![]() The U.S. Bureau of Labor Statistics (BLS) released their monthly employment survey results for the month of July on Friday August 3rd .

The U.S. Bureau of Labor Statistics (BLS) released their monthly employment survey results for the month of July on Friday August 3rd .

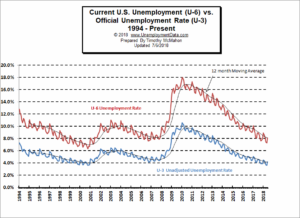

The current “Seasonally Adjusted” Unemployment Rate for July (released August 3rd) is 3.9% down from 4.0% last month. It was 3.8% in May and 3.9% in April. Unemployment was 4.1% from October 2017 through March 2018. Seasonally adjusted unemployment bounced around between 4.3% and 4.4% from April through October 2017, after declining from 4.8% in January 2017.

Typically Unemployment levels are worse in June and July so seasonally adjusting takes that into consideration. If we look at Unadjusted Unemployment we see that in 2017 it jumped from 4.1% in May to 4.5% in June at the same time the Seasonally Adjusted numbers simply went from 4.3% to 4.4%.

Key July Employment and Unemployment Numbers

- Adjusted U-3 Unemployment- 3.9% down from 4.0% in June but up from the 3.8% in May, 3.9% in April but still Below the 4.1% October – March.

- Unadjusted U-3 Unemployment- 4.1% down from 4.2% in June up from 3.6% in May, 3.7% in April and 4.1% in March.

- Unadjusted U-6 Unemployment- 7.9% down from 8.1% in June, up from 7.3% in May, 7.4% in April and from 8.1% in March and 8.6% in February.

- Employment 148.901 million. BLS adjusted June employment up from 148.912 million as released to 150.057 million.

- NOTE: On 8/3/2018 with the release of the new July numbers the BLS adjusted the June LFPR down to 62.9% from a recent high of 63.4%

See Current Unemployment Chart for more info.

Employment by Sector

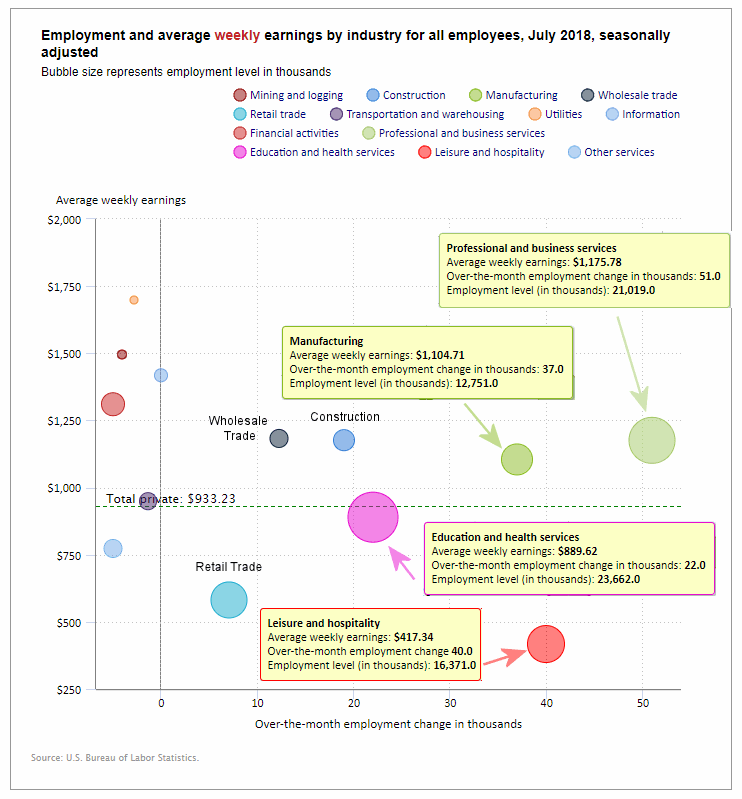

The employment “bubble chart” gives us a good representation of how each sector of the economy is doing (employment wise). As we can see from the chart below several sectors are to the left of the zero line this month indicating that Mining and Logging, Financial Activities, Utilities, and Transportation lost employees. The big gainers were Education and Health +22,000, Manufacturing +37,000, Leisure and Hospitality +40,000, and Professional and business Services +51,000.

(See the table below for average weekly earnings and other details.)

How to read this chart:

Bubbles location on the chart tell us two things:

- Change in Employment Levels over the most recent month.

- Average Weekly earnings.

- The further to the right the bubble the larger the increase in the number of jobs.

- The higher up on the chart the larger the average salary.

Bubble Size tells us:

- Total Employment for the sector.

- Larger bubbles mean more people are employed in that sector.

Employment and Average Weekly Earnings by Industry for All Employees

July 2018, Seasonally Adjusted

| Industry | Monthly Increase | Average Weekly Earnings | Employment Level |

| Total Private Employment | 170,000 | $933.23 | 126,794,000 |

| Mining and Logging | -4,000 | $1,495.48 | 735,000 |

| Construction | 19,000 | $1,176.48 | 7,242,000 |

| Manufacturing | 37,000 | $1,104.71 | 12,751,000 |

| Wholesale trade | 12,300 | $1,182.87 | 5,981,500 |

| Retail trade | 7,100 | $581.57 | 15,944,000 |

| Transportation and Warehousing | -1,300 | $949.26 | 5,324,800 |

| Utilities | -2,800 | $1,698.44 | 550,600 |

| Information | 0 | $1,418.04 | 2,772,000 |

| Financial Activities | -5,000 | $1,310.36 | 8,568,000 |

| Professional and Business Services | 51,000 | $1,175.78 | 21,019,000 |

| Education and Health Services | 22,000 | $889.62 | 23,662,000 |

| Leisure and Hospitality | 40,000 | $417.34 | 16,371,000 |

| Other Services | -5,000 | $773.16 | 5,873,000 |

U-6 Unemployment

For July 2018 the official Current U-6 unemployment rate was 7.9% down from 8.1% in June but still above the low of 7.3% in May and 7.4% in April and back in the range of 8.1% in March, 8.6% in February, 8.0% in December 2017.

U-6 Unemployment was 10.1% in January 2017 with a long term peak at 17.9% in February 2010.

See Unadjusted U-6 unemployment for more info.

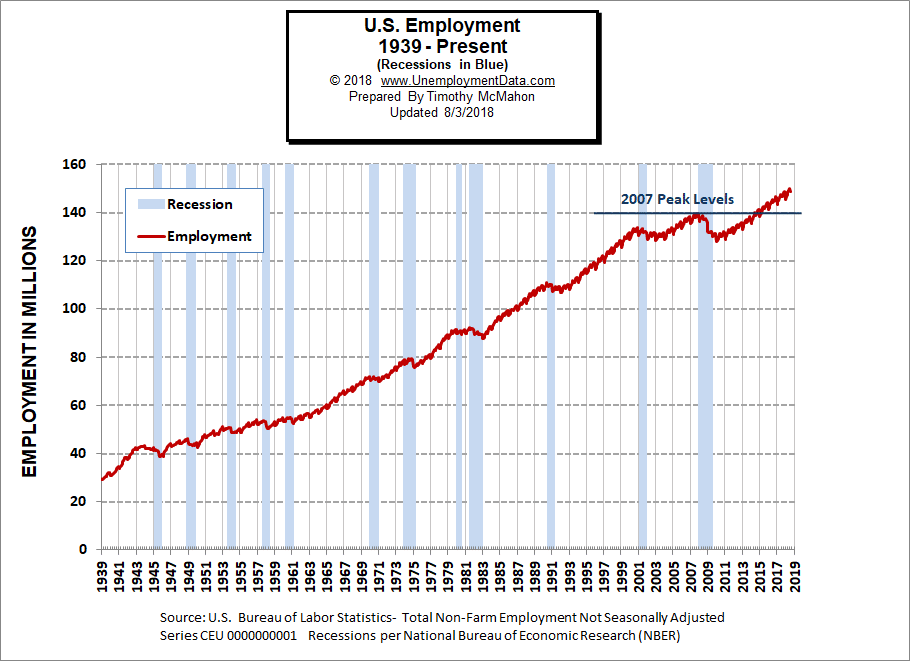

Employment

Typically Unemployment levels are worse in June and July… perhaps due to the increase in students looking for Summer jobs.

Note: The BLS adjusted the actual employment level from the originally reported 148.912 million in June to 150.057 million. With July employment at 148.901 million you would think that would be a decrease in employment not the 157,000 increase the Commissioner talks about. But he is talking about seasonally adjusted jobs. Also note that current levels are almost exactly what June levels were before they were adjusted.

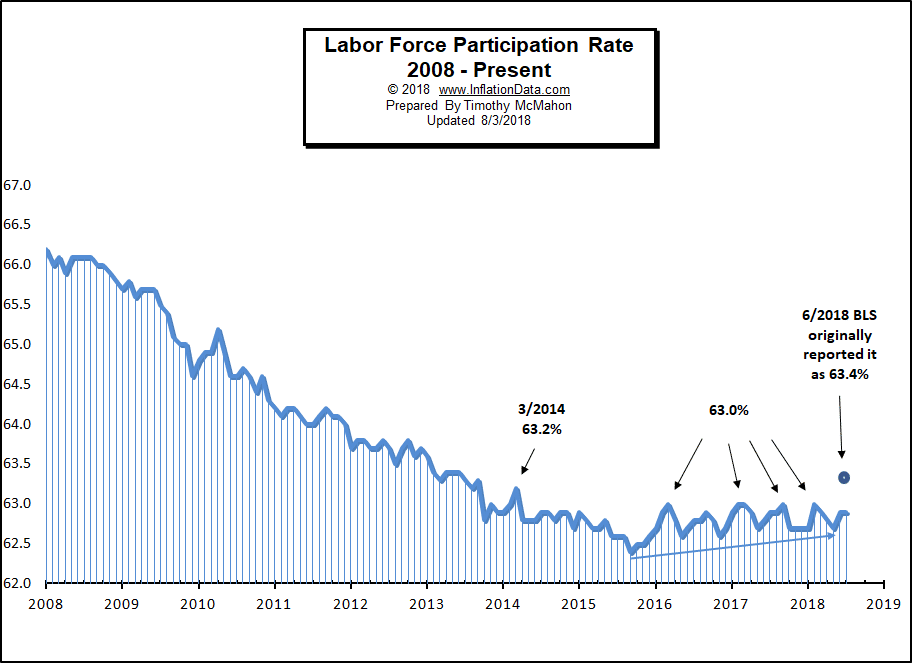

Labor Force Participation Rate

Last month the BLS reported that the June LFPR jumped dramatically to 63.4% exceeding 63.2% for the first time since 2014. Now they are saying it was really only 62.9% with the same level occurring in July. The LFPR for May was 62.7%, and in April it was 62.8%, March was 62.9%, February was 63.0%. (Higher is better so a falling LFPR is not good).

See Labor Force Participation Rate for more information.

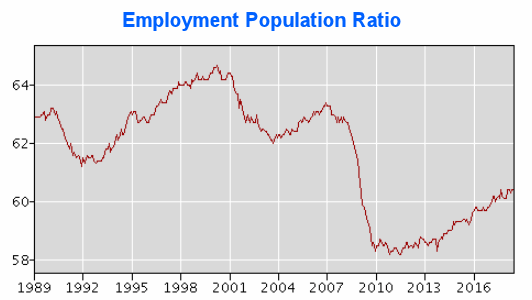

Employment Population Ratio

The index many people think of when they hear the term Labor Force Participation Rate might be closer described by the Employment Population Ratio. This index shows the percentage of the entire population that is working. In many ways it is a better index than the LFPR or the Unemployment rate.

For more information See:

- Article: Employment vs. Unemployment how do they compare?

- Historical Employment Data Chart

- Current Unemployment Rate Chart

- Current Employment vs Unemployment Chart Are they really “two sides of the same coin”?

- What is U-6 Unemployment?

- The Misery index measures inflation plus unemployment and is a good measure of the discomfort of the country’s population.

- More Unemployment and Employment Charts