Often we get complacent and think that our situation is the same (or very similar to) other developed countries. But that is not always the case. Today we are going to look at how the unemployment rate in the U.S. compares to that of Europe.

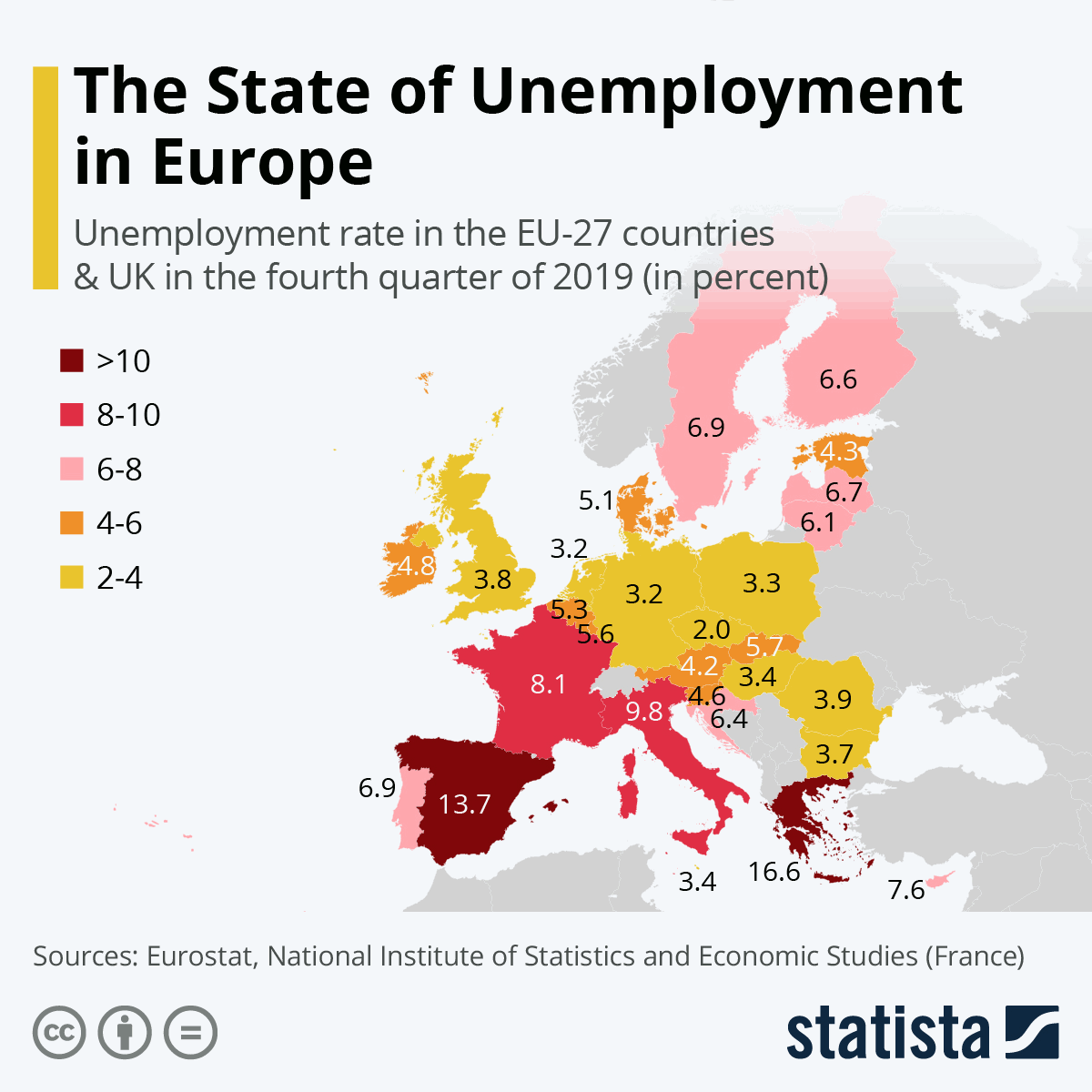

In the following chart created by Statista from data supplied by “Eurostat” and “National Institute of Statistics and Economic Studies (France)” we can see that Europe itself is not one unified block with identical (or even similar) unemployment rates.

The data in this graphic is from the end of 2019 when unemployment rates in the United States were at 3.5%. We can see that the countries in yellow had comparable unemployment rates to the U.S. i.e. Germany, Poland, and the Netherlands. Britain, Romania, and Bulgaria were in the high 3’s with the surprise being the Czech Republic coming in at a scant 2.0%. According to an article in The Atlantic, the 2017 elections decimated the “Left and Center” leaving the moderate right and the anti-immigrant far-right. So we are free to conclude that without the influx of cheap labor from Northern Africa, that all of the rest of Europe welcomed with open arms, the Czech Republic has record low unemployment as only native Czech’s are competing for the jobs.

One of the other surprises is that the Nordic Countries that the media often suggest that the U.S. should emulate has unemployment in the high 6’s i.e. roughly 50% higher than the U.S.

The countries that are not surprises are the basket cases of Greece, Spain, Italy, and France which have unemployment rates of 16.6%, 13.7%, 9.8%, and 8.1% respectively. One minor surprise was that Portugal was not among them but instead had unemployment rates more in line with the Nordic Countries.

One of the other lessons we can garner from the variety on this map is that although they had a unified currency they still had wide-ranging unemployment rates. So what could cause such a divergent economic situation?

First of all, as we already mentioned is immigration policy. If you have a massive influx of unskilled labor your unemployment rate is bound to skyrocket.

The Effect of Tax Rates and Social Welfare

Another factor is tax rates and social welfare. If you incentivize holding out for a better job, people will naturally take longer to find one, so there is less incentive for Nordic citizens to “take any job” because they have such wonderful unemployment benefits. Thus those who are working are subject to higher taxes to cover the expenses of their unemployed brethren. High taxes also raise costs for employers which means they can afford fewer workers.

Finland has a max tax rate of 67%, Norway is 53%, and Sweeden is 69.8%. The high unemployment countries of Greece has a combined tax rate of 65.67%. Spain has 45% maximum Income tax rate plus an employee contribution of 6.35% Social Security tax, 4.7% pension contribution tax, 1.55% unemployment tax, 0.1% worker training tax. This does not include the employer contribution of 23.6% Social security tax, 5.5% unemployment tax, 3.5% (or more) workers comp tax, worker training tax .06%, 0.2% FOGASA tax (employment tax in case of company bankruptcy).

Italy has a 43% income tax + 2.03% regional income tax + 0.8% municipal income tax. And France has tax rates of (45% +4% for annual incomes above €250,000 for single taxpayers or above €500,000 for married couples) + social security and social contribution taxes at various rates, for example, 17,2 % for capital gains, interest, and dividends.

Efficiency and Bureaucracy

At first blush, one might think that a high level of inefficiency would result in a lower unemployment rate since it takes more people to do the same job. But as our data shows countries like Germany with a reputation for high efficiency have lower unemployment and countries with (shall we say) more laid back lifestyles like the Mediterranean countries of Spain, Italy and Greece have much higher unemployment rates. These same countries also have a reputation for being highly bureaucratic taking weeks or even months to get simple things done. This frequently results in companies relocating to more friendly (and efficient) locations thus reducing the number of employers and increasing unemployment.

Corporate Tax Rates

In addition to personal income taxes corporations are also subject to taxes, in Greece for example, the corporate tax rate is 28%, in this case, Germany is quite similar depending on municipality ranging from 22.825% (in some small villages) to 32.925% in Munich. In 2018, France lowered its corporate tax rate from 33.3% (or more) to 30%. Italy has a 27.9% corporate tax rate, Spain has 25%, Sweeden is in the process of lowering their rates from 22%to 20.6% in 2021. Denmark is 22%, Finland is 20% and the Czech Republic is 19%. Ireland with its moderate unemployment rate of 4.8% has a corporate tax rate of from 12.5% to 25% depending on the type of business.