The U.S. Bureau of Labor Statistics (BLS) released the unemployment rate information for the month of April. The typically quoted “Seasonally Adjusted U-3” rate fell from 6.7% in March to 6.3% in April. The unadjusted U-3 was even lower at 5.9%. The broadest measure of unemployment which includes those who “would like” and are able to work, but have not looked for work recently and also includes part-time workers who want to work full-time is U-6 and the BLS determined that that rate is 11.8% down from 12.8% in March.

In addition according to Gallup the U.S. Payroll to Population employment rate (P2P), which is the percentage of the adult population that is working full-time for an employer was 43.4% in April up slightly from 42.7% in March. The average P2P for 2012 was 44.4% and for 2013 was 43.8% so we have not even reached those levels yet after declining sharply in January indicating that this has been a very anemic recovery in spite of the unprecedented level of quantitative easing.

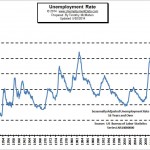

The U-3 Current US Unemployment Rate Chart shows the full picture of unemployment rates since 1948.

To get a better picture of the current employment situation you can compare the employment level vs. the unemployment rate.

In this chart we can see the historical employment figures from 1939 through the present. But in addition to the number of jobs we can also see the recessions shaded blue.