The U.S. Bureau of Labor Statistics (BLS) released its employment / unemployment report for March on April 7th 2023.

Employment Up and Unemployment Down

- Adjusted U-3 was 3.5% down from 3.6%

- Unadjusted U-3 was 3.6% down from 3.9%

- Unadjusted U-6 was Down from 7.3% to 6.8%

- Labor Force Participation Up from 62.5% to 62.6%

- Unadjusted Employment rose from 153.997 to 154.517 million

According to the Commissioner of the U.S. Bureau of Labor Statistics:

“Total nonfarm payroll employment rose by 236,000 in March, and the unemployment rate changed little at 3.5 percent, the U.S. Bureau of Labor Statistics reported today.

Employment continued to trend up in leisure and hospitality, government, professional and business services, and health care.”

You can read the full BLS report here.

As usual, they are talking about “Seasonally Adjusted Jobs”.

Looking at the Establishment Survey report we see…

Originally the BLS reported employment of 153.955 million for February which they adjusted to 153.997 million. So they added 42,000 jobs for February. They are reporting 154.517 million jobs for March which is actually an increase of 562,000 jobs based on their original estimates or an increase of 520,000 based on their updated numbers.

Full Employment?

Full Employment is when everyone who wants a job has one. It is generally considered to be slightly above 3%. Although, other factors, such as unemployment benefits, can shift the level higher or lower. So, if unemployment benefits are extended from 6 months to 1 year, people will tend to stay unemployed longer, thus raising the unemployment rate.

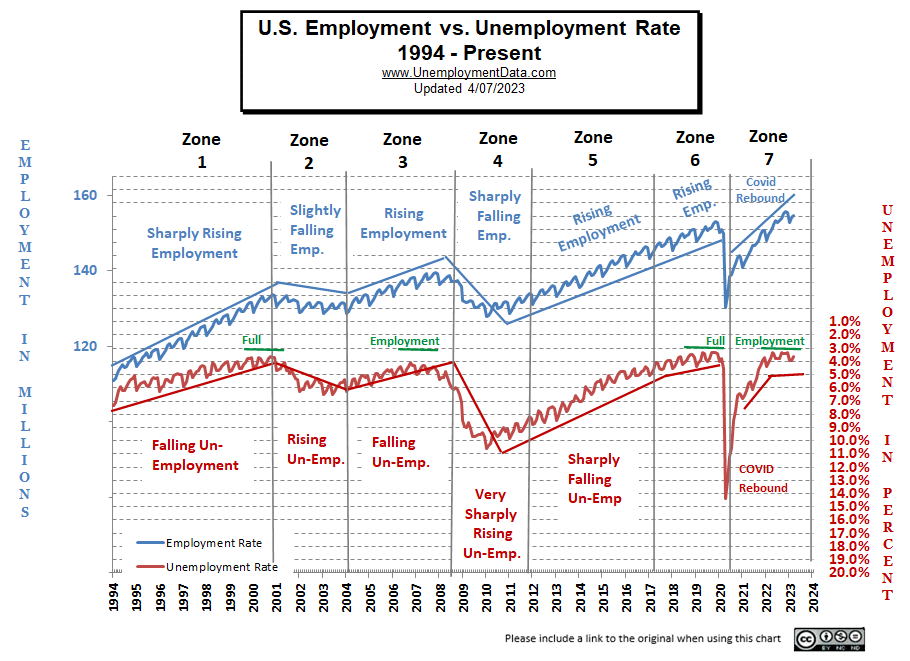

In the following chart, we can see four examples of employment continuing to rise, but unemployment flattens out at just over 3%.

Full employment is not considered to be at zero percent because even when employers are having difficulty finding employees, some people are still unemployed due to either structural unemployment (mismatch between worker skills and job requirements, i.e., not enough training) or simply because they quit their job knowing it would be easy to find another (hopefully better) job. Often referred to as frictional unemployment (there will always be people who have quit or have lost a seasonal job and are in the process of getting a new job). See: Highly Skilled Worker Shortage in a Recession?

If the unemployment rate stays constant, but more people are working, where are these extra workers coming from?

Somehow the workforce has to be growing to accommodate these newly created jobs. They could be long-term unemployed (no longer counted in the workforce) returning to the workforce, they could be immigrants entering the workforce, or possibly retired people coming out of retirement because of an offer too good to turn down.

ADP® National Employment Report

According to ADP® In collaboration with Stanford Digital Economy Lab, private employment was up in March.

ADP: Private employers added 145,000 jobs in March.

In other words, Ms. Richardson is saying that a 145,000 increase in jobs is not as high as she would have expected for a March with strong growth. And “pay growth” has plateaued and decreased slightly. Last month, “Job stayers” averaged a 7.2% annual increase in pay, while this month, the average annual increase is down to 6.9%.

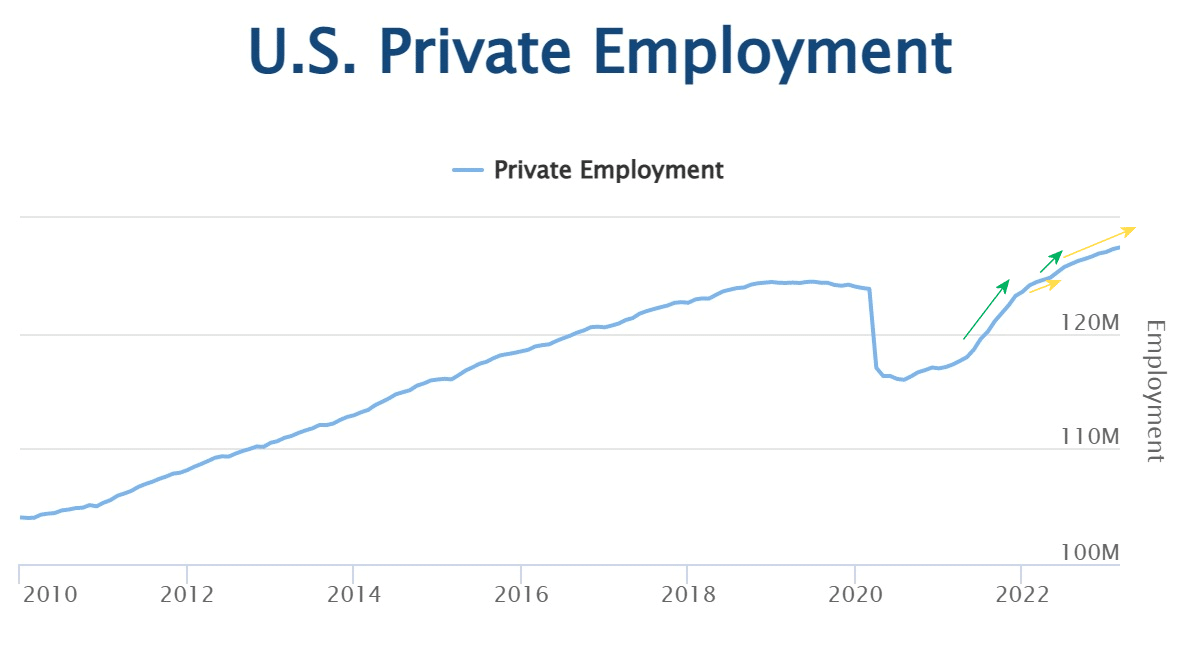

I’ve added some arrows to their private employment chart to indicate the slope of the line. The long green arrow shows the rapid post-COVID rebound in employment. Then in early 2022, the rate of increase slowed (small yellow arrow). Then around March 2022, the rate of increase picked up again (small green arrow). Perhaps, that is what Ms. Richardson was expecting. But instead, we’ve seen steady growth without the turbo boost of last year.

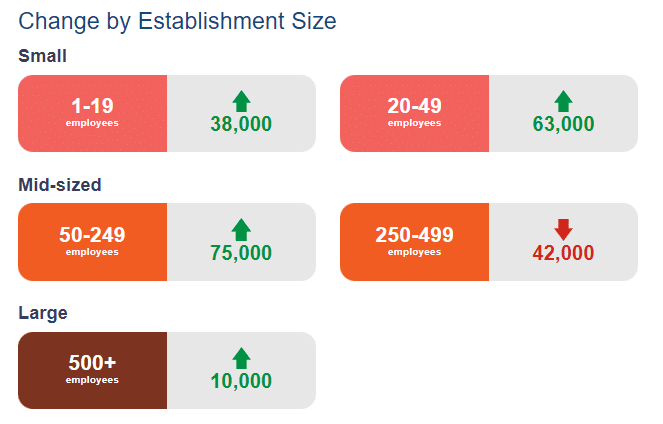

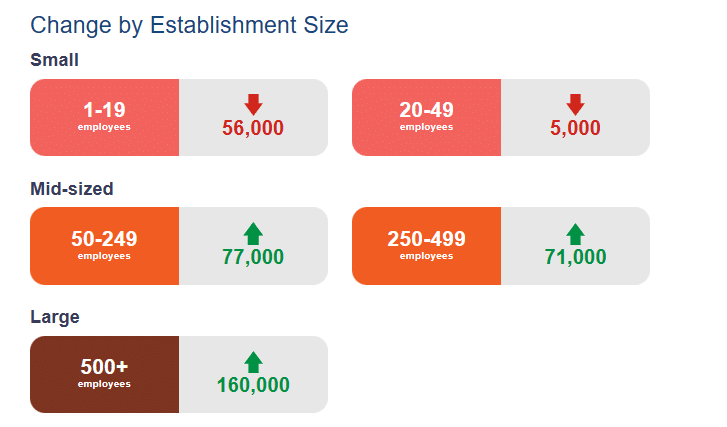

ADP Private Employment by Firm Size

ADP also lists increases by “firm size”.

This month, small companies are reversing the downsizing they did last month, while larger companies cut way back on their hiring.

March ADP Changes:

Comparing March changes to February changes we can see that increases shifted from large firm hiring to small firm hiring.