Often we get complacent and think that our situation is the same (or very similar to) other developed countries. But that is not always the case. Today we are going to look at how the unemployment rate in the U.S. compares to that of Europe.

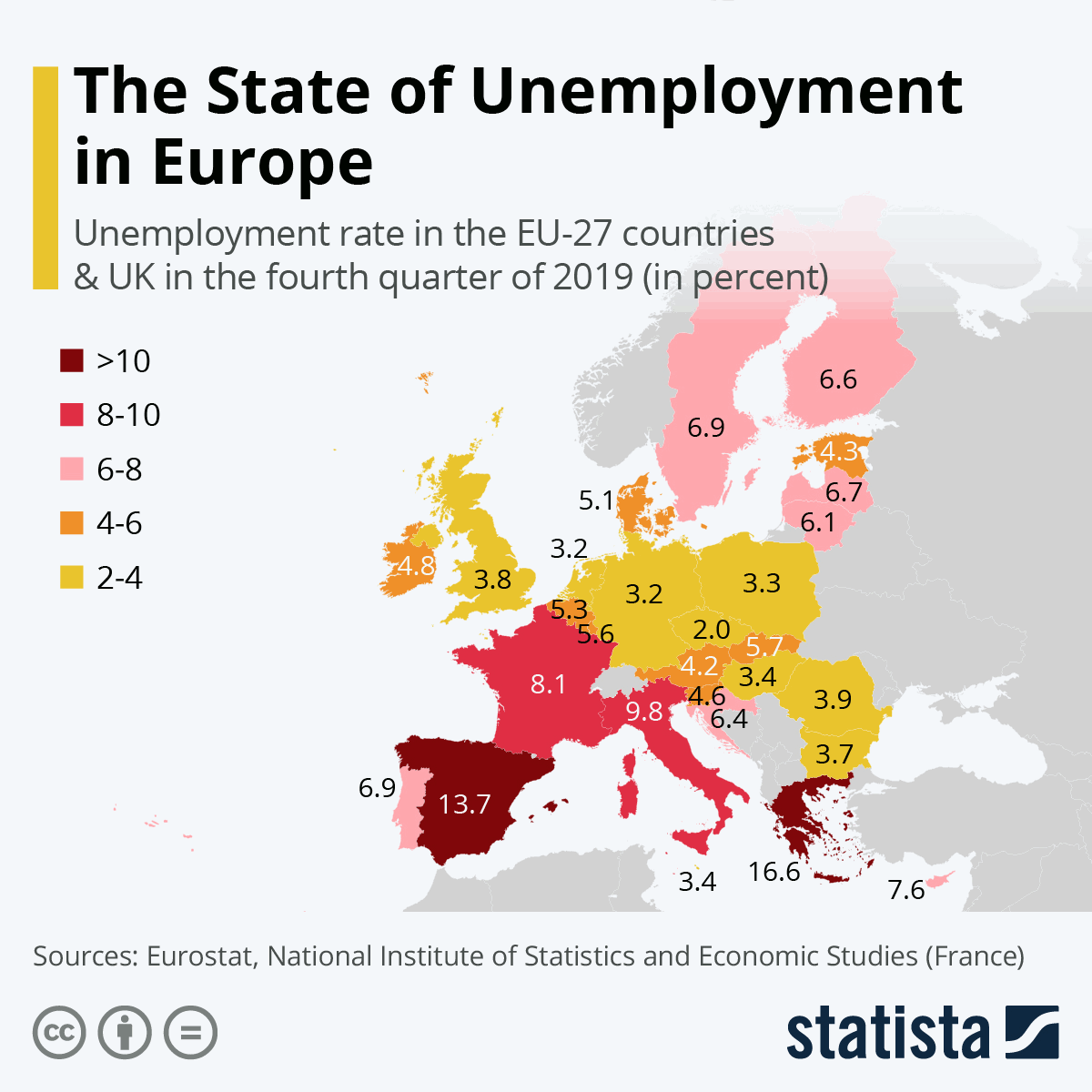

In the following chart created by Statista from data supplied by “Eurostat” and “National Institute of Statistics and Economic Studies (France)” we can see that Europe itself is not one unified block with identical (or even similar) unemployment rates.

The data in this graphic is from the end of 2019 when unemployment rates in the United States were at 3.5%. We can see that the countries in yellow had comparable unemployment rates to the U.S. i.e. Germany, Poland, and the Netherlands. Britain, Romania, and Bulgaria were in the high 3’s with the surprise being the Czech Republic coming in at a scant 2.0%. According to an article in The Atlantic, the 2017 elections decimated the “Left and Center” leaving the moderate right and the anti-immigrant far-right. So we are free to conclude that without the influx of cheap labor from Northern Africa, that all of the rest of Europe welcomed with open arms, the Czech Republic has record low unemployment as only native Czech’s are competing for the jobs.

One of the other surprises is that [Read more…] about Comparing U.S. and European Unemployment Rates

The amount of the deduction that a taxpayer can claim for job hunting is limited. The IRS only allows you to deduct expenses that are in excess of two percent of your annual income for expenses related to job hunting. So if you are making $30,000/yr. the first $600 in expenses is not deductible. For this reason, it is important to keep meticulous records of every job-hunting expenses in order to get above the threshold.

The amount of the deduction that a taxpayer can claim for job hunting is limited. The IRS only allows you to deduct expenses that are in excess of two percent of your annual income for expenses related to job hunting. So if you are making $30,000/yr. the first $600 in expenses is not deductible. For this reason, it is important to keep meticulous records of every job-hunting expenses in order to get above the threshold.