Today I’d like to welcome Mike Shedlock aka. “Mish”. He is a registered investment advisor representative for SitkaPacific Capital Management. He has graciously allowed me to reprint his article that answers the question “Can we expect more factory jobs out of the current expansion?” He includes some compelling arguments on why unemployment isn’t falling. Tim McMahon~editor

The latest ISM reports show Factories grow for 17th straight month in December.

Manufacturers produced more goods and booked more orders last month, leading to the fastest growth in factory activity since May.

The Institute for Supply Management said Monday that its index of manufacturing activity rose to 57 in December from 56.6 in the previous month. Any reading over 50 indicates growth. The latest is well above the recession’s low of 32.5, hit in December 2008. But it’s below the reading of 60.4 in April, the highest level since June 2004.

The report shows that manufacturers carried considerable momentum into the new year. Automakers, computer and electronics companies, and industrial machinery firms showed particular strength, the Tempe, Ariz.-based ISM said.

A survey of Chinese manufacturers last week showed that nation’s boom lost a bit of momentum last month. The HSBC China Manufacturing Purchasing Managers Index slipped to 54.4 in December from 55.3 in the previous month, a three-month low. Still, the number indicates China’s factories are increasing output.

In the U.S., export orders are still growing, the ISM said, but at a slower pace. ISM’s index of export orders was 54.5 in December, down from 57.

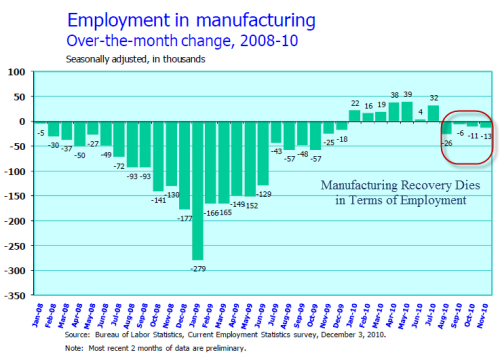

A big question for this year is whether the growth will translate into more hiring. According to the ISM, manufacturers are adding jobs, but at a slower pace. Its employment index fell to 55.7 from 57.5. But the ISM’s employment index hasn’t always been very reliable: the manufacturing sector has actually shed small numbers of jobs for the past four month, according to the Labor Department.

Manufacturing Employment

The BLS Current Statistics report shows November lost 13,000 jobs, October 11,000 jobs, September 6,000 jobs and August 26,000 jobs.

In spite of 17 consecutive months of manufacturing expansion, hiring was only up 7 of those months, and not once in the last 4.

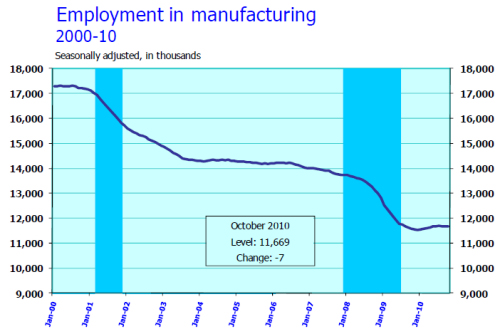

Manufacturing Long-Term Trends

The long-term trend suggests it would be a mistake to expect too many jobs out of manufacturing.

For more about jobs please see Jobs Forecast 2011 Calculated Risk vs. Mish

The BLS report for December comes out on January 7th. The January report comes out on February 4th. Those reports could be robust because of retail and service sector hiring, especially the January report.

Normally there are a lot of layoffs in January for obvious seasonal reasons. However, some of the recent hiring by stores might be permanent. If so, some expected layoff may not happen and we could see a couple of really nice looking jobs reports.

However, it would be a mistake to think that stores are going to keep hiring at a brisk pace all year simply because a couple of months look good. Headwinds are enormous and the mess states face is not accounted for. We are not going to spend our way back to prosperity regardless of what Keynesian clowns may think.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com

Factories Expand 17 Consecutive Months, Jobs Don’t