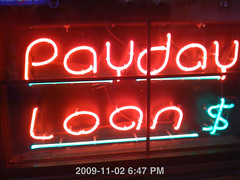

Payday Loans

Even for people who are careful, life’s unexpected events happen. People who have their lives carefully ordered and their finances sorted can still have a temporary setback in which they will need just a little bit of immediate cash to keep the train on the tracks. Cars do break down and trees do fall on roofs. These things are a part of everyday life that cannot be exactly predicted.

What can be predicted is that when they happen they are expensive even with insurance coverage.

Because “emergencies” can happen at any time you should be prepared for them. Proper budgeting involves a fund set aside to handle these intermittent but totally expected events. If a tire blows out you should be prepared knowing that tires don’t last forever. The same with washing machines, refrigerators, and roofs. Hopefully, they won’t all blow up at the same time. But if you don’t have an emergency fund that you are putting money into every paycheck in preparation then you are actually living beyond your means, even though during “normal” times it may not seem like it.

But eventually, something will happen and then you will have to resort to a payday loan and life will get much worse because you will not only need to pay for the repair but the high-interest rates that go with it. Plan for emergencies and they won’t be an “emergency” they will be a minor bump in the road of life. But if your credit cards are maxed out and you are living on the edge… a blown tire will force you to seek ever-higher cost forms of debt.

According to the Consumer’s Union: “Payday” loans are small, short-term loans made by check cashers or similar businesses at extremely high-interest rates. Typically, a borrower writes a personal check for $100-$300, plus a fee, payable to the lender. The lender agrees to hold onto the check until the borrower’s next payday, usually one week to one month later, only then will the check be deposited. In return, the borrower gets cash immediately. The fees for payday loans are extremely high: up to $17.50 for every $100 borrowed, up to a maximum of $300. The [annual] interest rates for such transactions are staggering: 911% for a one-week loan; 456% for a two-week loan, 212% for a one-month loan.

$17.50 may not sound like much but if you are working a near minimum wage job making $7.50 an hour you will need to work an extra 2 hours and 20 minutes just to pay the “fee”. $17.50 is 17.5% of $100 but since it is a “fee” and not “interest” it isn’t regulated in the same way. High-interest credit cards may charge 18% to 24% a Year compared to 17.5% a week for a payday loan. Thus you would still be better off with an Instant Approval Credit Card or a card for people with Bad Credit… even though the terms aren’t great… they are still infinitely better than the fees on a payday loan.

Post a comment and tell us what you think about Payday Loans.

See Also: