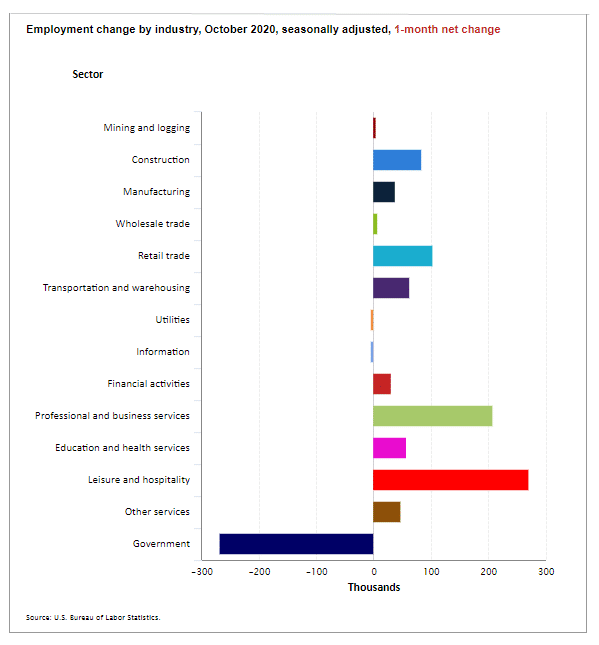

Employment by Sector

The employment “bubble chart” gives us a good representation of how each sector of the economy is doing (employment wise on a seasonally adjusted basis).

The best-performing sectors in October were Leisure & Hospitality which gained 271,000 jobs, and Professional and Business Services with a gain of 208,000 jobs and Retail which gained 103,700 jobs, . Other big gainers were Construction, Transportation, and Other Services.

Information lost -2,000 jobs, and Utilities lost -1,500 jobs.

Average weekly wages rose again in October to $1,026.60 from $1,022.61 in September, August was $1,019.66 and July was $1,013.96.

(See the table below for details.)

How to read this chart:

The bubbles location on the chart tell us two things:

- Change in Employment Levels over the most recent month.

- Average Weekly earnings.

- The further to the right the bubble the larger the increase in the number of jobs.

- The higher up on the chart the larger the average salary.

Bubble Size tells us:

- Total Employment for the sector.

- Larger bubbles mean more people are employed in that sector.

Employment and Average Weekly Earnings by Industry

October 2020, Seasonally Adjusted

| Industry | Monthly Increase | Average Weekly Earnings | Employment Level |

| Total Private Employment | 906,000 | $1,026.60 | 120,844,000 |

| Mining and Logging | 1,000 | $1,572.61 | 622,000 |

| Construction | 84,000 | $1,236.17 | 7,345,000 |

| Manufacturing | 38,000 | $1,166.81 | 12,231,000 |

| Wholesale trade | 6,400 | $1,265.88 | 5,630,600 |

| Retail trade | 103,700 | $655.08 | 15,173,500 |

| Transportation and Warehousing | 63,200 | $998.61 | 5,407,400 |

| Utilities | -1,500 | $1,900.47 | 539,400 |

| Information | -3,000 | $1,643.79 | 2,632,000 |

| Financial Activities | 31,000 | $1,459.08 | 8,716,000 |

| Professional and Business Services | 208,000 | $1,292.35 | 20,401,000 |

| Education and Health Services | 57,000 | $957.10 | 23,260,000 |

| Leisure and Hospitality | 371,000 | $444.60 | 13,381,000 |

| Other Services | 47,000 | $852.44 | 5,505,000 |

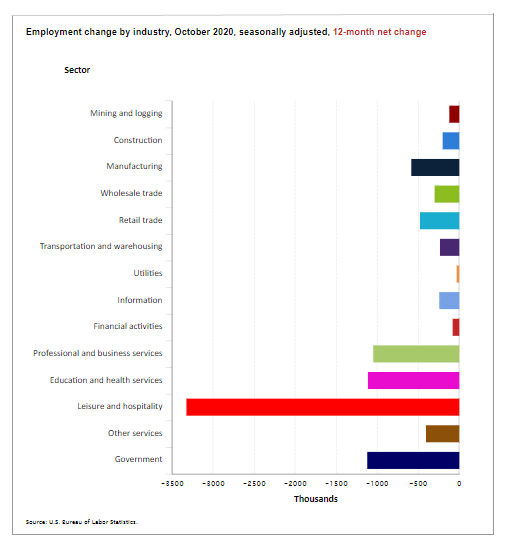

Another way to look at these monthly numbers. This one includes the massive decrease in government jobs (note that Utilities and Information are slightly negative):

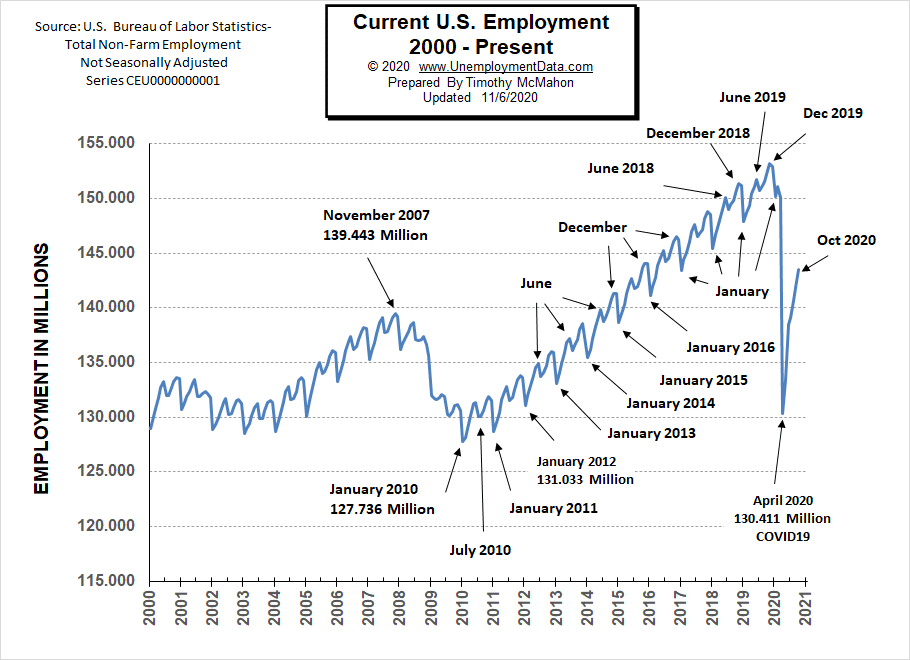

Current Employment

Typically the low point for each year occurs in January and then it moves almost straight up to a small peak around June with a slight drop around July and then the highest peak in employment happens in November/December.

But the COVID virus has shortcircuited the normal trend and we saw a drop which began in March and by April it took employment back down to approximately the level of July 2010. June saw employment rebound to approximately the January 2015 level. Fortunately, July did not follow the traditional pattern but instead rose (although only slightly) rather than falling. August’s employment rose to roughly the January 2016 level. October’s Employment was slightly above the January 2017 level.

See Current Employment for more info.

Previous Record Low Unemployment (Seasonally Adjusted U-3)

If we consider anything 4% or below as “low” we have had a few “low” stretches as we can see in the table below.

(4% or below in Green)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 1950 | 6.5% | 6.4% | 6.3% | 5.8% | 5.5% | 5.4% | 5.0% | 4.5% | 4.4% | 4.2% | 4.2% | 4.3% |

| 1951 | 3.7% | 3.4% | 3.4% | 3.1% | 3.0% | 3.2% | 3.1% | 3.1% | 3.3% | 3.5% | 3.5% | 3.1% |

| 1952 | 3.2% | 3.1% | 2.9% | 2.9% | 3.0% | 3.0% | 3.2% | 3.4% | 3.1% | 3.0% | 2.8% | 2.7% |

| 1953 | 2.9% | 2.6% | 2.6% | 2.7% | 2.5% | 2.5% | 2.6% | 2.7% | 2.9% | 3.1% | 3.5% | 4.5% |

| 1954 | 4.9% | 5.2% | 5.7% | 5.9% | 5.9% | 5.6% | 5.8% | 6.0% | 6.1% | 5.7% | 5.3% | 5.0% |

| 1955 | 4.9% | 4.7% | 4.6% | 4.7% | 4.3% | 4.2% | 4.0% | 4.2% | 4.1% | 4.3% | 4.2% | 4.2% |

| 1956 | 4.0% | 3.9% | 4.2% | 4.0% | 4.3% | 4.3% | 4.4% | 4.1% | 3.9% | 3.9% | 4.3% | 4.2% |

| 1957 | 4.2% | 3.9% | 3.7% | 3.9% | 4.1% | 4.3% | 4.2% | 4.1% | 4.4% | 4.5% | 5.1% | 5.2% |

| 1958 | 5.8% | 6.4% | 6.7% | 7.4% | 7.4% | 7.3% | 7.5% | 7.4% | 7.1% | 6.7% | 6.2% | 6.2% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1965 | 4.9% | 5.1% | 4.7% | 4.8% | 4.6% | 4.6% | 4.4% | 4.4% | 4.3% | 4.2% | 4.1% | 4.0% |

| 1966 | 4.0% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 3.7% | 3.7% | 3.6% | 3.8% |

| 1967 | 3.9% | 3.8% | 3.8% | 3.8% | 3.8% | 3.9% | 3.8% | 3.8% | 3.8% | 4.0% | 3.9% | 3.8% |

| 1968 | 3.7% | 3.8% | 3.7% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.4% | 3.4% | 3.4% | 3.4% |

| 1969 | 3.4% | 3.4% | 3.4% | 3.4% | 3.4% | 3.5% | 3.5% | 3.5% | 3.7% | 3.7% | 3.5% | 3.5% |

| 1970 | 3.9% | 4.2% | 4.4% | 4.6% | 4.8% | 4.9% | 5.0% | 5.1% | 5.4% | 5.5% | 5.9% | 6.1% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 1999 | 4.3% | 4.4% | 4.2% | 4.3% | 4.2% | 4.3% | 4.3% | 4.2% | 4.2% | 4.1% | 4.1% | 4.0% |

| 2000 | 4.0% | 4.1% | 4.0% | 3.8% | 4.0% | 4.0% | 4.0% | 4.1% | 3.9% | 3.9% | 3.9% | 3.9% |

| 2001 | 4.2% | 4.2% | 4.3% | 4.4% | 4.3% | 4.5% | 4.6% | 4.9% | 5.0% | 5.3% | 5.5% | 5.7% |

| … | … | … | … | … | … | … | … | … | … | … | … | … |

| 2018 | 4.1% | 4.1% | 4.1% | 3.9% | 3.8% | 4.0% | 3.9% | 3.9% | 3.7% | 3.7% | 3.7% | 3.9% |

| 2019 | 4.0% | 3.8% | 3.8% | 3.6% | 3.6% | 3.7% | 3.7% | 3.7% | 3.5% | 3.6% | 3.5% | 3.5% |

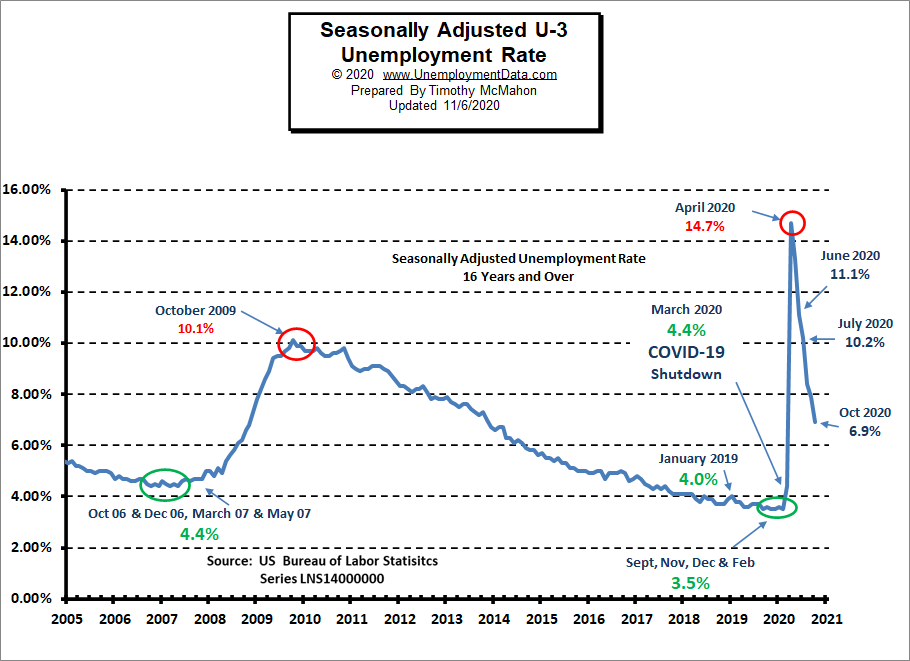

| 2020 | 3.6% | 3.5% | 4.4% | 14.7% | 13.3% | 11.1% | 10.2% | 8.4% | 7.9% | 6.9% |

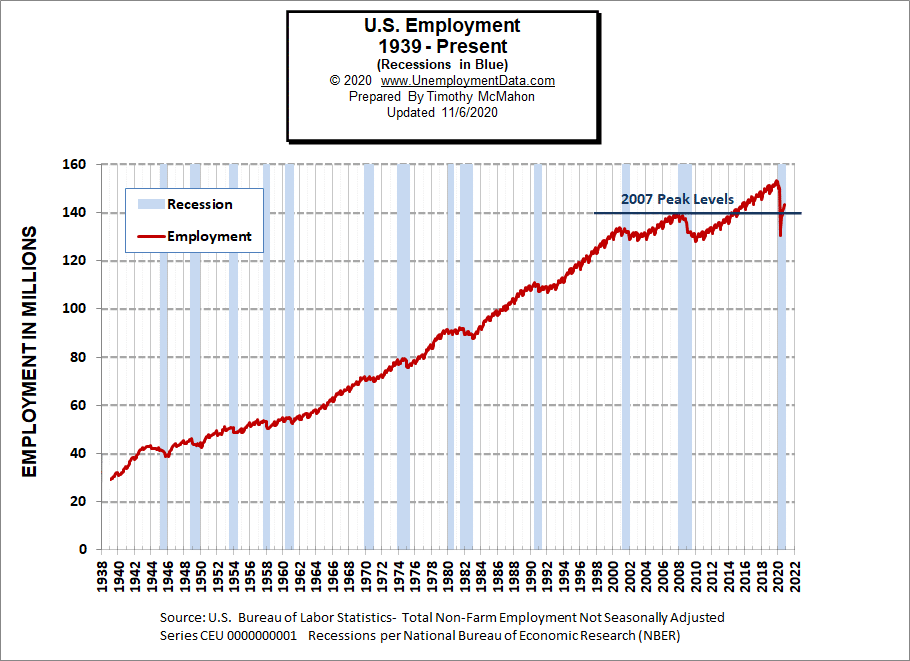

Historical Employment

Historically employment is closely tied to recessions and that is no accident. One of the primary factors in calculating whether the economy is officially in a recession is an increase in the unemployment rate. The chart below provides the Historical Employment Data overlaid on blue bars showing periods of official recessions. In April, the number of people employed fell below the 2007 peak, near the lows of the 2008-2010 crash. In August it rebounded back above the 2007 peak level. According to the National Bureau of Economic Research (NBER) we have officially been in a recession since February. Since they measure a recession beginning from the peak, that just means the economy is no longer growing, which is pretty obvious due to the virus.

See Historical Employment Data for more info.

Current Seasonally Adjusted Unemployment

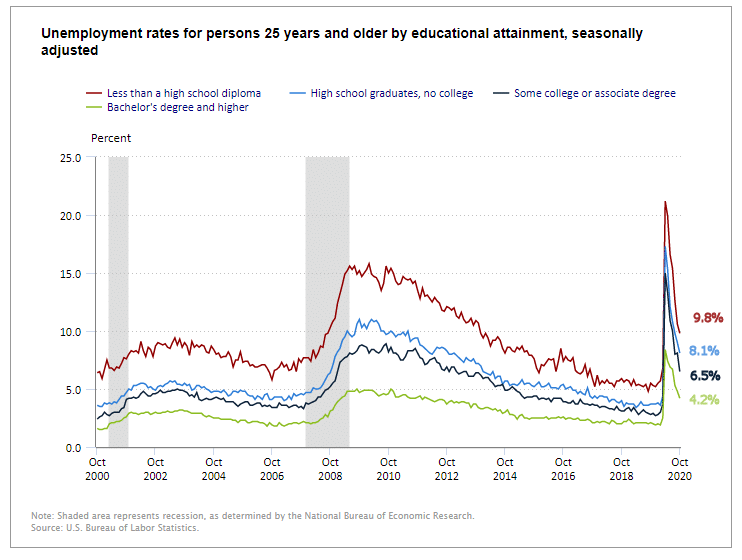

Unemployment by Education

Those unemployed with less than a High School Diploma fell from 21.2% in April to 15.4% in July and 9.8% in October. After bottoming at 4.8% in September 2019.

At the other end of the spectrum, those with a Bachelor’s degree or higher fell from 8.4% in April to 4.8% in September and 4.2% in October.

Typically those with a Bachelor’s degree are relatively immune to unemployment. Although during the 2008 recession college grads unemployment rose to slightly above 4%.

Source: Bureau of Labor Statistics

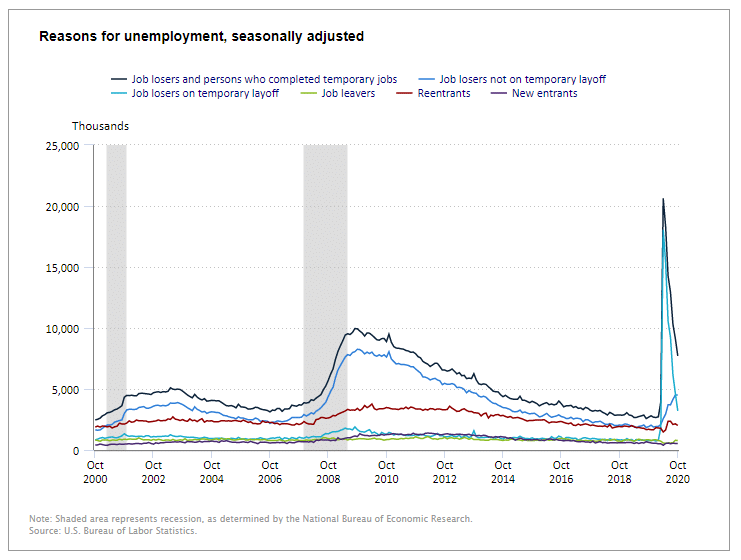

Layoff Status

Source: BLS

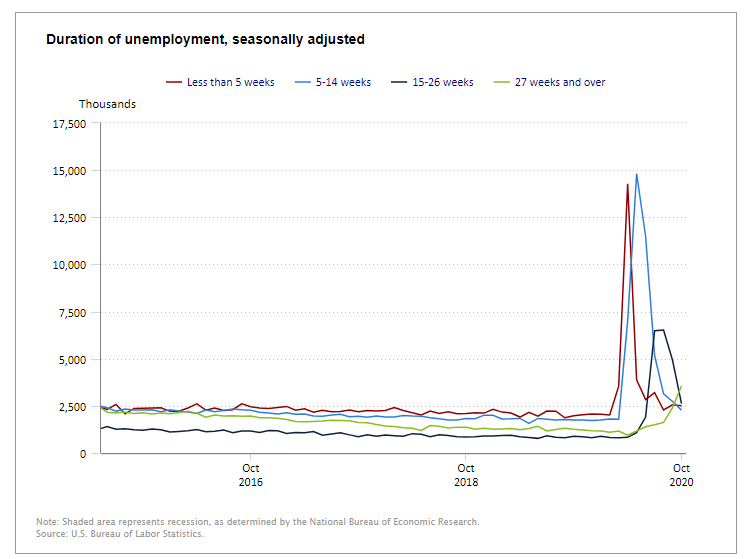

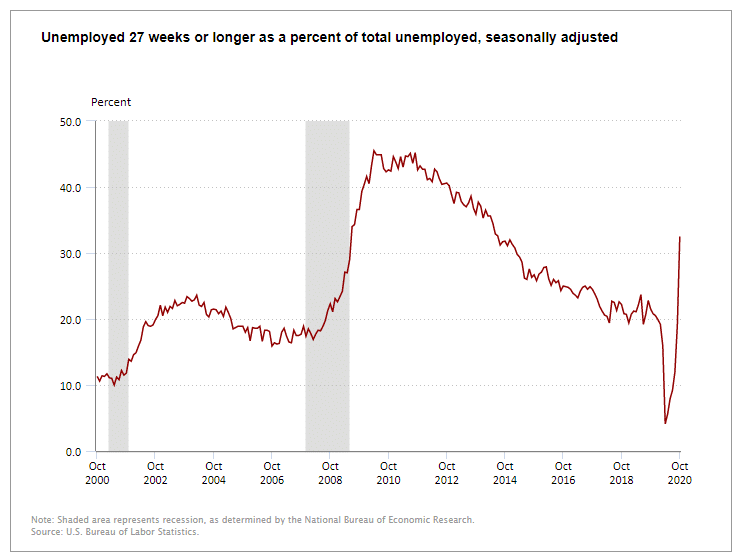

Duration of Unemployment

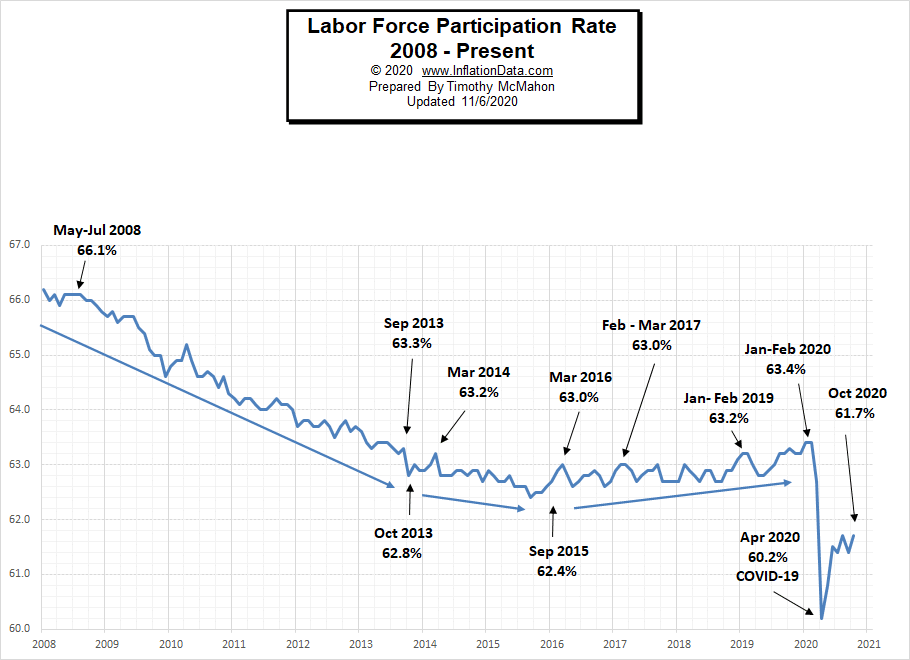

Labor Force Participation Rate

Even though Unemployment was in record low territory for quite some time, it wasn’t until January and February 2020, that the LFPR was finally able to claw its way back to 63.4%, its highest level since 2013.

Then COVID decimated all those gains dropping the LFPR down to 60.2% in April. In May it began to rebound and in June the LFPR was able to bounce back a little more to 61.5%, it fell slightly in July but this was probably due to people returning to the labor force rather than other factors. Over the last few months, the LFPR has bounced around between 61.4% and 61.7%.

See Labor Force Participation Rate for more information.

If you would like to receive this monthly report and other article updates click here you can unsubscribe at any time.

Here are some articles you might enjoy in case you missed them:

Read more on UnemploymentData.com.

- Should You Buy a House When Unemployed?

- 3 Top Tips for Climbing the HR Career Ladder

- Understanding Students Helps University Marketing

- Broaden Your Horizons and Expand Your Success

- Need a New Job Fast? Positions You Can Get With Quick Training

From InflationData.com

- Emerging Technologies

- A Better Understanding of How IRS Audits Work

- September Inflation Virtually Unchanged

- The Price of Oil Denominated in Bitcoin

- How has Venezuela’s Bitcoin experiment Fared?

From Financial Trend Forecaster

- China Ramps Up U.S. Crude Oil Imports

- Speed and Affordability: Cost of Internet Access Over Time

- New Technologies in the Oil and Gas Industry

- Oil Majors That Bet Big On Renewables

From Elliott Wave University

- Does the Stock Market Really “See” the Future?

- Gold: See What This Fibonacci Ratio Says About the Trend

- Forecasting Markets by Looking at Chart Patterns

- Seeking Certainty in Uncertain Times?

- Emerging Markets and Epidemics

From OptioMoney.com

- Should You Buy a Second Home?

- Learning to Trade from Video Tutorials

- Five Business Tips to Help Your Company Thrive

From Your Family Finances