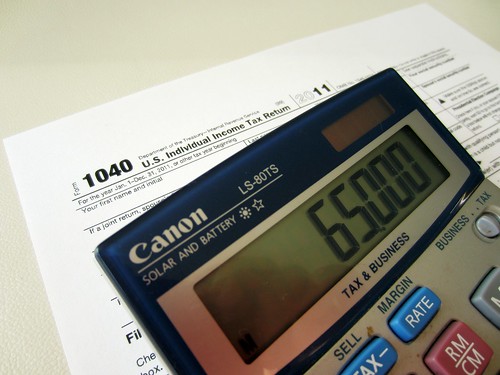

Keep all Business Receipts

As a small business owner, it’s absolutely imperative that you keep every receipt connected to your business expenses. Looking at old bank statements, trying to remember why you spent seventy dollars and eighty-three cents at Home Depot a year ago, and if it was a business expense or not, is frustrating in the extreme. Keeping a file for receipts for all business purchases you make throughout the year will allow you to start 2014 without the anxiety. On top of that, if you can do a once a week categorizing of all of the receipts will help you keep organized, and at the end of the year, will give you a list of total expenses, rather than having to go back through all those receipts. If you want to get really high tech you could try using the NeatReceipts Mobile Scanner and Digital Filing System.

Small Business Tax Deductions- Vehicle and Property Costs

If you use a vehicle for work or [Read more…] about Keeping Your Small Business Taxes Organized