Archives for January 2017

5 Careers to Consider for 2017

Environmental Science and Protection Technicians

If you like science and engineering, a career in [Read more…] about 5 Careers to Consider for 2017

Top 5 Places To Work In U.S. Oil And Gas

Indeed said that it ranked companies based on a number of factors but generally speaking, the better the site visitor ratings and reviews a company had, the higher it ranked on the “Best Places to Work” list.

The site has 200 million unique visitors monthly, lending credibility to its findings. The reviews and ratings it collected to compile the rankings included postings from current and former employees.

These, in the case of Anadarko, Chevron, and the rest of the best, praised the companies for [Read more…] about Top 5 Places To Work In U.S. Oil And Gas

5 Tips to Manage House Payments While You’re Unemployed

Here are some ways to manage the mortgage payment until you can get back to work:

1) Apply for Unemployment Benefits

The first thing to do when you become unemployed is to apply for unemployment benefits through your state unemployment agency. Often it takes time to be eligible for benefits or to wade through all the “red tape” before you actually get your benefits. So it pays to start early. Unemployment benefits vary by state with high cost states like Massachusetts paying as much as $993 per week for 30 weeks. But most states limit benefits to a maximum of 26 weeks and pay less than $500 per week. Note: While you are collecting unemployment benefits might be a good time to acquire new skills that make you more employable. See: Highly Skilled Worker Shortage in a Recession?

2) Call the Lender

The next thing that you should do is [Read more…] about 5 Tips to Manage House Payments While You’re Unemployed

When is Moving for a Career Worth It?

In the current job marketplace, more people are being forced to consider relocating in order to either find the job of their dreams or even just to find any job at all. With every passing year, the idea of remaining with the same employer for decades has become more the exception and much less the rule. While moving on to greener pastures can be alluring, knowing when to make the leap is important. To determine whether or not relocating is the right call to make, it pays to keep the following things in mind.

New Expenses

Unemployment Inches Up

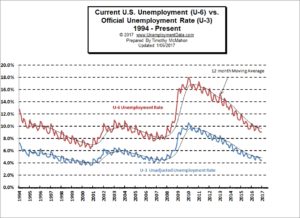

The U.S. Bureau of Labor Statistics (BLS) announced on Friday January 6th, 2017 that the seasonally adjusted unemployment rate for December was 4.7% up from 4.6% in November. The unadjusted U-3 came in at 4.5% up from 4.4% in November. Gallup on the other hand says the unadjusted U-3 is 5.1% up from 4.9% in November.

Gallup says their equivalent “Under Employment Rate” was 13.7% in December up from 13.0% in November.

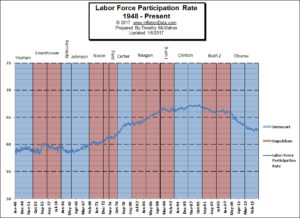

For the 20 years from 1989 to 2009 the Labor Force Participation Rate (LFPR) held fairly steady at around 66%

of the workforce being employed.

But starting in 2010 [Read more…] about Unemployment Inches Up

Is the U.S. Really at “Full Employment”?

Back in February of 2016 Fortune magazine published an article entitled “The U.S. Economy Is Finally at Full Employment” and then in May CNN-Money published an article entitled The U.S. is ‘basically at full employment’ quoting San Francisco Federal Reserve President John Williams as saying “We’re basically at full employment…that’s very good news.”

“We’re basically at full employment…that’s very good news.” San Francisco Federal Reserve President John Williams

So what is “Full-Employment” and are we really there? At first glance you might think that full employment should equal 0% and with the current unemployment rate hovering around 4.7% we obviously aren’t there. But Full employment, in macroeconomics, is defined by many economists as being an acceptable level of unemployment somewhere above 0%.

Even when employers are having difficulty finding employees some people are [Read more…] about Is the U.S. Really at “Full Employment”?