The U.S.Bureau of Labor Statistics (BLS) released the May unemployment numbers today. The BLS Commissioner says: Nonfarm payroll employment increased by 138,000 in May, but these are Seasonally Adjusted numbers. So since typically employment increases in May, what he is saying is that 138,000 more jobs than average were created. In unadjusted terms employment was 145.938 million in April and 146.748 in May for a net gain of 810,000 jobs. Adjusted U-3 Unemployment was 4.3% down from 4.4% in April. Unadjusted U-3 Unemployment was 4.1% unchanged from April.

Gallup Unadjusted U-3 was 5.2% down from 5.4% in April. Gallup’s unadjusted U-6 Unemployment was 8.1% unchanged from April. Gallup’s U-6 was 13.8% Down from 14.0% in April.

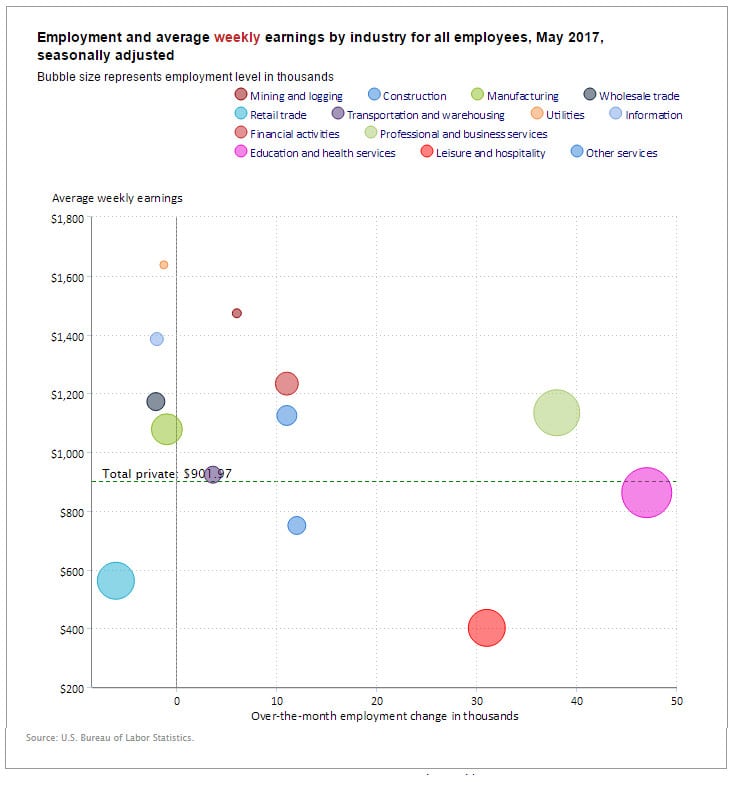

May Employment Gain and Loss Bubbles

In the following chart from the BLS we can see the biggest gainer is the pink Education and Health Services bubble with 47,000 new jobs over the month of May. Average weekly earnings are slightly below average at $861.65. Another big gainer was the light green bubble representing Professional and Business Services with 38,000 new jobs and an above average weekly salary of $1,133.64. Leisure and hospitality (red bubble) also gained 31,000 jobs in May but average weekly earnings are only $401.18. Other gainers were construction (11,000 jobs), Financial Activities (11,000 jobs) and transportation and warehousing (3,600 jobs). The biggest loser was Retail losing 6,100 low paying jobs averaging $561.72/wk. Other losers were Manufacturing losing 1,000 jobs @ $1,077.33/wk and Wholesale Trade losing 2,100 jobs @ $1,171.56/wk.

BLS vs. Gallup Unemployment Numbers

| BLS Numbers | May | April |

| Seasonally Adjusted U-3 | 4.3% | 4.4% |

| Unadjusted U-3 | 4.1% | 4.1% |

| Unadjusted U-6 | 8.1% | 8.1% |

| Gallup Numbers | ||

| Unadjusted U-3 | 5.2% | 5.4% |

| Unadjusted U-6 | 13.8% | 14.0% |

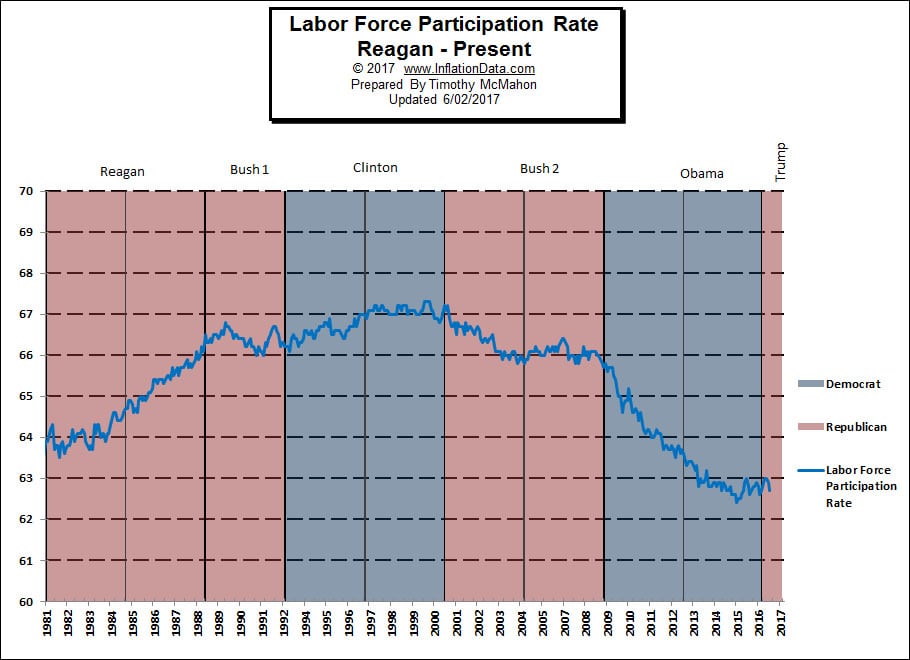

Labor Force Participation Rate (LFPR)

Read more about the Labor Force Participation Rate here.

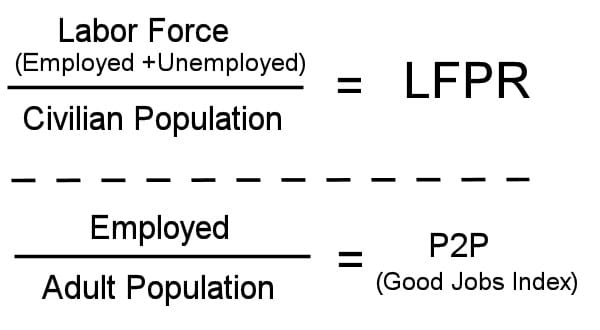

In contrast to the LFPR, Gallup uses the Payroll to Population ratio (P2P) now called the “good jobs index”. The LFPR includes both employed and unemployed people i.e. the “Labor Force” divided by the Civilian Non-Institutional Population. The P2P on the other hand uses the Employed divided by the Adult population giving you a much easier way to see what percentage of the population is actually working (not counting self -employed people). Currently Gallup is saying that the Good jobs index is currently 45.3%.

So with a Good jobs index below 50% we can see that less than half the adults are working. Although with roughly 10% of the population self-employed the numbers climb to slightly above half. Read more about comparing BLS numbers to Gallup…

Seasonally Adjusted Unemployment Rate Chart 1948-Present

The current “Unadjusted” rate is 4.1% which appears to be very low (equivalent to 2007) until you factor in the fact that the Labor force has declined drastically (see declining LFPR chart above). The population has increased by 22 million and the number of jobs has increased by only 7.3 million.

See: Current Unemployment Rate Chart here.

See Also: