The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for January on February 7th, 2025.

Employment / Unemployment

- Seasonally Adjusted U3- 4.0% Down from December

- Unadjusted U3- 4.4% Up from December

- Unadjusted U6- 8.2% Up from December

- Labor Force Participation Rate 62.6% Up

- Employment 157.091 million Down from 159.943 million

- Next data release March 7th, 2025

Summary:

The BLS sent mixed signals in January, with the Commissioner’s report stating a rise in employment and a fall in adjusted unemployment. However, the Unadjusted Establishment Survey report shows a decline in the number of employed and a massive downward adjustment in employment for all of 2023 and 2024.

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Total nonfarm payroll employment rose by 143,000 in January, and the unemployment rate edged down to 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, retail trade, and social assistance. Employment declined in the mining, quarrying, and oil and gas extraction industry…

The unemployment rate edged down to 4.0 percent in January, after accounting for the annual adjustments to the population controls. The number of unemployed people, at 6.8 million, changed little over the month.”

You can read the full BLS report here.

As usual, they are talking about “Seasonally Adjusted Jobs”.

Looking at the Unadjusted Establishment Survey report we see…

Originally the BLS reported employment of 160.458 million for December

which they just adjusted to 159.943 million.

They are currently reporting 157.091 million jobs for January which is actually a decrease of 3,367,000 jobs compared to their originally reported numbers or a decrease of 2,852,000 based on their new numbers.

Despite the drop in employment the LFPR was up from 62.5% to 62.6% which could indicate an increase in people entering the labor force rather than an increase in jobs.

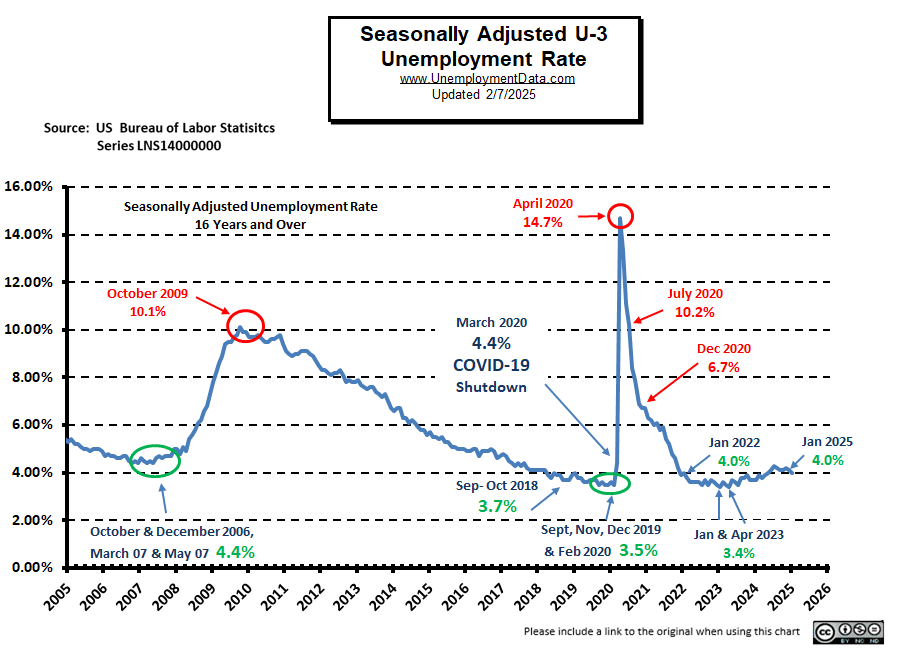

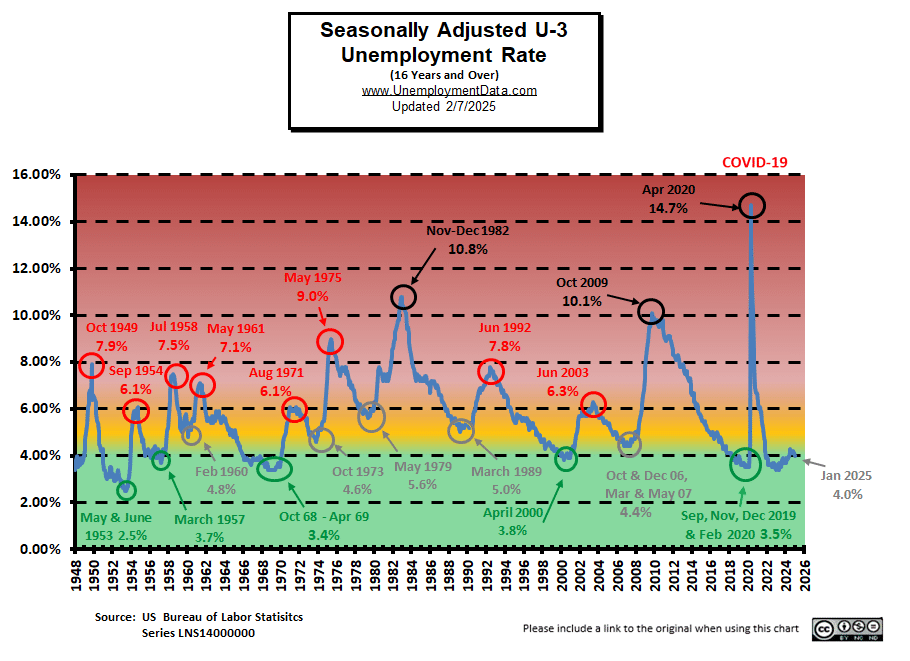

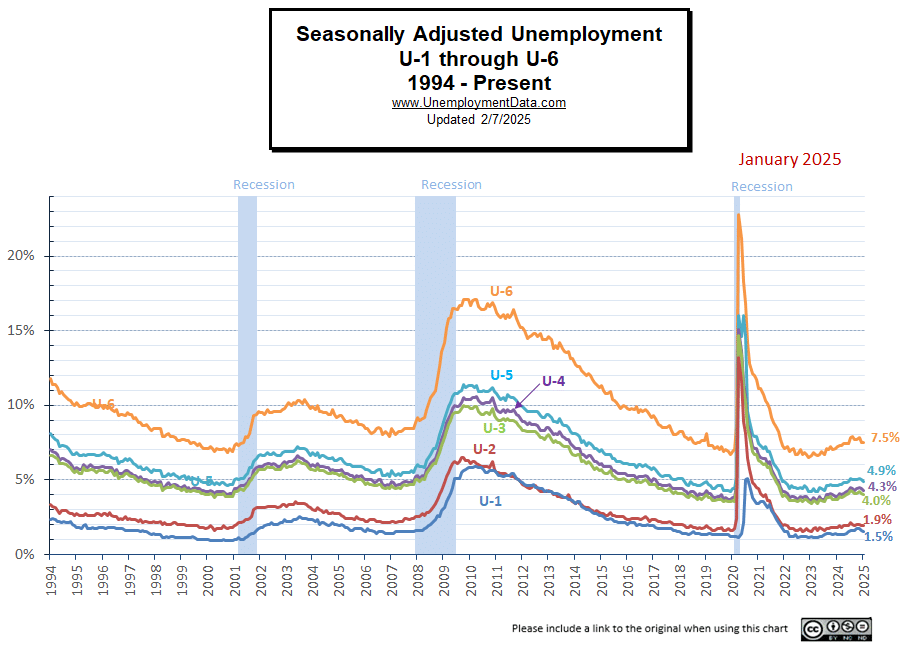

Current Unemployment Rate Chart

As the chart below shows, although unemployment is still low, it is above the lows of 2019 and 2023. At 4.0%, Seasonally Adjusted unemployment is still “Very Good”.

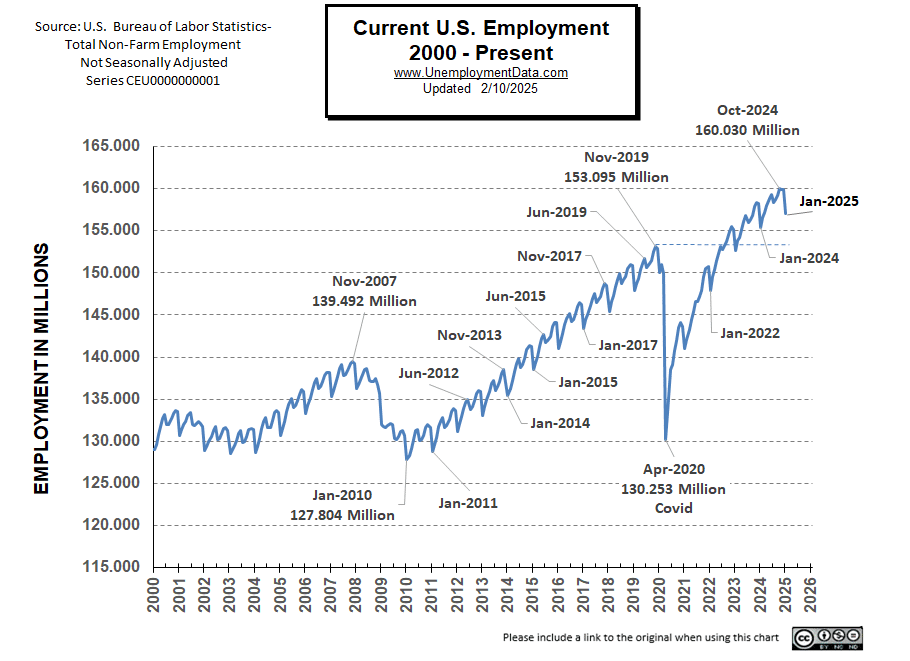

Current Employment Rate

This month’s massive BLS adjustments created a sea of red in the Employment levels, erasing millions of supposed jobs in 2023 and 2024.

| Date | Latest BLS Numbers (in Millions) |

Original BLS Numbers (in Millions) |

Change from Original |

| Jan-2025 | 157.091 | 157.091 | NA |

| Dec-2024 | 159.943 | 160.458 | -515,000 |

| Nov-2024 | 159.882 | 160.560 | -678,000 |

| Oct-2024 | 159.352 | 160.007 | -655,000 |

| Sep-2024 | 158.527 | 159.177 | -650,000 |

| Aug-2024 | 158.070 | 158.650 | -580,000 |

| Jul-2024 | 157.771 | 158.445 | -674,000 |

| Jun-2024 | 158.722 | 159.392 | -670,000 |

| May-2024 | 158.256 | 158.918 | -662,000 |

| Apr-2024 | 157.438 | 158.016 | -578,000 |

| Mar-2024 | 156.612 | 157.218 | -606,000 |

| Feb-2024 | 156.007 | 156.555 | -548,000 |

| Jan-2024 | 154.942 | 155.626 | -684,000 |

| Dec-2023 | 157.828 | 158.228 | -400,000 |

| Nov-2023 | 157.950 | 158.461 | -511,000 |

| Oct-2023 | 157.531 | 157.984 | -453,000 |

| Sep-2023 | 156.563 | 157.001 | -438,000 |

| Aug-2023 | 156.107 | 156.302 | -195,000 |

| July 2023 | 155.779 | 156.126 | -347,000 |

| June 2023 | 156.701 | 156.963 | -262,000 |

| May-2023 | 156.038 | 156.306 | -268,000 |

| Apr-2023 | 155.155 | 155.337 | -182,000 |

| Mar-2023 | 154.253 | 154.517 | -264,000 |

| Feb-2023 | 153.818 | 153.955 | -137,000 |

| Jan-2023 | 152.689 | 152.844 | -155,000 |

See Current Employment for more information.

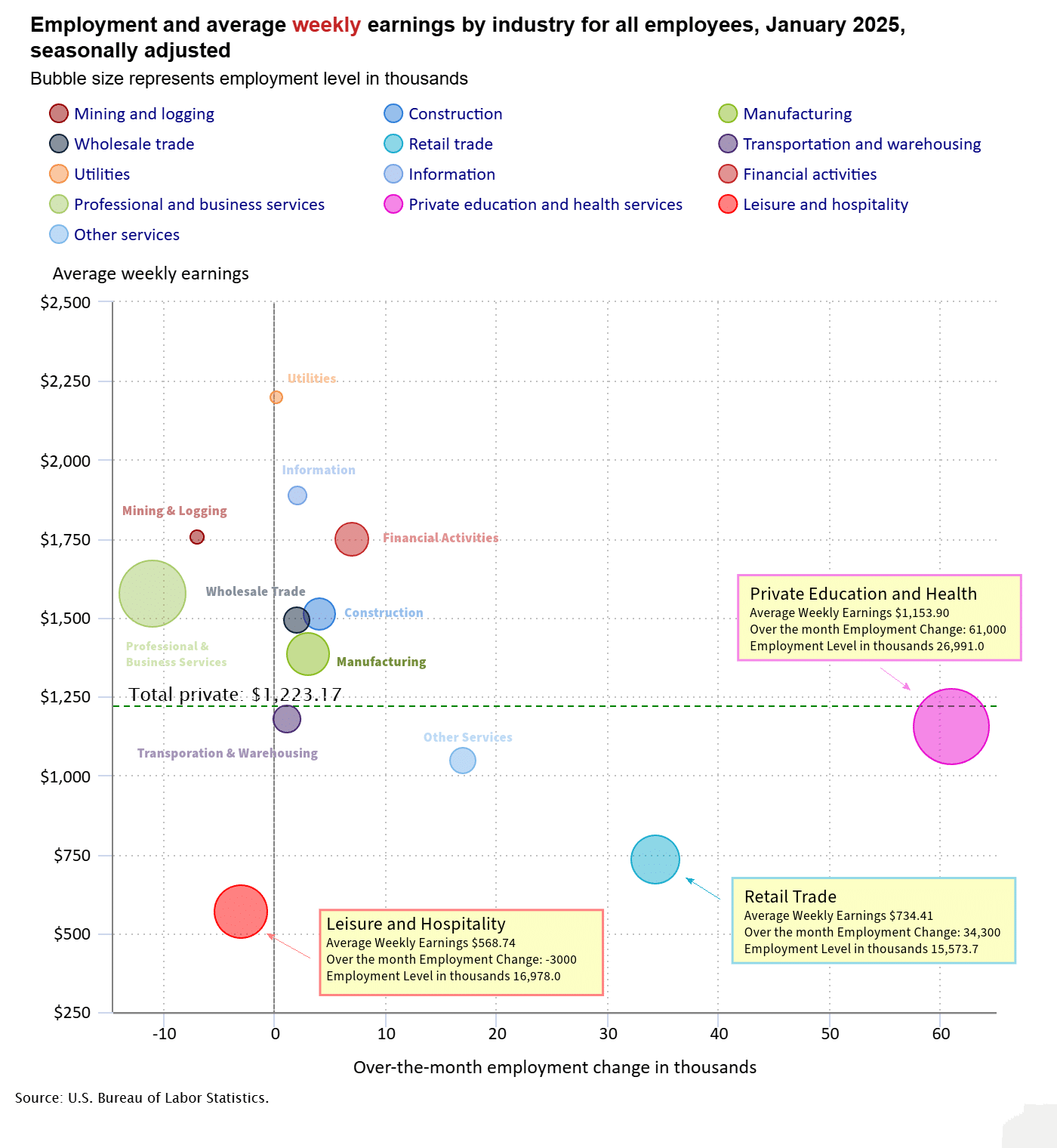

BLS: January 2025 Employment by Sector

The BLS employment “bubble chart” based on the Establishment Survey Data gives us a good picture of the Seasonally adjusted employment numbers.

The Bubble’s Size tells us the total Employment for that industry (i.e., larger bubbles mean more people are employed in that sector).

The bubble’s location on the chart tells us that there has been a change in Employment Levels over the most recent month… A bubble further to the right indicates larger job growth. A bubble’s vertical location on the chart shows the average industry salary.

Remember, these are Seasonally Adjusted Numbers, so they aren’t cumulative!

BLS Average Weekly Wages

| Date | Average Weekly Wage |

| January 2025 | $1,223.17 |

| December 2024 | $1,224.17 |

| November 2024 | $1,221.42 |

| October 2024 | $1,216.28 |

| September 2024 | $1,209.31 |

| August 2024 | $1,207.70 |

| July 2024 | $1,199.39 |

| June 2024 | $1,200.50 |

| May 2024 | $1,197.41 |

| April 2024 | $1,191.93 |

| March 2024 | $1,193.34 |

| February 2024 | $1,185.75 |

| January 2024 | $1,178.16 |

| December 2023 | $1,175.46 |

| November 2023 | $1,173.04 |

| October 2023 | $1,166.20 |

| September 2023 | $1,165.47 |

| August 2023 | $1,163.41 |

| July 2023 | $1,157.28 |

| June 2023 | $1,155.15 |

| May 2023 | $1,146.99 |

| April 2023 | $1,147.58 |

| March 2023 | $1,141.34 |

| February 2023 | $1,141.61 |

| January 2023 | $1,146.14 |

| December 2022 | $1,125.73 |

| November 2022 | $1,129.01 |

| October 2022 | $1,124.01 |

| September 2022 | $1,119.87 |

| August 2022 | $1,116.42 |

| July 2022 | $1,116.54 |

| June 2022 | $1,106.76 |

| May 2022 | $1,105.47 |

| April 2022 | $1,102.01 |

| December 2021 | $1,086.46 |

BLS Employment and Average Weekly Earnings by Industry

January 2025, Seasonally Adjusted Employment

Note that due to “seasonal adjusting,” although they may claim that there was a “monthly increase” (or decrease), there isn’t always an actual increase; you can’t just subtract last month’s “employment level” from this month’s level. For instance, Construction was supposed to be up by 4,000 in January. But December was 8,316,000 and January was 8,291,000 which looks like a 25,000 job decrease not a 4,000 increase.

| Industry | Monthly Increase | Ave. Weekly Earnings | January Employment Level | December Employment Level |

| Total Private Employment | 223,000 | $1,223.17 | 135,479,000 | 136,020,000 |

| Mining and Logging | -7,000 | $1,756.30 | 615,000 | 634,000 |

| Construction | 4,000 | $1,512.01 | 8,291,000 | 8,316,000 |

| Manufacturing | 3,000 | $1,385.60 | 12,761,000 | 12,873,000 |

| Wholesale trade | 2,000 | $1,491.95 | 6,180,600 | 6,191,800 |

| Retail trade | 34,300 | $734.41 | 15,573,700 | 15,677,100 |

| Transportation and Warehousing | 1,100 | $1,176.71 | 6,711,400 | 6,630,200 |

| Utilities | 100 | $2,200.38 | 593,200 | 591,600 |

| Information | 2,000 | $1,887.42 | 2,945,000 | 3,004,000 |

| Financial Activities | 7,000 | $1,746.39 | 9,220,000 | 9,286,000 |

| Professional and Business Services | -11,000 | $1,575.06 | 22,598,000 | 22,978,000 |

| Private Education and Health Services | 61,000 | $1,153.90 | 26,991,000 | 26,802,000 |

| Leisure and Hospitality | -3,000 | $568.74 | 16,978,000 | 17,101,000 |

| Other Services | 17,000 | $1,047.74 | 6,021,000 | 5,935,000 |

Source: BLS

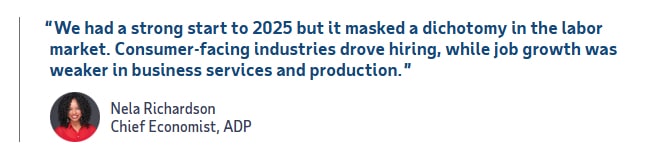

ADP® National Employment Report

ADP provides an independent (non-government) estimate of private-sector employment and pay, based on data derived from ADP client payrolls. According to ADP®, In collaboration with Stanford Digital Economy Lab.

Compared to the Seasonally adjusted 223,000 reported by the Bubble Chart or our calculated decrease of -102,000 jobs, ADP says there were 122,000 new jobs. Of course, this could be because people were taking on an additional part-time job.

ADP: Private employers added 183,000 jobs in January

Source: ADP®

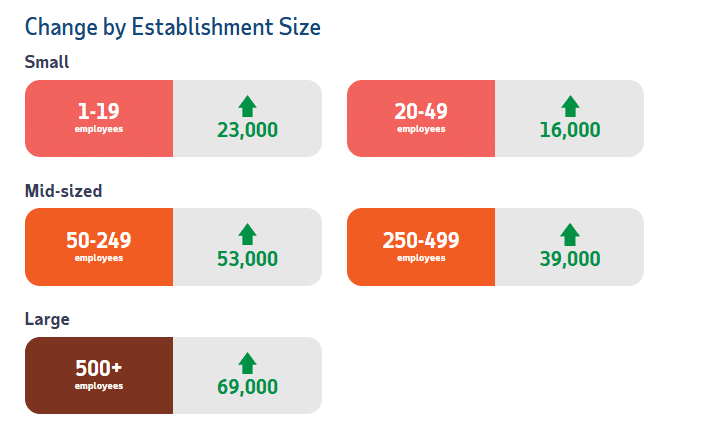

ADP Private Employment by Establishment Size

January ADP Changes:

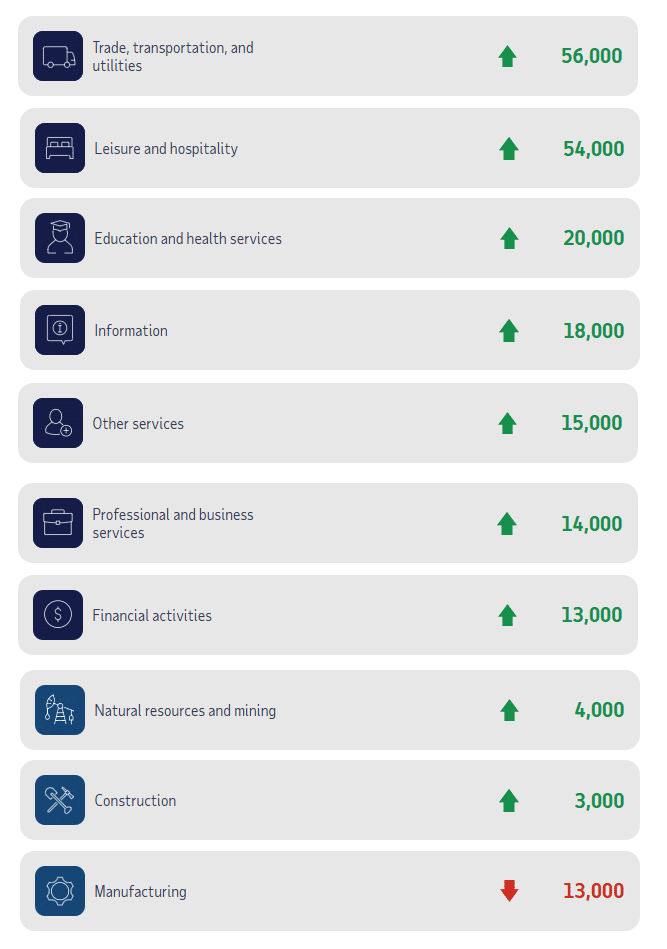

ADP Job Gainers / Losers

ADP provides a different picture of the job situation compared to the BLS perspective. For instance, according to the BLS Education and Health were the largest gainers at 61,000 but ADP says they only gained 20,000. Also, BLS says Leisure and Hospitality lost -3,000 jobs and ADP says they gained 54,000 jobs. ADP also combines Trade, Transportation, and Utilities while the BLS lists them separately.

Unemployment

Seasonally Adjusted Unemployment is down 0.1% at 4.0% which is typical for January.

Labor Force Participation Rate

The LFPR is up from 62.5% to 62.6% .

Less Than Full Employment

This chart compares employment levels with the (inverted) unemployment rate.

Full Employment is when everyone who wants a job has one. It is generally considered to be around 3%. After the unemployment rate almost touched the magic full employment line in April 2023, it began moving away (i.e., higher unemployment).

Note: The Unemployment rate is inverted to track the employment rate. Neither is Seasonally Adjusted. For more information see Employment vs. Unemployment.

Note: Full employment is not considered to be at zero percent because even when employers are having difficulty finding employees, some people are still unemployed due to either:

- structural unemployment (mismatch between worker skills and job requirements, i.e., not enough training) or

- frictional unemployment There will always be people who have quit or have lost a seasonal job and are in the process of getting a new job. Or

- Simply because they quit their job knowing it would be easy to find another (hopefully better) job.

Seasonally Adjusted U1 through U6 Unemployment Rates

Employment-Population Ratio

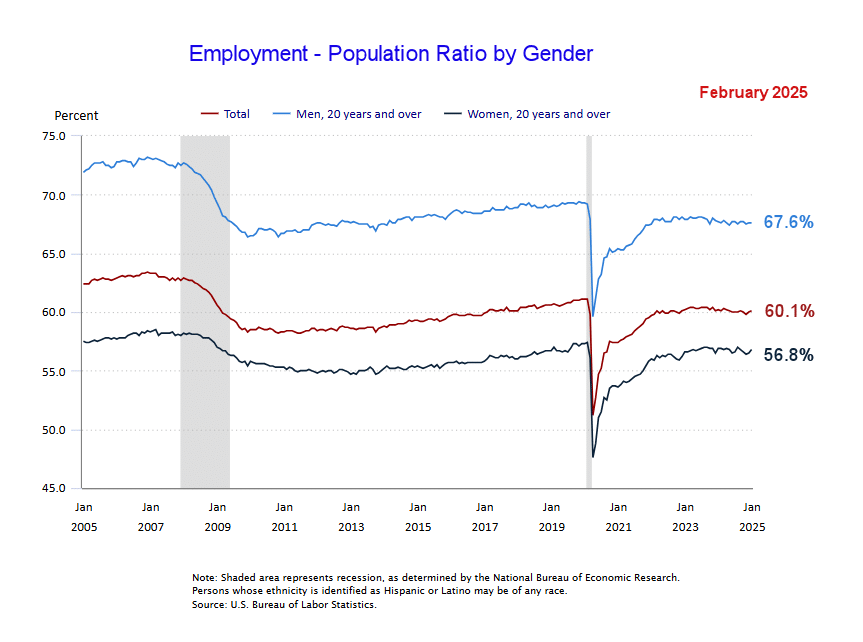

By Gender

This chart shows the Employment-Population Ratio by Gender. Men make up a much larger portion of the workforce, i.e., 67.6% of men are employed and only 56.8% of women are employed. But…

As you can see 20 years ago, back in 2005, almost 72% of men were working and 56.6% of women were working. In 2008 the Great Recession caused a massive decline in employment for both men and women. By December of 2009, only 66.4% of men were working and 55.4% of women. Over the next decade and a half, women workers rebounded back to 56.8% but men only rebounded to 67.6%.

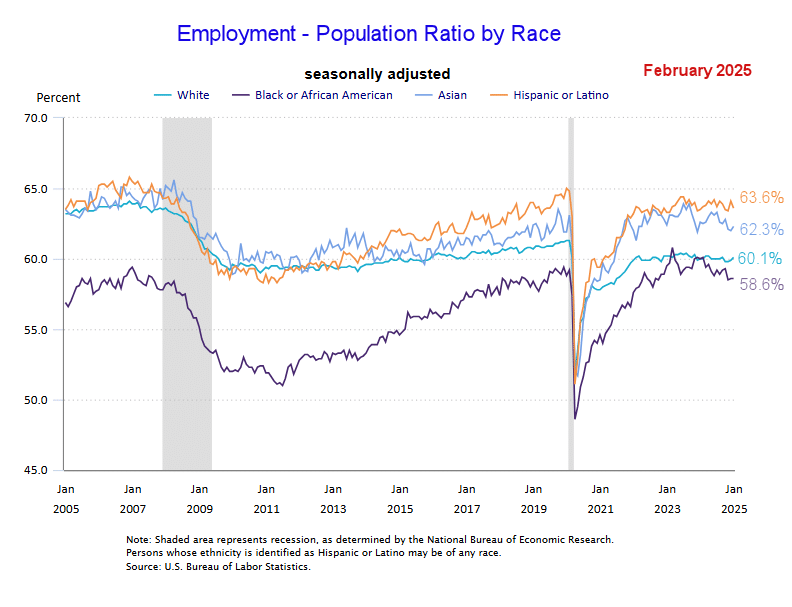

Employment-Population Ratio by Race

This chart shows the Employment-Population Ratio by Race. As we can see Hispanics have the highest percentage employed at 63.6% followed by Asians at 62.3%.

Read more on UnemploymentData.com.

- December 2024 Unemployment Report

- November Unemployment Report

- October 2024 Employment / Unemployment Report

- Can We Trust the September Unemployment Numbers?

- September Jobs Report

- Have Wages Kept Up With Inflation?

- BLS Erases 800,000 Jobs

From InflationData.com

- How Inflation Destroys Civilization

- November 2024 Inflation Up Slightly

- Inflation and Retirees

- 2025 Social Security COLA

- Inflation-Proofing Your Family Budget

From Financial Trend Forecaster

- NYSE ROC

- NASDAQ ROC

- Crypto ROC – BTC and ETH

- February Market Update- NYSE, NASDAQ and Crypto

- The Real Effects of Cutting Government Waste

- How Can Trump Drive Oil Prices Down AND Fill the SPR?

- Ethereum Buy Signal

- Bitcoin ROC Buy Signal

- One American’s Experience with Socialized Medicine

- Five Benefits of Using the Elliott Wave Principle to Make Decisions

- Invest Like Warren Buffet

- Gold Prices: The calm before a record run

- This Trend Will Likely Soon Rock the U.S. Financial System

- Elliott Wave Analysis of Bitcoin

From OptioMoney

- Tips for Mastering the Art of Bargaining and Negotiation After Moving to a New Country

- Consumer Culture Contrasting Spending Habits in the US and Europe

- Financial Considerations When Moving to Florida

- Splitting Your Golden Years:

- Home-Buying Guide for Newlyweds

From Your Family Finances