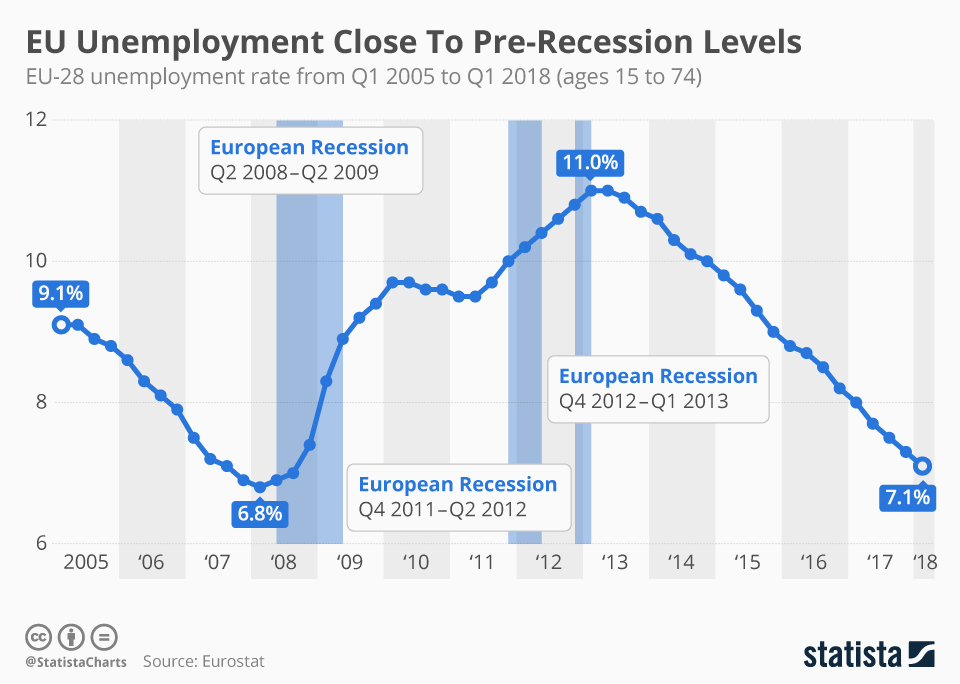

Way back in the first quarter of 2008 European Union (E.U.) unemployment bottomed at 6.8%. Then as the world slid into recession unemployment began climbing, ultimately peaking at 11.0% in the first half of 2013. From there it has gradually declined to 7.1% as we can see in this chart created by Statista.

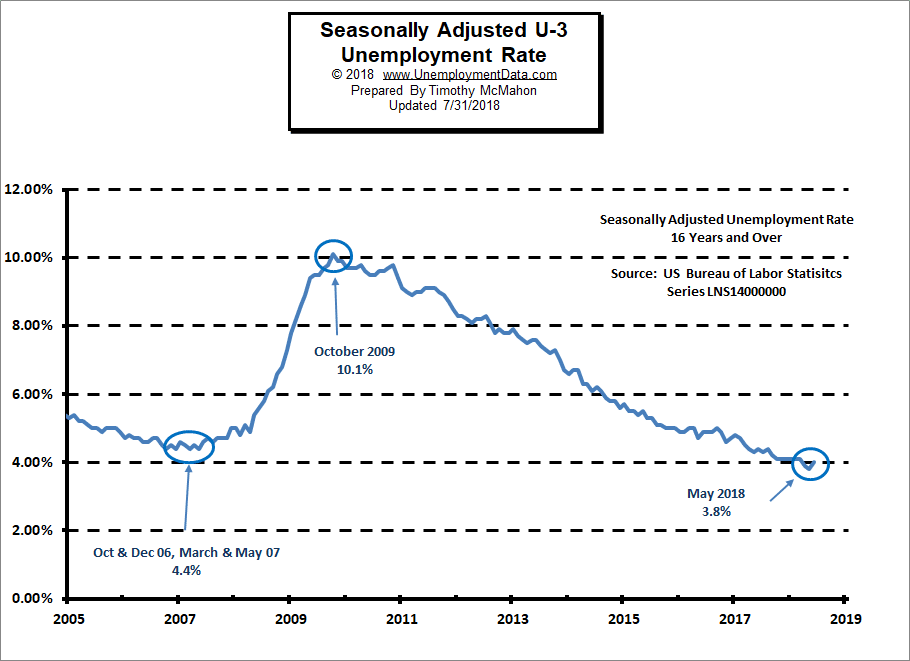

During the same period U.S. unemployment levels were considerably lower with a bottom of 4.4% (roughly 2/3rds the EU level) in October & December 2006 and again in March and May of 2007. And then we see that U.S. unemployment peaked earlier i.e. in October 2009 (compared to 2012-13 for the EU) and at a lower level 10.1% for the U.S. compared to 11.0% for the E.U. Interestingly the U.S. unemployment rate actually shot up faster in that it reached 10.1% in 2009 while the E.U. was still around 9% at that time. But then the U.S. rate turned down while the E.U. unemployment rate continued upward for another 3 years!

Currently the U.S. rate isbelow 2006-07 levels while the E.U. rate has not yet reached 2007 levels. And current U.S. levels are roughly 56% of E.U. levels.

Why are E.U Unemployment Levels So Much Higher?

This makes us ask a few questions:

- Why are U.S. unemployment levels consistently lower than E.U. levels?

- Why did U.S. unemployment levels rise faster than E.U. levels?

- Why did E.U. unemployment levels take longer to fall?

Why are U.S. unemployment levels consistently lower than E.U. levels?

The simple answer is that our economy is simply stronger than the E.U. economy. But there is more to it than that. Why is our economy stronger? To answer that we have to look at government policies. The E.U. has much more levels of bureaucracy. First they have the local country bureaucracy which in the case of Southern European countries like Spain, Italy, and Greece especially is quite restrictive and “anti-business” and then added upon that they have another layer of E.U. bureaucracy from Brussels that actually forces countries to be less competitive than they would be without the E.U.

According to a 2016 Financial Times article, “Europe’s biggest companies, banks and investment groups have launched a scathing attack blaming mounting regulations for stifling competition and threatening businesses with hundreds of billions of euros in extra costs.” These regulations and resulting extra costs have the effect of reducing the profitability of European companies and thus they cannot afford to hire as many employees. For instance, Brittain’s fishing industry was devastated by reducing the allowable fishing limit from 200 miles off the coast to 12 miles. The cucumber industry was devastated by regulations on how much a cucumber could bend. Eggs can’t be sold by the dozen but must be sold by the kilo, to save energy vacuum cleaners power was restricted by regulation to levels so low that they barely worked, production caps limited how much certain countries can produce, etc. Which brings us to the next question.

Why did U.S. unemployment levels rise faster than E.U. levels?

In the 2 ½ year period from March/May 2007 through October 2009 U.S. unemployment levels more than doubled from 4.4% to 10.1% (i.e. a 129% increase). During the same period E.U. unemployment levels went from 6.8% to 9.5% (a 40% increase). So U.S. unemployment skyrocketed while E.U. unemployment slowly crept up. Why the difference? Once again we see that legislation in the E.U. makes it very difficult for employers to lay-off employees. They are required to pay massive severance packages and thus are reluctant to let employees go. At first blush these “Socialist” policies may appear to be a good thing as unemployment is not rising as fast as in the mean old “Capitalist” U.S. but then we have to look at the long term effects.

Why did E.U. unemployment levels take longer to fall?

In the long run we see that the stringent regulations benefit a select few i.e. those with jobs but harm many more since as we saw earlier the base unemployment rate is higher, and unemployment levels remained higher for longer as well. As regulations reduce competitiveness and raise costs companies take longer to rehire employees for fear that they will be locked into high payments for these employees if the economy takes another dive. In addition, simply having more regulations to comply with means higher costs and fewer jobs. To some extent Obama tried to follow Europe’s example and added layers of bureaucracy in an effort to regulate away the recession. As a result, many believe that it actually took much longer for the U.S. to recover than it would have had Obama taken the opposite tack and reduced government intervention in the economy.

You might also like: