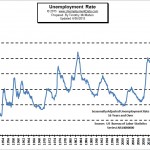

The U.S. Bureau of Labor Statistics (BLS) released the newest unemployment data for May 2015 on Friday June 5th. According to the BLS, the current “Seasonally Adjusted” Unemployment Rate for May is 5.5% up from April’s 5.4%. The BLS reported the “Unadjusted” Unemployment Rate is 5.3% which is lower than October’s unadjusted 5.5% and January’s 6.1% but up from April’s 5.1%. See Current Unemployment Chart for more information.

The U.S. Bureau of Labor Statistics (BLS) released the newest unemployment data for May 2015 on Friday June 5th. According to the BLS, the current “Seasonally Adjusted” Unemployment Rate for May is 5.5% up from April’s 5.4%. The BLS reported the “Unadjusted” Unemployment Rate is 5.3% which is lower than October’s unadjusted 5.5% and January’s 6.1% but up from April’s 5.1%. See Current Unemployment Chart for more information.

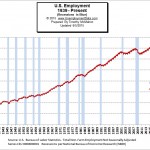

The BLS “preliminary estimates” for the employment situation for the month of May 2015 include 142.420 million jobs reported for May 2015. That was up 970,000 from April. But at the same time they revised the numbers for April down by 12,000. See Current Employment Commentary for more information.

The BLS “preliminary estimates” for the employment situation for the month of May 2015 include 142.420 million jobs reported for May 2015. That was up 970,000 from April. But at the same time they revised the numbers for April down by 12,000. See Current Employment Commentary for more information.

When looking at employment vs. unemployment you would think that they would simply be the inverse of each other. Flip one over and you have the other. But the U.S. Bureau of Labor Statistics (BLS) actually uses two entirely different surveys to calculate them. So by comparing them we can get a good idea of any anomalies in the data. See Current Employment vs. Unemployment Chart.

When looking at employment vs. unemployment you would think that they would simply be the inverse of each other. Flip one over and you have the other. But the U.S. Bureau of Labor Statistics (BLS) actually uses two entirely different surveys to calculate them. So by comparing them we can get a good idea of any anomalies in the data. See Current Employment vs. Unemployment Chart.

Employment Levels During Recessions

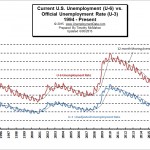

Comparing U3 to U6

You may also notice that when unemployment rises the gap between U-3 and U-6 generally increases. For instance, in October 2000, unemployment was at the lowest levels on this chart with U-3 at 3.6% and U-6 was at 6.3%. For a difference of only 2.7%. But at the peak of unemployment in January 2010 U-3 was at 10.6% but U-6 shot all the way up to 18% for a difference of 7.4%. More…

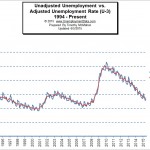

So in theory removing these fluctuations makes the data easier to compare from month to month and in practice it looks somewhat like a moving average smoothing out the peaks and valleys. So let’s look at how seasonally adjusted data compares to unadjusted unemployment data on a chart.

Comparing Bureau of Labor Statistics numbers to an Independent Source

In this chart we can see that the Gallup numbers are occasionally higher than the BLS numbers but they are occasionally lower as well, so it is difficult to tell if the data is significantly different. At first glance they appear to track pretty well until July of 2013 when they start diverging drastically. See: BLS vs. Gallup Unemployment Rates.

See Also:

- Monthly Historical Unemployment Rates from 1948 through the present.