If you are business-minded and good with numbers, consider making a career change to financial risk management (FRM).

As the name suggests, a risk management analyst assesses strategies for businesses and determines appropriate risks. So, how do you start a financial risk management career?

Understanding Financial Risk Management

There’s almost always a risk when it comes to spending money. Typically, businesses and organizations have guidelines to manage those risks and attempt to protect their financial interests.

The roles of financial risk management specialists are:

- predicting market trends that relate to the company

- using risk management tools to study potential financial risks

- potentially influencing company decisions

There are several categories of financial risks that you may specialize in. These risks include:

- Operational: involves the company’s day-to-day risks from management or technical failures

- Legal: involves risks related to legal proceedings

- Liquidity: involves funding or asset transactions

- Credit: involves the company’s debts or borrowings

- Market: involves the changing prices of funds, bonds, and shares

You may also come across other categories such as commodity, derivatives, and portfolio risk.

Financial risk managers are in high demand, as this type of advice is crucial for many businesses. You may be drawn to a certain specialty, or you may fall into one based on employment options.

How to Start a Career in Financial Risk Management

It would help to have a financial risk management bachelor’s degree, but this degree is not a hard and fast requirement.

To take the traditional route, you could have a bachelor’s degree in any finance or mathematics-related field. Some financial risk managers also get a master’s degree or an MBA.

For a non-traditional route, you could seek out online courses and certifications. A financial risk professional should have:

- leadership and project management skills

- analytical skills

- the ability to communicate professionally and effectively

- awareness of your state’s financial risk policies

Either way, you’ll need to pass the FRM Examination, which tests your knowledge of the financial industry. The exam has two consecutive parts, and the results are given as pass or fail.

Financial Risk Management Jobs

FRM is an exciting field because you’ll have a variety of employment options. Banks, government agencies, IT companies, and other financial institutions all need risk managers.

If you have a specific interest, you can work within that niche. Some people with FRM certifications may also work in:

- managing retail loans

- credit rating agencies

- risk consulting

- auditing

- compliance departments

- asset management or wealth management

- trading

- investment banking

On any given day, you may find yourself working on budgets, reviewing business contracts, creating presentations, and maintaining records.

The Perks of Making a Career Change

While changing careers is a daunting process, there are many reasons to study financial risk management. With an ever-changing market, the business world will always need risk specialists.

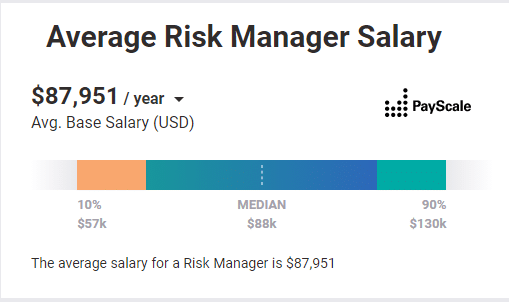

Additionally, the average salary is higher than many similar positions. According to Payscale.com the average salary for a Risk Manager is $87,951/yr. Of course, that includes positions with all levels of experience across all job markets in the U.S. so starting salaries will be less.

The steps to FRM certification will be well worth it if you enjoy problem-solving and seeing the results of your solutions in real-time.

For more information about careers in finance, check out the rest of our careers section.

You might also like: