One of the most important questions regarding your income is whether your wages have kept up with inflation. You might be getting nice yearly raises, but if inflation is growing faster, you are still falling behind. So, in order for your purchasing power to increase or at least stay the same it is important to look at Inflation-Adjusted wages.

If you ask your neighbors, they will almost certainly say that the average wage hasn’t kept up with inflation. And since “bad news sells” even the media tends to try to convince us that the average wage hasn’t kept up with inflation. But what do the actual numbers say?

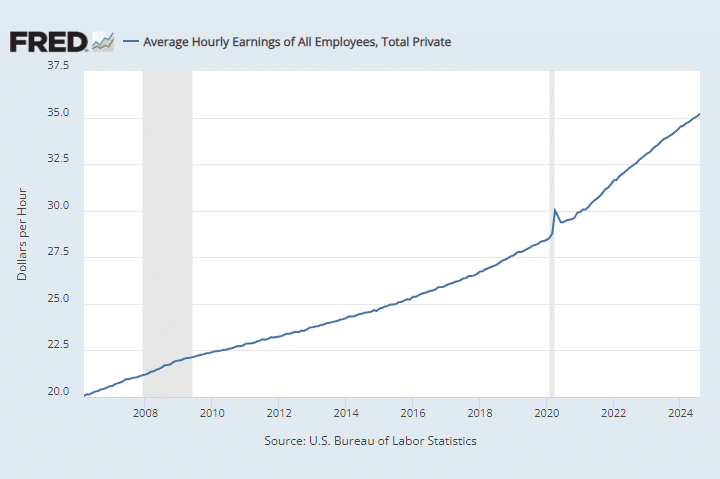

If we look at the numbers presented by the Federal Reserve CES0500000003 index (Average Hourly Earnings of All Employees) we get the following chart. And it looks pretty good, wages are going up fairly steadily. But is inflation going up faster? We really can’t tell.

Inflation-Adjusted Hourly Wages

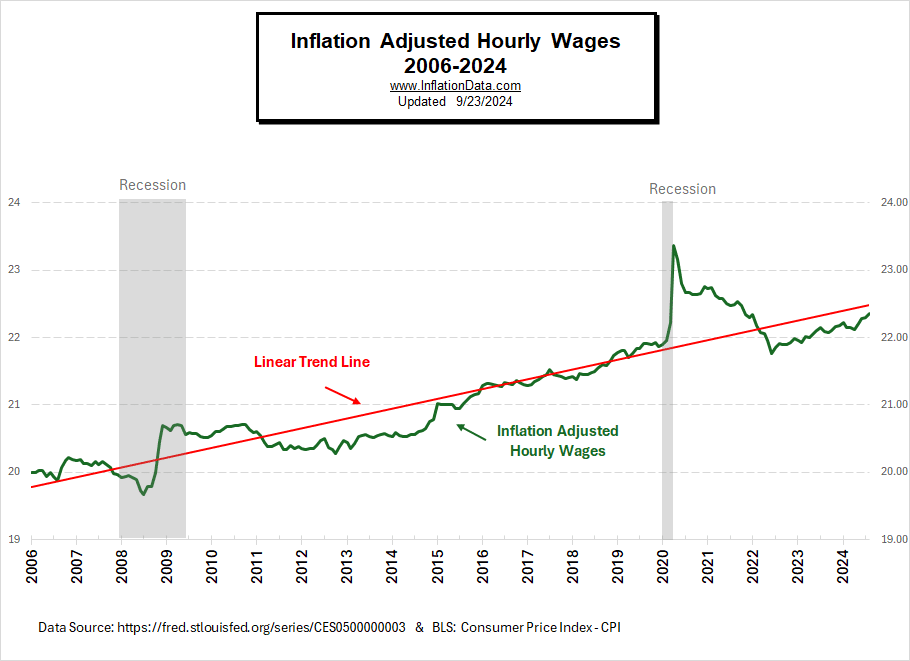

So to get the true picture we have to adjust it by the Consumer Price Index (CPI-U) and then we get the following chart:

Based on this chart since 2006 (the farthest this data series goes back) we can see that the trend line is actually rising pretty steadily as well. The major exceptions are the beginning of the 2008 recession and from 2020 through the middle of 2022. So, the long-term trend is that average wages ARE actually beating inflation. If wages were just keeping up with inflation the trendline would be flat and if wages weren’t keeping up with inflation the trendline would be sloping down.

Inflation-Adjusted Hourly Wages vs. CPI

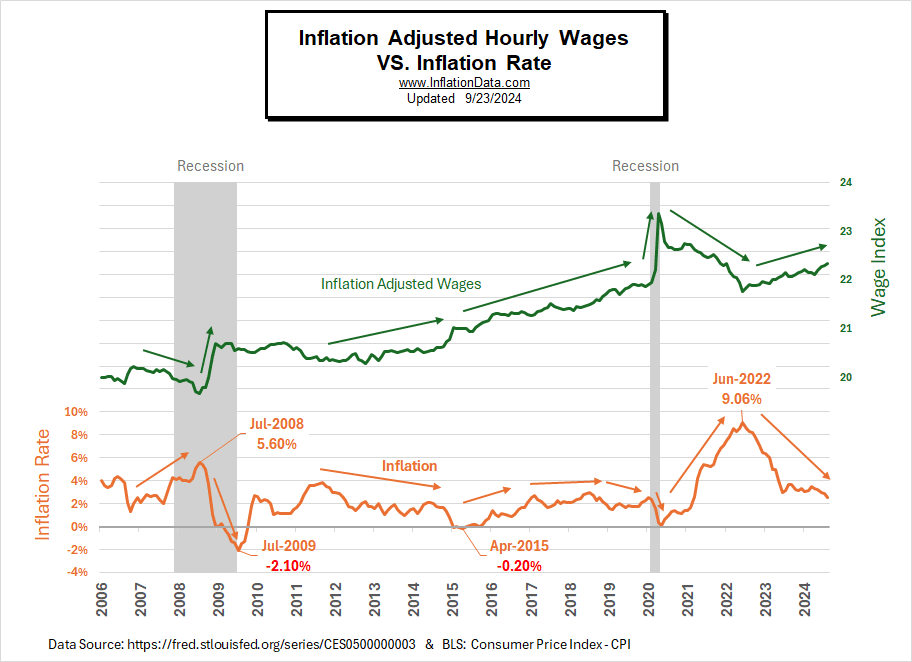

To get a bit better idea of the shorter-term trends we can look at the the above chart compared to the Annual Inflation Rate and see how wages perform during various time periods.

This chart shows that just before the 2008 recession inflation was rising and peaked in July 2008 at 5.60%. During that period, inflation rose faster than wages, so inflation-adjusted wages fell. But then, the recession caused prices to fall, so instead of inflation, we had deflation culminating in July 2009 at -2.10%. Because overall prices were falling, but wages were not, those people who weren’t laid off actually saw an increase in their purchasing power.

From 2009 through 2011, inflation picked back up but wages rose enough to compensate so Inflation-Adjusted wages remained relatively stable. Then another spike in inflation hurt purchasing power. After peaking in 2011, inflation remained below the FED target of 2% through the end of 2014, while wages increased just enough to keep up with inflation and then the drop in inflation to just below zero percent in April 2015 gave wages the opportunity to get ahead. In other words, wages increased slightly while inflation stalled. This would have been a good state of events for workers if it could have continued but then in 2016-2017 inflation started picking up again. Fortunately, wages increased faster so inflation-adjusted wages continued to rise. From 2017 through mid-2018 inflation remained steady at near the FED’s target 2% rate and wages continued to grow faster.

In 2019 both inflation and wages were fairly equal, so Inflation-adjusted wages were fairly level. And then COVID hit. Unemployment spiked, inflation fell sharply and inflation-adjusted wages skyrocketed. This was partly because of the low inflation but also because minimum wage workers were laid off, leaving only workers at higher levels, thus skewing the average wage.

After the recession ended, inflation-adjusted wages fell sharply and then leveled off. This sharp decline was probably the result of the lower-wage workers returning to the workforce.

Of course, then inflation shot up and inflation-adjusted wages fell in 2021 and 2022. And then finally as inflation got below 4% and labor shortages drove up wages we see inflation-adjusted wages rising again. Note that the angle of increase is pretty much the same as the overall angle from 2012 through 2019, except that it is actually displaced a bit lower. This displacement is the cost of inflation.

Inflation-Adjusted Wages by President

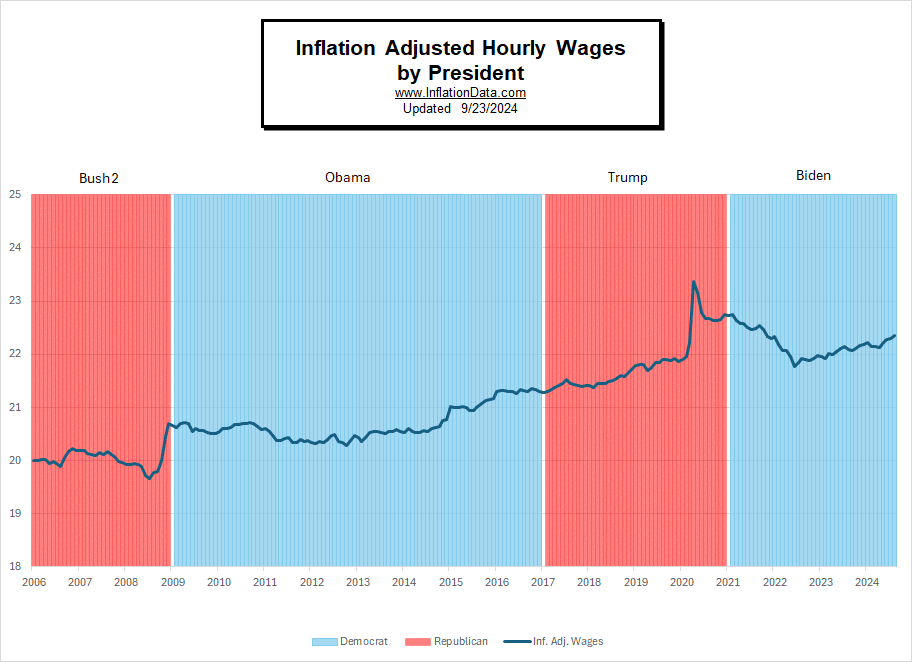

The final chart shows inflation-adjusted wages by President. We can’t see all of Bush 2’s term but what we can see inflation-adjusted wages were flat to slightly down until the 2008 recession hit. Under Obama inflation-adjusted wages were flat for the first 3/4s of his term then inflation-adjusted wages rose during 2015 and then remained flat during 2017. Under Trump inflation-adjusted wages rose steadily until the pandemic hit which skewed wages as previously discussed. Under Biden inflation-adjusted wages suffered under high inflation but then started to recover but still haven’t reached the levels they were at when he took office.

You might also like: