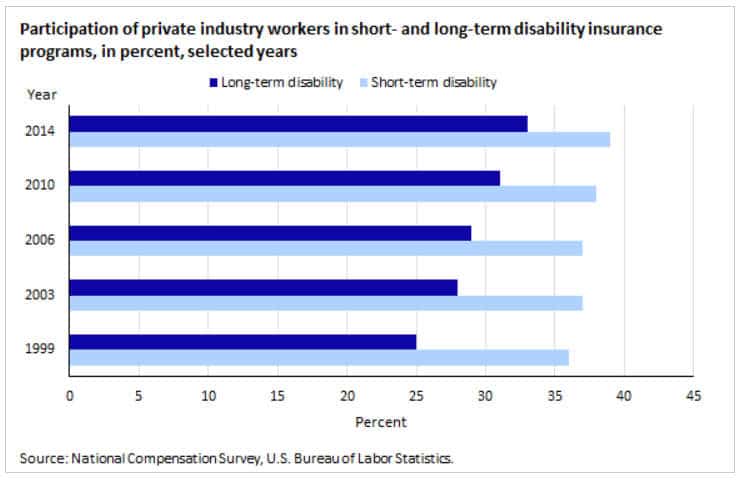

When you think of insurance through your employer, you typically think about health insurance. However, according to the Bureau of Labor Statistics (BLS), there is a growing trend for employers to offer other types of insurance as well. One of those is disability insurance. In this table (although dated) provided by the BLS, we can see that both long-term and short-term disability insurance coverage has increased over the years.

As the name implies, short-term disability plans are designed to replace lost wages for a short, fixed amount of time. Ninety-three percent of private industry workers are covered by a short-term plan. Generally, coverage is about 26 weeks.

If you are among the lucky ones whose employers offer the opportunity to have disability insurance here are some reasons why you should take them up on their offer.

4 Reasons to Get Disability Insurance Through Your Work

#1 Coverage

First of all, having disability insurance coverage in place will give you and your family tremendous peace of mind. Should the unthinkable happen and you become unable to work, this insurance will replace 60% of your income. As an example, if you earn $100,000 per year, disability insurance will pay you $60,000.

#2 No Health Questions or Medical Exams

When your employer offers group disability insurance, one of the biggest benefits you can reap is not having to answer any health questions or take a medical exam prior to getting coverage. Thus, it is much easier to qualify for this type of coverage, versus having to purchase it on your own. Also, you will get disability benefits assistance when filing a claim.

#3 Much Lower Costs

Of all the benefits that come with getting disability insurance through your employer, perhaps the biggest is the much lower costs you’ll encounter. In many cases, employers will offer this insurance to their employees at no cost, which gives you no reason whatsoever not to take the coverage. According to the BLS, “Most workers do not make contributions to their short- or long-term disability insurance plans. Across all workers, only 18 percent are required to contribute to short-term disability insurance and 6 percent to long-term.”

However, even if your employer does require you to pay for your disability insurance, it will likely be at least 20% less than what you would encounter when trying to purchase individual coverage.

#4 Additional Coverage is Possible

Even if you only have a basic level of disability coverage that is provided to you by your employer at no cost, you may also have the opportunity to get additional coverage through payroll deductions. This can be important, especially if you are stuck with a serious illness that will have you out of work for an extended period of time.

Though you never want to think about having an illness that may jeopardize your ability to work for a long period of time, it is always a possibility. By opting to have disability insurance through your workplace, you and your family can know that should this happen, coverage will be in place to help avoid financial disaster.

You might also like: